One of the worst things a person can experience is when finding themselves in a dire financial crisis. Sometimes, it could worsen, especially when no extra funds are accessible, like obtaining a max personal loan amount in Singapore. Talk about having yourself strikes out of luck.

Circumstances like these are primarily uncontrollable, particularly when connected to emergencies. Regardless of how hard you try to commit to your budget, personal finances come short due to soaring inflation rates and taxes.

So, a loan is worth considering in situations that must resolve monetary problems.

Have You Considered Taking a Loan?

So, you should get up and seek ways to solve your monetary issues. Have you considered taking out a personal loan? These loans are the type of credit popular and in demand in the country.

Find out the primary reasons for its popularity in Singapore and whether you can apply for one. In addition, uncover the specific lender in Singapore from whom you can request it.

In this article, discover the essential details you have to know about personal loans and the max amount you can obtain.

What are Personal Loans?

There are several loans you can apply for in Singapore. However, these loans mostly branch from two specific categories, secured and unsecured loans.

A secured credit has to have collateral linked with the loan request. The maximum amount accessible from a secured loan relies on the collateral’s value. A personal loan, on the other hand, falls into the unsecured loan categorisation.

It’s a particular loan choice for many communities in Singapore because of its flexible use. Whether you need more funds to repair your home or car, travelling or personal necessities, it is the loan best to apply for.

Why Is it an Unsecured Loan?

Banks, financial institutions, and licensed moneylenders in the country offer different loans. But, when the debt transaction doesn’t demand borrowers to provide collateral, the loan becomes unsecured. It’s primarily because the financial business has nothing that guarantees loan security.

An unsecured loan is also a consumer loan, as most people who request it will use the funds to buy necessities.

As it lacks surety, banks and licensed moneylenders have legal permission from the MAS and MinLaw to carry out a higher interest rate. It is to balance out the risks involved in the transaction.

An unsecured loan is small as the acquirable amount is far smaller than a secured loan. Yet, the maximum unsecured loan amount is perfect for those with immediate cash for monetary necessities.

How To Be Eligible for Personal Loans?

Before sending a request, be sure you are eligible for an unsecured loan. In Singapore, banks and licensed moneylenders offer these loans to their borrowers.

The process of evaluating a borrower has similarities and differences, such as;

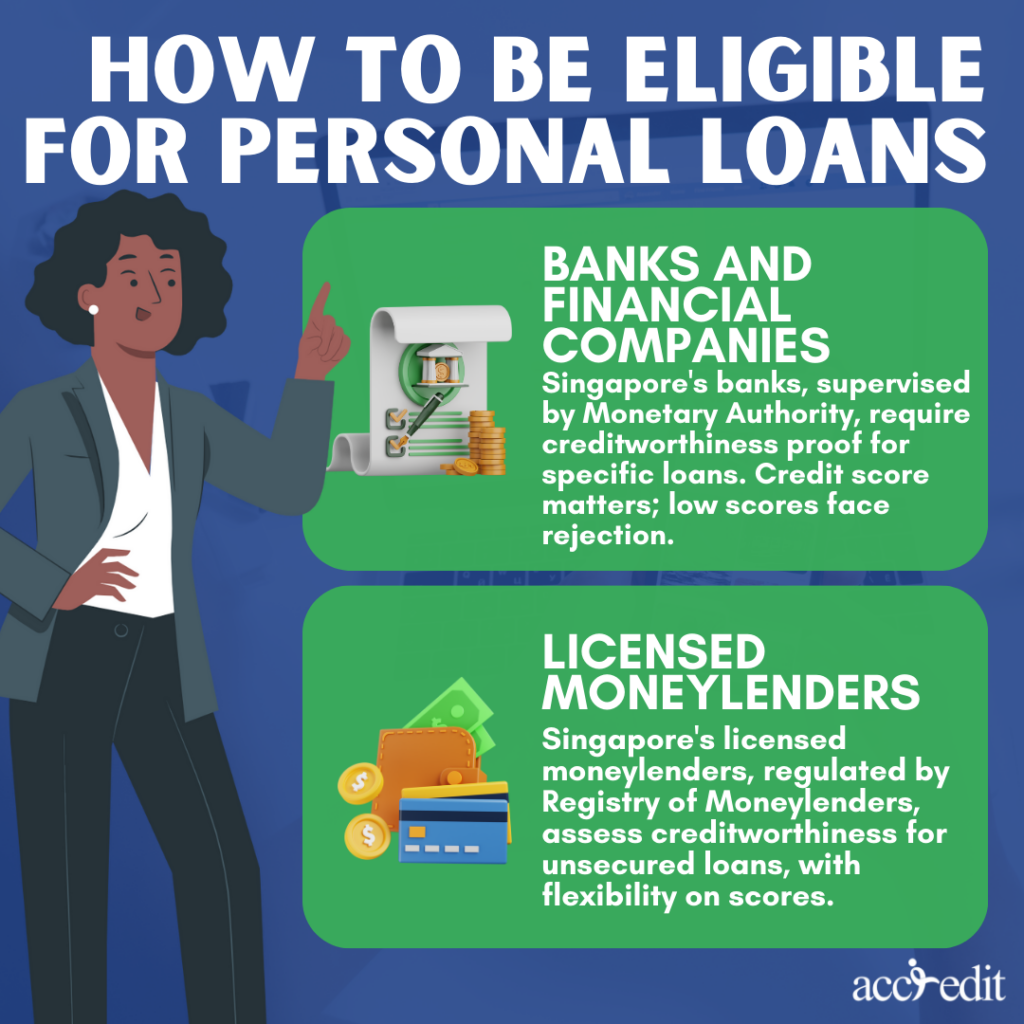

Banks and Financial Companies

Banks and financial companies are both under the Monetary Authority of Singapore. To qualify for this specific loan under these businesses, you must prove you’re a legitimate and credit-worthy client.

Your creditworthiness usually stems from the credit score and risk grade imposed by the Credit Bureau Singapore. If you have a credit score near 2000 points, you’ll likely successfully acquire a personal loan.

However, if you got a credit score of 1000 or a risk grade of HH, then it’s likely these monetary companies will reject your unsecured loan request. These financial businesses are not too forgiving with low credit scores and want to avoid defaulters at all costs.

Licensed Moneylenders

The licensed moneylenders in Singapore are regulated by the Registry of Moneylenders and authorised by the Ministry of Law. These businesses focus on purely moneylending services and grant their borrowers small amounts from an unsecured loan.

Licensed moneylenders in the country are legitimate loan providers and approve both secured and unsecured loans. Are licensed moneylenders in Singapore strict regarding a borrower’s unsecured loan eligibility?

The truth is a licensed moneylender in Singapore will assess and evaluate your creditworthiness. Since the Singapore government permits them to review your data as per the Personal Data Protection Act and gain access via the Moneylenders Credit Bureau.

But, licensed moneylenders in the country are more forgiving concerning credit scores and background. Just ensure you’ll show a valid proof of employment and a decent income. Moreover, you can be approved and access the ultimate personal unsecured amount.

What is the Max Personal Loan Amount?

Contrary to what people initially assumed about the “small amounts” attainable from an unsecured loan, it can be more viable.

Still, aside from your creditworthiness, you need the support of proof of your nationality and annual income for speedy loan approval. What is the highest personal loan amount you can get?

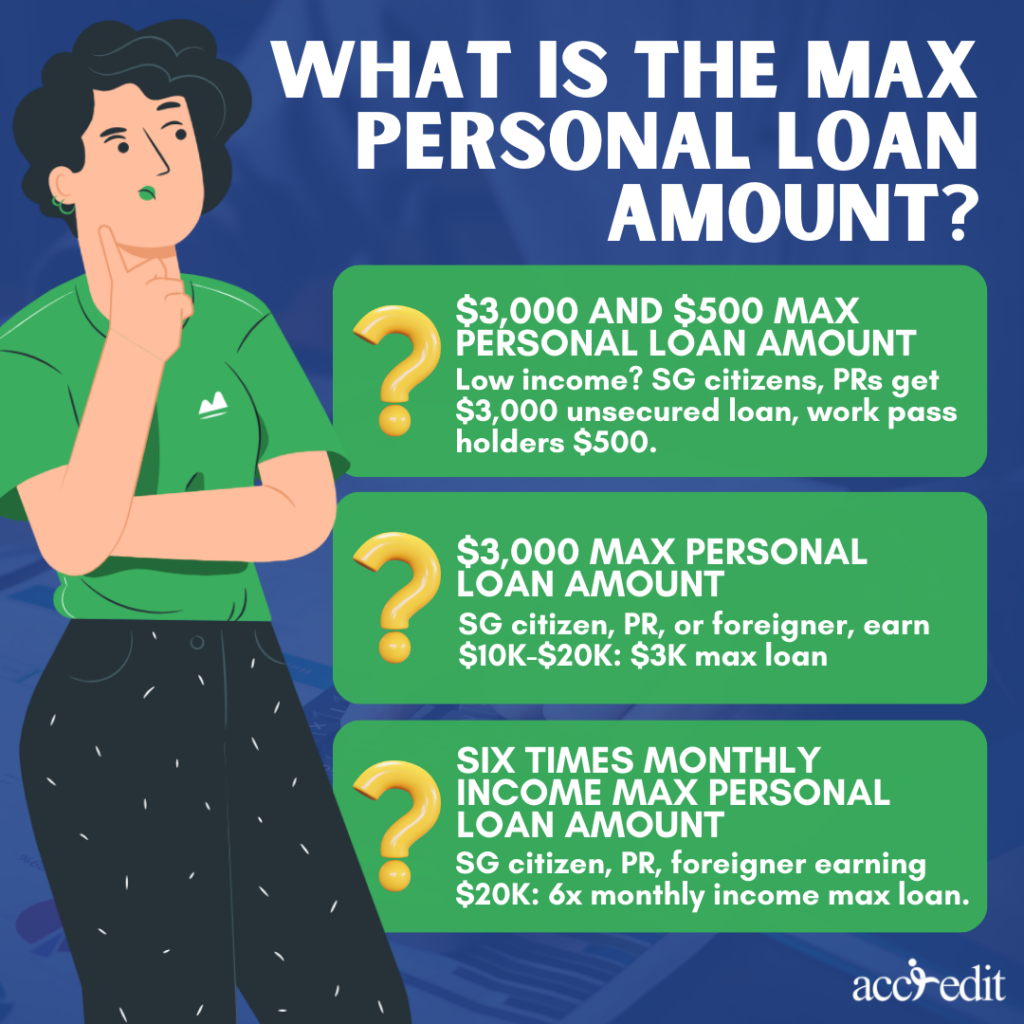

$3,000 and $500 Max Personal Loan Amount

Is your annual income less than $10,000, and you’re a Singapore Citizen or Permanent Resident? You are permitted to obtain the max unsecured loan amount of $3,000.

If you’re a foreign work pass holder with a yearly income of less than $10,000, you may take a $500 max personal loan amount.

$3,000 Max Personal Loan Amount

If you are a Singapore Citizen, Permanent Resident, or a foreigner working and living in the country earning at least $10,000 and not more than $20,000, you can collect $3,000 as the max personal loan amount.

Six Times Monthly Income Max Personal Loan Amount

Suppose you are a Singapore Citizen, Permanent Resident, or foreigner residing in the country, getting at least $20,000 a year. In that case, you may obtain the highest unsecured loan amount of six times your monthly income.

Where to Get the Max Personal Loan Amount?

From knowing the requirements to ensure your eligibility, now is the perfect time to know where to get the ultimate unsecured loan amount for your credit request.

Whether you are a Singapore Citizen, Permanent Resident, or foreigner in the country is already an advantage on your end. Further boosting your chances of getting the maximum unsecured loan amount that fits your needs best is when you’re connected to local banks or unions in the country, as they’d prioritise your application more than non-members. Yet, these financial institutions can be strict with their policies and rules.

Make sure that before your loan request, all documents are put together and evaluate your current credit score, risk grade and history.

A licensed moneylender in Singapore is a legitimate option to get the maximum unsecured loan amount you need. And the process from licensed moneylenders in the country might be the best fit for you, particularly when you require quick funding from an unsecured loan.

Choose a Licensed Moneylender for Max Personal Loan Amount

Licensed moneylenders in Singapore have functioned as the primary administrators for their moneylending businesses. A person or group claiming to be an authorised moneylender but lacking the licence and verification from the Registry of Moneylenders are not to be trusted since they’re primarily unlicensed.

Nevertheless, choosing to go to a licensed moneylender for loan transactions and obtaining the max personal loan can be an effortless and untroubling experience. Why? It’s because an authorised moneylender;

Quickness of the Loan Process

Aside from the smaller but sufficient maximum unsecured loan amount accessible from a licensed moneylender, there’s also the upper hand in gaining the money fast.

Admit it, in times of great financial despair, especially when involved in emergencies, applying for a loan and waiting for approval can be stressful. It isn’t possible to stay calm all the while and unfortunately end up being rejected due to policy issues, or it’s practically too late to use the funds.

Bypass situations like these by appealing a loan from a licensed moneylender. The entire loan process with a legal moneylender won’t even take a full 24-hour time frame.

So long as you have all the necessary documents for assessment, a borrower like you may receive the utmost unsecured loan amount in less than an hour. It is that quick.

Absolves Credit Records

A borrower’s creditworthiness is predominantly assessed and evaluated before approval. When a borrower’s credit history doesn’t align with the guidelines of banks and financial institutions, a possibility of loan request rejection may occur. It isn’t an ideal scenario for a person who’s in urgent monetary necessity.

On the other hand, a licensed moneylender may be lenient concerning credit records and would absolve their borrowers. Yet, it’s imperative for a borrower currently employed with an adequate salary for repayment.

Availability Beyond Designated Working Days

What’s the familiar scene when requesting a loan from a bank or other financial business? These businesses proffer timely and well-organised services to their borrowers. But because of the painstakingly long procedure, a borrower may become restless. Plus, the only days these companies accommodate their borrowers are from Mondays through Fridays, given there are holidays in between.

All procedures stop during holidays and weekends. Thus, the waiting becomes longer.

However, with a licensed moneylender, their moneylending services operate beyond the daily working days. They’re happy to assist you with your financial needs on weekends and some holidays.

Focuses on Smaller Loans

A loan amount may be too small, significant, or just enough for one’s needs. The benefit of acquiring the max personal loan amount from a licensed moneylender is its restriction. Why are rules beneficial?

When the maximum unsecured loan amount is small, it motivates borrowers to be mindful of the money they’ve attained. You would be cautious about spending the funds wisely and for their actual purpose rather than squandering them away.

Thus, the purpose of the restrictions by the Moneylenders Act on loan cap amounts comes in helpful. It encourages legal moneylenders to facilitate businesses and assist borrowers like you responsibly.

Final Note

You don’t have to worry too much for someone who may be a newbie with loan procedures and maximum unsecured loan amount. Whether you go to a bank, financial institution, or a licensed moneylender, you will receive a well-detailed explanation and diligent services.

Questions are natural; thus, feel free to ask your concerns until you get the answer you understand.

Get the maximum personal loan amount now for your financial needs. Apply here now!