For Non-Resident Indians residing in Singapore, life may present them with unexpected financial challenges – be it education, home renovation, or medical expenses. In these moments, a personal loan can offer a ray of hope. This post intends to take you on an in-depth exploration of the topic of loans for non-resident Indians (NRIs).

Gain a Deeper Understanding of Non-Resident Indians (NRIs)

When an Indian citizen lives outside of their home country for more than 182 days in a single fiscal year, they become a Non-Resident Indian (NRI). Whether they are pursuing a job, conducting business, or pursuing a career, an NRI has taken the path of living abroad with the intention of doing so indefinitely.

As an NRI residing in Singapore, you are considered a foreigner. In times of financial difficulty, a foreign loan, such as a personal loan, can offer a beacon of hope to guide you through.

Can NRI apply for a Personal Loan in Singapore?

The answer is yes, but you must meet the lender’s rigorous eligibility requirements. Typically, personal loan applicants must show evidence of a minimum income, a solid credit score, and a stable employment history. Moreover, foreign workers in Singapore must hold a valid work permit like the E-Pass or S-Pass.

To bolster your chances of approval, NRIs may need to provide additional documentation, including passports and employment contracts, to support their loan application.

What is a Foreigner Loan?

For those who call Singapore home but aren’t technically citizens, the Foreigner Loan is a valuable financial resource. Similar to personal loans offered to locals, this type of loan is designed to meet the specific needs of ex-pats.

While the guidelines for lending are stricter than typical personal loans, the Foreigner Loan provides a safety net for daily necessities such as housing, transportation, food, and medical care.

Eligibility and Requirements

What Distinguishes a Foreign Loan from Other Loans?

Consider the following significant distinctions between foreign loans and other types of loans in Singapore:

| Eligibility | Foreign loans may have a tighter grip on who qualifies, demanding proof of foreign employment or income. |

| Paperwork | Borrowers from outside Singapore may need to provide extra documentation, like a passport or valid pass, to validate their foreign status. |

| Loan Tenure | Repayment terms on foreign loans may also be more demanding, with shorter loan durations and stricter penalties for late payments. |

Foreigner Loan Providers in Singapore

Finding the best foreign loan in Singapore among the numerous available alternatives might be difficult. Here is a shortlist of the most highly suggested loan providers for foreign borrowers to help you narrow down your options quickly and confidently.

| Loan Provider | Interest Rate | Loan Amount | Minimum Yearly Income | Loan Tenure |

| Accredit | Up to 4% per month | S$500 to 6x monthly income | S$10,000 or less | 12 Months |

| DBS/POSB | 3.88% (EIR 7.9% p.a.) | 4x your monthly salary; 10x if your income is $120,000 and up | S$45,000 | 1 to 5 years |

| OCBC | 5.43% (EIR 11.47% p.a.) | 6x your monthly wage | S$45,000 | 1 to 5 years |

| HSBC | 4% (EIR 7.5% p.a.) | 4x your monthly salary, up to $100,000 | S$40,000 | 1 to 7 years |

| Citibank | 3.5% (EIR 7.85% p.a.) | 4x your monthly wage | S$42,000 | 1 to 5 years |

| Standard Chartered | 3.48% (EIR 7.99% p.a.) | 4x your monthly salary; cap at S$250,000 | S$60,000 | 1 to 5 years |

Which Loan Provider Should You Go for?

As an NRI in Singapore, choosing the right loan can be a daunting task. From interest rates and loan amounts to income requirements and beyond, there’s a lot to weigh and consider. To simplify your search and help you make an informed decision, here is a table that provides a comprehensive overview of each loan.

| Personal Loans | Best For |

| Accredit Personal Loan | -Lowest income requirement of S$10,000 or less -Minimum loan amount of S$500 |

| HSBC Personal Loan | -Lowest interest rate of 4% p.a. -Longest loan tenure of up to 7 years -Lowest income requirement of S$40,000 |

| Standard Chartered CashOne Personal Loan | -Large loan amounts of up to S$250,000 -Competitive interest rate of 3.48% p.a. |

| DBS/POSB Personal Loan | -Fast cash disbursement & loan approval for existing costumers -Minimum Amount of S$500 |

| Citibank Quick Cash Personal Loan | -Low-income requirement of S$42,000 -Low-interest rate of 3.5% p.a. |

| OCBC Cash-On-Instalment | -Loan amount up to 6 times monthly income -Quick loan approval for existing customer |

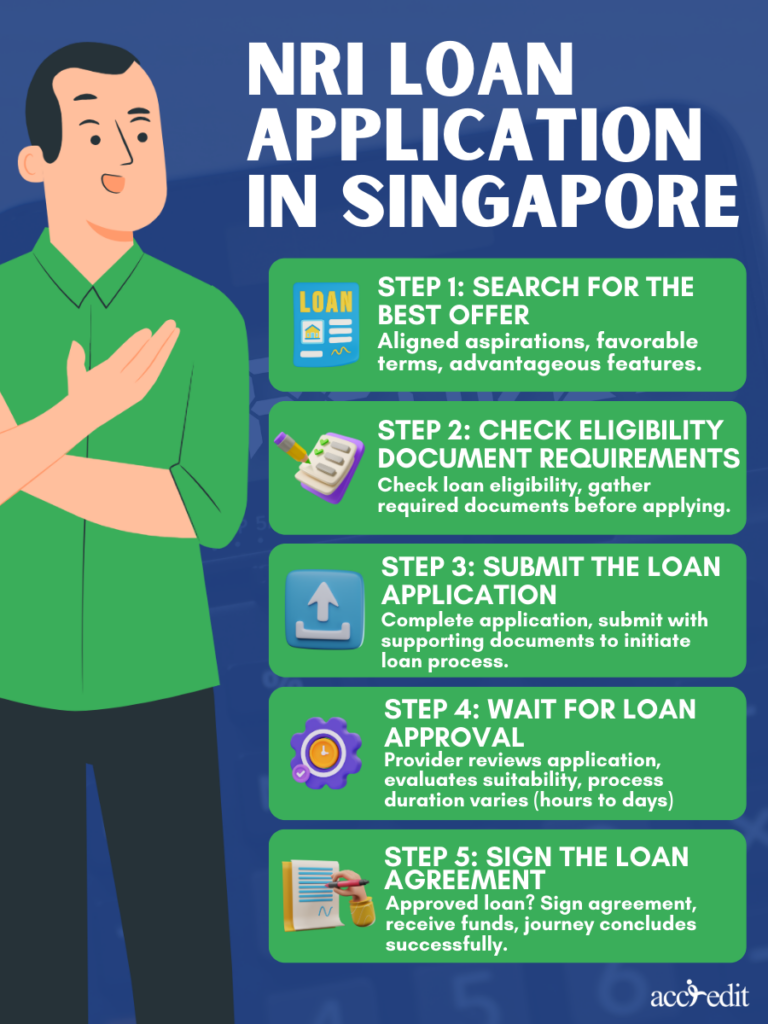

How to Apply for NRI Personal Loan in Singapore?

To ensure a seamless loan application process and informed decision-making, Non-Resident Indians residing in Singapore may refer to this comprehensive guide

Step 1: Search for the best offer

Find a loan that aligns with your financial aspirations, offering a suitable interest rate, loan amount, repayment tenure, and other advantageous features.

Step 2: Check eligibility/document requirements

Before applying for a loan, ensure that you meet the eligibility criteria for the loan you’ve picked and have all the necessary documents at your disposal.

Step 3: Submit the loan application

Fill out the loan application form and accompany it with the required supporting documents. Submit it to the lender, and the loan process begins.

Step 4: Wait for loan approval

The loan provider will thoroughly scrutinize your loan application and make a determination of your suitability for the credit. While the evaluation process might take a brief period, ranging from several hours to a few days.

Step 5: Sign the loan agreement

If your loan application is approved, sign the loan agreement, and the loan amount will then be disbursed to your account, marking the successful conclusion of your journey.

Thoughts

When living as an NRI in Singapore, opting for a personal loan can prove a prudent decision in realizing your financial goals. Not only will the right loan furnish the necessary funds, but it will also guarantee a payment plan that is within your means.

To secure the perfect loan alternative, it is vital to evaluate the market and scrutinize the different choices at your disposal to pinpoint the one that best suits your particular demands.

Accredit Moneylender – Your Ideal Foreigner Loan Provider

If you need a quick financial boost, look no further than Accredit Moneylender. Our reputation as a dependable lender speaks for itself, and we offer highly competitive interest rates for foreign personal loans. Don’t let financial hurdles hold you back any longer.

Contact Accredit Moneylender today and take the first step toward achieving your financial goals.