Are you finished with all the hassles you’ve endured while making manual loan payments? Fortunately, the option to make automatic payments are here to save your day and your credit score.

Automatic transfers are innovative and allow you to schedule regular payments without doing all the hard work. It’s a practical and convenient solution every debtor in Singapore must try. It eliminates the chances of debtors needing to accomplish manual payments on busy days and avoids the risks of late fees.

Would you like to understand and apply auto-debit for your existing loans? If you do, be ready to look at the benefits you can acquire, learn which loans are eligible, and use the best practices for managing automated payments today!

Types of Automatic Payments in Singapore

What are automated payments? These are the current and most innovative repayment methods for your existing debts.

These days, the concept of auto-transfers is becoming increasingly popular. It’s because of the convenience and hassle-free approaches when paying off loans. As a result, you can achieve loan repayments in a much more manageable manner.

Here are the most popular automatic repayment methods in the country today:

Monthly Instalments

An already popular automatic repayment option for loans in Singapore is monthly instalments. This payment choice permits you to set up automatic monthly deductions from your bank account to pay off the loan.

Credit Card Deductions

Another famous automatic payment method in Singapore is credit card deductions. It’s a payment option that allows you to utilise your credit card automatically and repay the existing loan each month. But, higher interest rates and additional fees may apply.

Direct Debit

A type of automatic repayment choice available for people who’ve taken out car loans in the country. It may be set up for instant monthly deductions from your bank account until the loan’s paid off.

Standing Instruction

Another automatic repayment choice in Singapore is standing instructions. You can set up this option to transfer funds from your bank account to your loan account each month.

Interbank GIRO

General Interbank Recurring Order, or GIRO, is among Singapore’s most popular automatic repayments. You can use the interbank GIRO system to instantly deduct loan payments from your bank account to your loan account.

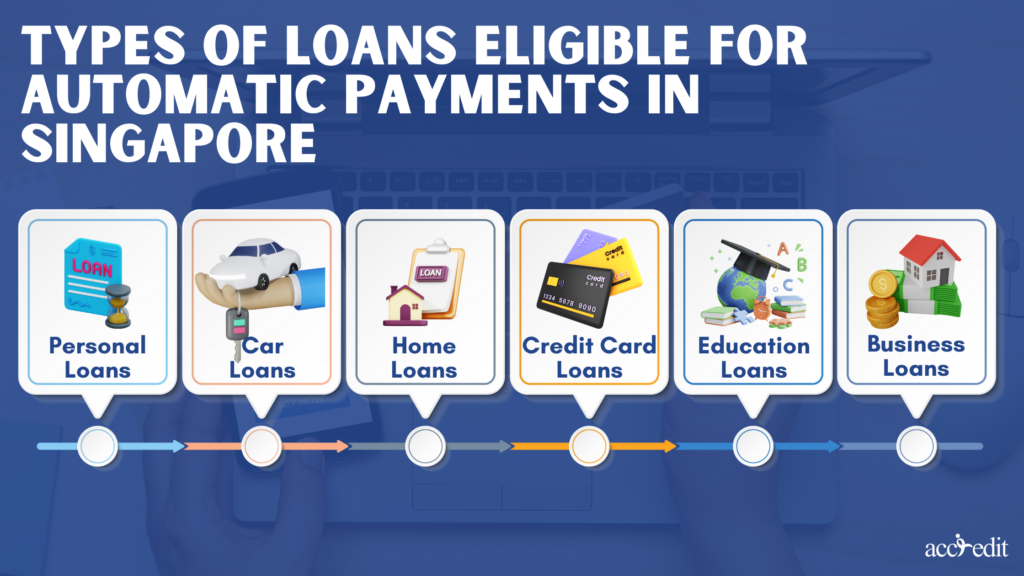

Types of Loans Eligible for Automatic Payments in Singapore

The borrower is responsible for paying bills and debts on time. Honestly, no one wishes to face late interest rates and fees.

But sometimes, there are circumstances beyond anyone’s control. For one, you were travelling to pay your lender but were held back by traffic or couldn’t leave a crucial meeting. Other times, accidents or natural calamities occur that would force you to cannot fulfil your obligations within the repayment period.

These situations happen in real life, and what better way to resolve late repayments than establishing auto-debit? Yet, not all loans are permitted to implement automatic transfers.

Automatic payment is available for certain loans, including:

Personal Loans:

It’s a well-known unsecured credit in Singapore because it can be utilised for various purposes, such as home renovation, debt consolidation, medical bills, or personal expenses.

Most banks and financial institutions in the country offer borrowers the option to set up automatic deductions via the bank’s online banking platform. Or debtors can authorise their loan provider to debit repayments from their bank account.

Licensed moneylenders in Singapore do offer automatic payment options for personal loans.

Car Loans:

When it comes to purchasing new or used vehicles, people rely on car loans.

Major car dealerships in Singapore, like Honda, Toyota, BMW, banks, and financial institutions, offer automatic repayments of this particular loan. It can be arranged via an online banking platform or GIRO.

Home Loans:

A home loan is another loan that borrowers may arrange an automatic repayment structure. Banks and financial institutions provide payment via an online banking platform or GIRO.

It’s possible that some banks would require borrowers to set up an automatic payment for them to become eligible for lower interest rates.

Credit Card Loans:

Another unsecured credit that allows automatic repayment in Singapore is credit card loans. It’s effective in paying off credit card balances.

Moreover, debtors who’ve acquired high-interest credit card debt can use the option to ease their payment concerns.

Education Loans:

It’s the loan many Singapore students apply for to obtain financial assistance to settle living expenses, tuition fees, and other related costs.

Central banks in the country that grant education loans, such as OCBC and DBS, offer automatic debit to guarantee timely repayments.

Business Loans:

SMEs prefer applying for business loans to help them finance their businesses’ operations, such as purchasing equipment, inventory, or expanding the company.

Notable banks, financing companies, and licensed moneylenders offer auto debit for business loans.

It’s imperative to consider that not every loan may be eligible for an automatic repayment option. You need to be cautious and double-check with the lender you’re working with to see the availability of this payment choice.

Now, how can you set your automatic repayments for your loan?

How to Set Up Automatic Payment for Loans

Timely payments are crucial for debtors as they can impact your credit score and history. Plus, keeping a clean credit history is more advantageous as it’ll grant you perks and easier loan transactions in the future.

Knowing which loans are eligible for auto debit, it’s time to move forward on setting it up, such as:

Check with your trusted lender:

The first step you have to take is to check the option with your trusted lender. Confirm whether they’re offering automatic payment transfers for specific loans.

It’s because some lenders may not grant it automatically, or they would require specific requirements for setting up the auto debit option.

Select the best automatic payment method:

Once you’ve affirmed the availability of automatic repayments that your lender provides, choose the payment method that best fits you.

You can select various choices from our GIRO, standing instructions, and online banking.

Gather the necessary information:

Gathering essential information for the whole transaction is necessary as you prepare to set up the automatic fund loan repayment.

Here is the information you have to prepare first, such as:

- Bank account number that you’ll provide to the lender. You’ll then authorise them to set up automatic payments. Thus, present accurate and correct account numbers to avoid any transaction problems.

- Lenders’ bank account numbers are essential in this payment plan, mainly if you do auto-debit via standing instructions or GIRO. You can access this information through your loan statement or contact your lender.

- Amount and payment frequency matters a lot in this plan. For one, you must pay the amount due for each loan; then, you select whether you’ll pay it weekly, bi-weekly, or monthly.

- Acquire information on payment start and end date.

- Fill out an authorisation form if needed.

Setting up automatic payments:

It’s crucial to note that arranging automatic repayment transfers will vary depending on your chosen repayment method. Yet, generally, here are some details that’ll give you a better understanding of the procedure:

- GIRO: An automatic repayment transaction made via GIRO will require you to fill out a GIRO application form and then submit it to your lender. The details of the form’s likely to entail you and your lender’s bank account number, amount, and payment frequency.

- Online banking’s accomplished by logging into the bank’s online banking platform and navigating through the auto debit repayments section.

- Standing instructions will require you to direct your lender instructions on payment amount and frequency. Afterwards, they’ll automatically deduct payments from your account on the agreed dates.

Monitor automatic payments at all times:

When the automatic repayment’s been set up successfully, monitor your payments to ensure they are processed accordingly.

It’s pretty easy to prepare for the auto-debit method, but why should you consider it in the first place? These advantages may help you decide on the matter.

Advantages of Automatic Payments for Loans

As a consumer, seeking methods or plans to grant advantages is natural. For scheduled payments, what benefits will you reap?

These are the several advantages you may enjoy when using automatic deductions:

- Convenience because it efficiently eliminates the need to remember to make monthly payments manually.

- Avoiding late fees becomes a breeze as late payments will no longer occur even when you’re too busy or have forgotten the repayment schedule.

- Credit score improved due to consistent on-time payments and boosted credit history results.

- Saves more cash as auto debit ensures timely repayments, thus, letting you save on interest charges or be granted discounts from your lender.

- Flexibility in managing your finances and budget by choosing the payment frequency that fits your monetary situation.

- Peace of mind as you know your payments are paid on time.

These are tremendous advantages that many borrowers would appreciate the moment they’ve set up automatic payments with their lender’s assistance. But are there disadvantages to consider as well?

Automatic Payments Transfer Possible Risks

Disadvantages are something to deal with, even with the best offers accessible to any customer and borrower. It’s a package to consider before pursuing a different approach to repaying your debt.

The enumerated disadvantages will give you a better understanding of whether you can commit through the automatic payment option. These are some disadvantages to consider:

- Lack of control as you no longer have any say when to pay or how much you may pay each month. It’s a significant disadvantage for people with irregular income or needing to change their payment schedule.

- Overdraft fees would occur when your bank account needs more funds to cover the automatic loan payments. Accumulation of overdraft fees will add additional costs and difficulty in managing finances.

- Inflexibility can be a disadvantage with automatic repayments as they don’t allow you to indulge in prepayments or pay off the loan earlier.

- Cancellation is challenging mainly because of the different processes you need to accomplish. If you don’t have the extra time to facilitate the cancellation procedure, it can be a frustrating experience.

Consider these potential drawbacks if you haven’t applied for your scheduled payments. Weigh whether you can fulfil your obligations or if the auto-debit isn’t as accessible as you assumed.

It’s never too late to contemplate your choices before deciding whether to pursue the pre-authorised payments. However, if you’re already sold on innovatively managing your loan payments, you might like to apply these certain practices.

Best Practises For Managing Automatic Payments for Loans

For a person who’s dealing with debts, managing repayments schedules is challenging as it is. So, introducing the automated payments option can assist a borrower with a hectic schedule.

To make use of the auto-debit effectively, these practices should be applied as they’ll serve more benefits for you and your credit background, such as:

- Guaranteeing you have sufficient funds accessible before payment due dates.

- Evaluating and reviewing payment amounts and making necessary adjustments.

- Monitoring your account’s balance regularly to ensure automated payments are processed smoothly.

- Maintaining a good and honest communication line with your lender lets you easily discuss and inform them of possible changes regarding payment details or other plans.

Awareness of these practices encourages you to be a meticulous and cautious borrower. You also learn to trust your lender more. Moreover, even if you no longer have to make manual payments, you’re practising self-accountability too.

Pay Loans and Be Debt Free with Automatic Payments

Paying for loans manually can be a good and educational experience for someone. You’ll face more late interest rates and fees if you no longer have the extra time due to a hectic schedule. This’ll hike up your total loan costs and rob you of what’s supposed to be your additional funds.

Discussing your loan choice and automatic payment option with the lenders you’re working with grants you both disadvantages and advantages. Yet, these two factors would also assist you in paying your loans the right way and becoming debt-free faster by automatic repayments.

Moving forward with automatic payments for loans, you get to avoid late interest fees and attain maximum convenience. You’ll have peace of mind while your loan’s paid according to your chosen payment frequency.

So, don’t miss out on the opportunity to be debt free, especially when you have automated payments to lean on.

Do you want to take out a loan with automatic payment choices to avoid delayed repayments? Click here and apply now!