No one can ever deny the beauty and vibrancy of Singapore. It isn’t only a diverse country that captivates millions of visitors annually and intrigues foreign workers. But it’s possible to encounter financial challenges, and foreigner loans in SG are mostly sought after.

If you’re a foreigner in Singapore, you understand the situation completely. This article will help you explore your options as a foreigner in Singapore. Plus, the steps to prepare requirements and processes, avoid loan-related issues, and ultimately secure the loan to get the needed funding.

Types of Foreigner Loans in SG

Singapore isn’t just famous for its beauty and culture; it’s also renowned for its outstanding financing industry. As a result, all communities living in the country have the best financial services accessible to them. It includes every foreigner who is living and working in Singapore.

Do you still need to decide which type of foreigner loans in SG you should get? Here’s some information on the various types of loans below:

Personal Loans:

These are unsecured loans, also called consumer loans in Singapore. It favoured foreign loans in Singapore because they were accessible and easy to acquire.

Banks, financial institutions, and licensed moneylenders in the country proffer personal loan to foreigners who can present all necessary documents and other requirements.

It’s a loan that may consolidate debts to pay medical expenses, home renovations, vehicle repairs, and education fees.

The interest rate from diverse financial businesses may vary, ranging from 3.5% to 7% per annum. Licensed moneylenders are permitted by the Ministry of Law to impose the designated 4% per month interest date due to the high-risk nature of the unsecured loan.

Nonetheless, a personal loan is an excellent choice for any foreigner in Singapore needing quick cash.

Foreigner Loans:

The foreigner Loans in SG are specifically designed for foreigners. It’s accessible to them when they require it for personal use, education or business purposes.

Banks, financial businesses and licensed moneylenders offer the foreigner loan in Singapore. The eligibility may vary due to the various policies of the authorised lenders. Thus, it’s best to check with each lender for the specific criteria, interest rates ranging from 3.7% to 9% per annum or 4% per month from a licensed moneylender in the country.

Nevertheless, please discuss with a certified moneylender regarding their offers and options and review the loan agreement first at all times.

Business Loans:

Foreigners can start up or expand their businesses in Singapore. They may acquire financial assistance from a certified lender and seek a business loan.

Aside from the general criteria of proffering the stipulated paper works, a foreigner also needs to educate themselves regarding the loan amount and other factors involved in the business loan.

A foreigner applying for a business loan from a bank or financial institution may get SGD 50,000 to SGD 500,000. Licensed moneylenders offer a smaller sum of up to SGD 100,000.

The repayment terms for a business loan a foreigner is approved for may range from one year to five years. It’ll vastly depend on the borrowed amount and type of loan, with flexible repayment options.

Banks and financial businesses offer interest rates from 4% to 15% annually. On the other hand, licensed moneylenders impose 4% per month following the Moneylenders Act. For a foreigner who requires the fastest and most legitimate loan process possible, it’s still best to seek a licensed moneylender.

What types of businesses are allowed or not eligible for the loan? So long as the enterprise is legal and licensed, it’s qualified.

Payday Loans:

These loans are also recognised as cash advance loans in Singapore. Its design aims for a short-term loan that can assist foreigners in covering unanticipated expenses or financial emergencies. Unlike the other loans accessible to foreigners, it relatively grants smaller amounts and demands a repayment schedule within a few weeks or upon the borrower’s next payday.

Where can a foreigner apply for payday loans? Licensed moneylenders in Singapore are the typical financing business a foreigner can visit. The borrower has to comply with the requirements, such as being of legal age, having a steady income, and presenting a valid working visa.

Since the borrower will apply for payday loans from a licensed moneylender, it’ll primarily be based on their minimum annual income of less than $10,000, obtaining $500. Foreigners with at least $10,000 yearly income acquire $3,000. Those earning at least $20,000 may get six times their monthly payment.

The interest rate is at 4% per month per the Act.

Foreigner Loans in SG Requirements

The Singaporean government gives every foreigner in the country equal rights. Among these is equal access to loans when a foreigner genuinely requires the extra money.

You must prepare the requirements before applying for a loan that meets your needs. To get better chances of loan approval, you must meet the following criteria:

Age:

It would be best if you were of legal age eligibility between twenty-one (21) years old to sixty-five (65) years old.

Valid Documentation:

There’s general paperwork when an individual seeks a loan in the country. But, it’s worth noting that for foreigners, additional documentation such as:

Valid passport:

It’s for the borrower’s identification and citizenship verification.

Employment pass:

It serves as proof of the borrower’s employment status and work permit in the country. A foreigner may get theirs issued by the Ministry of Manpower. It’s among the main requirements for foreigners interested in working in Singapore specifically:

- Employment Pass (EP): It’s a pass designated to foreign professionals, executives, and managers who earn at least SGD 4,500 per month, meeting specific qualifications like academic and work experience backgrounds.

- S Pass: It’s a pass usually assigned to mid-level skilled workers who earn at least SGD 2,500 per month and meet specific academic and professional qualifications.

- Personalised Employment Pass (PEP): It’s intended for high-earning foreign professionals obtaining at least SGD 18,000 monthly. They also have to have a certified track record of employment in Singapore.

- EntrePass: For foreigners interested in starting and running their businesses in the country, they must acquire EntrePass. To qualify, the applicant must present a viable business plan, company incorporation, shareholding, investment, employment creation, qualifying criteria and financial documentation.

Legitimate proof of income:

The borrower should provide these documents. It includes income tax statements, the most recent payslips, and bank statements.

If the foreign borrower has an enterprise and chooses to take a business loan, they’d need to provide financial statements for their company.

Bank statements:

These are essential requirements as they comprise every pay the borrower has earned for a few months. Also, a lender gets to have additional ideas of the borrower’s expenses.

Proof of residence:

To qualify for loans in Singapore, a foreigner must provide valid proof of residence. The purpose of these paper works is to certify your current address and residency in the country. You may present the following various types of documents for proof of residence:

- Utility Bills: These include the most recent bills for water, gas, electricity, or telephone services providing the borrower’s address and full name.

- Bank Statements: It’s a document with many uses that benefit a foreigner seeking a loan in the country. It doesn’t only provide the foreign borrower’s income and expenses; it also includes their full name and address.

- Tenancy agreement: It’s the type of contract shared between a landlord and a foreign borrower. It mainly outlines the rental property’s terms and conditions. Within the tenancy agreement are the borrower’s full name, address, and the lease’s duration.

- Government-issued documents: The Singaporean government issues various documents for everyone in the country. Among these are NRIC, work pass, passport, driving licence, birth and marriage certificate.

For foreign borrowers, aside from their passport and work pass, dependent pass, long-term visit pass, student pass, and personalised employment pass.

These documents aim to provide proof of identity, legal status, and your ability to repay the loan.

Business Licence

Business licences are required for foreign borrowers if they plan to start a business in the country and pursue a business loan. Along with the business licence is the proof of business registration with the Accounting and Corporate Regulatory Authority (ACRA).

Minimum Yearly Income

Singapore also requires a minimum yearly income proof for foreigners who wish to apply for different loans accessible to them. The minimum annual salary may vary following the loan being used for and their work level category.

There are four primary work-level classifications for foreigners in the country. These are the Employment Pass Holders, Work Permit Holders, Personalised Employment Pass (PEP) and S Pass Holders. For the minimum yearly income, the requirement for each work level classification is as follows:

Employment Pass Holders:

Professionals, managers, executives, and specialists in management, information technology, finance, healthcare, education, engineering, and creative industries must primarily acquire their work visa or Employment Pass. For each loan accessible to a foreigner with an Employment Pass, the specific minimum yearly income requirement they have to meet are:

- Payday Loan: SGD 20,000

- Foreigner Loan: SGD 45,000

- Personal Loan: SGD 60,000

- Business Loan: SGD 100,000

S Pass Holders

S Pass are foreigners working visas who are considered mid-level skilled workers. These individuals are employed in the engineering, information technology, healthcare, manufacturing, hospitality and tourism industries.

The required minimum annual income an S Pass Holder must present to an authorised lender in the country are:

- Payday Loan: SGD 20,000

- Foreigner Loan: SGD 30,000

- Personal Loan: SGD 45,000

- Business Loan: SGD 60,000

Work Permit Holders

Last but not least are the foreigners in the work permit holder’s category. These individuals have attained working visas for semi-skilled or unskilled foreign workers within specific sectors. They primarily work in the construction, manufacturing, marine, and service industries.

Work permit holders interested in obtaining any of the accessible loans for foreigners have to present proof of earning a minimum annual income of:

- Payday Loan: SGD 20,000

- Foreigner Loan: SGD 18,000

- Personal Loan: SGD 30,000

- Business Loan: SGD 45,000

Personalised Employment Pass (PEP)

Foreigners with Personalised Employment Pass aren’t explicitly tied to any job or industry in the country. It’s a unique type of employment pass. It’s mainly granted to the highly-skilled foreign professional who is known to have a strong and stable employment track history and possibly provides significant contributions to Singapore’s economy,

PEP holders are recognised for their impressive professional influences in finance, healthcare, technology, research, and many more. Foreign professionals have expressed great interest in PEP due to its flexibility, especially when switching jobs without needing a new work pass.

Eligible PEP applicants must provide proof of earning at least SGD 30,000 annual salary, with a track record of outstanding qualifications and work experience.

Before applying for a loan, you must first meet all these eligibility criteria. Once you’ve assessed, reviewed, and completed all necessary documents and certifications, you may apply for foreign loans in Singapore.

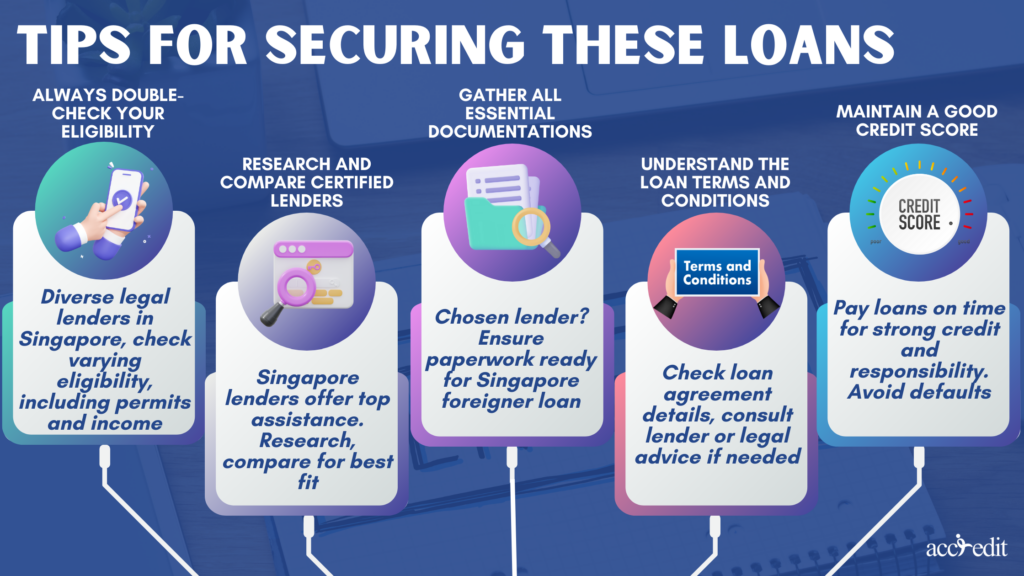

Tips for Securing These Loans

Everyone knows and understands that Singapore is a country that’s strict with its lending policies. The best way to handle the situation is by choosing a knowledgeable approach and making informed decisions.

For you to have a smooth, hassle-free loan experience, follow these helpful tips for securing foreigner loans in SG:

- Always Double-Check Your Eligibility:

Singapore is filled with diverse legal lenders. It’s logical to expect that their eligibility criteria could vary. Thus, make sure and double-check your eligibility, like valid work permits, employment passes, and minimum income requirements.

- Research and Compare Certified Lenders:

All certified lenders in Singapore aim to provide their borrowers with excellent financial assistance. Researching and comparing certified lenders offers a better understanding of their services and assess which one suits your needs the best.

- Gather All Essential Documentations:

When you’ve finally picked the authorised lender to work with regarding the foreigner loan in Singapore, evaluate that every critical piece of paperwork is prepared to avoid delays or rejections.

- Understand the Loan Terms and Conditions:

Remember to consider the details and information included in the loan agreement. Here you’ll gain access to the total loan amount, repayment terms, interest rate and other fees or charges. If you’re confused, address your concerns with the certified lender immediately.

Don’t hesitate to get legal advice when necessary.

- Maintain a Good Credit Score:

A foreigner can maintain a good credit score by ensuring you repay all existing loans on time. When you have an excellent credit background, it reflects your traits as a responsible borrower. Avoid committing loan defaults at all costs, and pay all your bills without delay.

Feel Financially Secure with Foreigner Loans in SG

It’s a fact that being a foreigner in another country has its disadvantages. For one, language barriers can create misunderstandings between locals and foreigners. Work conditions could differ in your homeland from Singapore due to various policies and regulations.

One of the biggest worries a foreigner faces when in a foreign country is experiencing low funds. As laws and regulations vary, you’ll likely feel intimated seeking loan opportunities in the country.

Nevertheless, Singapore’s government accurately understands foreigners needing financial assistance. As a result, the country grants different types of foreigner loans in SG to fulfil monetary services to eligible applicants. You can apply for payday, personal, foreigner and business loans if you meet the eligibility criteria and requirements.

With these loans accessible, you feel financially secure even when you’re far from home.

Are you a foreigner in need of funding? Please click here to apply for a loan today!