Someone’s finances can often be a reflection of their character. For one thing, pursuing to administer personal finances properly embodies a responsible mindset and strategy. It sometimes involves considering moneylending Singapore to assist one’s finances.

Many people desire to attain their goals of financial security. Nevertheless, opportunities are not the same for everyone. As a result, some can appropriately manage personal finances, while others take a bit longer to achieve this.

Diverse circumstances lead to varying consequences. When the budget doesn’t reach the intended timeline, people consider borrowing from banks, financial institutions, and moneylending businesses.

In this article, you’ll uncover the primary lending businesses when borrowing money and the differences between banks, financial institutions, and moneylending in Singapore. Also, you’ll understand more about the moneylending industry and the vital details you must know before transacting with these businesses.

When Should You Take Out a Loan?

Borrowing money is the typical response to solving financial troubles. Indeed, along with it is the obligation to pay for the loaned funds the soonest time possible. And at times, interest rates may be involved even when it’s a person-to-person transaction.

Is borrowing money a good idea? Generally speaking, many people may have borrowed funds once or twice.

Because in reality, is there ever a person who has never borrowed money even once? That would be near impossible.

Financial Need

With due consideration, the most prominent entrepreneurs usually get a loan from a person they know, banks, financial companies, or moneylenders to establish their start-up businesses. Borrowing money does not necessarily mean it is a bad practice, especially when there’s a great need for it.

Various Purposes

People get the urge to take out a loan due to a multitude of purposes. Some can no longer wait for their savings fund to fill up because it does take time. Some individuals already have big plans in mind and have to have the cash to purchase their wants and needs. However, most cases revolve around emergencies.

In light of these reasons, people who need to take out a loan search for loan providers in Singapore. And the primary choices when borrowing money in the country are banks, financial companies, and licensed moneylending businesses.

Borrow Money Only from Legal Lenders in Singapore

Singapore is famous for its trade, commerce, and finance industry. It is a country that has become an excellent player in the world of finance. In truth, it’s recently earned an exemplary international finance hub status.

No one can ever deny Singapore’s prevalence in the finance industry.

Considering Singapore’s reputation becomes the basis for why people opt for banks, financial institutions, and moneylenders in Singapore for different loans like personal loans.

Singapore’s Banking Industry

It’s an industry estimated to reach a whopping 1548.2 Billion around 2025. The country’s financial sector acquires the gross domestic product accounting for 14%.

The Monetary Authority of Singapore (MAS) regulates the banking industry. As of late, the country supervises and regulates 150 banks, institutions, credit card and charge card issuers. All of these 150 companies are governed accordingly by the Banking Act.

Moneylending in Singapore

Moneylending in Singapore plays a role in the country’s finance industry as the operations are almost similar to the banking industry. Nonetheless, there are stark variations between these industries.

The industry of moneylending in the country isn’t new. The Moneylenders Act, which the moneylenders of today abide by, was enacted in 1936 in the country. It was called the Moneylenders Ordinance (Cap 193, 1936 Ed).

The basis for the Moneylenders Act branches from the 1900 and 1927 English Moneylenders Acts with the legislative intention to save vulnerable individuals from moneylenders. In those times, the reference was considered derogatory.

But in these modern times, the lending Singapore industry has become another reliable and authorised source for personal loans. It’s vastly appreciated, especially by people who genuinely need money.

In addition, there’s a sense of safety and security. Because all transactions done through licensed moneylenders in Singapore are under the legal protection of the Moneylenders Act and the Ministry of Law.

What is Moneylending in Singapore?

Moneylending Singapore is a business financing method which involves giving cash loans. Interest rates are high, and debts have to be repaid in a short amount of time.

Every legal lending Singapore businesses have moneylenders who manage and operate the company. The Moneylenders Act stipulates explicitly that moneylenders are allowed to employ legal lending Singapore functions such as;

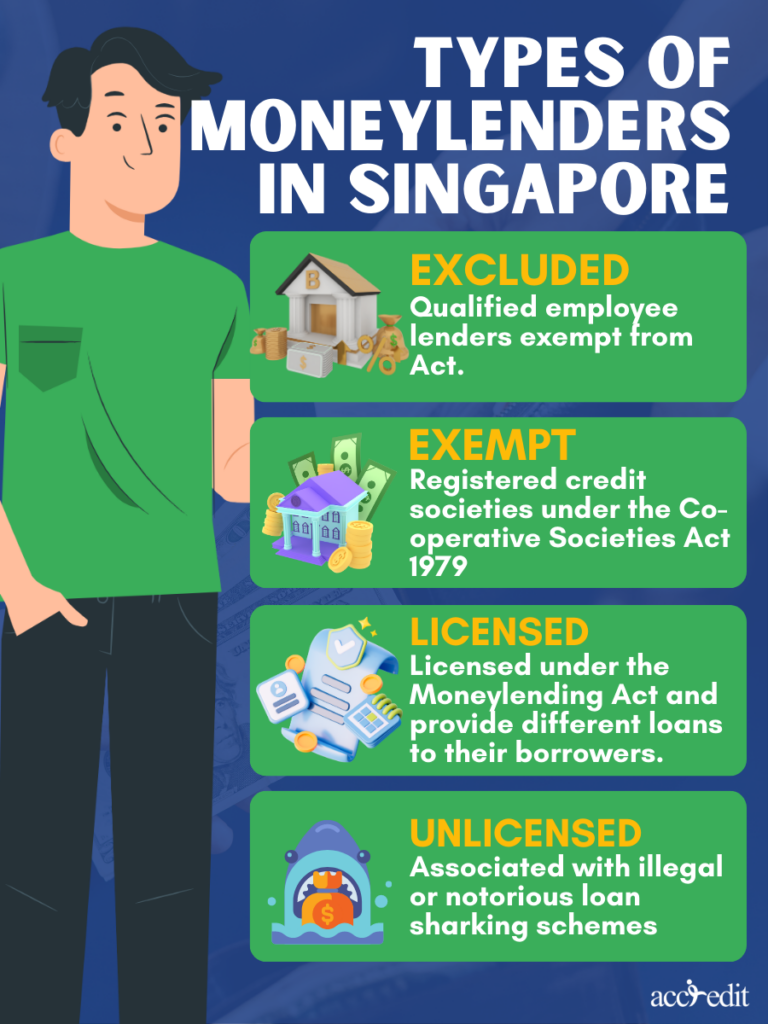

Excluded Moneylenders

- Individuals who have the permission and authorisation regulated by the Authority to lend money or may acquire money via lending under the written law

- Anybody empowered, corporate, or incorporated to lend money authorised by the Act of Parliament.

- Credit Society legally under the Co-operative Societies Act 1979

- Licensed pawnbrokers under the Pawnbrokers Act 2015

- Any person who lends money specifically to their employees as an employment benefit, to accredited investors, to limited liability partnerships, corporations, trustee-managers or trustees, real estate trustees

Exempt Moneylenders

These are any moneylenders in Singapore granted an exemption for holding a licence.

Licensed Moneylenders

These are any group or individual that often lends out a slight amount of money in proportion to higher interest rates. The motivation to demand an interest rate higher than some financial institutions is due to the risky nature of the moneylending Singapore industry.

How Does Moneylending in Singapore Operate?

Moneylending Singapore has attained a practical function in the country. Its efficiency is through regulating and supervising the Ministry of Law and the Moneylenders Act and Rules.

Appropriate procedures must be followed thoroughly when taking up a personal loan from lending Singapore.

- Lending Singapore loans must be processed and granted only by licensed moneylenders. Only legitimate moneylenders in Singapore understand and comply with the Moneylenders Act.

- Licensed moneylenders in the country administer loan requests via lending in Singapore. The licensed moneylender should thoroughly explain all terms related to the loan, whether secured or unsecured.

Failure to do so implicates the integrity of the business’s moneylending activities and could be reported to the authorities.

- Loan contracts are imperative proof of the legal agreement between the borrower and the licensed moneylender. Thus, lending Singapore focuses on ensuring every necessary signed copy of terms in writing and loan contracts are provided to the borrower.

- lending Singapore also facilitates stringent regulations concerning existing loans. For these situations, licensed moneylenders must issue receipts for all repayment made towards the current loan.

In addition, every licensed moneylender has to provide their borrowers with an authorised statement of accounts every month of January or July within the year.

Moneylending in Singapore Loan Caps

Moneylending Singapore grants personal loan requests from communities living and residing here. Nonetheless, specific changes must be fulfilled because of the recent amendments imposed on the Moneylenders Act and Rules.

The lending operations in Singapore took a severe turn with an intent to enforce a better scope of protection for licensed moneylenders and communities in Singapore.

As a result, loan caps were brought into the regulation. The motivation for such loan caps is to ensure licensed moneylenders will not unfairly structure the borrower’s debt.

It could lead to further late and administrative fees. Also, the loan caps for lending in Singapore intensify its regulation that the communities refrain from over-borrowing.

Borrowers subjected to the lending Singapore loan caps are;

Singaporean Citizens

They are the country’s ethnic group.

Permanent Residents

These individuals, particularly foreigners granted permanent resident status in the country. They are permitted to reside in Singapore permanently. PRs aged 15 years old and above acquire Singapore’s blue Identity Card or (IC)

Foreigners in Singapore

These foreign nationals have acquired work passes or valid visas in Singapore.

Loan capping in moneylending Singapore usually depends on nationality and annual income.

- At least $10,000 annual income

Singapore Citizens, Permanent Residents, and foreigners residing in the country with a specific income can take out a loan. But, the loan cap for SCs and PRs would be $3,000, and for foreigners, it’ll be $500.

- At least $10,000 and lesser than $20,000

Individuals who acquire these amounts for their annual income can borrow a maximum sum of $3,000. It applies to all Singaporean Citizens, Permanent Residents, and foreigners in the country.

- At least $20,000 annual income

Every Singaporean citizen, Permanent resident, and foreigner with a $20,000 annual income may be qualified to borrow funds that are six times their monthly income.

Moneylending in Singapore’s Interest Rates

For a business in the moneylending sector, the interest rates proffer their return on investments. As a result, instances of moneylenders imposing interest rates according to their choices did not sit well with the Ministry of Law.

It is because the interest rates are too unreasonable. It also becomes a factor where borrowers cannot carry out their responsibilities of paying the debt. As a result, many more borrowers turn to defaulters, which hurts the businesses in the moneylending Singapore sector.

With the repetitive occurrence of these situations, the Ministry of Law improved the Moneylenders Act through its Moneylenders Amendment Rules 2015. It is to cite amendment rules regarding loaning caps and designated interest rates to all licensed moneylenders in Singapore that will come into operation on October 1 2015.

Singapore’s designated interest rate cap moneylenders may charge it 4% monthly. And licensed moneylenders cannot charge more than the stipulated amount.

Other Charges for Moneylending in Singapore

Moneylending Singapore continues to implement its loan capping not only for the maximum total amount loanable. The Moneylenders Act further enhances its regulations by restricting other fees within the industry. The following lending Singapore ordinances are;

- An administrative fee of not exceeding 10% of the loan principal

- 4% for late repayment interest rate

- $60 monthly for late fees and should never exceed the set amount

Illegal Moneylending in Singapore Complaints Are Essential

The borrower is always responsible for assessing their capacities in getting and paying for loans. Licensed moneylenders are simply assisting the debtor with their financial needs. Nonetheless, issues of illegal activities do rise from time to time in the lending Singapore market.

Illegal Moneylending Red Flags

Particular signs are red flags when dealing with moneylenders in Singapore. These would often involve unlicensed moneylenders who pretend to be licensed to gain their victim’s trust. The modus operandi for communicating with the victims is SMS, messaging apps like WhatsApp, and social media.

As soon as unlicensed moneylenders have grabbed the attention of their targets, they manipulate the borrowers to acquire crucial personal information and more. Everything usually goes out of hand when the supposed money for a loan is involved in the equation.

Unlicensed moneylenders in Singapore are like loan sharks or Ah Longs, as Malaysians and Singaporeans call them. They do not hold back when threatening, abusing, scamming, and disturbing the victims. Or anyone who is associated with their target.

It is their way to instil fear and for their targets to give in to illegal activities.

Contact the Registry of Moneylenders and Relevant Authorities

To stop all the nonsense, the Ministry of Law, Singapore Police Force, and authorities encourage borrowers and eyewitnesses to file a complaint against illegal moneylending activities.

A borrower can verify a lending Singapore business by checking the Registry of Moneylenders. For possible cases of unlicensed lending schemes, complainants may call 1800-924-5664 X-Ah Long hotline or the Singapore Police Force at 999.

Employers with foreign domestic workers in their midst and wishing to protect them from unlicensed moneylenders opt to reach the X-Ah Long hotline at 1800-924-5664.

Monetary Issues Resolved with Legal Moneylending in Singapore

Sometimes circumstances come that disrupt your finances. Your budget could suffer even more if you don’t act on the monetary issue soon.

Although you may apply for a personal loan from banks and other financial institutions, moneylending in Singapore is always a reliable alternative. Before you request a loan, comply with the annual income requirement and analyse the interest rates and fees.

Don’t forget to be exceptionally cautious when lending transactions, and be mindful of the red flags of illegal lending. Call the relevant authorities immediately to ensure your safety and security if you encounter such activities.

Moneylending in Singapore only seeks to grant the best financial services it can offer to the country’s community. If you’re ready to apply for a loan from Singapore’s best moneylending businesses, click here.