The Moneylenders Act Singapore is the legislation which governs the movement of every moneylender in Singapore. It’s a crucial law for borrowers to understand, providing information about identifying licensed moneylenders in the country.

Moreover, the Act details the specifics of moneylending interest rates and fees. It also shares the undesirable consequences of borrowing from an unlicensed moneylender.

Borrowers need to learn the Act to help them make informed decisions while borrowing funds. Furthermore, mastering the Act effectively prevents financial troubles due to high-interest rates and unjust moneylending practices.

Read the essential facts you need to know and understand about the Moneylenders Act in Singapore.

What is the Moneylenders Act Singapore?

Under the Act, moneylending is a financing industry which lends money with interest and other charges to its borrowers. It also includes the sale of goods on credit, with markup prices.

It means that if a person borrows money from another individual or company, the borrower has to repay the loan with interest and fees. Individuals or companies who engage in these functions, mainly lending money, exercise moneylending functions.

The Act is put in place to protect both licensed moneylenders and borrowers by regulating the industry, plus ensuring that only legal lenders are operating in the industry. Certified moneylenders are duly registered with the Ministry of Law and operate legally via the Act.

Understanding the Moneylenders Act Singapore

People living in Singapore, like you, need to understand the Act to know the process of moneylending. Also, you’ll obtain information on identifying and dealing with a licensed or unlicensed moneylender.

Illegal moneylenders operate without a licence and are not registered with the government. In many situations, illegal lenders charge exceptionally high-interest rates, which causes stress and additional financial worries to their victims.

Thus, learning more about the Act provides methods for borrowers like you to protect themselves from illegal lending activities and harassment. In addition, you gain access to licensed moneylenders in the country through the Ministry of Law’s list.

What is the Moneylenders Act Singapore’s Coverage?

The regulation coverage of the Moneylenders Act Singapore is the types of loans for purchasing goods or acquiring services.

Types of Loans from Moneylenders Act Singapore

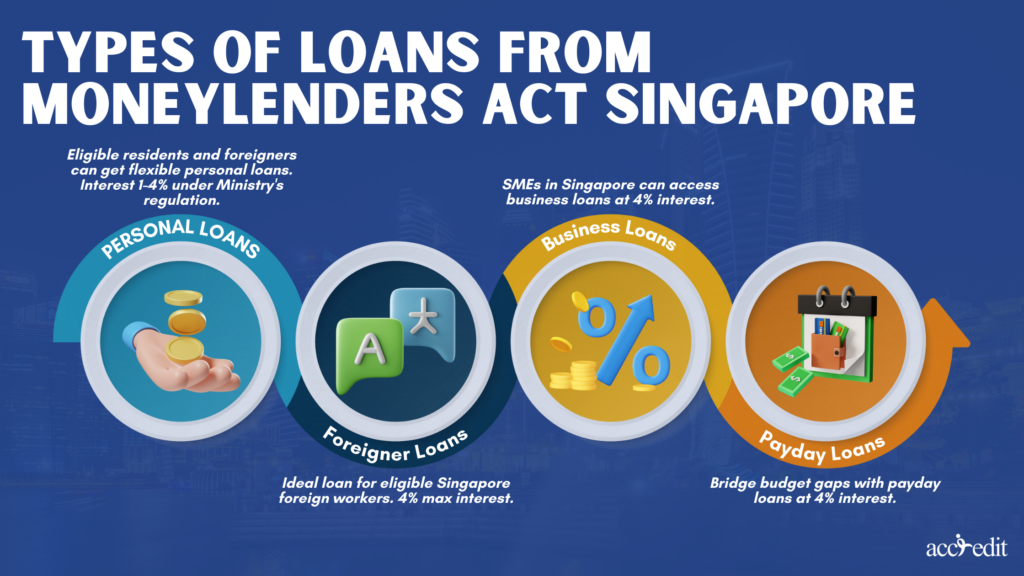

1. Personal Loans

Singaporean Citizens, Permanent Residents, and foreigners with accreditation and permits to work and stay in the country are eligible applicants for a personal loan. It’s an unsecured loan that’s popular as it’s flexible for personal expenses, consolidating debts, funds for travelling, or car repair.

As regulated by the Ministry of Law, the interest rate for a personal loan is from 1% to 4% maximum per month.

2. Foreigner Loans

The perfect loan choice for foreigners in Singapore. Every foreigner with a valid work permit, S Pass, and employment pass may apply for a foreigner loan.

The interest rate for a foreigner loan is capped at a 4% maximum.

3. Business Loans

Singapore’s SMEs needing financial assistance may apply for a business loan. It’s the ideal option to help with the company’s working capital or for expansion purposes. So long as the registered business is Singapore-based with a 30% local shareholding, the applicants may be eligible.

A business loan’s interest rate from a licensed moneylender is at 4% max monthly.

4. Payday Loans

Did you find yourself falling short of your monthly budget? Then you need to get a payday loan. It’s an excellent loan option to bridge monetary gaps before your next salary day.

Remember, it’s a short-term loan meant for short-term financial relief. The interest rate is capped at 4% for a payday loan.

Aside from the diversity of loans, the Act also controls the interest rates and fees chargeable by getting a loan from a licensed moneylender. The fees are all applicable regardless of the loan application.

4% Interest Rate

Among the most notable influences of the Act is the stipulation associated with the interest rate. In the past, the interest rate lenders may impose can reach up to 10% to 20%.

The Ministry of Law understood the implications it could cause not only to certified moneylenders but primarily the borrowers. In October 2020, the provision of the Act added pertains to the specific maximum interest rate a licensed moneylender may charge is only 4% per month.

10% Administrative Fees

Legal moneylenders in Singapore are permitted to charge administrative fees. However, it’s still regulated by the Act. The allowable maximum charge for administrative fees is 10% of the principal loan amount.

Also, authorised lenders may only charge it once. What if they exceed the maximum percentage or demand the borrower pay another administrative fee?

It means these lenders are practising illegal moneylending functions.

It’s best to contact the authorities, specifically the Registry of Moneylenders at 1800-2255-529 and Singapore Police Force at ‘999’. Or, a borrower should call the X-Ah Long hotline at 1800-924-5664.

Moneylenders Act Singapore’s Maximum Loan Amount

Another scope of coverage the Act oversees is the maximum loan amount. It’s the total amount a borrower’s likely to gain when applying for a loan from a licensed moneylender in Singapore.

But there are specific rules applicable before obtaining the total loan amount, and these are the borrower’s citizenship and annual income.

Singaporean citizens and permanent residents obtaining an annual income lower than $10,000 may take a max loan of $3,000. Foreigners with work pass earning the same yearly salary can get a max loanable sum of $500.

Yet, Singapore citizens, permanent residents, and foreigners residing in the country earning at least $10,000 up to $20,000 a year may get a maximum loan sum of $3,000.

Moreover, Singapore citizens, permanent residents and foreigners living and working in Singapore earning at least $20,000 annually can take six times their monthly salary.

Moneylenders Act Singapore’s Licensing Requirements

The Act also requires all lenders to be duly licensed to ensure they provide financial services and operate legitimately. To become a licensed moneylender in Singapore, specific requirements are set by the Ministry of Law.

The licensing requirements for moneylenders in Singapore include the following:

Registration with the Accounting and Corporate Regulatory Authority (ACRA)

ACRA is the Ministry of Finance’s statutory board in Singapore. Its main operation oversees the regulation and registration of businesses and public accountants in Singapore.

Moneylending in Singapore requires ACRA for business registration and acquires the unique Entity Number (UEN). The procedure also includes business name approval, submission of relevant documents connected to company constitutions and particulars of the directors.

Business Name Approval

ACRA oversees the approval of the moneylending business name before the registration is officially completed. The name shouldn’t contain any obscene or offensive words and isn’t similar to existing companies in the country.

When the business name is finalised, it can be used for registration.

S$100,000 Minimum Capital

According to the Act, a moneylender must present S$100,000 as minimum capital for their business. They can proceed with the licensing once they’ve proven they have the said amount.

Proper and Fit Criteria

The Ministry of Law evaluates the directors and moneylenders to determine whether they meet the fit and proper criteria. It primarily includes their character, reputation, and financial background. In addition, ACRA also considers previous or recent criminal records, disciplinary actions or bankruptcy history.

The designated standards improve the scope of protection provided to borrowers and maintain public confidence. Thus, a moneylender applying for a licence has to have notable characteristics as they’ll represent the integrity and credibility of the moneylending industry in the country.

Compliance with Moneylenders Act Singapore

Complying with all Act regulations significantly impacts moneylending operations in the country. It’s the law that licensed moneylenders need to commit to.

Here are the rules a licensed moneylender must adhere to.

- A licensed moneylender must follow the 4% monthly interest rate restrictions. Under the Act, they’re not permitted to extend the charge more to specific amounts of interest on loans. Thus ensuring that borrowers won’t be exploited or taken advantage of.

- Loan agreements should be in writing. It must include loan terms, interest rates, repayment periods, and additional charges or fees linked to the loan to be clear and transparent. If a lender doesn’t honour their obligations to the Act, the borrower may file a complaint against them.

- Debt collection practices are also among the laws the Act administers. Certified moneylenders are permitted to collect debts but mustn’t use threats. They’re also prohibited from intimidating borrowers when collecting loan repayments.

They’re only allowed to send reminders and notifications to their borrowers as it is in the Act’s guidelines always to treat borrowers fairly and respectfully. Yes, it includes even the event of default.

Moneylenders Act Singapore Licensing Fee Payment

Businesses that concentrate on moneylending should fulfil the licensing fee payment. The Registry sets it, and the amount may change occasionally.

The uncapped licensing fee is due to the type of licensing applied for and the overall moneylending business size. Also, the fee isn’t a one-time payment. Licence renewal is highly encouraged every year.

Failure to comply with paying for the licensing fee or licence renewal may result in penalties. Other times it could lead to licence revocation.

Moneylenders Act Singapore Borrowing Practices

Borrowing money from moneylenders is a convenient way of obtaining financial assistance. It’s primarily of great help when traditional banks and lending institutions are available for a borrower.

Now, it’s time to discuss the borrowing process regulated by the Act.

First and foremost, a borrower has to make sure they’re dealing with a licensed lender. The best way to uncover their legitimacy is by checking the moneylender’s number to see if it corresponds with the ACRA’s list or the Registry. Then they must present their documents to move forward with their loan application.

Comparing Different Moneylenders in Singapore

The Act explicitly highlights the rules that signify the lender is certified by the law. Moreover, researching enough to distinguish and compare the lender’s differences will help them get the best loans and conditions.

Aside from the previously mentioned factors on interest rates, fees, and charges, the lender’s reputation is crucial too. A moneylender in Singapore who operates the business with integrity and credibility usually earns impressive customer reviews. To be sure they’re working legitimately, borrowers can check ACRA regarding their licence status.

Moneylenders Act Singapore Borrowing Responsibilities

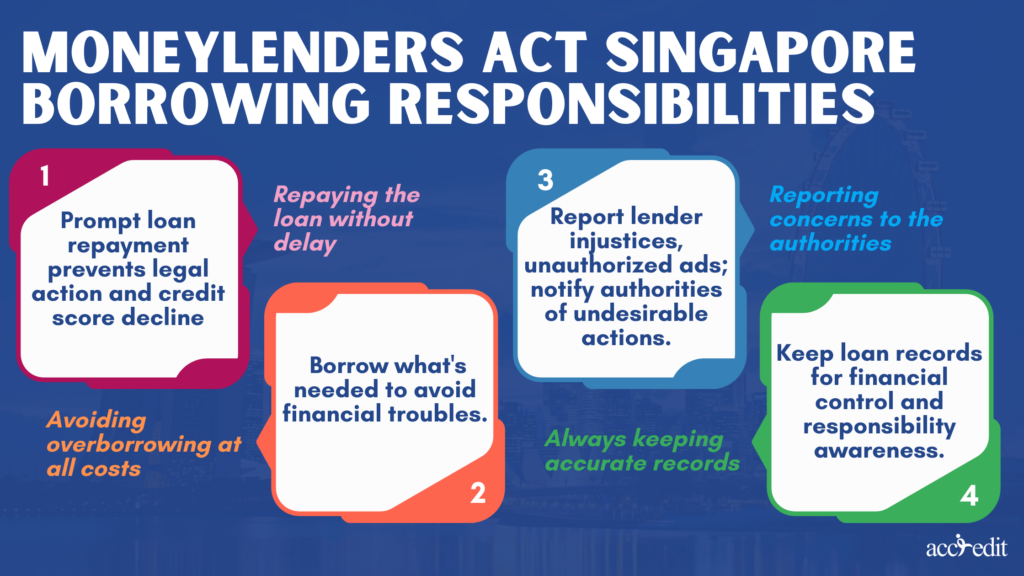

Another crucial detail a borrower needs to know is how to become a responsible borrower. The Act doesn’t only focus on moneylenders but educates borrowers too.

Here are the notable ways to become a responsible borrower;

- Repaying the loan without delay.

The borrower must repay loans without delay, as these schedules are already stipulated in the loan agreement. Failure to commit to these repayment periods would cause more problems for the borrower, eventually leading to legal actions and negatively impacting credit ratings.

- Avoiding overborrowing at all costs.

In the past, overborrowing issues were prevalent in the moneylending industry. Thus, the Moneylenders Act Singapore imposed new provisions like loan capping to prevent overborrowing.

It’s highly advised that borrowers should loan the money they genuinely require. This way, they avoid tendencies of overborrowing which may lead to financial issues or bankruptcy.

- Reporting concerns to the authorities.

The Act encourages borrowers to report concerns regarding unjust practices done by a lender. It may involve amplifying the interest rate or refusing to explain the loan agreement.

Other issues may root from an unlicensed moneylender advertising their offers through text, calls, or messaging apps. Any undesirable actions of licensed or unlicensed moneylenders should be reported to the relevant authorities.

- Always keeping accurate records.

Legal moneylenders in Singapore do keep records of the loan transaction. But a responsible borrower will keep accurate records for easier reference.

The documents that need to be kept and organised are loan agreements, payments made, and additional relevant information.

These records are vital as you acquire better control of the finances. Plus, it helps the borrower to become aware and make a conscious effort to meet their responsibilities.

Moneylenders Act Singapore’s Consequences of Defaulting on a Loan

The Moneylenders Act Singapore further expands its advocacy to educate borrowers about defaulting on a loan. It primarily leads to severe consequences. How?

The borrower’s credit rating could be negatively affected by the default. A low credit score equates to lower chances of obtaining loans or credit in the future. If the borrower is in dire need of cash, they won’t gain fast, easy and legitimate access to getting a loan.

Defaulting on a loan may cause late payment fees. These will eventually add up and burdens the borrower more due to the difficulties of repaying the loan.

Legal actions could happen when a borrower chooses to default on a loan. It’s the legal right of a certified lender to pursue this as stipulated in the Act. It’ll mainly involve court judgement against the borrower, including the demand to pay the debt, legal fees, and all interest accrued to the loan.

What if a borrower ultimately fails to repay the loan? According to the Act, licensed moneylenders may seize the borrower’s assets to recover the existing debt.

Thus, a borrower must be responsible and thoroughly read the loan terms and agreement. So they can weigh their options and understand the obligations to fulfil under the Act.

A Knowledgeable Borrower Makes Informed Decisions

The Moneylenders Act Singapore might look intimidating initially, but it isn’t a handful. Loaning money is a big responsibility. As a result, borrowers need to know precisely what they’re getting into.

If the current Act seems overwhelming for a borrower, this is an accessible guide for everyone to follow. Nonetheless, referring to and reviewing the Act on the Ministry of Law’s website is always encouraged.

The knowledgeable borrower makes informed decisions that help them control their finances and betters their life’s approach.