Do you belong to a small or medium-sized enterprise (SME) in Singapore? If you are, consider taking out different business loans in Singapore for growth.

But since your aim is for the company’s growth, a business loan in Singapore would fit your needs best. It’s the type of loan that’ll help you, particularly on capital for operations expansion. The advantages of taking a business loan don’t end there.

In this article, we’ll check the various types of loans for businesses accessible in Singapore. You’ll also learn the steps to apply for a business loan, some excellent tips for getting approved, and how to use the loan to expand your business effectively and successfully.

Types of Business Loans Available in Singapore

Today, SMEs have a lot of business loan options in Singapore. There are several types to choose from, including term loans, trade financing, working capital, etc.

All of these business loans can meet the financing requirements of an SME in Singapore. Here are the standard types of loans:

Term Loans

It’s a loan designed to offer enterprises a significant sum of cash. The funds can be paid over a specific timeline, with interest.

The term loans can either be unsecured or secure. It makes them a suitable choice for enterprises requiring larger purchases or investments.

Even when you have to pay the loan’s interest for longer, purchasing your business needs outweighs the term loan’s overall cost. As a result, you chose a logical financial decision for your business.

Personal Loans

SMEs in Singapore may apply for personal loans to assist their business’ funding requirements. It’s a popular type of unsecured credit that banks, financial institutions, and licensed moneylenders in Singapore provide.

For businesses, a personal loan has the funding capacity to grant quick cash access, particularly to pay for unanticipated company expenses. It’s possible also to use this unsecured loan for financing business expansions. Furthermore, it efficiently improves the company’s cash flow when necessary.

The amount accessible from a personal loan to businesses may range between S$ 1,000 to S$200,000. SMEs can expect approximately interest rates from 6% to 18% per annum, with flexible repayment terms of six to sixty months.

For SMEs, it’s crucial to have a good credit score, business registration documents, proof of income, and financial statements to become eligible for this loan.

Working Capital Loans

Working capital loans mainly focus on the total amount of money a company has access to cover daily operations.

It’s the distinct difference between the business’s current assets, like inventory and cash. It also includes accounts receivable from the liabilities, like accounts payable and short-term debts.

It’s a business loan in Singapore that’s typically unsecured and utilised for various reasons for the enterprise’s progress. In many cases, SMEs may acquire a working capital loan to pay for their inventory, manage unexpected expenses, and cover payroll expenses. These also have shorter repayment terms compared to term loans.

Although it’s an outstanding loan to assist the daily operations, you must prepare for the higher interest rates it comes with. According to the Monetary Authorisation in Singapore, all unsecured loans must carry higher interest rates than secured loans due to a higher risk level.

Thus, consider the terms and conditions carefully before moving forward to a working capital loan application. It’s undoubtedly a valuable business tool, specifically for managing daily operations. So, it’s best to reach and work with a reputable Singapore lender to provide comprehensive financial assistance.

Equipment Financing Loans

These loans are designated to assist SMEs with the necessary equipment they require in their businesses. It enables companies to buy or lease specific equipment they couldn’t afford upfront.

Sometimes, an equipment financing loan helps enterprises replace or upgrade equipment when they lack the extra funds. What is the standard machinery that falls into equipment financing loans? These are primarily computers, vehicles, and other assets necessary for the enterprise to operate efficiently.

Equipment financing loans are both secured and unsecured loans. Thus, the equipment becomes a viable option to be the loan’s collateral. As a result, SMEs default on a loan; their assets are put up for collateral and repossessed by the lender. It’s the legal way regulated by the MAS for lenders to recover from the outstanding balance.

There are also two specific types of equipment financing loans in Singapore, and these are:

- Lease Financing

It mainly covers renting out the machinery for a certain period. Borrowers will then make regular payments.

- Loan Financing

The concept of loan financing under equipment financing loans involves borrowing money from the lender to buy the machinery upfront.

Trade Financing

The world of trade can become an overwhelming and challenging industry for many SMEs. It’s possibly the market that’s considerably most complex and unpredictable. There are many instances of risks, uncertainties, and variabilities.

But, an SME can rely on the trade financing loan to ease their business burdens. It’s the type of loan that can be excellent financial support for businesses that import and export goods.

Its coverage isn’t only limited to exporting and importing products. Its scope is broader because an SME may apply for financial services, invoice financing, and other trade-related financing products.

Applying for a trade financing loan effectively mitigates risks connected to the international trade industry. Through the trade financing loan, the business loan Singapore can provide letters of credit which ensures the importer will commit to paying the exporter for the products or services provided.

Microloans

These business loans in Singapore are noted as “small loans.” But don’t let the name fool you.

It’s among the types of loans in the country that are ideal for small business owners or entrepreneurs. Primarily because it’s a good loan choice for initiating or expanding the business, these loans are accessible through microfinance institutions or other organisations specialising in offering financial assistance to marginalised or underserved communities.

Many start-up businesses in the country sometimes need help getting loans from traditional credit. The Microloans absolve the issue due to their flexibility and accessibility.

A suitable example of a microloan is getting a loan for $1,000 with a 15% interest rate and a 12-month repayment term. The microfinance institution shall grant financial assistance to the SMEs needing the loan. Thus, the SME borrower has to pay back the $1,000 loan amount plus $150 interest.

Asset-based Loans

For SMEs who prefer secured loans, then asset-based loans are ideal for those borrowers. The assets which can become collateral for this type of loan are equipment, inventory, or real estate. Businesses that focus on working capital needs, fund expansion projects, and purchase machinery and inventory will appreciate this type of loan.

In many situations, SMEs cannot qualify for traditional bank loans, and asset-based loans are ideal alternatives. It’s because it’s a secured loan, and the collateral guarantees it will fulfil outstanding payments.

The asset-based loan repayment terms may vary on the moneylender and borrower’s requirements. Yet the general rule for the period is from six months up and up. The interest rate may vary according to the lenders’ policy, such as traditional banks, lenders, and speciality finance companies.

Governments offer asset-based alternatives through the Enterprise Financing Scheme (EFS), administered by the Enterprise Singapore agency. It grants SME funds for growth plans and daily operations. An SME may qualify for an asset-based loan upon meeting the criteria:

- Currently registered and operating their business in the country

- Local shareholding is 30% minimum

- Annual sales turnover must be below S$500 million or below 200 employees

- Feasible business plan and financial projections

The lender shall assess the SMEs’ financial standing and creditworthiness. In addition, the total loan amount will be subject to the collateral’s value used for the loan,

Invoice Financing

It’s a financing option SMEs can access to acquire funds. The process involves an SME selling their accounts receivable or outstanding invoices to a moneylender in Singapore to obtain the necessary funds. Banks and other financial institutions do offer invoice financing in Singapore as well.

With invoice financing, the lender will mostly pay a percentage for the accounts receivable or invoice value upfront and the remaining amount. The interest rate and fee deductions would occur once the customer pays the invoice.

Invoice financing is an unsecured loan that doesn’t require collateral and grants flexible financing to SMEs. It’s also a helpful loan to timely pay dues which helps improve the SMEs’ credit scores.

Before signing the loan agreement, SMEs must diligently practise reading it as thoroughly and carefully as possible. These terms and conditions mainly include the loan’s interest rates and fees.

Temporary Bridging Loans

Another short-term accessible for SMEs in Singapore is the bridging loan. It aims to bridge the gap between a SMEs immediate funding needs with a longer-term financing plan.

It’s effective in temporarily funding cash flow shortages. In some cases, it’s an efficient solution for covering additional costs connected to new businesses or projects before securing a long-term financing solution.

Bridging loans are secured loans. Thus, an SME is expected to provide any valuable possession to guarantee the loan. A lender will need equipment, machinery, inventory, or property collateral.

Merchant Cash Advance

Merchant Cash Advance (MCA) is another business loan in Singapore that SMEs may apply for to get quick funding for operational expenses. Licensed moneylenders in Singapore mainly offer this type of loan to provide financial assistance to SMEs.

If the loan is approved, the lender gets a percentage of the SMEs future credit and debit card sales. It isn’t a loan that fits every SME in Singapore. It precisely suits small and medium-sized enterprises that deal with daily credit or debit card sales in high volume.

The loan process for this business loan in Singapore is straightforward. SMEs may visit a licensed moneylender’s office. Here they can have the lender assess their creditworthiness and documents.

Once MCA is approved, the lender disburses the agreed loan amount directly to the SMEs’ provided bank account.

Business Loans Singapore Application Process

For an SME, it’s pretty challenging to start a business. It’s also a long road before attaining success because all companies require capital and funding for pieces of machinery, paying the staff, and daily expenses.

As a result, the option to get a business loan isn’t only practical but also logical. For SMEs, here are the steps to fulfil when applying for a business loan in the country:

Analyse and Determine Business Loans Requirements

Pursuing a loan is pointless when a borrower isn’t sure why they need it in the first place. Thus, SMEs should analyse and determine the requirements associated with the loan, precisely the total loan amount, interest rates, and payment terms. They must also pay attention to details, focusing on business expenses like payroll, rent, inventory costs, and expansion plans.

An SME has to analyse the loan’s purpose. For instance, does the business require new machinery, equipment, vehicle, and growth operations?

Is there enough working capital to cover the daily expenses?

These questions will give a better scope of the loan’s purpose that’ll assist the SME borrower in choosing the ideal loan and lender.

Compare Business Loans Lenders

A business loan is a big responsibility, so you should take it seriously. It could be a deal maker or breaker for any SME. As a result, thorough research and comparison lenders have to be done. Banks, financial institutions, and licensed moneylenders in Singapore offer business loans.

Determining the type of loan an SME necessitates research and comparing the lender’s financial assistance efficiently is imperative. Also, what do SME borrowers look for when researching and comparing moneylenders in Singapore? Here are the notable factors:

- Type of loan the business targets

- Fees and interest rates

- Repayment terms

- Other costs associated with the loan

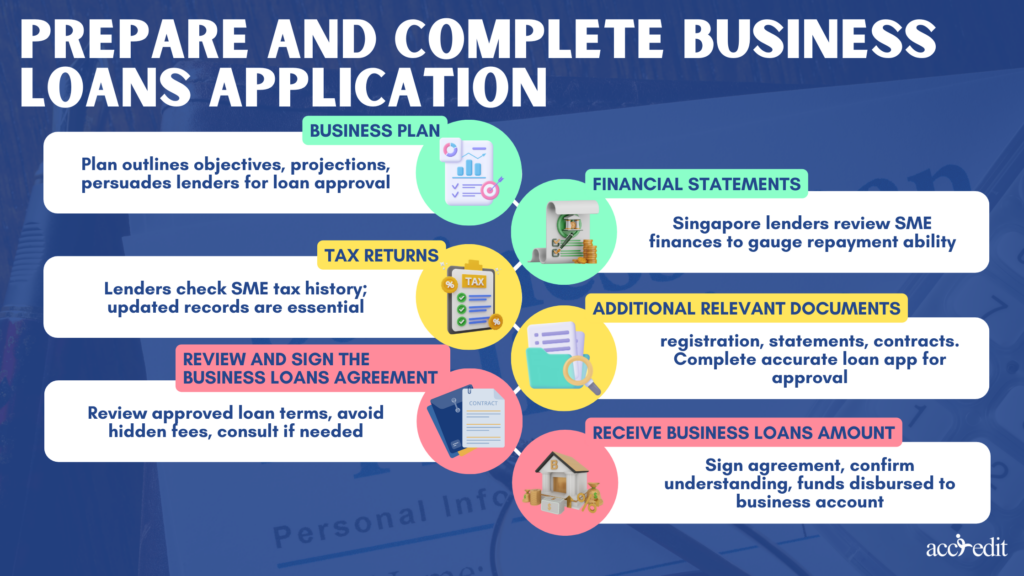

Prepare and Complete Business Loans Application

After completing steps 1 and 2, it’s time to prepare the loan application. SME borrowers are not like ordinary borrowers. There are certain dissimilarities in terms of documentation.

Here are the documents SME has to provide for the business loan application:

Business Plan

It outlines the business’ overall objective, financial projections, and strategies. It must be detailed, comprehensive, and convincing to persuade the lender to approve the loan.

A business plan includes information regarding executive summary, business description, market analysis, marketing and sales strategies and financial projections.

Financial Statements

All moneylenders in Singapore will assess SME financial statements. It evaluates the enterprise’s current financial health and loan repayment capacity.

Financial statements primarily include balance sheets, income, and cash flow statements.

Tax Returns

A moneylender will also review SMEs’ tax returns from the past years. Thus, an SME borrowers must guarantee their tax returns are updated.

Additional Relevant Documents

These documents may be necessary for following through with the business loan requirements. An SME borrower should organise initially in case the lender asks for the following documents business registration, bake statements, and contracts and agreements.

To complete the loan application for a business loan in Singapore, an SME borrower has to fill out the form as thoroughly and accurately as possible. It ensures the loan process won’t be rejected or halted due to missing information.

After completing and passing the application form, an SME borrower waits for the loan’s approval. The waiting period may take a few days to a few weeks, depending on the moneylender the SME borrower’s working with.

Review and Sign the Business Loans Agreement

When the loan’s finally approved, review the agreement thoroughly before signing it. Make sure there are no hidden fees or charges. Discuss concerns or clarifications with the lender or seek legal advice if necessary.

Receive Business Loans Amount

Signing the loan agreement signifies that SME borrower has understood their responsibilities and will commit to their repayment obligations. The lender will disburse the funds to the business’ bank account.

Grow Your Business; It’s Always Worth the Risk

Many SMEs in Singapore have needed help returning their business to its best status. Nonetheless, all companies have risks involved, and choosing business loans to meet your enterprise’s requirements is another risk you have to take.

A business loan can financially assist you in scaling your business. It even gives you new opportunities, invests in new technologies or equipment, and hires more employees. So long as the purpose is to expand and grow your business, then the risk is always worth it.

Are you ready to grow your business successfully? To apply for a business loan today, click here!