Are you in a challenging situation regarding your finances? There’s no need to worry because you can acquire a quick financial fix from short-term loans.

People living in Singapore are fond of this financing option. This type of loan’s specific design fits Singapore’s fast lifestyle.

A short-term loan does have the capacity to resolve cash problems in a flash. But, as quick as the funding assistance is, so is the repayment period.

Thus, it’s best to learn the risks of a short-term loan. Today, you’ll obtain specific details on this financing choice in Singapore, the notable benefits and risks, and how to safely utilise it.

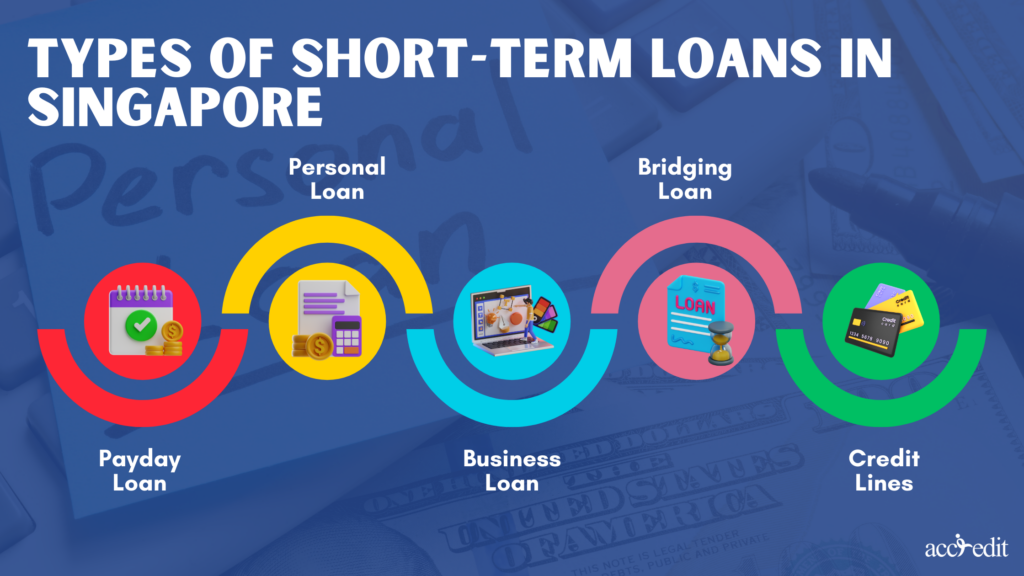

Types of Short-term Loans in Singapore

A short-term loan in Singapore branches out to several types of loan products. It’s possible to apply for it from a bank, a financial institution, or licensed moneylenders in the country.

These loans are ideal for resolving financial situations that are meant to be resolved immediately, such as personal expenses, medical bills, home repairs, etc. So here are the different short-term loans you can gain access to in the country:

1. Payday Loan

It’s the loan product that a borrower has to pay the money they borrowed after a month or on their next payday.

Only licensed moneylenders proffer payday loans in Singapore, thus, expect interest rates ranging between 1% to 4% per month.

2. Personal Loan

Unsecured loans like personal loans are perfect for covering short-term financial requirements. These have higher interest rates with a shorter loan tenure.

The interest rate from banks may range from 3.5% up to 8.99% per annum. Financial institutions would impose interest rates ranging from 1% to 7.5% per annum. Licensed moneylenders may legally enforce interest rates for a personal loan starting from 1% to 4% max following the Moneylenders Act.

3. Business Loan

For a small or medium size enterprise owner in the country needing financial assistance to start or expand their business operations, it’s the best short-term loan for you.

The business loan can bridge the cash flow gap, cover payroll, or purchase inventory. Interest rates may range from 4.5% to 13.5% per annum. While from a licensed moneylender, it’s from 1% to a maximum of 4% per month.

4. Bridging Loan

It’s the perfect short-term loan for people interested in purchasing a new property, as they’re selling a different one. It bridges the financial gap occurring in the transaction.

The interest rate is much higher than traditional mortgages. The estimated interest rate for bridging loans can be between 3.68% to 13.5% per annum.

5. Credit Lines

The loan mainly involves revolving credit accounts, allowing borrowers to borrow funds to a predetermined credit limit. It’s a good choice for individuals who require funding on an ongoing basis.

The estimated interest rates from credit lines may range between 3.88% to 8.99% per annum. Licensed moneylenders may impose an 8% to 15% per annum or a max of 4% per month.

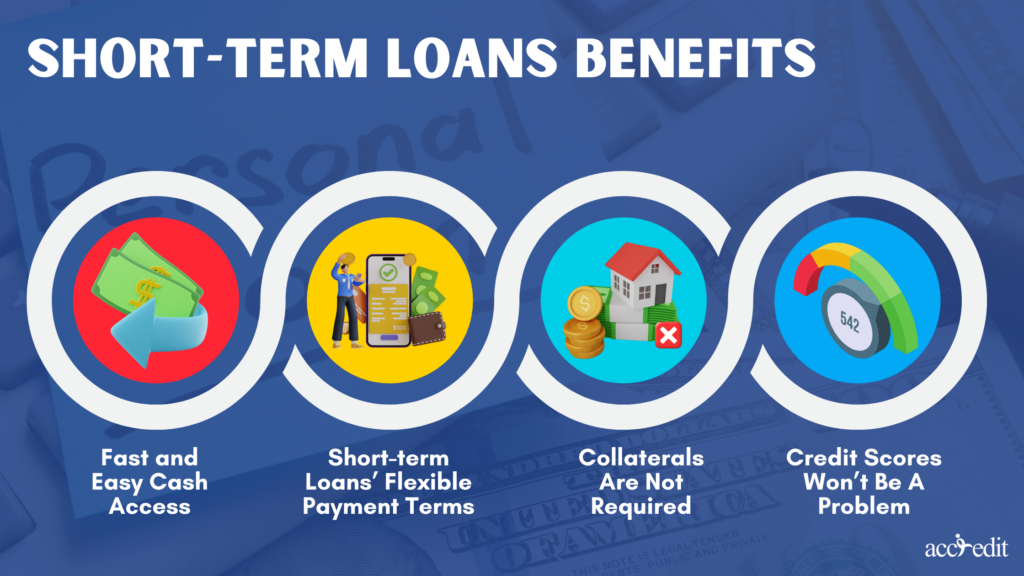

Short-term Loans Benefits

As a consumer, you’d always desire the best products and services. It’s a natural mindset of every client or consumer. Of course, you’d want to get your money’s worth or amplify your money’s value.

So, it’s only reasonable to weigh their benefits first regarding loans. Here are the commonly known advantages borrowers in Singapore enjoy through short-term loans:

1. Fast and Easy Cash Access

Who doesn’t want fast and easy cash access, especially when facing unexpected expenses? This is the primary benefit of a short-term loan because borrowers acquire funding in an instant.

The application process is easy. For one, a borrower can apply for the financing choice online or in person. The approval and loan disbursement follow after the application form is filled out.

The waiting period isn’t that long either, as it doesn’t last a week. It can be within the same day or hours of the application. It’s that fast and accessible.

You can use the funds you’ll acquire for medical expenses and medications, vehicle repairs, minor home renovations, or personal necessities.

2. Short-term Loans’ Flexible Payment Terms

People prefer getting a short-term loan because lenders grant them flexible payment terms for the financing option.

Short-term loans’ payment terms are dissimilar compared to traditional debts. For one, a short-term loan’s repayment period is usually less than twelve months. Sometimes, the repayment terms can be as short as one week, which is most likely about the agreed-upon loan agreement.

On the other hand, traditional loans’ repayment terms would last for several years. It will prolong the loan period and pile on the interest rate acquired during the loan period.

The flexible payment terms are accessible via these loans, and borrowers can freely request loan amounts. In addition, they may choose a repayment period that best fits their financial capacities and overall situation.

3. Collaterals Are Not Required

Traditional loans in Singapore are known for imposing prerequisite collateral on their borrowers. It’s a legal method financial institutions opt for to secure the loan and obtain returns on investment if borrowers default on the loan.

Short-term loans are unsecured loans. This means borrowers do not need to put up any form of assets as loan security. So, borrowers can obtain financial assistance without surrendering their valuable possessions.

4. Credit Scores Won’t Be A Problem

Singapore is truly the most prosperous country in Asia regarding the financing industry. The country isn’t called a financial hub for anything. Its rise to financing greatness can be attributed to the country’s long history of financing and moneylending.

Or using the credit score system assisted Singapore’s steady and robust financing dominance. The Credit Bureau Singapore established the credit score system to help financial institutions assess their borrowers’ creditworthiness.

The higher the credit score, such as 1911-2000, the lower the loan default risks. The lower the credit score, such as 1000-1755, the higher the risk of loan default.

What’s excellent about a short-term loan, lenders do not require a high credit score to be approved. It’s a beneficial loan option for individuals who have trouble borrowing money due to having no credit history or low credit scores.

These are the benefits worth contemplating or attainable when taking a short-term loan. Yet there are some risks that borrowers must also keep in mind.

A Short-term Loan’s Possible Risks

Risks are always present in any projects, plans, and, most significantly, loans. If you’re considering taking a short-term loan, you need to read these several risks first:

1. High-Interest Rates:

Loans like these have to be repaid in a shorter period. Because it’s an unsecured loan, it has relatively higher interest rates and fees than traditional loans.

For instance, traditional loans accessible from the bank or credit union may have an overall interest rate of 3.8% up to a 10% annual percentage rate. A short-term loan may acquire a 48% annual percentage rate, which could sometimes be higher.

The main reason behind higher interest rates and fees is that the loan nature is highly risky to loan default. Thus, lenders opt to charge higher charges to compensate their lending businesses.

2. Short-term Loans Repayment Period

As the loan has a scheduled repayment term shorter than most traditional loans, loan default may ensue. This is among the significant risky aspects when choosing short-term loans.

In many cases, the repayment period is shorter, and the amount to repay must be in full, along with the interest rates and fees. Although the longest period for repayment would reach 11 months, it can still cause heavy blows to a borrower’s financial capacity.

Moreover, being unable to pay the loan on time will lead to additional interest and fees. As such, the borrowers may experience an issue coping with the payments pushing them to either default on the loan. Or borrowers would end up in a debt cycle.

3. Debt Cycle

Another absolute risk associated with a short-term loan is the debt cycle.

For instance, a borrower gets a short-term loan to pay medical bills. Yet, when the loan’s due came, the borrower didn’t get to repay it on time due to unpredicted situations.

Because of the event, the borrower has diminished their credit score and is charged additional interest rates, fees, and a lump cost to the loan. So, they’d take out another loan to pay the existing loan, and the cycle starts.

The most concerning debt cycle is when it’s practically indefinite. As the debt piles up, the charges stock up too.

A common misconception regarding a short-term loan is that it can be a viable option as a long-term solution to financial problems. The short-term loan’s design isn’t meant for long-term financial assistance.

As a result, borrowers who continually acquire it would mostly end up in a debt cycle.

These risks linked to a short-term loan may be few, but they can have a massive impact on one’s credit score. Assess the need for the loan first. Weight cautiously if the monetary problem is genuinely urgent or if you can find another alternative means to solve it.

If it’s impossible to avoid getting a short-term loan, here are ways to make the most of it.

Make the Most of the Short-term Loans in Singapore

Loans are financial products that can significantly assist in times of financial emergencies. So, at times, it’s unavoidable to apply for a short-term loan in Singapore. Here are some tips that you can contemplate and use when borrowing shorter-period loans:

1. Assess Your Financial Status

Don’t be in complete haste to take out a short-term loan, even in financial emergencies. Assessing your financial status can assist you in uncovering whether you can afford the loan on time.

Make sure to consider your monthly income, expenses, and existing debts, if there are any. Taking a loan, knowing you can’t afford it, will be a disastrous situation you wouldn’t want to be in.

So, write down all essential monetary aspects to help you assess your financial status.

2. Shop for the Best Short-term Loans Rates

If you can shop for the best products, why not also for the best interest rates? The country has hundreds of financial services, like banks, financial institutions, and licensed moneylenders. These have diverse interest rates and repayment terms for particular shorter-period loans.

Comparing rates from different lenders will help you find the best deal that suits your budget. Additionally, don’t hesitate to scrutinise these lenders’ loan terms and conditions as carefully as possible. Be sure you understand all the fees associated with the loan, and always ask for your copy.

3. Understand the APR

APR is the abbreviation of the Annual Percentage Rate. It refers to the overall cost of borrowing money from a lender, which includes interest rates and other fees connected to the short-term loan. A lower APR means you’d pay less interest and fees over the loan’s tenure.

4. Do Not Overborrow

A short-term loan can be expensive because of higher interest and charges than a traditional one. Thus, do not overborrow beyond your needs or means. Borrow only what you need to avoid falling into a deathly debt cycle.

5. Pay Your Dues on Time

Typically, short-term loan repayment terms are between a few weeks to a few months. Thus, it’s relatively short.

Paying your dues on time will help you avoid late interest charges. It is a big plus not only for your credit score but for your overall financial status.

6. Seek Professional Financial Advice

You may need professional financial advice if you notice that you’re experiencing challenges with paying your debts, even a short-term loan. A financial advisor can assist you in developing a budget and plan to manage your finances and debts.

Social service agencies in Singapore help consumers recover from serious debt problems. These professionals provide credit counselling and general credit management information. You may seek these professionals at Adullamn Life Counselling, Blessed Grace Social Services, and Credit Counselling Singapore handles cases that involve bank debts.

Loan products are excellent options, especially when financial troubles happen at the most unexpected time. Nevertheless, benefits and risks are present in all financial transactions. All you have to do is follow the tips on making the most out of the short-term loan to use the money to its purpose and maintain your good credit score.

Make the Best Choice Via Short-Term Loans Conscious Knowledge

It’s possible that each living in Singapore has faced money troubles. These troubles may be big or small, but they can affect someone’s life and plans.

Taking out short-term loans may resolve such problems. You have many options in Singapore, such as credit lines, bridging loans, business loans, payday loans, and personal loans. All of these will cater for each of your financial needs.

But regardless of the accessible options, getting a loan is a big responsibility. You may enjoy benefits. But you could encounter risks if you don’t consciously try to avoid ways that could lead to them.

Thus, evaluate the risks and benefits before applying for any of Singapore’s loans. Make the most of the loan choice so you don’t overborrow and pay your dues on time. If you need additional assistance, never hesitate to seek professional financial advice.

Remember, the choice is always yours. At the same time, legal lenders in Singapore are more than happy to assist you with your financial requirements.

Once you’ve assessed and are ready to take a short-term loan, click here and apply for one today!