Unraveling the mysteries of personal loan interest rates in Singapore is paramount to avoiding future financial mishaps. When taking on a personal loan, it’s crucial to comprehend how interest rates operate to make an educated choice. In this article, we’ll unveil the secret to calculating personal loan interest rates in Singapore, so you can stay informed and steer clear of any nasty surprises.

Understanding Interest Rates in Singapore

The success of any loan application hinges on a single, all-important figure – the interest rate. It represents the price you pay for the privilege of borrowing, expressed as a percentage of your principal amount. But borrowers know this, not all lenders are created equal. The range of fixed interest rates runs the range from a mere 3.5% to a whopping 10.8%.

The Lowdown on Interest Rates: How Banks and Licensed Moneylenders Determine Their Rates

Bank Interest Rates Calculation

To decode the calculation process, let’s break it down into an easy equation: Take the interest rate and divide it by the loan tenure, then multiply that result by the loan amount. As a result, you now have the monthly interest amount at your fingertips.

loan amount x (interest rate/loan tenure) = monthly interest amount

Let’s put theory into practice: Imagine you’re borrowing S$80,000 over five years with an annual interest rate of 3.88%. To determine the monthly interest amount with monthly repayments, use the that was previously mentioned formula:

80,000 x (0.0388/12) = 258.67

As a result, you’ll need to pay S$258.67 every month towards interest.

| Payments | Calculations | Results (5-year loan) |

| Interest Paid | 258.67 x (12 x 5) = 15520.2 | S$15,520.2 |

| Monthly Payments with Interest Rate | 80,000 / (12 x 5) = 1333.33 (monthly payments) 1333.33 + 258.67 = 1592 | S$1,592 |

| Total Amount Paid | 1592 x (12 x 5) = 95520 | S$95,520 |

Licensed Moneylenders Interest Rates Calculation

When dealing with licensed moneylenders, the law is crystal clear: the maximum interest rate chargeable is 4% per month. For instance, imagine you need a S$1,500 loan for a month, with an interest rate of 3.85%. Applying the basic formula of principal multiplied by interest rate, you’d expect to pay S$57.75 in interest.

loan amount x interest rate = interest amount

1500 x 0.0385 = 57.75

Note: Different lenders, whether banks or moneylenders, may use unique algorithms for calculating their interest rates. Therefore, it’s prudent to consult with your loan officer for an accurate estimate of the costs involved.

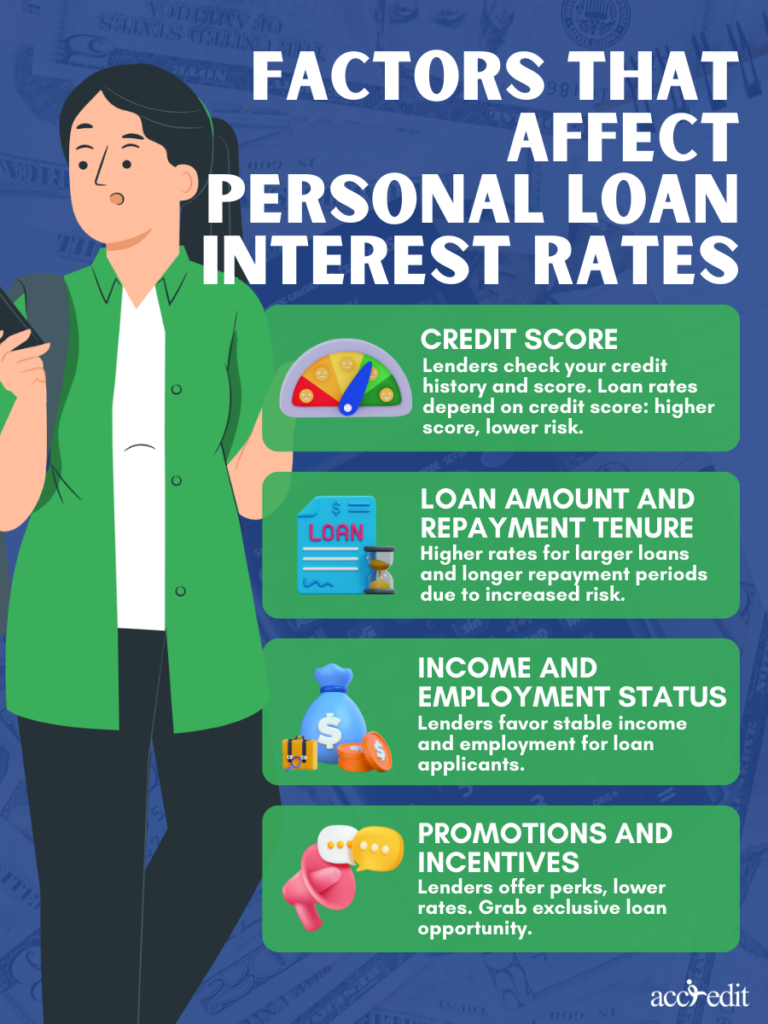

Factors That Affect Personal Loan Interest Rates

Personal loan interest rates are subject to multiple factors that influence their fluctuations. These may include:

Credit score

In the realm of loan acquisition, credit score plays a vital role in determining the interest rate to be granted. A commendable credit score signifies a borrower who is dependable and trustworthy, which renders lenders more inclined to offer a lower interest rate.

Loan amount and tenure

When it comes to personal loans, loan amount and tenure are also essential factors that impact the interest rates charged. As a general rule, a lower loan amount and a shorter tenure usually result in a lower interest rate because lenders view these loans as less risky and are more likely to offer a lower rate.

Income and Employment History

These two factors can not only improve your financial status but also secure more favorable loan terms and interest rates. With a steady income and a good employment history, you can assure lenders of your ability to repay the loan, thereby earning their trust and confidence.

Promotions and Incentives

Lenders understand the importance of utilizing promotional strategies to captivate potential borrowers. These attractive incentives provide you with a chance to experience reduced effective interest rates, ultimately leading to a mutually beneficial outcome.

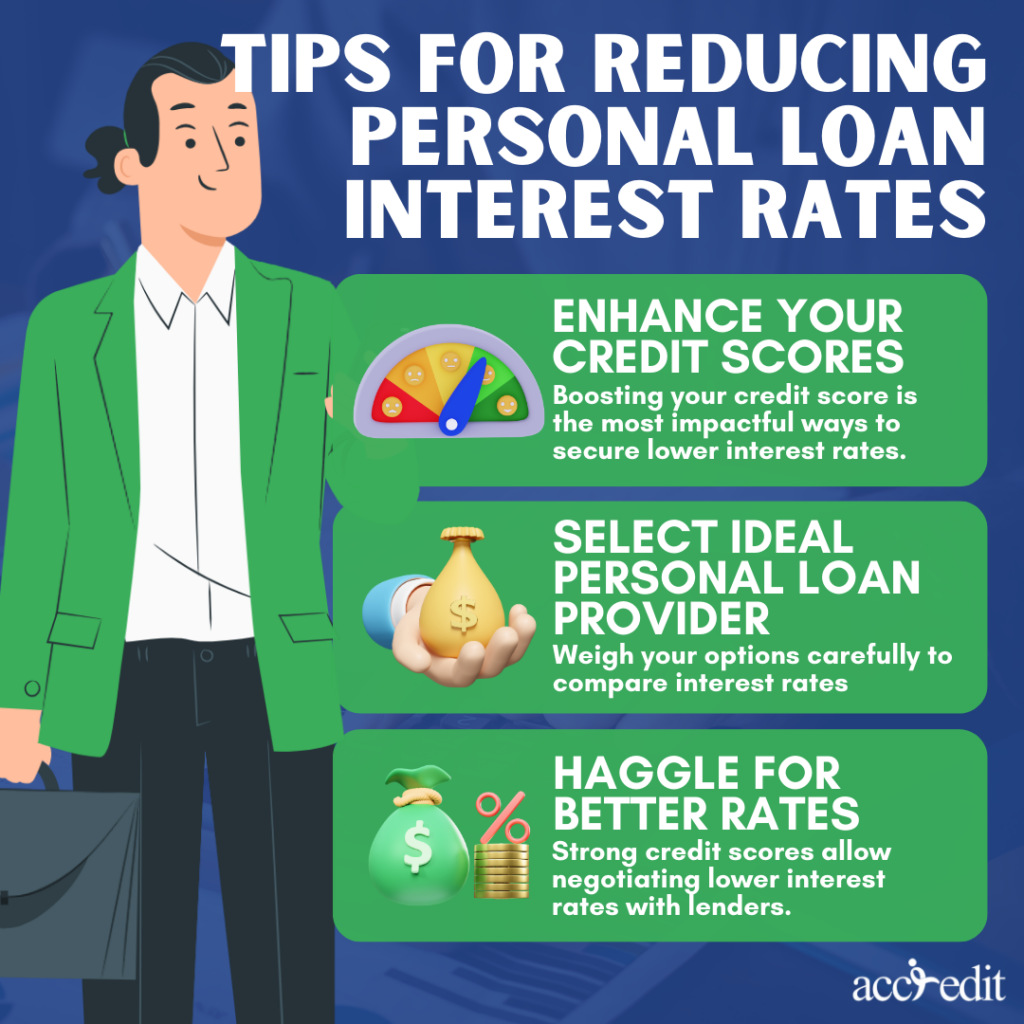

Tips for Reducing Personal Loan Interest Rates

When seeking to trim down personal loan interest rates in Singapore, a few key strategies can help you save big. Consider these tips:

- Enhance your credit scores: Boosting your credit score is among the most impactful ways to secure lower interest rates on personal loans.

- Select the ideal personal loan provider: There’s no one-size-fits-all lender for personal loans in Singapore. Weigh your options carefully to compare interest rates and loan terms.

- Haggle for better rates: Armed with a solid credit score and sound financial history, it’s possible to negotiate lower interest rates with lenders.

Thoughts

Being well-versed in the intricacies of computing personal loan interest rates in Singapore can prove to be pivotal when you are in the market for a loan. Delving deep into the nitty-gritty of the underlying factors that shape the interest rates and the intricate mechanisms that lenders use to arrive at them can empower you to make informed and shrewd financial choices.

Discover the Best Interest Rates for Personal Loans with Accredit Moneylender

If you’re searching for a trusted source of personal loans in Singapore that offers the most favorable interest rates, then look no further than Accredit Moneylender. As a leading money lender in the city, we have earned a reputation for providing an effortless and uncomplicated loan application process, speedy approvals, and affordable interest rates that won’t put you in a financial bind.