Dreaming big is easy, but turning those dreams into a reality requires a financial injection. If you’re based in Singapore, the task of getting your hands on the necessary cash can seem overwhelming. Thankfully, a personal loan could provide the financial freedom you crave.

However, with a plethora of options available, how do you differentiate the best from the rest? Don’t fret, as we will reveal the inside scoop on the various personal loan types in Singapore.

Personal Installment Loan

For those seeking a reliable and steady personal loan, the Personal Instalment Loan is an excellent option. This loan type provides a lump sum payment, which you can repay through a set of fixed monthly installments over an agreed period. You have the flexibility to select the repayment period that fits your financial capabilities, and the fixed interest rate ensures that your monthly payments are predictable and stable.

How It Works

To secure a personal installment loan, the lender evaluates your credit score, income, and financial situation to ascertain your eligibility and borrowing capacity. After approval, you receive the lump sum and then pay it back over a fixed duration through regular monthly installments.

When to Use It

A personal installment loan is an optimal choice for singular expenses, including but not limited to property improvements, grand events, or unforeseen medical bills. It’s also effective for consolidating debts that carry hefty interest rates.

| Advantages | Disadvantages |

| Fixed interest rates and repayment periods | A high credit score or income may be required to qualify for the loan |

| A lump sum amount is useful for covering large expenses | Late or missed payments can lead to additional fees or credit score damage |

| Lower interest rates compared to credit cards | The repayment period may be long, resulting in higher overall interest cost |

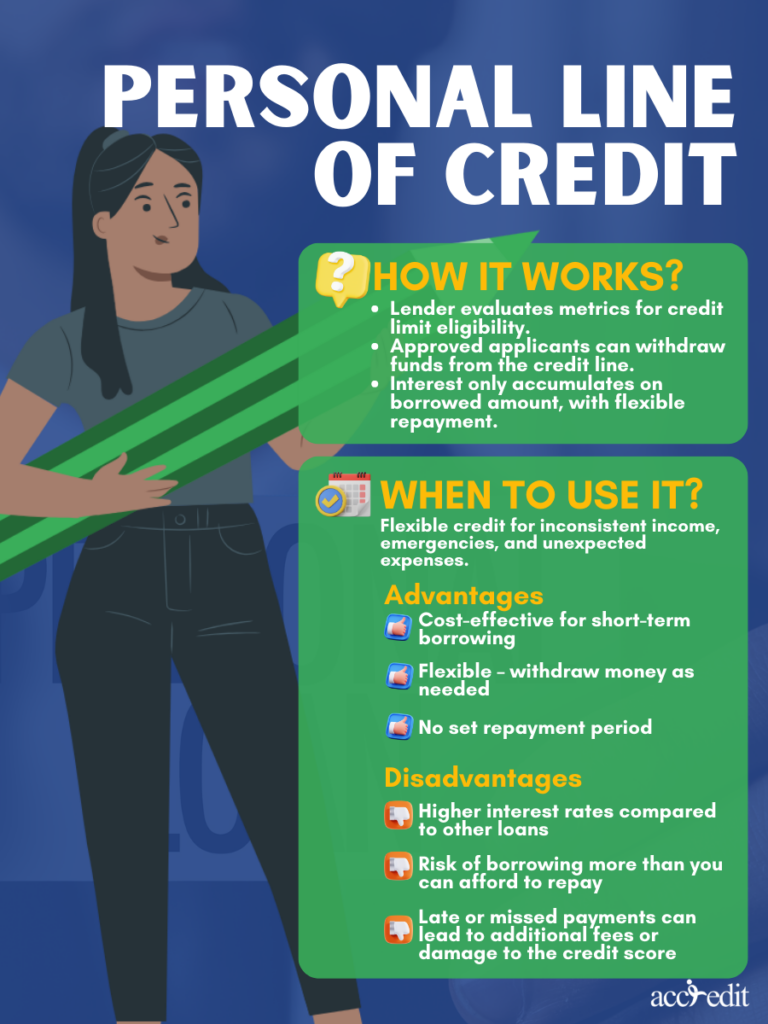

Personal Line of Credit

A personal line of credit is a type of loan that gives borrowers access to a predetermined credit limit. Borrowers can withdraw funds as needed and will only pay interest on the amount borrowed. Repayment is flexible, and interest is only charged on the outstanding balance.

How It Works

When you apply for a personal line of credit, the lender evaluates your financial metrics like credit score and income to determine if you’re eligible and to establish your credit limit. Once approved, you can start tapping into the credit line and withdraw funds as needed. Interest only accumulates on the borrowed amount, and you can repay it at your convenience.

When to Use It

Individuals seeking continuous cash flow, especially those with inconsistent earnings or self-employed, can rely on personal lines of credit. This type of loan can also be handy in sudden emergencies or unforeseen expenses.

| Advantages | Disadvantages |

| Cost-effective for short-term borrowing | Higher interest rates compared to other loans |

| Flexible – withdraw money as needed | Risk of borrowing more than you can afford to repay |

| No set repayment period | Late or missed payments can lead to additional fees or damage to the credit score |

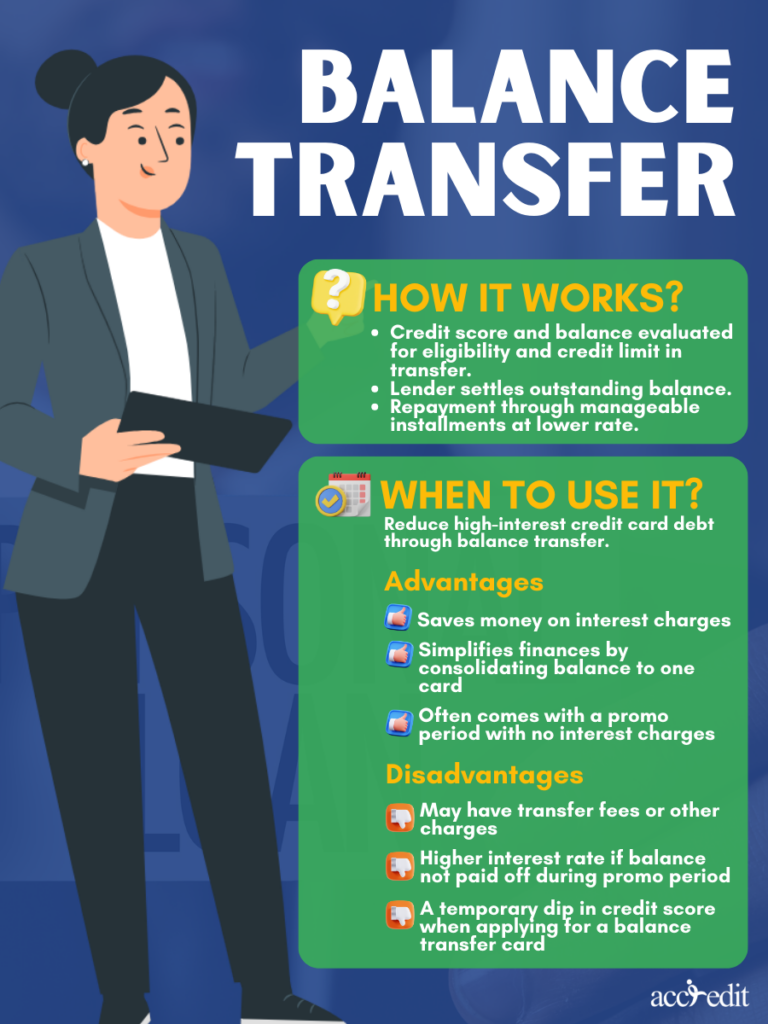

Balance Transfer

A balance transfer is a personal finance strategy that entails shifting your current credit card debt to a different card with a reduced interest rate. This enables you to settle your outstanding balance at a lower rate, leading to considerable long-term savings.

How It Works

When you opt for a balance transfer, the lender will first evaluate your credit score and existing credit card balance. These metrics will decide your eligibility and credit limit. After approval, the lender will settle your outstanding credit card balance, and you’ll be obligated to repay the loan in manageable monthly installments, featuring a lower interest rate.

When to Use It

A balance transfer is a financial tactic that’s most advantageous for those carrying high-interest credit card debt. By shifting their balance to a card with a lower interest rate, they can reduce their interest charges and accelerate their debt repayment.

| Advantages | Disadvantages |

| Saves money on interest charges | May have transfer fees or other charges |

| Simplifies finances by consolidating balance to one card | Higher interest rate if balance not paid off during promo period |

| Often comes with a promo period with no interest charges | A temporary dip in credit score when applying for a balance transfer card |

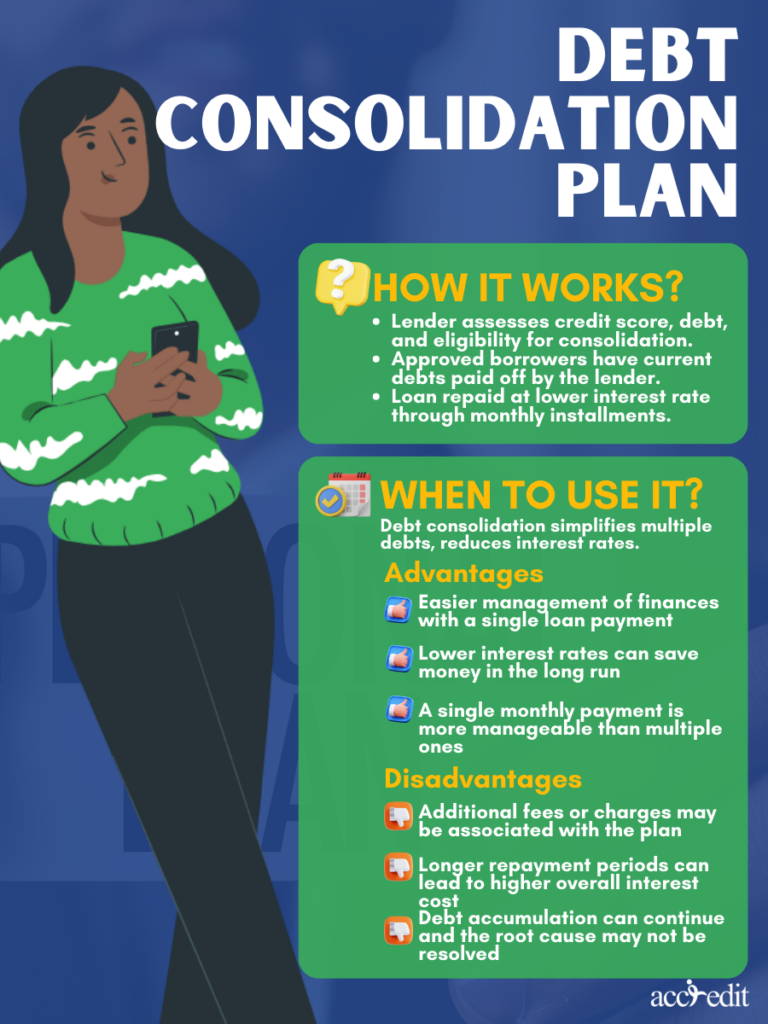

Debt Consolidation Plan

Debt consolidation plans are financial instruments aimed at helping borrowers simplify their financial obligations. These plans enable borrowers to combine multiple debts into a single, more manageable loan. The result? A more straightforward approach to managing finances that replaces several high-interest payments with a single, lower-interest monthly payment.

How It Works

Debt consolidation involves a lender assessing your credit score, existing debt, and other factors to determine your eligibility and borrowing capacity. If approved, the lender pays off your current debts, and you repay the loan at a lower interest rate through monthly installments until it’s fully repaid.

When to Use It

Debt consolidation plans serve as a helpful resource for individuals carrying multiple high-interest debts, such as personal loans, credit card debt, and unpaid bills. The purpose of consolidating these debts into one loan is to potentially reduce interest rates and simplify financial management.

| Advantages | Disadvantages |

| Easier management of finances with a single loan payment | Additional fees or charges may be associated with the plan |

| Lower interest rates can save money in the long run | Longer repayment periods can lead to higher overall interest cost |

| A single monthly payment is more manageable than multiple ones | Debt accumulation can continue and the root cause may not be resolved |

Comparison of the Different Types of Personal Loans

To secure a personal loan that aligns with your financial requirements, you must evaluate a few crucial elements. These include the loan amount, loan tenure, interest rates, and any additional fees. A comparison of these factors will enable you to determine the optimal personal loan for your needs.

| Types of Personal Loans | Interest Rate | Loan Amount | Loan Tenure | Fees |

| Personal Instalment Loan | 3.7% to 7% p.a. | 10x monthly salary for a yearly income above S$120,000 | 1 to 7 years | 0% to 5% processing fee |

| Line of Credit | 18% to 22% p.a. | 2x monthly income | No fixed loan tenure | Yearly fee between S$60 to S$120 |

| Balance Transfer | Interest-free for a limited timeframe, 17%–28% after. | 4x monthly income | 3 to 18 months | Balance transfer fees range from 1% to 5%. |

| Debt Consolidation Plan | 3.18% – 12% p.a. | 18x monthly salary | 1 to 10 years | 0% to 3% processing fee |

Thoughts

When faced with unexpected costs or a need for cash flow, Singaporean individuals can turn to personal loans. These loans come in various types and serve different purposes, such as consolidating debt or covering one-time expenses. By considering interest rates, repayment terms, eligibility requirements, and fees and charges, borrowers can make informed decisions to find the best personal loan for their unique financial needs.

Accredit Moneylender: Your Trusted Source for the Best Personal Loan Rates

In Singapore, financial distress can strike when you least expect it. That’s where Accredit Moneylender comes in – our team of licensed professionals is here to help you secure the financial lifeline you need. With our commitment to transparency and customer satisfaction, we offer the most affordable short-term loans in the market.

At Accredit, we believe in empowering our clients by providing them with the lowest interest rates and flexible repayment plans that suit their unique needs. Choose us as your go-to personal loan provider and take charge of your finances with ease.