Tired of dealing with the monthly drain of personal loan repayments? Do you want to hack down your interest fees and give your credit score a much-needed lift? The solution is glaringly simple: eliminate your personal loan debt ahead of schedule. In this piece, you’ll discover the how-to’s of achieving this feat and whether it’s the optimal move.

What is a personal loan pre-closure?

A personal loan pre-closure is a method of paying off the loan before the due date. This can be done by covering the remaining outstanding balance of the loan and other charges like early fees. The process for pre-closing your loan may vary depending on the loan providers. You should always contact your lender before taking any action.

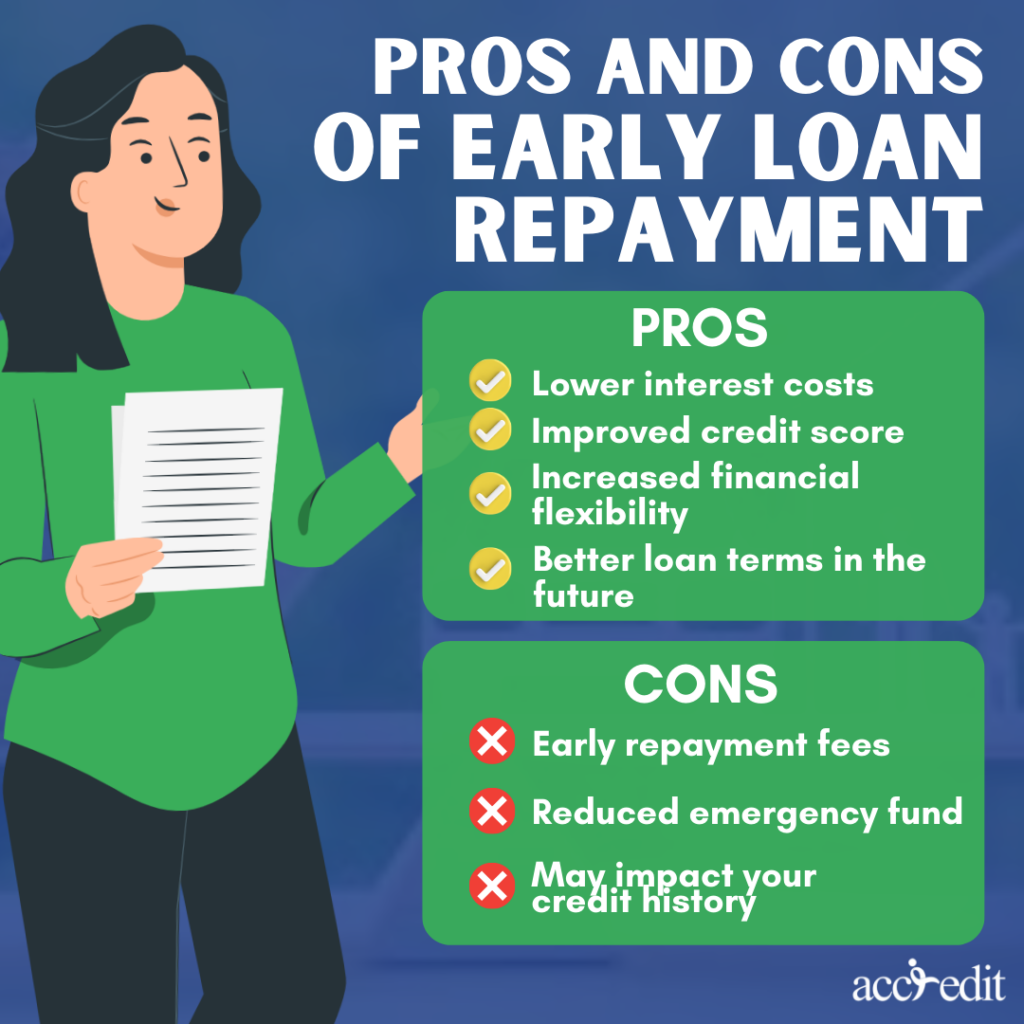

The Pros and Cons of Early Loan Repayment

Clearing your loan balance before its maturity date has its advantages and disadvantages.

While it can provide you with considerable financial advantages like reducing the overall interest you pay, improving your creditworthiness, and freeing up cash flow for future borrowing, it also comes with some potential drawbacks.

One potential downside is the prepayment penalty you might incur, which could wipe out any potential savings. Moreover, repaying your loan early could leave you without a financial cushion for unexpected expenses.

| Pros | Cons |

| ✔️ Lower interest costs ✔️ Improved credit score ✔️ Increased financial flexibility ✔️ Better loan terms in the future | ❌ Early repayment fees ❌ Reduced emergency fund ❌ May impact your credit history |

Is it a smart move to close my personal loan early?

When it comes to personal loans, deciding whether to pay off the balance early depends on your current financial situation. If you’ve experienced a recent income increase or your business has been generating higher profits, settling your loan ahead of time can be a savvy move. Not only does paying off your personal loan early save you significant sums in interest charges, but it can also have a positive impact on your credit score.

Imagine, for instance, you have a personal loan with a principal balance of $10,000, an 8% interest rate, and a three-year term. By closing the loan one year early, you could enjoy savings of over $700 in interest fees alone.

But before you proceed with closing your personal loan early, think twice if you’re already having trouble making ends meet. Settling the entire outstanding balance means you’ll also have to shoulder early repayment fees and charges, which could hurt your finances further. Failure to keep up with payments may also negatively impact your credit score, so consider all the factors carefully.

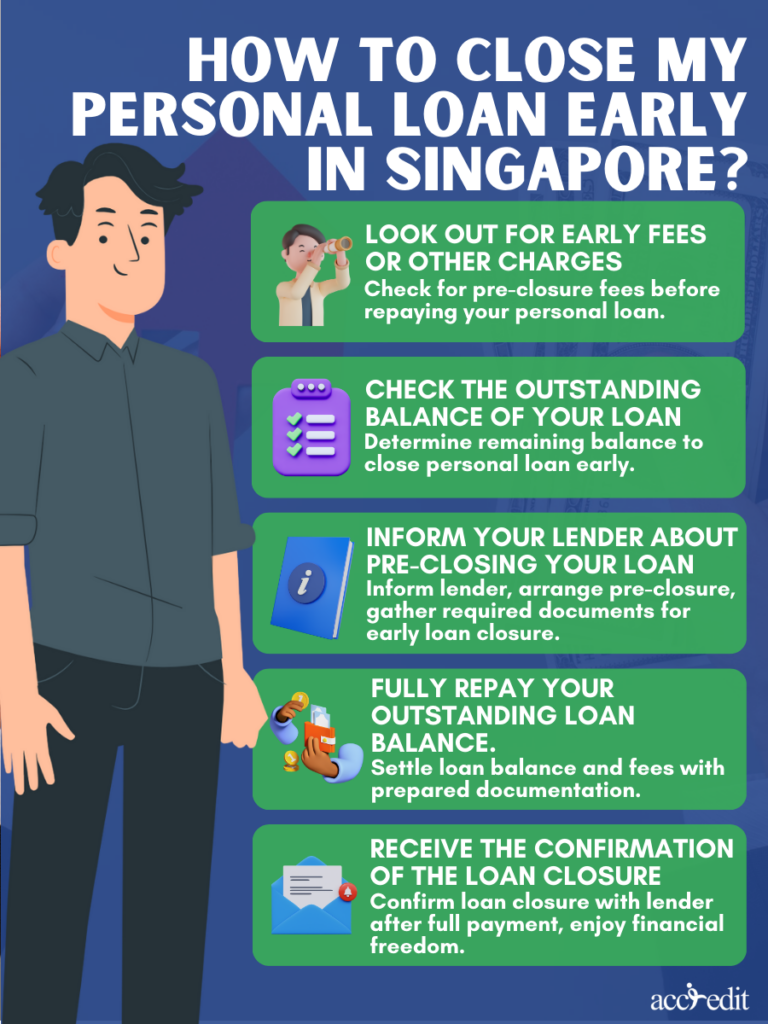

How to close my personal loan early in Singapore?

Most loan providers in Singapore have different procedures for closing your loan early. But here are the common steps on how to do it:

Step 1: Look out for early fees or other charges

Before you pre-close your personal loan, you should check for fees or other charges associated with early repayment. You can check this on the terms of your contract or ask directly to your lender.

Step 2: Check the outstanding balance of your loan

In order to close your personal loan early, you need to know the total unpaid balance. This is to help you get ready to pay off what you owe with the money you save from your raise or other incentives.

Step 3: Inform your lender about pre-closing your loan

It is important to contact your lender about the decision to close your loan early. The lender will assist you in pre-closing your loan and give you a list of required documents for you to prepare.

Step 4: Completely pay off the remaining unpaid balance of your loan

With all your documentation and paperwork in order, it’s time to clear the slate and take care of that outstanding loan balance and any associated fees.

Step 5: Receive the confirmation of the loan closure

After you have paid off everything, you have to head to your lender to make sure that the loan is officially closed. You can be free of any obligations and use your money for other things.

Why is closing or pre-closing a personal loan important?

When it comes to personal loans, closing or pre-closing is crucial. By doing so, you can avoid having any unpaid debts lingering under your name. Moreover, closing your loan early opens up a world of possibilities, from investing your money to saving it for future endeavors or even applying for a new loan.

Closing your loan ahead of schedule not only gives you financial flexibility but can also work wonders for your credit score. It demonstrates to your lender that you’re a responsible borrower who pays their debts on time and in full.

Thoughts

To slash the expense of your personal loan in Singapore, mull over prepaying it. However, hold off on making any decisions until you’ve confirmed the specifics with your lender, including potential charges for early repayment. After you’ve settled your dues, contemplate how to make the most of your newfound economic independence. Perhaps it’s worth considering investing or growing your savings.

Trustworthy Lending Solutions from Accredit Moneylender

Looking for a reliable source of personal loans in Singapore? Look no further than Accredit Moneylender. Our lending solutions are designed to provide hassle-free access to cash with swift approval and reasonable interest rates.

At Accredit Moneylender, we understand that repaying a loan can be stressful. That’s why we offer flexible repayment plans that are tailored to your unique needs. We work with you to find an option that fits your budget, so you can pay off your loan without worrying about the financial strain.

Choose Accredit Moneylender for easy, stress-free personal loans in Singapore.