Are you a $25K earner in Singapore seeking personal loan options? Well, here’s the scoop. The amount you’re eligible for hinges on a variety of components, such as the financial institution, credit score, liabilities, and repayment duration.

In Singapore, many banks and financial institutions extend personal loans to income earners S$25,000, offering two to four times your monthly wage. Say, if you boast an ace credit score and are free of debts, you could qualify for the ultimate amount. Let’s break down the numbers.

Computation:

| Monthly salary: S$25,000 / 12 = S$2,083.33 Loan multiple (taking the maximum of 4 times monthly salary): S$2,083.33 * 4 = S$8,333.33 |

Your monthly salary is $25,000 divided by 12 months, equating to $2,083.33. The loan multiple caps at four times your monthly salary, which tallies up to $8,333.33. But that’s a tentative estimate and the actual sum you’re eligible for hinges on the financial institution’s policies and your financial background.

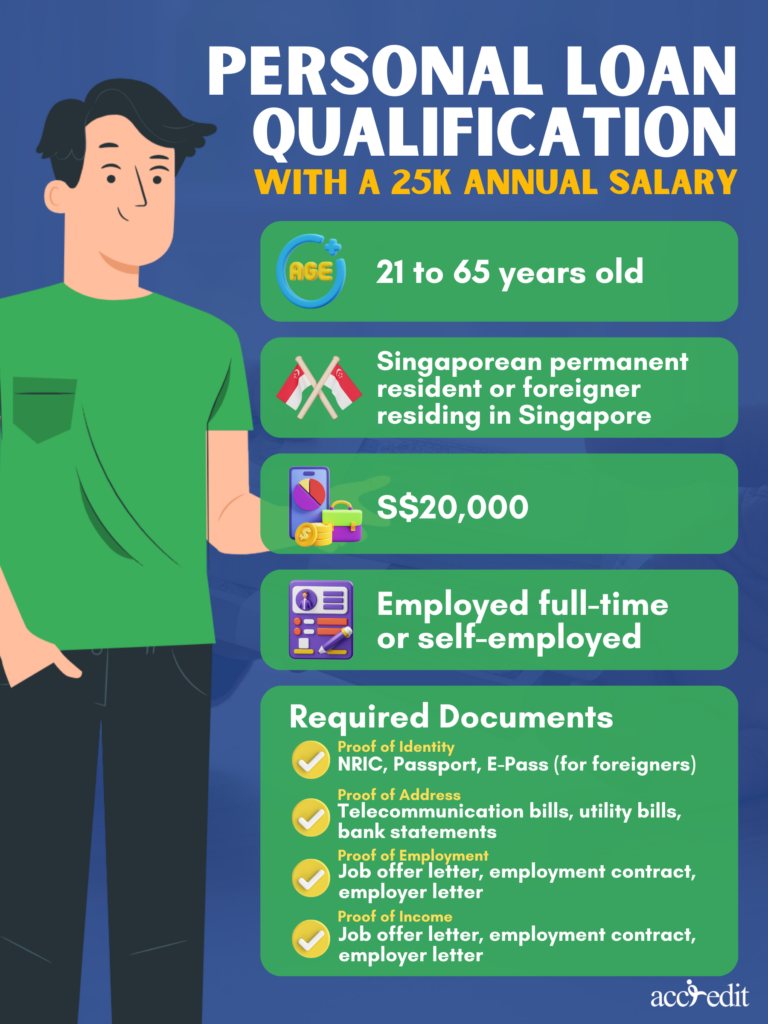

Personal Loan Qualification with a 25k Annual Salary

Before you can participate in obtaining a personal loan, there are some necessary criteria to fulfill. Take note of the following requirements to determine if you qualify:

| Age | 21 to 65 |

| Citizenship Status | Singaporean, permanent resident, or foreigner residing in Singapore |

| Minimum Income Requirement | S$20,000 |

| Employment Status | Employed full-time or self-employed |

Required Documentation

To ensure a streamlined application process, you must get your hands on these required records beforehand.

| Proof of Identity | NRIC, Passport, E-Pass (for foreigners) |

| Proof of Address | Telecommunication bills, Utility bills, Bank statements |

| Proof of Employment | Job offer letter, Employment contract, Employer letter |

| Proof of Income | Bank statements, CPF, NOA, Computerized payslip |

Best Personal Loan for 25000 Salary in Singapore

When it comes to personal loans in Singapore, there are a few standout options worth considering. Standard Chartered, OCBC Personal Loan, and DBS/POSB Personal Loan are all reputable financial institutions that offer competitive interest rates. However, if you’re unable to meet the standard bank requirements, licensed moneylenders like Accredit present a viable alternative.

| Personal Loan Provider | Interest Rate | Minimum Income | Loan Amount | Processing Fee |

| Accredit Personal Loan | Up to 4% per month | S$20,000 | $3,000 – 6x monthly income | 10% of the Principal Amount |

| Standard Chartered CashOne | 3.48%.(EIR 7.99% p.a.) | S$20,000 | S$1,000 – 2x monthly salary | S$0 |

| DBS/POSB Personal Loan | 3.88%(EIR 7.9% p.a.) | S$20,000 | S$500 – 4x monthly salary | 1% processing fee |

| OCBC Personal Loan | 5.43%(EIR 11.47% p.a.) | S$20,000 | S$1,000 – 4x monthly salary | S$100 |

Final Thoughts

Determining your eligibility for a personal loan in Singapore is a multifaceted process. As a $25K earner, you must factor in the financial institution, credit score, liabilities, and repayment duration before determining the amount you can borrow. Remember that the loan multiple caps at four times your monthly salary, up to $8,333.33 if you meet the necessary requirements.

Secure Personal Loans Six Times Your Monthly Pay with Accredit Moneylender

Need quick financial assistance without the hassle? Look no further than Accredit Moneylender. Our streamlined personal loan application process makes getting the funds you need easier than ever before. And with our loans available to those earning S$25,000 or more, you can borrow up to six times your monthly income.

Ready to take control of your finances?