Do you see yourself as a responsible individual with plans to apply for small loans in Singapore?

But you aren’t sure if you’re eligible for it in the first place?

It’s best to avoid taking unnecessary actions, specifically risky ones when requesting a loan. It’s because it’s not in your nature to pursue things that do not guarantee any profitable outcome.

Why Do You Need Financial Assistance?

The philosophy of applying for a loan from financial service providers in Singapore is due to the money crisis. Loans are accessible mainly to entrepreneurs and employees in the country. Companies and individuals utilise loans to fill monetary gaps and bridge their business growth or personal needs.

In times of financial need, a small loan can be a welcoming option for you to ease your monetary worries. But borrowing money can indeed be challenging and risky. Yet, it’s possible to acquire profits when you repay the debt systematically.

So, where can you get an unsecured loan in the country, and from whom?

Before digging deeper into getting a loan, knowing if you’re eligible for a small loan in Singapore is best.

What is a Small Loan in Singapore?

A small loan in Singapore has another reference, and it’s called a personal loan. It is a type of credit which borrowers may quickly obtain funds from.

Yet due to its accessibility, it is considered an unsecured credit and risky. Financial service providers in the country implement higher interest rates or fees to counter the probabilities of defaults from borrowers and acquire some leverage for their losses.

A borrower may request an unsecured loan from Singapore’s banks, financial institutions, or licensed moneylenders. However, before the loan’s approval, the borrowers must be suitable for it first.

What are the Eligibility Criteria for a Small Loan?

A borrower can be a person or a company that intends to get a loan from financial institutions in the country. There are different types of loans a borrower can get access to. Still,l the most sought-after is the unsecured loan due to the smaller loanable amount that’s much easier to repay than other secured credits.

Banks and financial institutions offer a small loan among financing options but concentrate their financial service assistance on their clients or members. It’s because the regulations for these monetary businesses are stern and rigorous. Since it is the Monetary Authority of Singapore’s provisions, it is as it should be.

On the other hand, moneylending in Singapore does accept requests and award personal loans to its borrowers. The licensed moneylenders in the country shall evaluate all loan applicants to see if they are fit for the grant. Who is eligible for a personal loan, and do you belong to the group?

- A person qualified for a small loan is a Singapore Citizen, Permanent Resident, and a foreigner residing in the country.

Although these are the required nationality status from a borrower, additional stipulations have been added as per the Moneylenders Act. It is the borrowers’ overall annual income to access the maximum loanable amount feasible to grant.

Small Loans Eligibility Based on Annual Income

Proof of salaries and annual income plays a massive role in granting borrowers loans in the financing market because financing businesses cannot approve a loan from someone who clearly can not pay the debt. Unless with the exemption of securing the loan with collateral.

Nevertheless, since the loan request revolves around an unsecured loan, the annual income and maximum loanable amount a borrower can take in Singapore are expounded below.

- Yearly income of not more than $10,000

Singapore citizens and Permanent Residents are eligible for a small loan upon showing proof of their yearly income of not more than $10,000. The maximum loanable amount is $3,000.

Foreigners residing in Singapore are also qualified for personal credit when they earn the same yearly income and may take $500 upon loan approval.

- A minimum of $10,000 and not more than $20,000 annual income

All eligible Singapore Citizens, Permanent Residents, and foreigners with work pass with a minimum of $10,000; at most, a $20,000 yearly income may take away $3,000 as the maximum loanable sum.

- Yearly income reaching $20,000

Singapore Citizens, Permanent Residents, and foreigners living and working in the country with a yearly income reaching $20,000 are eligible to take up to six times their monthly payment.

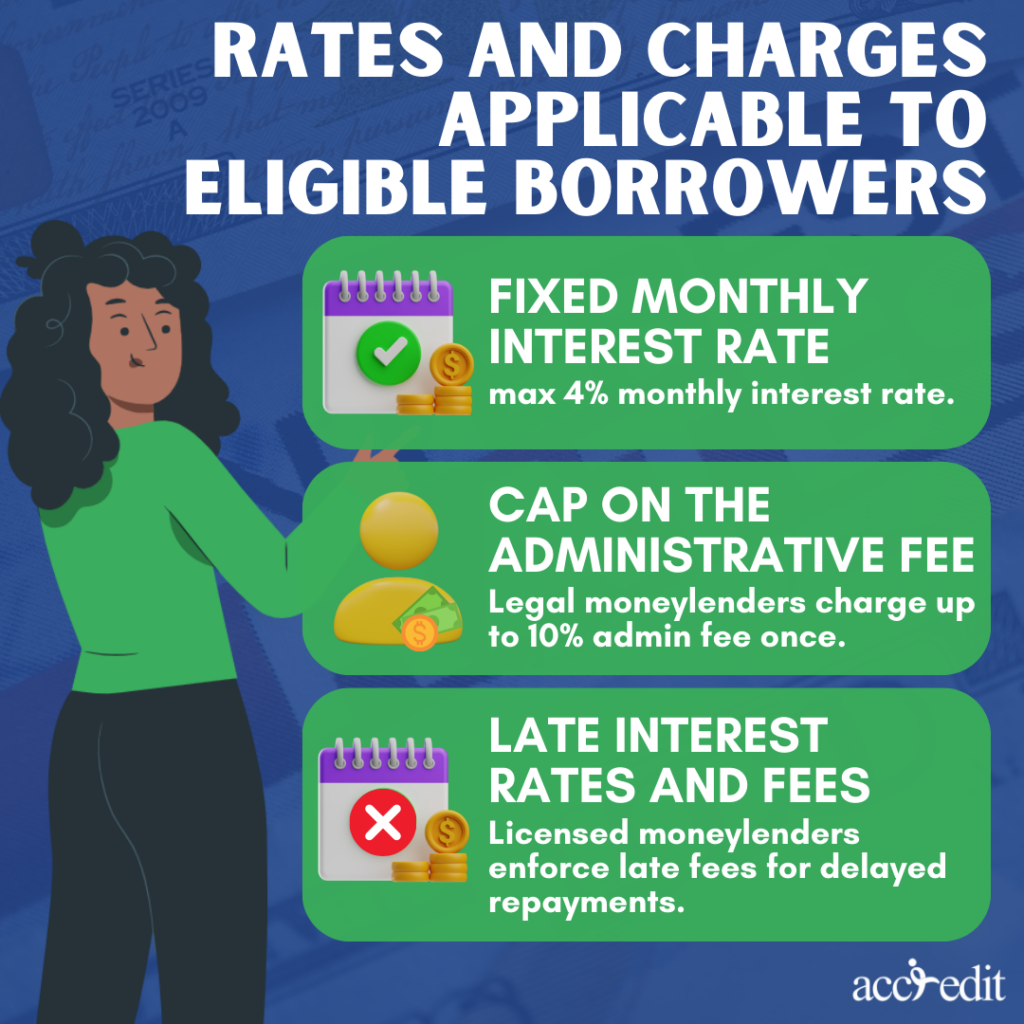

Rates and Charges Applicable to Eligible Borrowers

An eligible borrower must understand the interest rates, fees, and charges. This way, you can make calculations and prepare for the monthly payments and other charges beforehand.

The Registry of Moneylenders has instructed all legal moneylenders in the country to honour the most recent amendment on loan caps stipulated by the Moneylenders Act, which has taken effect since 1 October 2015.

Fixed monthly interest rate

- A legal moneylender in Singapore can only charge a maximum interest rate of 4% per month to an eligible borrower.

Cap on the administrative fee

- Those who have legal moneylending businesses in the country are allowed to impose charges for the administrative fee. But, the cap is at a 10% administrative fee from the loan capital. An eligible borrower must know that the administrative fee is a one-time charge.

Late interest rates and fees

- Even an eligible borrower experiences repayment delays. That’s alright. Licensed moneylenders in Singapore will continue to send payment reminders and notices. Yet there are late interest rates and fees to take care of.

The fees and interest rate charges are $60 and 4% monthly for missed months. These charges are all fixed. A mere suggestion from a moneylender to increase any fees or interest rates indicates that the eligible applicant should file a report regarding the incident.

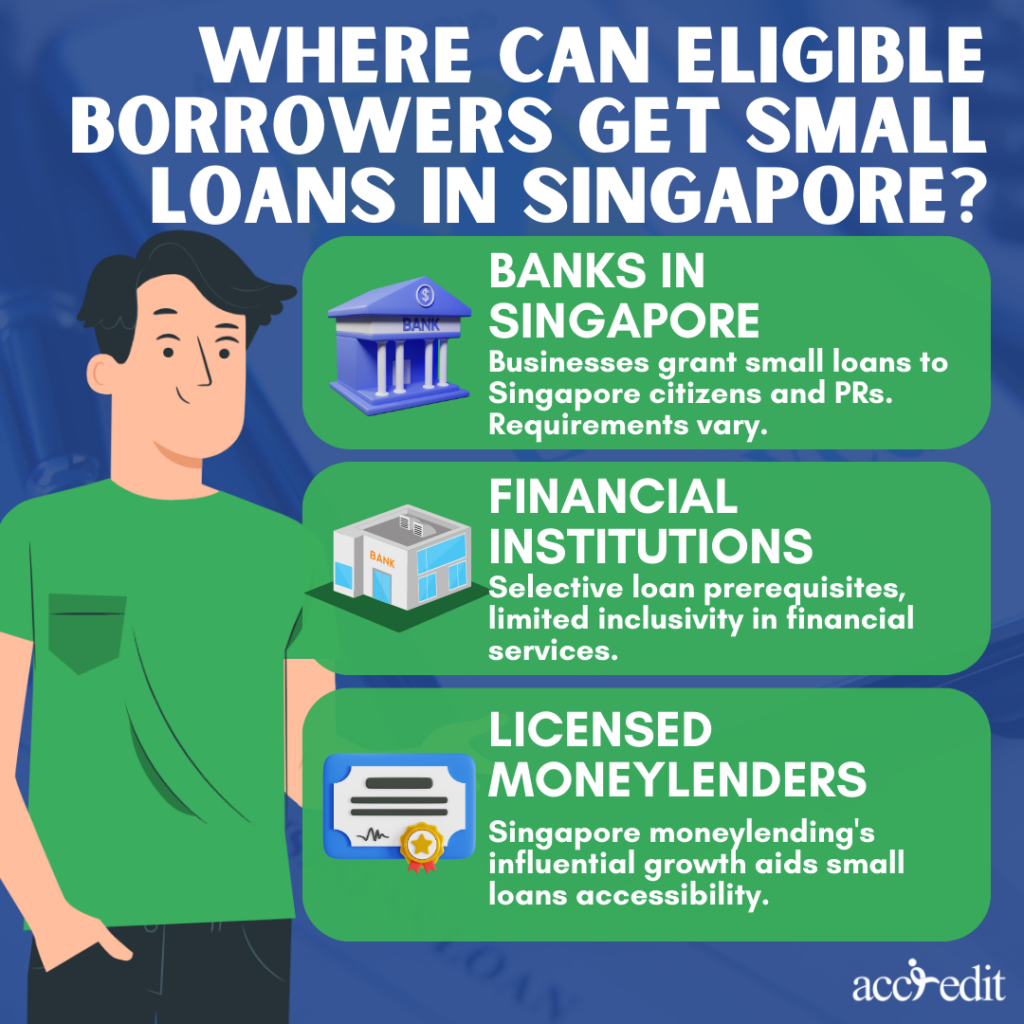

Where Can Eligible Borrowers Get Small Loans in Singapore?

Since you do belong on the list of eligible borrowers for a personal loan, where should you go to initiate the loan process and get approval?

Banks and financial companies are good options, but a legal moneylender is the best choice for faster procedures and reasonably sensible lending outcomes.

A licensed moneylender in Singapore is dutiful and diligent in complying with the Moneylenders Act. As a result, borrowers are always seeking those in the moneylending industry.

However, borrowers should be cautious in trusting anyone who claims to be a licensed moneylender. It’s because lots of unlicensed moneylenders swarm the country and target vulnerable individuals or businesses.

An eligible borrower must check the Ministry of Law – Registry of Moneylenders to avoid entanglement with illegal moneylending activities.

- The Registry of Moneylenders

It offers a comprehensive list of all licensed moneylenders in the country. The information disclosed in the list is the licensed moneylenders’;

- Name of business

- License number

- Contact numbers

- Business address

- Official business website

How to see these details? All eligible borrowers must visit the Ministry of Law – Registry of Moneylenders website and search for the list. A link is immediately accessible to any borrower via the Ministry of Law’s web page, and they may download the list in PDF format.

Awareness of Small Loans and Moneylending Leads to Proactivity

There have been many cases related to illegal moneylending issues in Singapore. Most of the time, it happens not just because of the unlicensed moneylenders’ tactics, but eligible borrowers may have contributed to the situation.

From the police reports and research accomplished over the years, borrowers become targets because of their vulnerability and the lack of information on whether a person or group is an unlicensed or licensed moneylender. That’s why a borrower seeking a personal loan must broaden their understanding of the differences between an unlicensed and licensed moneylender.

To counter these particularly undesirable events, the Registry, Ministry of Manpower, and Singapore Police Force banded together and continuously educated all communities regarding the consequences when associating with an unlicensed moneylender.

As the Singapore Parliament comprehends the risk of borrowing and lending money, the government motivates all the necessary steps to ensure one’s safety and awareness.

For a person who may have been or was about to become an unlicensed moneylending victim, The Registry advises filing a complaint or report via their number at 1800-2255-529 or ‘999’ to reach the Singapore Police Force. Other numbers to call are X-Ah Long at 1800-924-5664 and 1800-722-6688 for the anti-scam helpline.

You can trust Accredit Licensed Money Lender to give you the financial service you need for your small personal loans. Apply here today!