When things get rough in Singapore, cash injections become imperative to cope with expenses or debt. When your pockets are empty, you might think collateral is the only way to secure a personal loan, but not anymore. In this article, we unveil little-known secrets that will get you a personal loan without collateral in Singapore.

Understanding Personal Loans without Collateral

To fully grasp how to obtain a personal loan without collateral, it’s crucial to understand what it entails. Unsecured personal loans are loans that don’t necessitate pledging assets as collateral. Unlike secured loans, such as car loans or mortgages, unsecured personal loans rely entirely on your creditworthiness.

Unsecured personal loans suit those who don’t want to jeopardize their assets or can’t afford to offer collateral. In Singapore, unsecured personal loans are readily available from various financial institutions, and they offer a quicker approval process than secured loans.

Understanding Secured versus Unsecured Personal Loans

Personal loans may seem straightforward, but you must comprehend the differences between secured and unsecured options. Collateral is the critical factor here – secured loans require it, while unsecured loans don’t.

Lenders are keen on protecting their investments in the event of default. However, if your credit score and income are exceptional, unsecured loans could be the perfect solution. Ultimately, the decision hinges on your financial situation, creditworthiness, and the interest rates available to you.

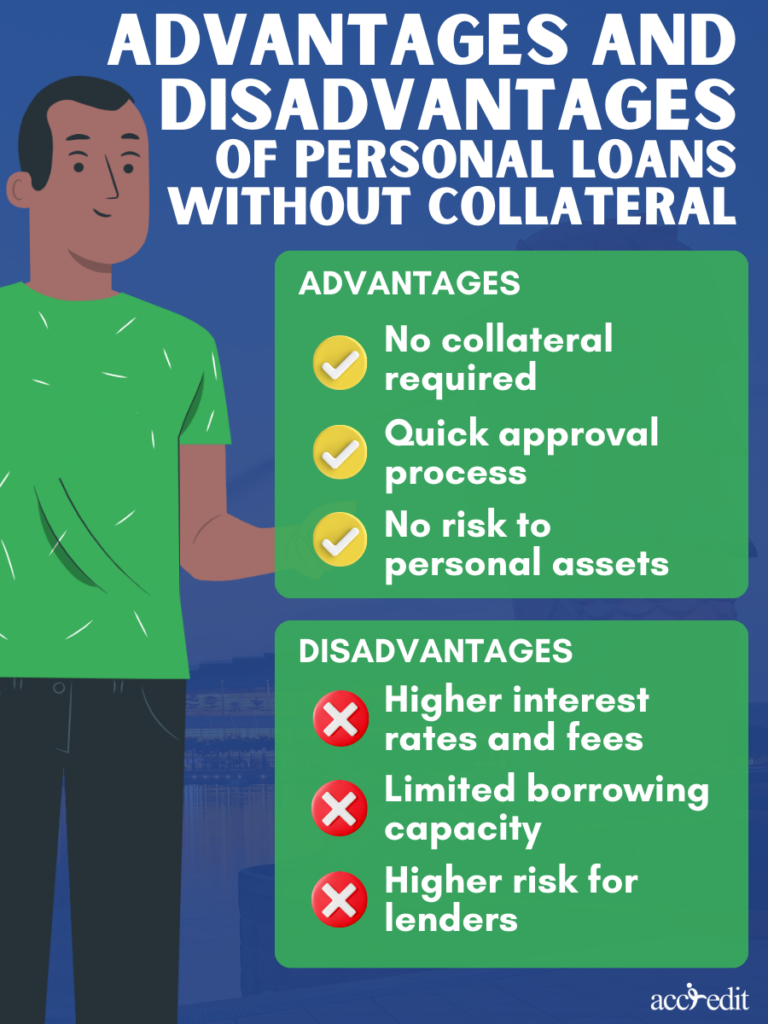

Advantages and Disadvantages of Personal Loans without Collateral

Money woes can be overwhelming, and if you’re eyeing personal loans without collateral in Singapore, it’s essential to weigh the pros and cons. Luckily, this handy chart lays out the benefits and drawbacks of acquiring unsecured personal loans:

| Advantages | Disadvantages |

| No collateral required | Higher interest rates and fees |

| Quick approval process | Limited borrowing capacity |

| No risk to personal assets | Higher risk for lenders |

Where to Get an Unsecured Personal Loan in Singapore Without Collateral?

When in need of personal loans, banks, and licensed moneylenders are the go-to options for borrowers who lack collateral. However, selecting the right destination that suits your needs might be challenging.

To make your search easier, we’ve compiled a table featuring the top destinations for unsecured personal loans in Singapore without collateral. Take a look and choose the one that aligns with your requirements.

| Personal Loan | Interest Rate (p.a.) | Loan Amount | Loan Term |

| Accredit Personal Loan | From 4% p.a. | S$3,000 – 6 x the monthly income | Up to 12 months |

| HSBC Personal Loan | 4% (EIR 7.5% p.a.) | S$1,000 – 8x monthly salary | Up to 7 years |

| SCB CashOne Personal Loan | 3.48% (EIR 7.99% p.a.) | S$1,000 – 8x monthly salary | Up to 5 years |

| CIMB CashLite Personal Loan | 3.38% (EIR 6.38% p.a.) | Up to 90% of your credit card limit | Up to 5 years |

| UOB Personal Loan | 3.99% (EIR 7.49% p.a.) | S$1,000 to 95% of your available credit limit | Up to 5 years |

| DBS/POSB Personal Loan | 3.88% (EIR 7.9% p.a.) | S$500 – 10x your monthly salary | Up to 5 years |

| OCBC Personal Loan | 5.43% (EIR 11.47% p.a.) | S$1,000 – 6x your monthly salary | Up to 5 years |

With this information, you can make an informed decision on where to go for your unsecured personal loan in Singapore.

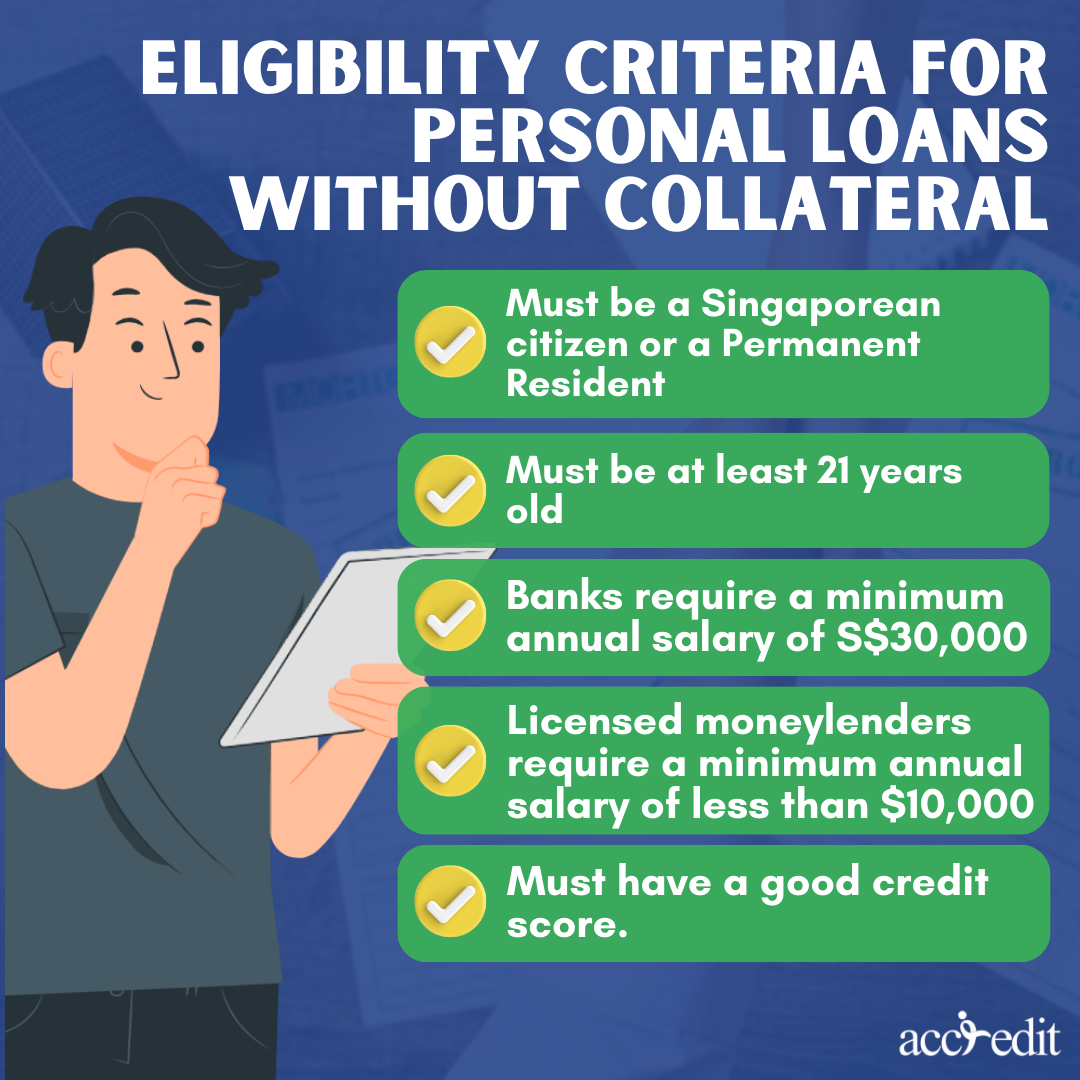

Eligibility Criteria for Personal Loans without Collateral

Securing personal loans in Singapore without collateral is easy if you meet the eligibility criteria outlined below:

- You must be a Singaporean citizen or a Permanent Resident.

- You must be at least 21 years old.

- Banks require a minimum annual salary of S$30,000.

- Licensed moneylenders require a minimum annual salary of less than $10,000.

- You must have a good credit score.

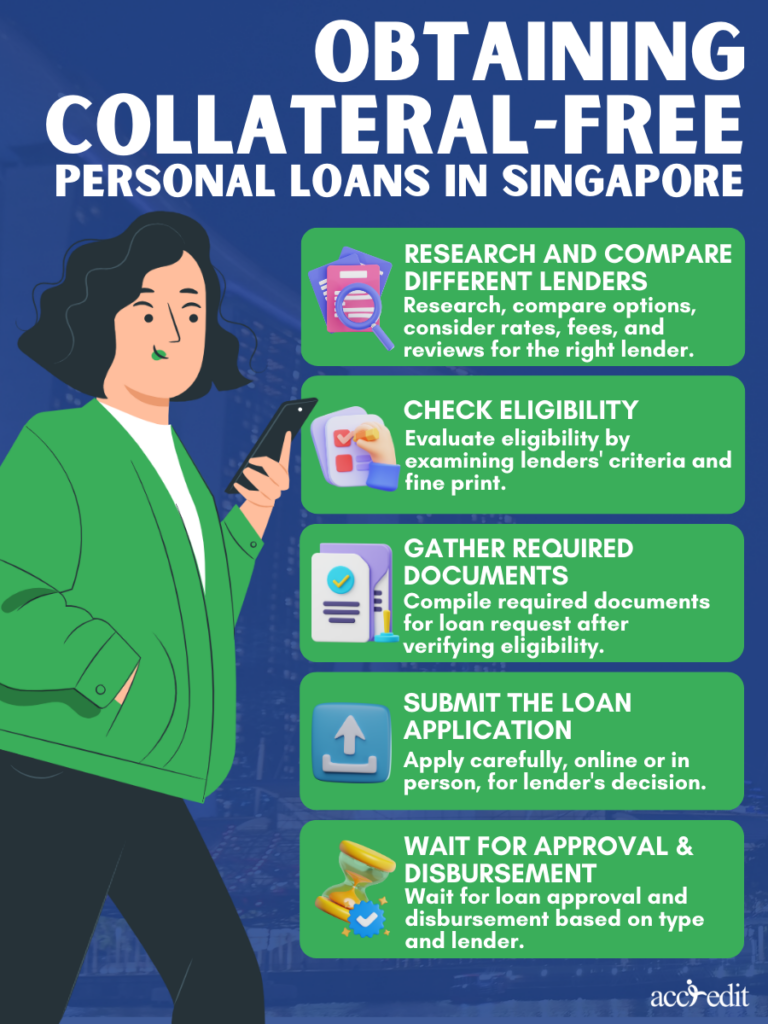

How to Get a Personal Loan without Collateral in Singapore?

You now know that collateral-free personal loans are an option in Singapore, but how do you actually obtain one? Here’s a speedy summary of the necessary steps:

Research and Compare Different Lenders. To secure the right lender, your first move should be to research and compare different options that best suit your requirements. Pay attention to interest rates and fees and, to gauge their customer service, browse through reviews from past borrowers.

Check Eligibility. After identifying prospective lenders, evaluate your eligibility by examining their criteria. It is crucial to understand the fine print because some lenders may demand higher income or credit score standards than others.

Gather Required Documents. After you’ve discovered the ideal lender and verified that you satisfy their eligibility criteria, the next move is to compile the requisite documents for your loan request. Commonly, these include proof of earnings, bank records, and identification papers. To accelerate the loan process, ensure that you have all the necessary documentation in order.

Submit the Loan Application. Personal loan applications are typically accepted online or in person by most lenders. Take your time filling out the application form and ensure that every detail is accurate and complete. After submitting the application, the lender will review it and give you a decision.

Wait for Approval and Disbursement. The moment you submit your loan application, the waiting game begins. The lender will process your request and send the funds directly to your bank account. However, the timing of the approval and disbursement process relies on two significant factors: the loan type you opt for and the lender you choose.

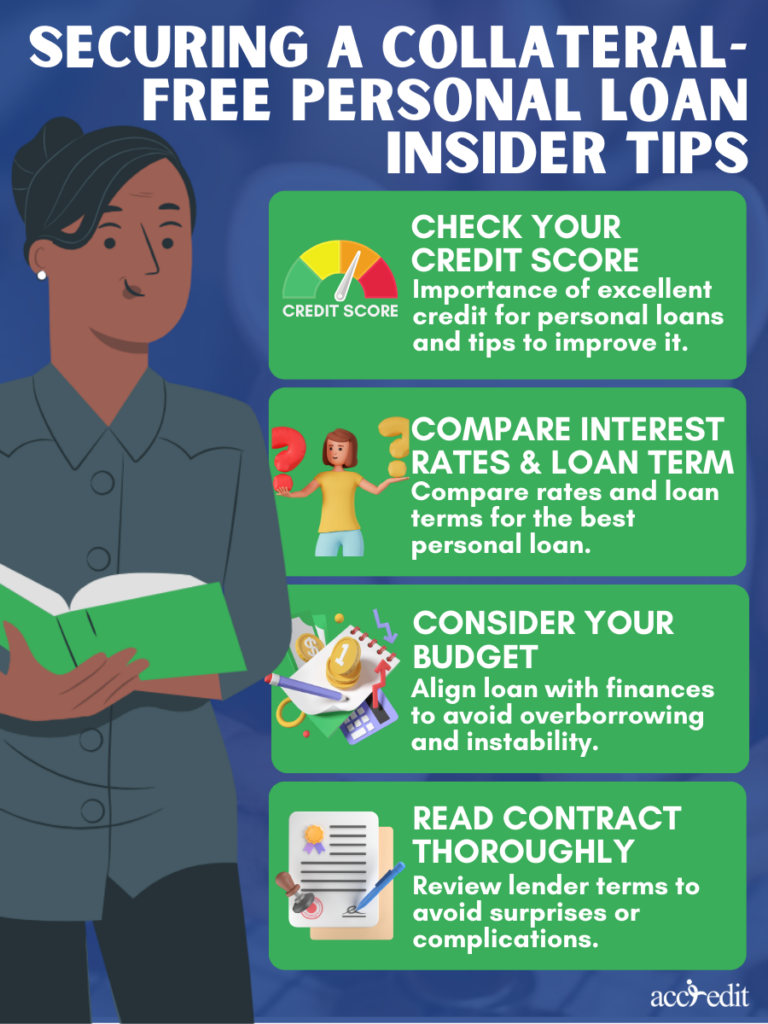

Insider Tips for Securing a Personal Loan without Collateral

Maximizing your chances of loan approval while steering clear of financial pitfalls is within reach with these insider tactics.

1. Check your credit score

When considering applying for a personal loan, one of the most important factors that lenders assess is your credit rating. Therefore, ensuring that your credit score is in excellent condition is essential. If your credit score is not up to par, taking significant steps to improve it is crucial before submitting your loan application. Improving your credit score can help you secure more advantageous loan terms, which will benefit you in the long run by keeping your hard-earned money where it belongs.

2. Compare interest rates and loan terms

To secure the best personal loan deal without collateral, it’s essential to assess interest rates and loan conditions from different lenders. Evaluating these factors can aid in selecting a loan that fits your financial capacity, allowing you to avoid overburdening yourself. Thus, it’s crucial to do your due diligence and compare the offerings of various lenders before making a final decision.

3. Consider your budget

Before obtaining a loan, it’s critical to scrutinize if the loan amount and repayment schedule align with your financial roadmap. Avoid the folly of borrowing more than you can afford, as this can lead to difficulties during the repayment process. It’s essential to consider your budget and make a sensible decision that won’t negatively impact your financial stability.

4. Read the contract thoroughly

It’s imperative to check the lender’s terms and conditions meticulously before submitting your loan application. Doing so ensures that you comprehensively grasp the loan provisions, associated fees, and charges, thus shielding you from any potential surprises or unanticipated complications.

Secure Your Financial Future with Accredit’s Personal Loans in Singapore

Obtaining an unsecured personal loan in Singapore is achievable, but it’s crucial to exercise caution and conduct thorough research before submitting your loan application. Take the time to weigh your alternatives, assess interest rates and loan provisions, and scrutinize the lender’s terms and conditions with precision.

By adhering to these guidelines, you can ensure that you secure the most advantageous deal possible and circumvent the perils of falling into financial obligations that outweigh your capacity to repay. With Accredit, you can gain access to a personal loan with favorable terms that can help you fulfill your aspirations.