Did you know bad credit loans in Singapore may be accessible for people with unimpressive credit scores? Yes, it’s probably the best way to resolve a person’s monetary challenges. Imagine being in an urgent financial crisis but you can’t access any financial assistance; it’s almost like a dead end.

Now, it’s true that a poor credit score indicates that the borrower may have had issues and difficulties repaying their debts in the past. As an SOP, lenders in Singapore assess and profile those individuals as high-risk borrowers.

If you’ll look at it at first glance, it seems hopeless. But the truth is, options are available for those with poor credit who desire to get a loan.

Before you give up on all hope, you must have all the essential information meant for you. Discover the options accessible even when you have poor credit. Uncover the steps to acquire the funds you genuinely need through this article.

What is a Bad Credit Score?

Singapore is a financial hub that’s quite sensitive to credit score matters. It’s because the credit score system is the method financial institutions use to assess and evaluate a person’s creditworthiness.

The Credit Bureau Singapore (CBS) has proposed the system since the government agency’s establishment on 15 November 2002. The credit score scale ranges from 1000 being the lowest to 2000 being the highest, and overall measures an individual’s creditworthiness.

The higher the credit score, the more creditworthy lenders profile the person. An individual with poor credit has a credit score and grade from 1499 to 1000. To better illustrate the concept and bands of CBS’s credit score scale, here’s the table with the corresponding range as follows:

| Credit Risk Grade | Credit Score |

| “AA” | 1911-2000 |

| “BB” | 1844-1910 |

| “CC” | 1825-1843 |

| “DD” | 1813-1824 |

| “EE” | 1782-1812 |

| “FF” | 1755-1781 |

| “GG” | 1724-1754 |

| “HH” | 1000-1723 |

Other factors still impact the loan application, especially the borrower’s employment history, income, and debt-to-income ratio.

Nevertheless, credit scores play a massive role as lenders consider their borrowers’ creditworthiness. Licensed moneylenders may offer a bad credit loan to accommodate the financial assistance individuals with credit risk need.

What are Bad Credit Loans in Singapore?

Initially, people with low credit scores are not given access to loans, especially from traditional banks and other monetary institutions. However, it’s vital to comprehend that these financial businesses aren’t the only financing institutions in the country.

As a result, a bad credit loan can be an option. These are types of loans mainly designed for people who’ve acquired a low credit score or poor credit history in their lifetime. Moreover, it can either be a secured or unsecured loan.

A borrower who seeks a secured loan would need collateral. These pledges act as insurance to the lender. The valuable possessions commonly considered viable and accepted collateral are real estate properties, vehicles, and other assets.

An unsecured loan is a complete contrast to a secured loan. It doesn’t necessitate any forms of collateral to secure the loan. On the other hand, it’s the type of loan which enforces a higher interest rate.

As banks and other financial businesses are stern with lending policies, individuals with credit risk must seek another lender. They may search for a licensed moneylender in Singapore instead to facilitate their loan application and approve the loan. But what kind of loans are allowed for people with poor credit history?

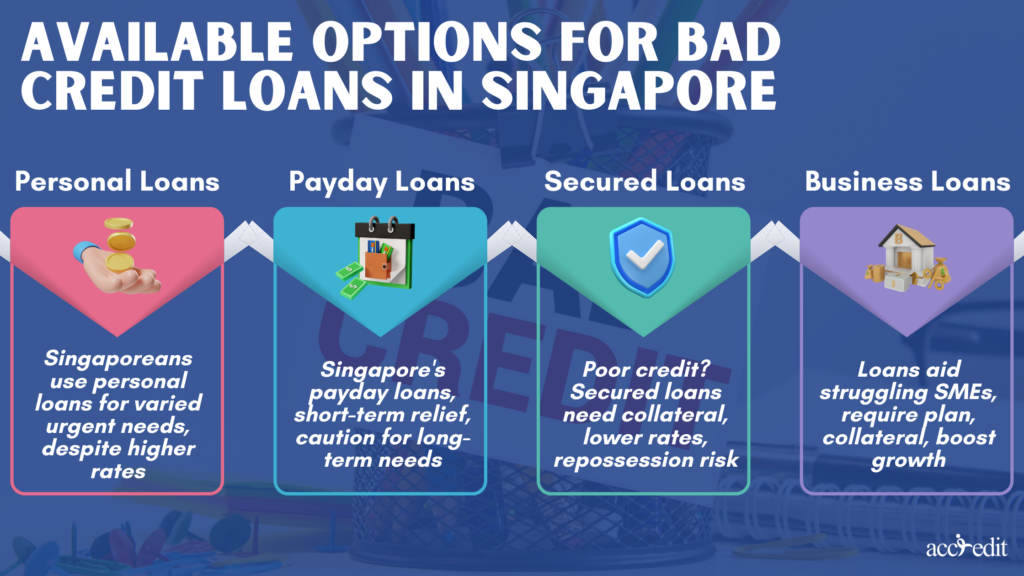

Available Options for Bad Credit Loans in Singapore

In Singapore, various bad credit loans are available to those with credit risk. Licensed moneylenders in the country offer these loans.

Would it be possible to utilise the loan for various purposes? Most of it is deemed essential to an average citizen’s needs.

Here are a few of the most recognised the bad credit loan in Singapore:

Personal Loans for Bad Credit:

In Singapore, individuals who face credit risk can make the most of the most popular loan granted by licensed moneylenders, a personal loan. These are known as unsecured loans and are meant to meet the individual financial requirements of the borrower.

It’s a valuable loan to finance medical bills and medications, urgent expenses, home or vehicle repairs, or to consolidate debt. An important detail a borrower with poor credit must understand. Personal loans are ideal for people with bad credit but expect higher interest rates with a lower loan amount than traditional personal loans.

Licensed moneylenders in Singapore are good options for those with bad credit, and here are the vital details you have to know:

- Interest rates are capped at a 4% maximum per month

- Late payment fees are capped at $60 monthly

- The repayment period would range from three to twenty-four months

- Repayment methods available are cheque, cash, bank transfer

- Eligible applicants are Singapore Citizens, Permanent Residents, and foreigners with valid employment passes and work passes.

- Requirements are a minimum age of 21, proof of residency, income, and valid identification.

Payday Loans:

A payday loan is a short-term loan that can become a bad credit loan in Singapore. As its name suggests, it has to be repaired on the borrower’s next salary.

It’s a popular short-term loan that disburses small amounts ranging from a few hundred to a few thousand. These have high-interest rates and fees as well.

People usually use payday loans to cover urgent financial payments or bridge the monetary void when waiting for the next salary.

Although this help manages brief financial concerns, it won’t be wise to use them for long-term financial requirements because it could lead to an unhealthy debt cycle.

Payday loans crucial details as an option for bad credit loans in Singapore:

- Interest rates are from 1% to 4%, capped payday loan transaction

- The repayment period is a few weeks or a month after obtaining the loan

- Repayment methods are lump cash

- Singapore Citizens, Permanent Residents, and foreigners with valid working and employment passes may apply for this specific loan.

- Requirements are a minimum age of 18, proof of income, identity, and address.

Secured Loans:

A borrower with poor credit can have access to a secured loan. But, they have you provide collateral to secure the loan effectively.

These collaterals would be cars, real estate property, and other types of assets. The loan becomes less risky as the borrower hands these personal valuables to the lender. Lenders are more likely to offer lower interest rates than unsecured loans.

If the borrower fails to fully repay the loan during the agreed-upon schedule, the licensed moneylender can legally acquire the collateral to compensate for their invested money.

Here’s an example of a secured loan with essential details for people with bad credit:

Pawnshop Loans:

- Interest rates start at 1% to 1.5% monthly

- Late payment charges are applicable

- The repayment period is up to six months, with an option to extend

- You may pay the loan via bank transfer or cash

- Anyone may apply for this secured loan if they have a valuable item as collateral.

- Valid identification and collateral appraisal from the chosen pawnshop is the primary requirements.

Business Loans:

Business owners, particularly small and medium-sized enterprises, may suffer financial losses when establishing or funding their companies. Regardless of the size, it can be challenging to juggle a company’s expenses, pay staff salaries, buy equipment, and anything business-related. Because of these circumstances, entrepreneurs may eventually obtain poor credit history.

Licensed moneylenders in Singapore understand the entrepreneur’s dilemma, specifically those who specialise in working with borrowers with poor credit scores. These loans need a business plan, financial projections, and collateral to secure the loan.

Business loans are an excellent help for business owners in managing their cash flow and expanding their operations.

Here’s a business loan choice for people with bad credit:

Microloans:

- Interest rates are between 8% to 19% per annum.

- The processing fees the typical charges may range from 1% to 3% of the loan amount

- The repayment period is up to sixty months.

- The repayment methods available are bank transfer or GIRO.

- Eligible applicants are businesses registered in Singapore with a 30% minimum local shareholding.

- The typical requirements include a S$100,000 minimum annual revenue, at least one year of business operations, and valid business documents.

These are the accessible loans a borrower can apply for, even with credit risks. What should you do next? Let’s see the necessary steps to obtain the funds you need.

Steps to Take When Applying for Bad Credit Loans in Singapore

A good credit score may ensure your financial plans are successful. Yet it doesn’t mean it can halt it altogether. The reality that you’re still eligible for a bad credit loan in Singapore options encourages factors to pursue a debt to solve your financial troubles.

Before you apply for those particular loans, first, you have to prepare yourself adequately. Here are some specific steps you can take to increase your chances of getting approved:

Check your Credit Report:

What is a credit report? It’s a comprehensive record of your credit payment history, including different types of credit accounts and other relevant information. It’s compiled from all the various credit providers whom you’ve worked with in the past.

Before you apply for a bad credit loan in Singapore, check your credit report. Review the information and ensure no inaccuracies or errors may affect your credit score.

You may gain a credit report for free from the Credit Bureau Singapore (CBS) once a year. You can also get it from the Moneylenders Credit Bureau (MLCB).

Fix your Credit Score:

A bad credit loan in Singapore is designed for individuals who’ve obtained credit risks. Still, it’s best to fix your credit score to increase the possibility of loan approval.

You could qualify for lower interest rates with a higher credit score. To fix your credit score, the things you need to do are:

Paying your bills on time:

Many people underestimate paying their bills on time. Yet it’s an act that has a massive pull on improving one’s credit score.

To ensure timely payments are on time, set up automatic payments. You can also opt for digital reminders to help you pay those essential bills on time.

Pay down your existing debts:

High debt levels can impact your credit score. Do your best to pay down your debts to enhance your credit utilisation ratio.

Resist applying for new credit:

Every new credit line you apply for will negatively impact your credit score. Only apply for a new loan only when it’s essential.

Find the Best Licensed Moneylender Specialising in Bad Credit Loans in Singapore

Contrary to what most people believe, licensed moneylenders do not offer every loan accessible in the moneylending industry. In truth, each registered moneylender often has their specialisations. This way, they can provide the best financial assistance and services according to their customers’ needs.

You can find the best-licensed moneylender specialising in bad credit loans through research. Also, compare the ideal options accessible, interest rates, fees, charges, and repayment schedules.

There are eligibility criteria you have to fulfil and requirements to meet. Make sure to complete these before applying, such as:

- You must be twenty-one years old.

- Borrowers have to be Singaporean Citizens or Permanent Residents.

- You need to have a stable income source, whether it’s from self-employment or employment. Registered moneylenders shall require you to present proof of income, such as tax returns or payslips.

- Some licensed moneylenders require a minimum credit score to be met. Thus, don’t hesitate to ask and clarify whether they do allow bad credit loans and see what they can do to assist you.

- Collateral is mandatory to secure loans. If you choose a loan that is considered confirmed, be ready to provide the collateral.

- Bank accounts are essential for income assessment and loan disbursement. These are also used for automatic payments; be sure to have them prepared.

- Be mindful of the fees, mainly because bad credit loans come with higher interest rates and other fees. Always read the terms and conditions cautiously and carefully to comprehend the total loan cost.

Licensed moneylenders will review your application and consider additional factors like employment history and debt-to-income ratio. Nonetheless, ensuring you’ve met all the requirements and steps does increase the chances of obtaining the bad credit loan approval.

Licensed Moneylender for Bad Credit Loans in Singapore

Bad credit doesn’t mean it’ll always be a bad loan situation. Undoubtedly, credit risk affects a person’s financial aspect and credibility.

The good thing is you have a licensed moneylender to lean on in these times of monetary problems.

For one, as these financial institutions are under the Ministry of Law, they can only enforce a monthly 4% maximum interest rate. The administrative fee is a one-time payment of 10% of the principal loan amount. The loan repayment schedule is flexible, making it easier to repay the debt and improving your credit score.

They can help you reverse your poor credit when you get a bad credit loan from them. You can experience this by getting a bad credit loan from a licensed moneylender. It’s the best option for you.

Are you ready to improve your bad credit score? Improve your financial situation, and click here to be assessed for a loan today!