Most people want to be done with their personal loans in Singapore as soon as possible. However, is it feasible to pay off your loan early? And if yes, are there any consequences? This write-up reveals the process of repaying your personal loan early in Singapore and important considerations to keep in view.

Pre-Closure and Early Repayment Fees: What You Need to Know

The act of closing a personal loan prior to its fixed repayment term is known as pre-closure. Some lenders, in exchange for the privilege of paying off the loan earlier, may impose a fee, referred to as an early repayment fee.

When pondering the idea of early repayment, it’s imperative to discern whether your lender has such a fee in place. This fee, though seemingly insignificant, can accumulate and greatly enhance the cost of early repayment. Thus, it’s crucial to take this fee into account before reaching a final decision.

The Benefits and Drawbacks of Early Loan Repayment in Singapore

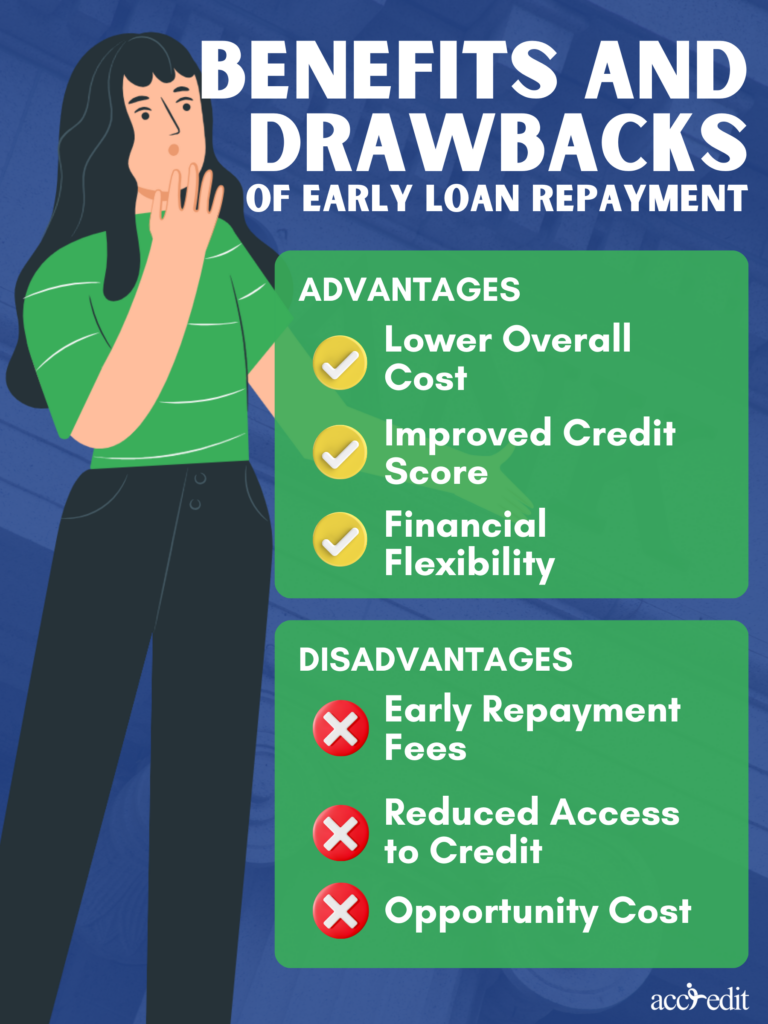

By paying off a loan ahead of schedule, you may lighten the burden of interest payments, exhibiting your responsible financial behavior and potentially enhancing your credit reputation. With reduced or removed debt, your finances become more flexible, affording you greater opportunities to pursue your financial aspirations.

The joy of freeing oneself from debt can be quite a thrill but beware of the possible pitfalls. Some lenders in Singapore may impose a fee for early repayment, which can diminish the satisfaction of paying off a loan. And with a reduced credit history, accessing loans in the future could prove to be a challenging feat.

It is important to consider that the funds used to pay off the loan prematurely may be better utilized for other investment opportunities that could potentially yield greater returns.

Know Before You Go: Lender Early Repayment Fee in Singapore

When it comes to settling loans before the due date in Singapore, some lenders impose an early repayment fee. To avoid any unwelcome surprises, it’s crucial to communicate with your lender before making any repayments. Here’s a rundown of loan providers that enforce an early repayment fee.

| Personal Loan | Early Repayment Fee |

| HSBC Personal Loan | 2.5% of the redemption amount |

| Standard Chartered CashOne Personal Loan | S$150 (or 3% of the unpaid outstanding amount, whichever is greater) |

| CIMB CashLite Personal Loan | S$250 (or 3% of the unpaid outstanding amount, whichever is greater) |

| UOB Personal Loan | S$150 (or 3% of the unpaid outstanding amount, whichever is greater) |

| DBS Personal Loan | S$100 for a credit card personal loan S$120 for a cash line personal loan |

| POSB Personal Loan | S$250 |

| OCBC Personal Loan | S$250 |

| Maybank CreditAble Term Loan | S$200 (or 3% of the unpaid outstanding amount, whichever is greater) |

| BOC $martLoan | S$100 |

Thoughts

The burden of debt might seem like a weight lifted off your shoulders when you finally pay it off. You may save money and establish financial independence by minimizing your interest payments.

But before putting extra payments towards your debt, it’s wise to check in with your lender and uncover any fees that may come with early repayment. Being informed allows you to make a decision that supports your overall financial well-being.

Accredit Licensed Moneylender: Your Trusted Financial Partner

Is your bank account running on fumes? Look no further than Accredit Licensed Moneylender to get you out of this bind. The best part? You get unparalleled low-interest rates, courtesy of their esteemed reputation as a trusted and dependable moneylender.

Accredit understands that each customer is unique. That’s why their team of experts adopts a personalized approach with each client, treating them as a trusted confidant while offering top-notch financial advice.