Are you looking to acquire some extra cash for your newest gadget or to cover a sudden medical expense? Maybe you’re considering renovating your kitchen, but you lack the funds to start. No matter what the reason, personal loans are a top choice for Singaporean folks in need.

Yet, before you dive into any agreement, be aware of the charges on the loan’s interest rate imposed by the lenders. It’s critical to be fully informed about the potential costs and risks involved in personal loans.

Typical Interest Rates for Personal Loans in Singapore

It’s imperative to decode the lending game if you’re a Singaporean seeking a personal loan. And if you’re just starting, you’ll come across two significant categories of interest rates that the loan providers will set.

- Annual Fived Rate, and

- Effective Interest Rate

Annual Fixed Rate

When seeking financial stability, it is prudent to consider loans with an annual fixed rate. This option ensures consistency throughout the loan term, allowing for predictability in repayment schedules. Personal loans and mortgages commonly offer this feature, with financial institutions like banks providing rates of around 5.6% per annum based on the loan’s principal amount.

Effective Interest Rate

Calculating the actual expense of a personal loan entails assessing its effective interest rate, which includes a combination of charges and promotions. In Singapore, the effective interest rate spans between 11% and 14%.

Nevertheless, there exist certain lenders that present alluring incentives by offering lower effective interest rates. You may come across personal loan offerings in Singapore with interest rates plummeting as low as 6.5%.

Comparing Personal Loan Interest Rates in Singapore

For those seeking a personal loan in Singapore, navigating the interest rates and effective interest rates (EIR) of different providers is vital. To aid in your search, here is a selection of the most reputable personal loan providers that offer the most attractive rates in 2023.

| Personal Loan | Interest Rate (p.a.) | EIR (p.a.) |

| HSBC Personal Loan | 4% | 7.5% |

| SCB CashOne Personal Loan | 3.48% | 7.99% |

| CIMB CashLite Personal Loan | 3.38% | 6.38% p.a. |

| UOB Personal Loan | 3.99% | 7.49% |

| DBS/POSB Personal Loan | 3.88% | 7.9% p.a. |

| Citi Quick Cash Loan | 4.55% | 8.5% |

| OCBC Personal Loan | 5.43% | 11.47% |

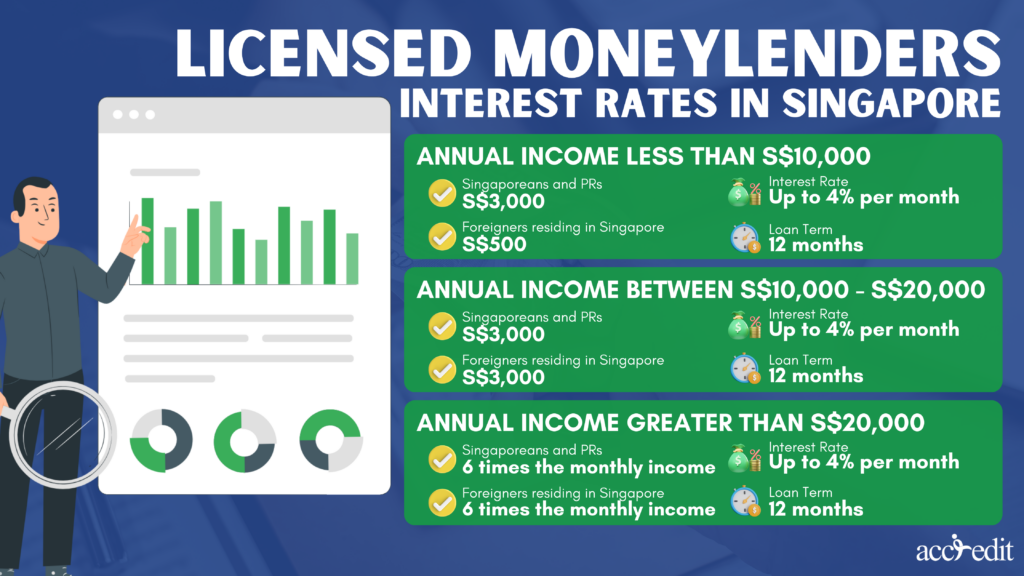

Licensed Moneylenders and their Interest Rates in Singapore

When it comes to personal loans in Singapore, traditional banks and financial institutions are not the only options. Licensed moneylenders are also in the mix.

However, it’s important to note that these moneylenders typically charge higher interest rates than banks, which reflects the higher risk they undertake. To ensure consumer protection, regulatory limits are placed on the interest rates of licensed moneylenders in Singapore.

As of 2023, the maximum interest rate that licensed moneylenders like Accredit can charge is 4% per month, with a cap of 4% per month on late repayments. It’s crucial to exercise caution when considering taking out a loan with licensed moneylenders.

| Borrower’s annual income | Singaporeans and PRs | Foreigners residing in Singapore | Interest Rate | Loan Term |

| Less than S$10,000 | S$3,000 | S$500 | Up to 4% | 12 Months |

| Between $10,000 to $20,000 | S$3,000 | S$3,000 | Up to 4% | 12 Months |

| Greater than $20,000 | 6 times the monthly income | 6 times the monthly income | Up to 4% | 12 Months |

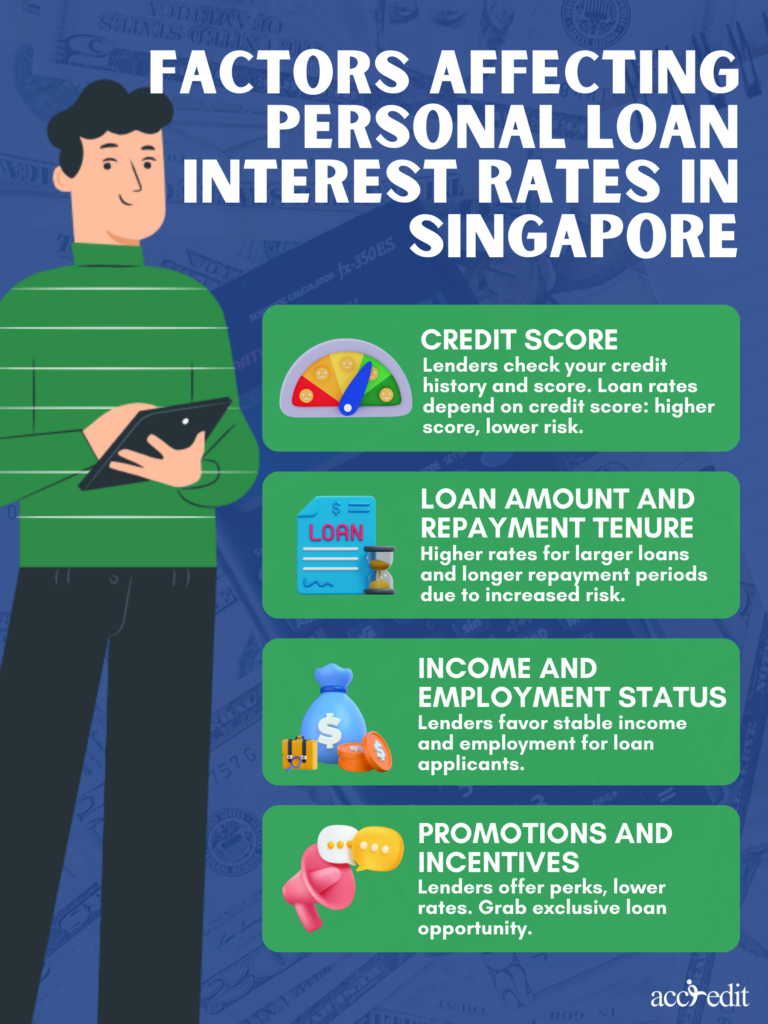

Factors Influencing Personal Loan Interest Rates in Singapore

The interest rates of personal loans in Singapore are subject to various elements that can potentially sway your loan terms. If you want to secure the most favorable rate, you need to comprehend the following critical factors:

Credit Score

The interest rate you obtain when applying for a personal loan is contingent on one paramount factor: your credit score. Lenders conduct a thorough examination of your credit history and score, as higher scores near 2000 signify lower risk, while lower scores result in disadvantageous terms.

Loan Amount and Repayment Tenure

In Singapore, personal loan interest rates are also impacted by loan amount and repayment tenure. Financial institutions tend to impose higher interest rates for larger loan amounts and longer repayment tenures.

Income and Employment Status

Financial institutions analyze loan applicants’ financial status, prioritizing those with stable employment and a reliable income source. Such borrowers are considered low-risk and appeal to lenders for loan approvals.

Promotions and Incentives

It’s no secret that lenders often employ promotional tactics to entice potential borrowers. These alluring perks can translate to reduced effective interest rates, which is a win-win for you. It pays to stay on the lookout for these exclusive offers and seize the opportunity to apply for a personal loan that ticks all your boxes.

The Bottom Line

When seeking a personal loan, don’t overlook the significance of annual and effective interest rates. These numbers will give you a clear picture of the potential cost of your loan. Remember, annual interest rates remain fixed for the entire duration of your loan, dictating your monthly interest payments. On the other hand, effective interest rates reveal the complete cost of your loan, encompassing additional expenses such as processing or origination fees. To guarantee that you receive the maximum benefits of a personal loan, meticulously scrutinize interest fees and concealed expenses.

Get the Best Interest Rates for Personal Loans with Accredit Moneylender

In Singapore, finding a reliable provider of personal loans with competitive interest rates can be a challenge. But you can trust Accredit Moneylender to meet your needs. As a certified moneylender, Accredit offers flexible and dependable loan options tailored to your unique requirements.

Make the smart choice for your financial future by choosing Accredit.