To successfully secure a personal loan in Singapore, being well-prepared with the required paperwork and meeting all necessary requirements is key. By understanding the mandatory documentation and application process, you can improve your chances of approval. This article will delve into the necessary documents you’ll need to obtain a personal loan and provide a comprehensive overview of the application steps.

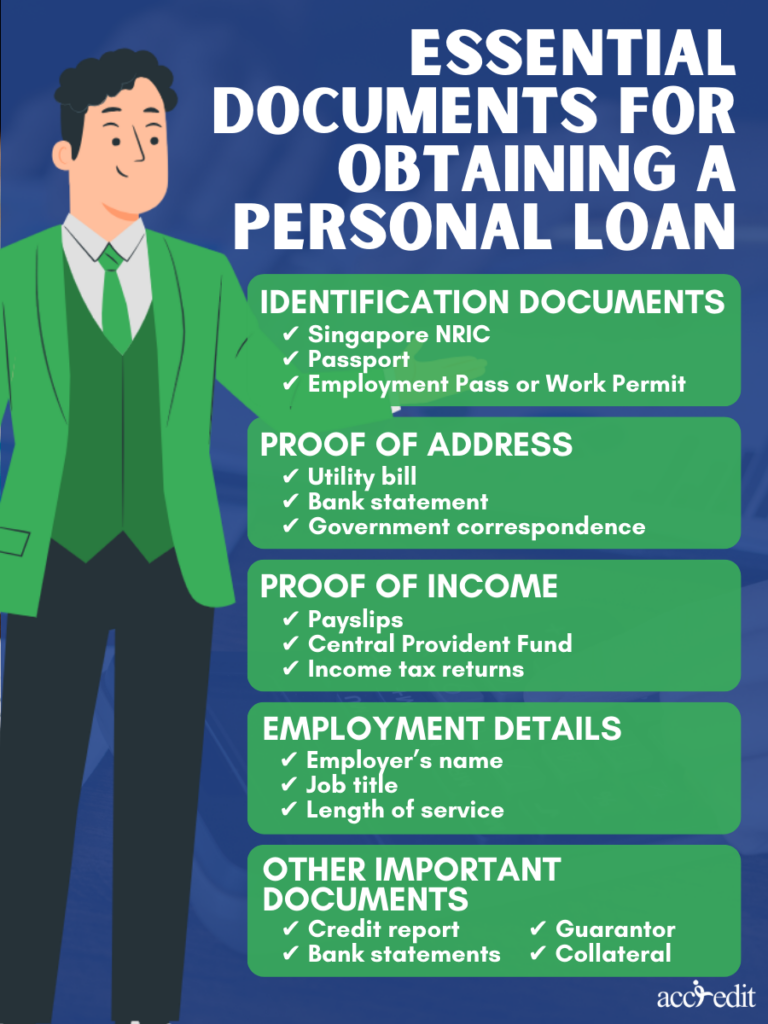

Essential Documents for Obtaining a Personal Loan

To ensure that your personal loan application process goes without any hiccups, you need to provide specific documents and meet certain criteria. Below are the essential credentials you must have to avoid any needless complications.

Identification documents

A. Singapore National Registration Identity Card (NRIC)

Your NRIC serves as the primary form of identification for citizens and permanent residents of Singapore. Notably, when applying for a personal loan, a photocopy or digital copy of your NRIC must be provided to prove your identity and eligibility.

B. Passport

If you’re a foreign national residing and employed in Singapore, securing a personal loan requires a vital document – your valid passport. Serving as your main identification, overlooking the importance of keeping it updated and unexpired can lead to significant delays in processing your loan application.

C. Employment Pass or Work Permit

Lending institutions may require certain documents aside from the standard identification requirements. For foreign applicants, providing an employment pass or work permit may be deemed necessary to verify their employment status and financial capability.

Proof of address

A. Utility bill

Utility bills, encompassing electricity, water, or gas, hold immense importance as proof of residency when seeking a personal loan. The lending institution scrutinizes your ability to repay the loan and, therefore, requires concrete evidence of your residency.

B. Bank statement

Instead of utility bills, you can submit your recent bank statements. These statements must show your name and address to be considered valid. This alternative option can be helpful, especially for those who face difficulties obtaining their utility bills.

C. Official government correspondence

Government correspondence can also serve as valid proof of residential address, which includes official documents like tax papers and notices. These can be used to authenticate your current living address for various purposes.

Proof of income

A. Payslips

In order to verify your employment and salary, lenders typically demand your latest payslips as proof of income. The required documentation usually encompasses the previous 3-6 months and serves as a crucial indicator of your financial stability.

B. Central Provident Fund

For Singaporeans and permanent residents, the CPF proves to be a valuable asset when seeking a personal loan. Monthly contributions reflected in CPF statements provide a comprehensive record that financial institutions and employers use to assess your financial standing.

C. Income tax returns

Your income tax returns or the Tax Notice of Assessment (NOA) from the latest year can also serve as credible evidence of income. Requesting such information is a common practice among lenders when assessing loan applications.

Employment details

A. Employer’s name

Including the name of your employer in your loan application allows lending institutions to authenticate your employment status and establish communication with your employer to validate the information provided.

B. Job title

Your job title serves as a critical identifier of your professional standing and the extent of your accountability. Such factors significantly impact your eligibility for loans. As lending institutions are risk-averse, they rely on job titles to gauge your repayment capacity and financial stability.

C. Length of service

Your length of tenure with your present employer offers lenders invaluable insight into your employment stability and overall financial well-being. By examining the duration of your employment, financial institutions can better evaluate your creditworthiness, loan eligibility, and ability to make timely repayments.

Other Important Documents

A. Credit report

In evaluating your eligibility for credit, lenders may solicit a credit report from a credit bureau. This report discloses crucial information about your credit accounts, including your payment history and outstanding debts. Consequently, a credit report is a vital factor in determining your creditworthiness.

B. Bank statements

Bank statements are more than just providing proof of address. They hold valuable insights into your income, expenses, and debts that lenders use to assess your creditworthiness. The strength of your financial profile, as demonstrated through your bank statements, plays a crucial role in securing a personal loan.

C. Guarantor (if applicable)

When facing low credit scores or unstable income, you may find yourself in need of a guarantor to secure a loan. The role of a guarantor is to pledge to repay the loan should the primary applicant default on payments. Lenders typically require similar documentation from the guarantor as they do from the primary applicant.

D. Collateral information (if applicable)

When pursuing a secured personal loan that involves collateral, it’s crucial to comprehend the implications. This type of loan demands a valuable asset, such as real estate or securities, as a guarantee for repayment. In the event of a loan default, the lender has the right to take possession of the collateral to recuperate their losses.

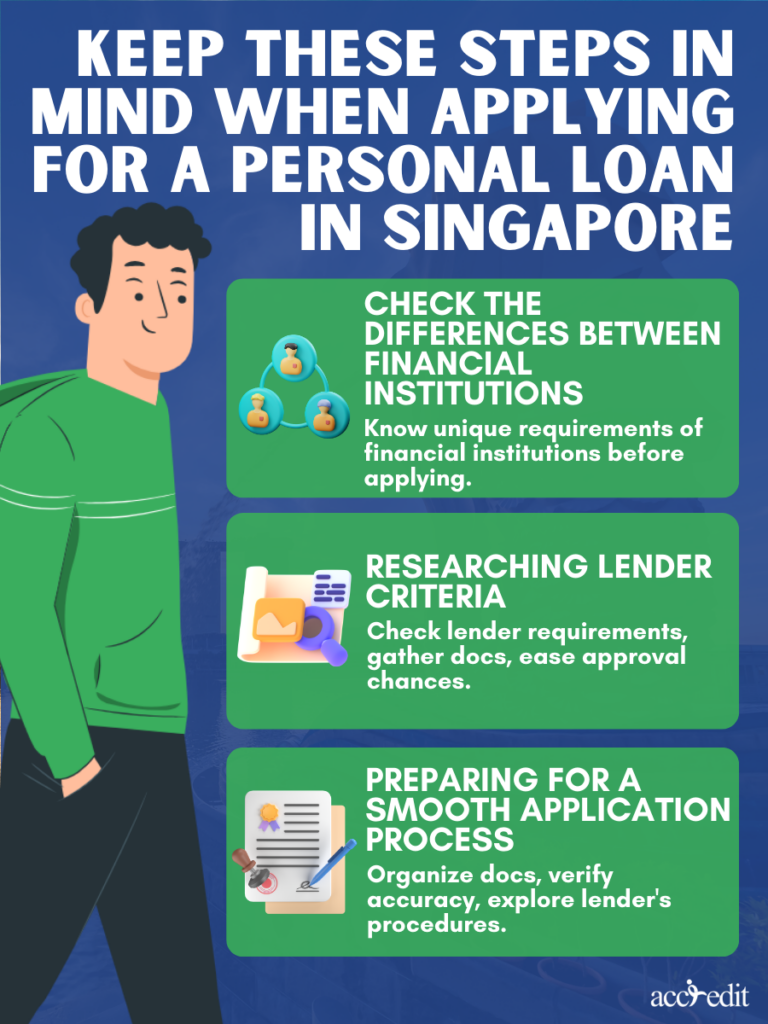

Keep These Steps in Mind When Applying for a Personal Loan in Singapore

- Check the differences between financial institutions: It’s essential to recognize that every financial institution has distinct prerequisites and eligibility standards. Certain creditors might enforce stricter documentation criteria or entail additional paperwork.

- Researching lender criteria: Exploring the lender’s specific requirements and collecting all necessary documents before submitting your application can facilitate a seamless application process and heighten your prospects of approval.

- Preparing for a smooth application process: Ensure that your documentation is meticulously organized and verify its precision. It would be prudent to explore the lender’s customer service channels or peruse their website to gain comprehensive insights into their application procedures and prerequisites.

Thoughts

Acquiring a personal loan in Singapore hinges on your understanding of the necessary paperwork. By arming yourself with the right information, you can avoid unexpected setbacks and increase your chances of securing your desired loan.

It’s worth noting that Singaporean lenders typically demand various documents, including proof of identity, income, and residency. Failing to fulfill any of these requirements may result in needless delays or even a loan denial. As such, it’s vital to conduct thorough research and adequately prepare yourself before applying for a loan.

Quick and Easy Loan Approval with Accredit Moneylender

Accredit Money Lender ensures that your loan application is processed with lightning-fast speed. Here’s how we can help you get the money you need, when you need it:

- Same-day approval for all customers who qualify

- Instant cash disbursal on the very same day

- No need for a good credit score

If you’re considering a loan in Singapore, choose Accredit, a reliable licensed moneylender that offers hassle-free loan processing. Simply fill out our online application form and one of our experienced officers will assist you in gathering the necessary documents. These typically include identification documents, proof of address, proof of employment, and proof of income in the form of pay slips.