Some problems are self-made, while others occur unintentionally. In cases of getting a maximum personal loan, it’s an issue that requires better understanding.

For instance, the goal to save as much funds as you can to renovate your home is well on its way. But, instead of waiting for the right time, you used it as an investment. The investment didn’t cultivate returns, and the need for financial assistance is excellent.

Take Responsibility and Find a Solution

Why did you have to face this particular financial issue in the first place? It’s partly due to impatience and miscalculation. But it’s a good thing the monetary dilemma has a solution. And the answer is taking out a large consumer loan.

Can you take a significant amount from an unsecured loan?

Aren’t these supposedly “small amounts” only?

Well, It’s more than possible.

Indeed, it’s crucial to make sure you are qualified. Aside from your eligibility, it’s essential to know additional details on unsecured loans. Particularly on where you may apply for it and if you need it.

What is a Personal Loan?

In the world of finance, loan choices are almost endless. It ensures that the finance industry may serve its clients and gain a fast return on investment.

With this efficient system, the finance market is profitable mainly as a person or business cannot operate with cash. The currency helps propel personal, trade, and commerce-associated goals. Thus, it’s almost impossible to see any individual or company that’s never taken out a large loan.

A personal loan is one of Singapore’s most popularly known types of credit. It’s best described as a consumer loan as, in most situations, people would borrow cash for personal and business needs.

Loans in Singapore branch in two categories. Secured and unsecured credit. A personal loan is an unsecured credit because borrowers may borrow funds from a lender without surrendering any valuable possession or collateral.

Many are familiar with a personal line of credit only proffering “small amounts” to its borrowers. But the truth is, you can qualify for a large unsecured loan. How much maximum funds can the amount be?

How Much Maximum Personal Loan Can You Get?

In Singapore, it’s rare to find a considerable amount approved for a consumer loan. But it’s not impossible.

Since a personal loan is an unsecured credit, lenders must guarantee their businesses will not suffer massive blows if a borrower defaults. Thus, the Monetary Authority of Singapore and the Ministry of Law have since compelled other bodies to proffer provisions on limiting loan access.

Nevertheless, a large sum from an unsecured loan is available, primarily when focused on smaller amounts.

The maximum total loanable amount will vary on where you will get it, such as licensed moneylenders or banks. The lender will also assess a person’s nationality or citizenship status to obtain the highest overall personal loan amount accessible.

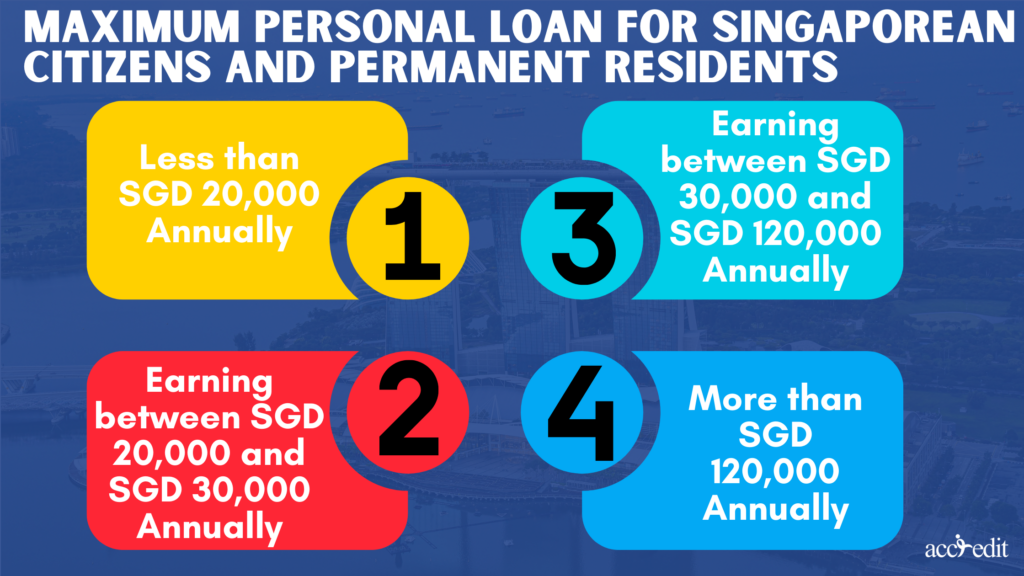

Here’s an estimated breakdown of the maximum unsecured loan amounts based on residency status and annual income levels:

Maximum Personal Loan for Singaporean Citizens and Permanent Residents

- Less than SGD 20,000 Annually

- Singapore’s traditional banks usually refrain from offering unsecured loans to borrowers earning below SGD 20,000.

- Some monetary institutions may offer it, and the loan amount could be lower than borrowers would expect.

- The max loan amount licensed moneylenders grant to individuals earning less than SGD 20,000 annually is capped at SGD 3,000.

- Earning between SGD 20,000 and SGD 30,000 Annually

- Banks in Singapore may grant personal loans of up to two times the borrower’s yearly salary.

- Financial institutions could grant up to two times the borrower’s annual salary.

- Singapore’s licensed moneylenders are capped at SGD 3,000.

- Earning between SGD 30,000 and SGD 120,000 Annually

- Banks may grant a max personal loan amount of up to four times the borrower’s yearly salary.

- Singapore’s financial institutions could permit up to four times the borrower’s annual income.

- The maximum loan amount licensed moneylenders grant is capped at SGD 6,000.

- More than SGD 120,000 Annually

- Banks in Singapore offer a maximum personal loan amount reaching up to eight times their borrower’s yearly income.

- Financial institutions offer up to eight times the borrower’s annual income when the latter earns more than SGD 120,000 yearly.

- Licensed moneylenders in Singapore grant SGD 6,000 for the max loan amount.

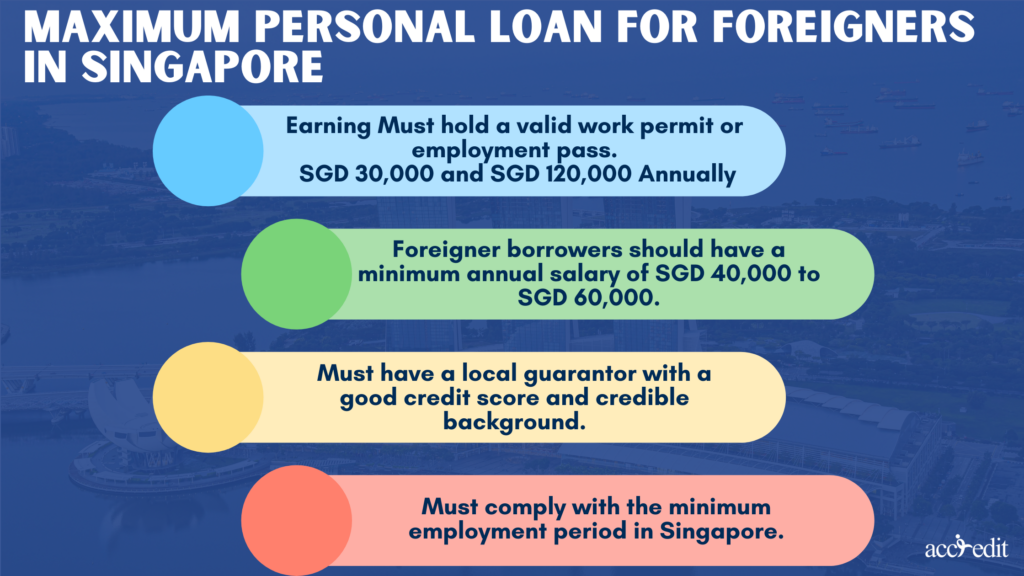

Maximum Personal Loan for Foreigners in Singapore

For foreigners in Singapore, the max loan amount and eligibility criteria still differ on the bank, financial institution, or licensed moneylenders. Generally, foreigners may apply for personal loans upon meeting the following criteria:

- Must hold a valid work permit or employment pass.

- Foreigner borrowers should have a minimum annual salary of SGD 40,000 to SGD 60,000.

- Must have a local guarantor with a good credit score and credible background.

- Must comply with the minimum employment period in Singapore.

The typical maximum personal loan amount for foreigners in Singapore is lower than for Singaporean Citizens and Permanent Residents. It usually ranges between two to four times the borrower’s yearly income.

Maximum Personal Loan Qualifications

Borrowing money from lenders in Singapore is possible, especially when you know where to seek financial assistance. Also, complying with the qualifications can boost your loan approval.

Here are two specific qualifications that can assist max unsecured loan approval in Singapore:

Banks

Banks in the country are particularly stern with their policies. When you already have an account with a local bank, applying for a loan is more accessible. But that isn’t the only qualification to get a large unsecured loan from a bank. You also have to provide the following;

Proof of income

Proof of income is essential for loan qualification, notably if you’re targeting a significant amount. Banks must guarantee you can repay the debt with interest rates and other charges.

Creditworthiness

A borrower’s creditworthiness is highly valued in Singapore as it’s relevant in assessing one’s monetary status. Thus, you must determine your creditworthiness before applying for a large consumer loan.

To access your credit report, you must acquire a copy of the credit file online through SingPost branches or from the Credit Bureau Office. Prepare $8.00 for the credit report with the current GST.

A credit score and risk grade of 2000 and AA can lead you immediately to a large instalment loan.

Yet if you have a 1000 and HH credit score and risk grade, it’s best to reconsider taking a bank loan and pursuing an alternative financial institution.

Licensed Moneylenders

A licensed moneylender in Singapore is under the regulations of the Ministry of Law – Registry of Moneylenders.

Every licensed moneylender in the country is subject to commit and comply with the Moneylenders Act. Among the provisions of the Moneylenders Act is the more significant amount of instalment loan accessible for a borrower.

To qualify for a large unsecured loan, a borrower has to provide several requirements, such as;

Valid employment proof

With a higher interest rate, a borrower has to have the means to repay the unsecured loan. And a valid proof of employment guarantees that.

Nationality

Singapore has always had a unique and harmonious blend of culture, tradition, and heritage. The reason behind this is the all-inclusive community perceptible in the country.

For a borrower to be eligible to take out a substantial personal loan, they must indicate their nationality as a Singapore Citizen, Permanent Resident, and foreigner living and working in the country.

Creditworthiness

Like banks, a licensed moneylender will assess a borrower’s creditworthiness. It is a standard operations procedure that the Ministry of Law – Registry of Moneylenders encourages.

Via the Moneylenders Credit Bureau (MLCB), a licensed moneylender acquires information on the borrower’s previous or existing loans and repayment records. A licensed moneylender often purchases the credit report with the borrowers’ details.

In addition, you can purchase your credit report through www.mlcb.com.sg or at DP Information Group’s offices for in-person appearances.

Even though your creditworthiness may not be as excellent as you’d hoped, it is still possible to be granted a large instalment loan. The final decision will depend on your decent monthly and annual income.

Annual income

A borrower’s annual income is the customary evaluation pre-requisite upon qualifying for a large consumer loan. An interested borrower’s yearly earnings must be at least $20,000 to be granted up to six times the monthly income.

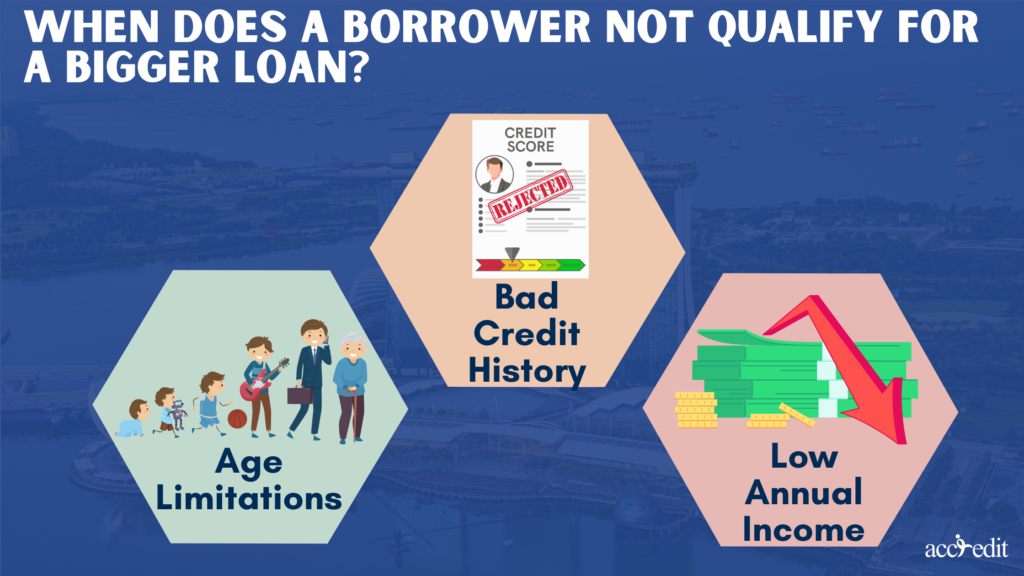

When Does a Borrower Not Qualify for a Bigger Loan?

Before applying for a large unsecured loan, you must have your checklist. By going through the checklist method, you’d know the requirements to be granted the enormous unsecured loan amount. But did you know that some variables may affect your loan request, especially when you do not meet the provisions?

As a result, you also have to create a separate checklist to ensure you won’t fall into the criteria of borrowers not qualified to get a more considerable loanable amount receivable. What are these factors?

Age Limitations

In Singapore, Singapore Citizens, Permanent Residents, and even foreigners residing in the country must comply with the designated age level when borrowing money from banks, financial institutions, and licensed moneylenders.

Age matters for these transactions as it also indicates if the person can work, have a business, and repay the credit.

Banks, financial institutions, and moneylenders mostly allow people already 21 up to 65 years old. A person younger than 21 or older than 65 is not encouraged to take in new loans.

Bad Credit History

In many cases, unfavourable approaches regarding handling loans and repayment can affect present and future transactions. It is usually evident when someone might be profiled as a defaulter due to a low credit score and risk grade.

Thus, leaving a noticeably troublesome dent in one’s credit history. It will, in turn, affect a person’s creditworthiness. Banks and financial institutions often reject loan requests when they see an unimpressive credit history.

For a licensed moneylender, a borrower can obtain some slight considerations for unsecured loans. Nevertheless, the proper loan process, assessment and evaluation guarantee the borrower can commit to their obligations.

Low Annual Income

Annual income is a borrower’s criteria for eligibility for a larger unsecured loan. Banks and financial institutions can only allow borrowers to apply for loans if they reach the minimum annual income.

On the other hand, licensed moneylenders in the country accommodate borrowers with a total annual income of less than $10,000. However, it is vital to understand that a low yearly earnings total will disqualify any borrower from requesting a larger unsecured loan.

Advantage of Knowing Maximum Personal Loan Qualifications

It’s normal to search for means that can assist you in solving your financial issues. Borrowing funds in times of need is a logical and ethical move.

As a result, it’s crucial to prepare written documents and every data and detail connected to your credit score and background. Lacking any of the papers will cause more problems because you won’t get the financial assistance you need.

So, make it a habit to assess, evaluate, and monitor your previous loans if you have any. Update and repay existing credits. Ensure you have a decent-paying job to guarantee the maximum personal loan amount for your needs.

To apply for a maximum personal loan today, please, click here.