Are you searching for a way to afford a significant purchase or cover unforeseen expenses? If so, a personal loan could be the solution you need.

A personal loan allows you to finance expenses such as tuition fees, credit card debts, vehicle repairs, and more without depleting your savings account.

In Singapore, numerous licensed moneylenders and banks offer personal loans. However, it’s crucial to keep in mind that each lender has its unique borrowing limitations, and your borrowing eligibility is determined by your salary.

Eligibility for Personal Loans in Singapore: Minimum Income Requirements

If you’re a Singaporean or Permanent Resident, you need to make a minimum of S$30,000 annually. But if you’re a foreign worker, the criteria can be more complex. Alongside possessing a valid E-pass for at least one year, you must earn a minimum of S$40,000 yearly, although some banks may ask for more.

Yet, fret not if your income falls short of these thresholds. Licensed moneylenders are a feasible option, extending financial aid to those making less than S$20,000 annually. No matter your earning level, there’s a range of loan products accessible to you in Singapore.

| Loan Providers | Singaporeans/ PRs | Foreigners |

| Bank income requirement | S$30,000 per year | S$40,000 – S$60,000 per year |

| Licensed moneylender income requirement | Earn less than S$10,000 or S$20,000 a year | Earn less than S$10,000 or S$20,000 a year |

How much money can I borrow with personal loans in Singapore?

Now that you know the specific income requirements to apply for a personal loan in Singapore. Here is a table that shows the general sense of how much money you can borrow.

| Loan providers | Minimum Loan Amount | Maximum Loan Amount |

| Licensed Moneylenders | $3,000 for Singaporeans and PRs S$500 for foreigners | 6x times your monthly salary |

| Banks | S$500 or $1,000 | 4x times your monthly salary or 10x times your monthly salary |

Discover the important factors that determine your loan amount

Your monthly income does not solely determine your loan amount. There are other significant factors that play a crucial role in determining the amount you can borrow. This includes your credit score, employment history, and DTR.

Credit Score

Your credit score holds immense importance in the loan application process for two critical reasons. Firstly, it determines your eligibility for the loan. Secondly, it allows the lender to determine the maximum amount of funds they’re comfortable lending to you.

A lackluster score is an alarm bell that alerts the lender to the fact that you pose a higher degree of risk as a borrower. Consequently, you may only receive a limited sum of loan funds. On the other hand, a high credit score demonstrates your responsible money management, making you a more attractive candidate for a loan with a larger amount.

Employment History

The other factor is your employment history which contains your performance and cash advances. Your lender will certainly hand you a higher loan amount if you are the type of person who has worked for more than 1 to 2 years.

This is because the longer you stay employed means you have a steady source of income. And if you manage to get a raise based on your record, best believe you’ll receive a fair loan offer.

Income-to-debt ratio

In the realm of lending, your income-to-debt ratio holds immense weight. If you bear the burden of existing debts, your loan amount is likely to shrink as lenders aim to minimize their risk. Despite your eligibility for a loan, your lender will offer a limited sum as a precautionary measure.

However, if you seek to borrow a larger sum, it is wise first to clear your outstanding debts. This way, you can secure a more substantial loan and safeguard your financial future.

Compare Loan Amounts from Different Personal Loans in Singapore

When searching for the perfect loan, the amount offered is undoubtedly a crucial factor. As such, it’s essential to compare the loan amounts offered by different providers to make an informed decision.

| Personal Loan | Minimum Income Amount | Minimum Loan Amount | Maximum Loan Amount |

| Accredit Personal Loan | S$10,000 or less | $3,000 for Singaporeans & PRs S$500 for foreigners | 6x your monthly salary for an income of S$20,000 |

| SCB CashOne Personal Loan | S$20,000 | S$1,000 | 2x monthly salary for yearly income below S$30,000; 4x monthly salary for yearly income greater than S$30,000; 8x monthly income for yearly income above S$120,000; cap at S$250,000 |

| DBS/POSB Personal Loan | S$20,000 | S$500 | 4x monthly salary 10x your monthly salary for income greater than S$120,000 |

| OCBC Personal Loan | S$20,000 | S$1,000 | 4x monthly salary; 6x your monthly salary for income greater than S$120,000 |

| UOB Personal Loan | S$30,000 | S$1,000 | 95% of your available credit limit |

| HSBC Personal Loan | S$30,000 | S$1,000 | 4x monthly salary for income S$30,000 to S$120,000; 8x monthly salary for income greater than S$120,000 |

| CIMB CashLite Personal Loan | S$30,000 | S$1,000 | Up to 90% of your credit card limit |

| Citi Quick Cash Loan | S$30,000 | S$1,000 | 4x your monthly salary or S$150,000 |

Personal Loan Eligibility Based on Salary: FAQs

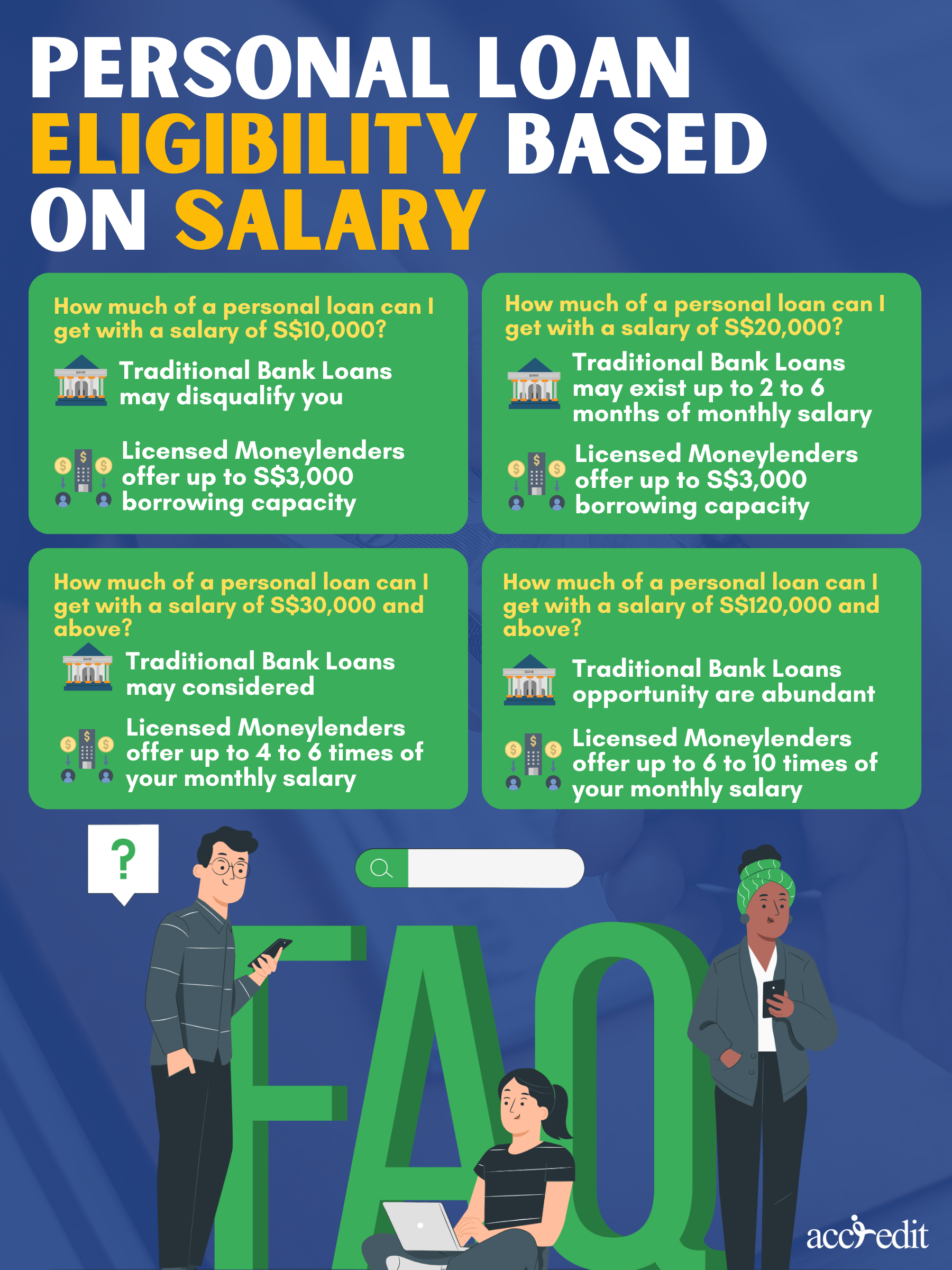

- How much of a personal loan can I get with a salary of S$10,000?

Earning S$10,000 per annum may disqualify you from traditional bank loans. However, a licensed moneylender presents an alternative solution with a borrowing capacity of up to S$3,000.

- How much of a personal loan can I get with a salary of S$20,000?

For those earning a yearly salary of S$20,000, loan opportunities exist through various banks, with borrowing capabilities ranging from 2 to 6 times the individual’s monthly income. However, those seeking the greatest likelihood of loan approval may consider regulated moneylenders, offering loans of S$3000.

- How much of a personal loan can I get with a salary of S$30,000 and above?

Individuals earning a yearly salary of S$30,000 may be considered for substantial loan amounts. Based on the selected lender, one may have the opportunity to secure financing of up to 4 or even 6 times their monthly earnings.

- How much of a personal loan can I get with a salary above S$120,000?

For those earning a yearly income above S$120,000, loan opportunities are abundant, with potential borrowing capacities reaching 6 to 10 times your monthly income.

Get Secure Personal Loans Six Times Your Monthly Pay with Accredit Moneylender

Accredit Moneylender takes the hassle out of personal loan applications, so you can enjoy the convenience of getting financial assistance without any worries. We understand that low-income earners may find the loan process daunting, which is why we offer loan limits of up to six times your monthly income if you earn more than S$20,000.

If you earn less than S$20,000, there’s no need to worry because you can still get a loan limit of up to S$3,000. At Accredit Moneylender, we believe that everyone should have access to financial assistance, no matter their income level. Don’t wait any longer.