People are moving forward against higher inflation rates and taxes with the option to refinance a personal loan. Communities in Singapore have set out and tightened their belts. But, the promise of financing access to getting a personal loan also becomes an appealing recourse.

Different financial organisations in Singapore, particularly banks and other institutions, grant unsecured or personal loans. Licensed money lending companies can offer personal loans to individuals residing and working in Singapore as these organisations have authority granted by the Ministry of Law.

In the past, people intended to get personal loans for instant funds or to enhance their lifestyles. They purchase gadgets, travel, or pursue their leisure. Yet, every person living in Singapore’s current financial state and high inflation rate may require more than one personal loan. As a result, many people seek those interested in refinancing a personal loan.

What is refinancing?

Does it mean you’ll be in more debt than you are now?

Why do you need it?

Does it have any effect on your credit score or status? And when can an individual apply for it? Below, let’s discover more details on how to refinance your loan successfully.

What is Personal Loan Refinancing?

Personal loans are the typical choice for people in Singapore who are in dire need of fast funds. Paying the debt continuously, you’d sometimes find yourself unsatisfied with the plan. With this, you seek another option to pay the debt with favourable terms.

And there is. It is a method called refinancing a personal loan.

It’s a feasible option granting individuals the latest credit line or loan. Moreover, it provides an effective means to pay off the current debts with one more obligation. Yes, it’ll play the purpose of replacing your existing credit.

It can impact one’s finances because of its diverse approach to relieving debt payments and possibly getting lower interest rates.

You may apply to refinance a personal loan regardless of the purpose of the initial debt.

How to Refinance a Personal Loan?

When considering how to refinance a personal loan, the first step is researching which financial organisations can provide you with the most suitable interest rates. When considering refinancing a personal loan to help you save money, then it’s wise to take your time to select the best institution for you.

Where can you acquire assistance with refinancing your unsecured debt?

- Banks

Banks proffer a wide array of refinancing alternatives for a personal loan. The packages these financial institutions provide vary, particularly the interest rates that often start at least 3% per annum and EIR per annum, with further information on fees and payment plans.

Most banks in Singapore grant diverse refinancing plans for homes and other loans, which include personal loans.

As such, a representative will guide you through terms, rates, and fees and discuss incentives when you refinance a personal loan.

- Licensed Money Lending Companies

According to the Ministry of Law, licensed moneylenders can pursue a financial transaction between a Singaporean citizen, permanent resident, and foreigner.

All licensed moneylenders comply with the Moneylenders Act 2008. The maximum interest rate per annum authorised moneylenders charge is 4%.

These two financial organisations grant diverse refinancing alternatives to assist you in getting a new loan to clear your debts. You are not limited to applying for refinancing solely on the institute you previously chose. You can stay with the bank or licensed money lending company or select to switch sources to refinance a personal loan.

Consider Debt Consolidation

Debt consolidation is another method of refinancing a personal loan. It’s functional, especially when you have loans that reach the legal limit of your monthly income.

Here, the coverage of the refinancing program, like debt consolidation, applies when the process shall consolidate all the loans in one financial institution. And it’ll be at a lower interest rate level.

Debt consolidation as a refinancing program is only applicable to unsecured loans. Many lenders in Singapore concentrate on providing eligible applicants for refinancing personal loans and prioritise Singaporean citizens and permanent residents.

Do Credit Scores Impact Personal Loan Refinancing?

In Singapore, one’s credit score is highly advantageous in finance. It is among the most useful in discovering an individual’s capacity to fulfil short-term or long-term monetary obligations.

In many cases, banks are apprehensive about allowing a person to apply for refinancing an unsecured credit, mainly when the credit score is low. However, licensed moneylenders are more forgiving in matters of credit history.

Although it isn’t 100% that they’ll allow every person to refinance a personal loan even with an unimpressive credit history. People have higher chances of getting approved for refinancing a personal loan at licensed moneylenders than banks.

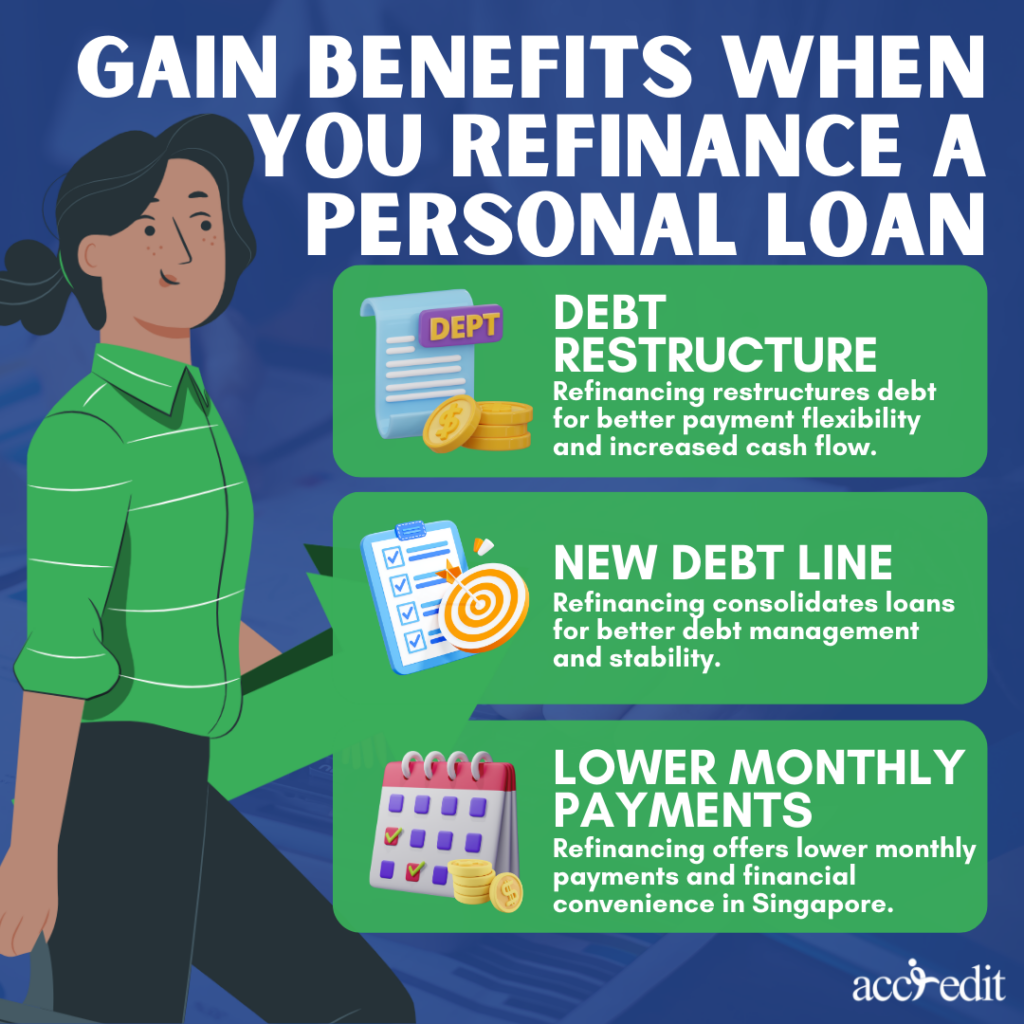

Gain Benefits When You Refinance a Personal Loan

Repaying a personal loan for a long time can take its toll. The payment scheme becomes obsolete and doesn’t offer much incentive to your finances.

The concept and application for refinancing become a practical scheme to become debt-free sooner. And here are the reasons why:

- Debt restructure

Refinancing a consumer loan allows you to restructure your debt that suits your preference best.

For instance, other financial institutions may have a refinancing program that allows you to save money. How?

When refinancing a personal loan, you can choose a program with a favourable payment design. As a result, one’s cash flow increases.

- New debt line

Many people sometimes perceive having multiple loans at once can aid them in paying their debts. However, it only causes headaches and monetary crises.

The best strategy to go for is to refinance a personal loan instead. Here, you get to open a new debt line that will finance all previous credit correspondingly.

- Lower monthly payments

In recent years, many people in Singapore suffered due to the economic crisis brought on by the pandemic. Today, only some have recovered.

So, another advantage of refinancing a personal loan is the convenience of determining a lower monthly payment plan. It is possible by picking a longer repayment term.

As you refinance a personal loan, you’ll notice significant financial changes. Nonetheless, it’s best to research, ponder, seek, and apply for such a payment strategy only when it makes sense and is beneficial to restructure your loan via refinancing.

Are you interested in refinancing a personal loan? Let Accredit help you today! Apply here.