People living in Singapore have experienced many highs and lows while in the country and have considered taking a personal loan. As ongoing economic issues arise, people struggle to keep up with the inflation rates and taxes and make ends meet. It is a common financial predicament worldwide, and Singapore’s communities experience the same cataclysm.

Whenever people are facing these situations, different strategies come up. For instance, those prepared for unforeseeable events have organised their liquid savings as these types of protection are crucial to settle any financial liabilities. For those unprepared, taking a loan from lenders in Singapore may lighten the monetary challenges.

Though, with the various financial products, some are keen on having money as soon as possible. For these particular circumstances, applying for personal loans becomes logical.

Requesting a loan is one thing; what happens after its approval? What about the means of paying off the debt? No one wants to deal with a complicated debt setup. So, today you’ll learn how to reduce your loan obligation.

What is a Personal loan?

People sometimes refer to it as a consumer loan or an unsecured debt. It is an unsecured loan borrower mainly apply for due to requiring a small sum for their daily needs or to cover emergency expenses.

What is an unsecured fund or loan? From the term itself, it is a form of unsecured funds or loan privileges that do not demand the borrowers to provide collateral.

Due to the lack of collateral, banks, financial institutions, and licensed moneylending companies are taking a massive risk when considering approving a personal loan. To ensure these specific financial entities acquire leverage on borrowers with higher interest rates, plus fees and other charges.

What is Collateral?

It is an object with a specific value that borrowers may offer as pledges to a financial institution or lender for approval to get a loan or credit line.

The entities usually accepted as collateral are vehicles, properties, forms of investments, and cash.

The financial institution demands these bonds, so credit is a secured loan.

Who Needs a Personal Loan in Singapore?

Loans are available to Singaporean Citizens and Permanent Residents. Foreigners can also apply for this unsecured loan whilst asking for an unsecured loan. Although demographics play a massive role in uncovering more details regarding who often seeks consumer loans, it’s also a matter of intent.

Most of the motivations for getting an unsecured loan are because of its fast availability. People are more than aware of the economic crisis happening worldwide. Thus, everyone understands that as financial emergencies arise, a personal loan is the fastest accessible source of cash.

Can a person without proof of income obtain an unsecured loan?

There might be cases wherein a person finds themselves in a difficult monetary situation. For instance, they lost their job recently, or they just started working but don’t have enough funds for their daily expenses, and so on.

The notion of acquiring an unsecured loan becomes a welcomed choice. But, Singapore’s financing and moneylending industry imposes strict laws. These laws ensure the industry’s stability and lessen overborrowing occurrences. Plus, it encourages responsible borrowing as debtors would understand their obligations more.

As a rule of thumb, everyone inclined to take out personal loans must have proof of income. However, a person may contact banks, financial institutions, and licensed moneylending companies regarding their concern about borrowing without proof of payment in Singapore.

Furthermore, people must refrain from engaging in any transaction with illegal financial businesses and unlicensed moneylenders due to abuse and legal implications that may ensue.

How can you ensure the loan transaction’s legitimate? It’s best to check the Registry of Moneylenders. Here you’ll find the complete list of Singapore’s accredited lending companies.

Where Can One Apply for a Personal Loan?

Singaporean citizens, Permanent Residents, and foreigners may seek banks and financial institutions for their unsecured loans application.

Banks

Most, if not all, banks accessible in Singapore offer personal loans to their customers. There are specific steps before they grant loanable money to their clients. It would primarily involve checking the borrower’s credit history and score.

Most of the time, banks will prioritise their clients for a personal loan.

Financial Institutions

These businesses allow clients to apply for different credit lines, including unsecured loans. As with the banks’ policies and following the law, financial institutions will screen the client’s overall creditworthiness before permitting the loan’s approval.

Financial institutions do put forward competitive, flexible policies and interest rates. Nonetheless, only have an agreement with these businesses authorized to operate by the Ministry of Law in Singapore.

These monetary institutions will concentrate on putting their members first regarding loan approvals.

Licensed Moneylenders

The Ministry of Law grants all licensed moneylenders in Singapore duly authorized to proceed with lending operations and must abide by the Moneylenders Act 2008.

The operations of licensed moneylenders in Singapore focus on providing cash, services, and goods to their clients. And the loans people take from their services are primarily at a much higher interest rate than banks. What’s more, these are in shorter intervals.

Registered moneylenders disburse personal loan amounts according to the loan capping system. The cash for their business usually comes from the owner or the small group who established the company. As a result, the Ministry of Law acknowledges the 4% monthly interest rates licensed moneylenders may charge their borrowers.

Borrowers may obtain a maximum interest rate of 4% per month. It’s applicable regardless of the client’s monthly income as long as the loan requested is secure or unsecured.

When Do Unsecured Loans Become a Disadvantage?

Many individuals want a personal loan because it is the fastest way to fund their needs. Challenges may arise due to unmet repayment schedules or borrowers wishing to maximize their loans intently.

To the Ministry of Law’s guidelines, all borrowers must lawfully fulfill their loan contracts regardless of their personal or professional situations. Debtors must abide by the contractual terms and be fully aware of their income and other financial commitments.

The Ministry of Law also has high demands for Singapore’s banks, financial institutions, and licensed moneylenders. These legal regulations provide necessary details and terms that borrowers must easily understand and comply with. It’s an approach to ensure debtors become more responsible and diligently repay the loan accordingly.

Thus, financial advisors and the Ministry of Law urge borrowers to borrow funds they can repay. If they cannot meet the terms accordingly, the unsecured loan disadvantages amplify because of late payment fees and higher interest payments. These will put a massive amount of stress on borrowers and even their families.

How to Reduce Personal Loan Burden?

An unsecured loan becomes a massive commitment once someone abandons their lawful duty as a borrower. So, in light of this, how does an individual reduce unsecured loan responsibilities?

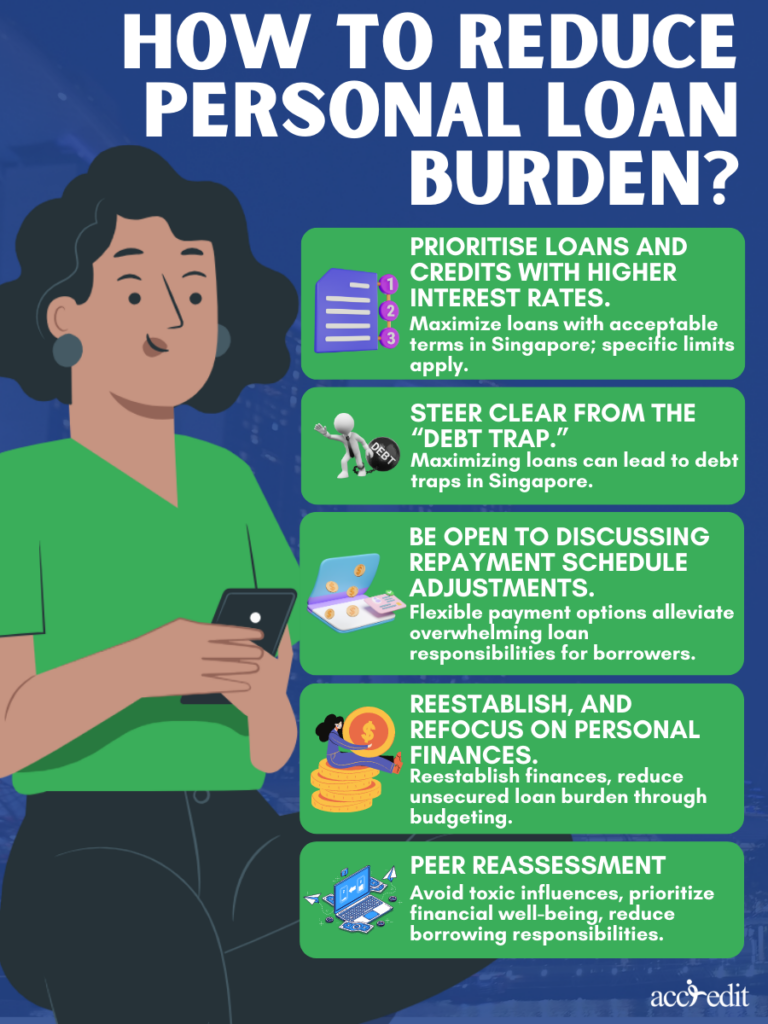

Prioritise loans and credits with higher interest rates.

With the acceptable loan terms in Singapore, some individuals have chosen to maximize their loans.

In this scenario, secured credits may obtain loans of any amount. However, it is a different case for unsecured credit, like consumer loans. The Ministry of Law in Singapore imposed the maximum amount that borrowers may get, specifically from licensed moneylenders.

Singaporean citizens, permanent residents, and foreigners with a total annual income of a minimum of $10,000 and not reaching $20,000 may acquire $3,000. When the yearly income hits at least $20,000, they can loan up to six times their monthly payment. But, foreigners with less than $10,000 annual income may only get $500.

As unsecured credits enforce higher interest rates and other fees, the financial obligation quickly becomes apparent to the borrower.

Because of this, borrowers should prioritise their loans or credits that already have higher interest rates. In this manner, borrower can pay their debts faster.

They gradually free themselves from the debt pit of higher and unattainable interest rates and late fees.

Steer clear from the “debt trap.”

Singapore’s Ministry of Law grants financing opportunities to individuals working and residing there. These individuals have the legal rights to apply, obtain approval and loan disbursement, and even maximize their loans. But, over-maximizing loan advantages can lead to overborrowing and debt traps.

Any borrower that finds themselves in this particular situation may experience surpassing their loan’s repayment capacities. There are many cases where the debtor’s income is no longer sufficient. Because of this, they can no longer pay on time and incur late payment penalties, which continue to inflate the overall debt.

It is a debt trap. As borrowers take on multiple loans to maximize their accessible funds, they’ll realize they can no longer keep up with their obligations. Plus, the interest increases each month.

No matter how tempting, decreasing the loan burden is possible when you avoid the debt trap.

Be open to discussing repayment schedule adjustments.

There’s a time for everything. The acknowledgement that the initial payment schedules may be too rigid on the borrower’s finances proffers an opportunity to lessen the overwhelming loan responsibilities.

It is a fact that many borrowers do not want a lengthier timeframe when paying for their debts. As a result, it is prudent to discuss repayment schedules with banks, financial institutions, or licensed moneylenders and ask for some adjustments.

What’s most important here is the borrower doesn’t have any plan to abandon their legal responsibilities as a debtor. Still, it’s good to seek a method that enables them to pay, which crosses out another debt-related worry.

Reestablish, and refocus on personal finances.

When unsecured loans pile up, it can lead anyone to feel inadequate and paralysed. It is a natural occurrence and is always a mendable problem.

Another strategy to diminish the loan’s load is reestablishing and refocusing on personal finances. One of the most critical techniques a borrower may apply to pursue their finances better and ease the debt load is documenting their income and expenses and creating a better budget plan.

Making a budget plan is challenging enough, particularly when the personal loan payments are dangling in the spreadsheet. But, it is an efficient way of becoming more aware of one’s finances.

The plan recognises the clear intent to lower the liabilities linked to the loan at the most feasible and maximum level permissible for a borrower. Additionally, it broadens the borrower’s prospect to allocate enough funds for their individual needs, debts, and other payments while ensuring that in balance.

With the aspiration to lessen the unsecured loan load to the bare minimum, reestablishing and refocusing on one’s finances is a logical and workable approach.

Peer Reassessment

There’s no denying the reality that people contrast in many ways. Some can be of significant influence, while others push their peers to do unnecessary things. And many people may not realise it yet, but the individuals around them may have a more profound impact on their lives, particularly their finances.

Avoid people who urge or harass others to pay for food, drinks, and items that aren’t in a person’s budget. These individuals will disrupt one’s finances through favours, guilt-tripping, or simply in the guise of having fun.

Peer reassessment assists a person in filtering through who among their friends, community, or family members have toxic tendencies about money or loans. Thus, with appropriate repercussions, you can devise suitable methods to lessen interactions with such people and ease your borrowing responsibilities.

Borrowing Responsibly Lessens Personal Loan Burden

These are a few yet effective ways to diminish personal loan burden. Still, being aware and responsible for one’s finances is a primary perspective any borrower can take to minimise personal loan before it becomes a serious concern.

Unburden your financial troubles today, and click here to apply for a personal loan via Accredit.