As higher inflation rates threaten the people in Singapore, the concern about enduring the severe economic crisis is evident. Everyone residing and working in the country continuously asks whether moneylending in Singapore is legal.

The impending financial concerns have people urging themselves to seek a reliable source that could extend monetary assistance actively. Indeed, there are several lending options in Singapore. Nevertheless, you would prefer to get funds from credible and registered platforms that moneylending businesses offer.

Apply for Loan Easily From a Lending Business

Acquiring cash from a loan demands a legitimate transaction with a bank or financial institution. In Singapore, there are also licensed lending businesses proffering the same benefits. Banks and financial institutions do provide loans to individuals who are either employed or self-employed.

Yet achieving the loan approval would take time and effort. What’s more, the requests may not reach disbursement endorsement.

Due to the lengthy procedure from these financial businesses, many opt to seek a different fix to their financial problems, which are the licensed lending businesses in Singapore.

But what are these licensed moneylending businesses in Singapore?

Is it legal in Singapore or not?

What are the laws revolving around the moneylending industry in the country?

And if it’s legal, who can secure the services from these lending businesses?

What is Moneylending Singapore?

Moneylending is supplying services and goods and giving cash loans to an individual with debt who must repay at a high rate quickly.

Does it mean that banks, financial institutions, credit unions, and insurance companies are authorised to provide moneylending privileges to individuals in Singapore?

No, as those businesses offering financial assistance are not considered money lenders. Although these are financial institutions, their primary functions differ from those of a moneylending company.

It’s because bank operations revolve around admitting deposits, controlling withdrawals, and acquiring money from the public or their duly paid interest clients. Credit unions are considered not-for-profit, with operations focusing on distributing profits to their designated members. Insurance companies concentrate on proffering insurance services, financial security, and other coverages to protect their client’s futures.

Money lenders are the individuals who own or manage their moneylending companies. It is their business to lend funds to people bound to pay interest.

The sum of money that money lenders grant to their borrowers varies. But in many cases, it is in smaller amounts with comparably higher interest rates than other financial businesses.

Why do moneylending companies impose high-interest rates on their borrowers?

The purpose of the approach is simple yet logical for the money lenders. They are taking a higher risk compared to other financial institutions. Thus, these money lenders aim to counter the threats they’ve taken on through the interest rates.

Is Moneylending Singapore legal?

Yes, the moneylending industry in Singapore is legal. Thus, the prevalence of licensed moneylenders in the country is noticeable.

It follows the newest Moneylenders Act 2008, passed in November 2008 by the Singapore Parliament. It has taken its legal effects since the 1st of March 2009.

The Moneylenders Act 2008 proffers a flexible and continuously developing process to the moneylending regulations, ensuring support with the modern credit economy.

The new Act further clarifies that lending activities and transactions should be licensed. It must match the modernisation of moneylending operations with a secure regulatory framework.

Are there rules that moneylenders must follow?

A new set of rules was introduced as the Moneylenders Rules along with the current Moneylenders Act.

It stipulates the provisions associated with unsecured lending via moneylenders. The Ministry of Law and the Monetary Authority of Singapore finalised the requirements for unsecured lending, particularly by financial institutions and licensed moneylenders.

It is an explicit provision on the borrower’s eligibility for applying and being granted unsecured credit. It states explicitly to regulate access to credit only when the borrower provides proof of having an annual income of $20,000 at the minimum, which will be, at most, $30,000.

In addition, the Moneylenders Rules also indicate the borrower may gain access to the unsecured credit approved by the licensed moneylender only at a limit of two times their monthly income. Also, borrowers with a lesser annual income than $20,000 may only be permitted to attain a small personal loan of at most $3,000, plus a capped interest of 18 per cent per annum.

In light of the matter, some borrowers could experience exclusions from the capped interest. These individuals that licensed moneylenders may offer scope to their services are Singaporean citizens or permanent residents who earn $120,000 at the minimum per annum. Additionally, non-permanent residents or non-Singaporeans are also eligible for the provision.

Exclusions could apply to particular types of loans, such as student or education loans, medical treatment or expenses, home renovations or purchases, etc.

What is a Licensed Moneylending Singapore Company?

With the massive numbers of money lending companies in Singapore, many borrowers need clarification about whether they are dealing with licensed or unlicensed moneylenders.

One of the best ways to learn if a company or lender is legally authorised to operate their services in Singapore is by checking the Registry of Moneylenders online. All licensed moneylenders must subject themselves and abide by the Moneylenders Act and Rules.

How do licensed moneylenders operate?

The licensed moneylenders in Singapore operate almost as similarly to banks. It’s because they grant loans to people needing financial assistance.

Licensed moneylenders do not telemarket their services online or even send out SMS to prospective clients. It is imperative for licensed moneylenders they communicate with their borrowers and transact face-to-face, especially when there’s a requirement to sign documents.

What if the borrowers’ payments come in late?

Due to unforeseeable circumstances, a borrower may be in a rough situation. As a result, they cannot comply or pay for the loan they got at the right time or meet the payment schedule.

Licensed moneylending companies refrain from harassing their borrowers. The legally allowed medium to approach late payers is notifications or notice reminders.

Why do most people choose licensed moneylending Singapore companies?

Banks and other financial businesses are willing to offer their services to borrowers needing financial help. But, the procedure is often too long for most people, precisely when the requirement for money is either for emergencies or situations that require immediate cash.

Another distinction regarding licensed moneylending in Singapore and its operations is its fast and efficient services to its borrowers, particularly involving: high interest, speed of the process, focusing more on smaller loans, and the forgiveness of a credit assessment.

These are the most significant differences between licensed moneylending in Singapore, financial organisations and banks.

Who are the Unlicensed Moneylender in Singapore?

Unlicensed moneylenders have caused trouble in Singapore’s community. They brought many controversies and legal troubles, especially for the borrowers and the moneylending industry. It’s because their leading practices with moneylending are illegal in the industry.

These individuals or entities possibly did register under the Ministry of Law. However, they may have breached the contract, which revoked their licenses. On the other hand, it’s also possible they did not apply for the moneylending license in the first place.

Ah Longs or Loan Sharks

Once caught, these ah longs or loan sharks are continuously under surveillance and brought to justice. They do not pay any heed to the Moneylenders Act and Rules.

But why do people in Singapore call them ah longs? It’s the general reference Malaysians and Singaporeans give anyone committing illegal lending activities in the country.

Ah longs or unlicensed moneylenders are constantly searching and picking out desperate individuals in dire need of immediate financial help. Among these victims are individuals who earn low incomes.

These companies or individuals usually search for their target market through text messages via WhatsApp. They often pretend to be legal moneylenders and offer an array of promotions to tempt people who need money or endure low salaries.

How do they do it? They endorse their standard promotion of granting the lowest interest rate to their target market. Moreover, they relentlessly promise to assess, evaluate, and fulfill online transactions faster than traditional lenders in the country.

As soon as they have caught their victim’s attention through their incredible promotions, they will ask for the borrower’s photo and the NRIC. With these supposed requirements, they will further inquire about unnecessary information about their victims. They’ll sometimes obtain critical information connected to victims’ families, work, and their employer or address details.

When the victim does not repay the intended amount the unlicensed moneylender asks for, these ah longs begin their threats and harassment pursuits towards the borrower.

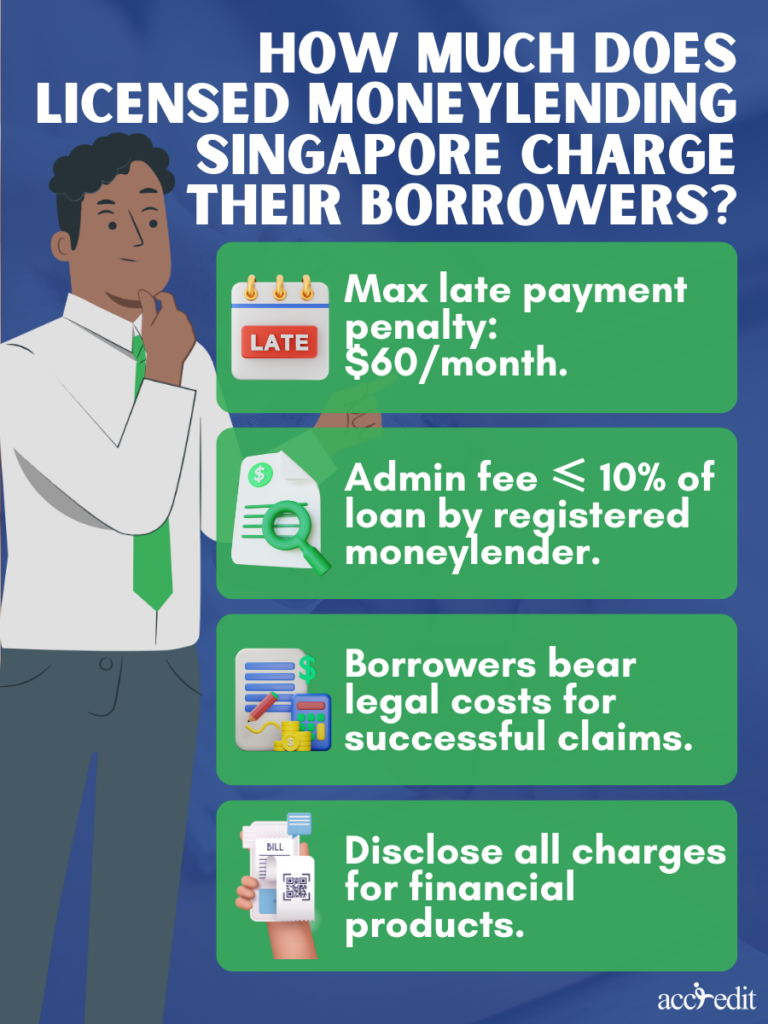

How Much Does Licensed Moneylending Singapore Charge Their Borrowers?

To Singapore’s moneylending laws and regulations, these businesses cannot freely impose their own choice of fees.

From the beginning of October 2015, the only allowable fees that legal moneylending may charge on personal loans are the following:

- Costs should not go beyond $60 per month for the incurred late payment penalties

- Fees should be at most 10% of the admin fees. The registered moneylender will charge it upon the initial loan sum.

- The court lawfully orders the legal costs for successful claims created by the moneylender to recover the loan.

- The accredited moneylenders shall establish all the total charges for financial products, like personal loans.

It shall include the upfront admin fees and the interest. There are also late fees and late interest.

It’s important to note that these specific charges must not be more than the total amount of the credit, particularly to the initial debt of the acquired personal loan.

How to Check a Moneylender’s License in Singapore?

All a person has to do when verifying the legitimacy of a certified moneylending company in Singapore is by logging in online and visiting the Ministry of Law website.

The site welcomes visitors with an important note on the increasing reports regarding scammers and unlicensed moneylenders. The notice further warns the borrowers about the distinctive practices of unlicensed moneylenders. So, it encourages vigilance and awareness to everyone living in Singapore who wishes to transact only with licensed moneylenders.

A downloadable link is below the vital note to view Singapore’s entire list of licensed moneylenders.

Along with the note are the contact number of the Police hotline 1800-255-0000 and www.police.gov.sg/iwitness to report plausible unlicensed moneylenders or activities.

Moneylending in Singapore is legal. And some laws protect both licensed moneylenders. With this, the borrowers and authorised moneylending companies have a safe, trouble-free and highly efficient transaction that can enhance the citizens’ lives and Singapore’s financing industry.

Are you searching for a reliable licensed moneylending Singapore business to help with your personal loan needs? Accredit will gladly be of service. Apply now!