Borrowing money when necessary is a distinctive approach to solving financial problems or projects. For people in Singapore, it’s possible to borrow funds from traditional banks. But you can take out different loans from licensed moneylenders in Singapore.

Singapore is an excellent country with vibrant colours, exhilarating culture and history, and an impressively inclusive community. Yet, money issues do arrive at some of the most inconvenient times. Or funding is necessary for specific plans.

Thus, the modern lenders in Singapore have become a good source when seeking loan approvals and disbursement.

Today, in this article, you’ll uncover the various purposes for seeking their lending business, types of loans, whether it’s legitimate and how they practice their moneylending responsibilities. You’ll also discover where you must go for lending concerts, crucial facts about a licensed moneylender, and why they’re exceptional with loan transactions.

Various Purposes for Seeking Licensed Moneylenders in Singapore

Every person has diverse reasons why they need cash. For instance, an individual wants to ensure a safe shelter for their family. They would pursue getting a home loan.

Others dream of having their vehicles. They see it as a solution to the costs and problems they have experienced from travelling via public transportation.

Some do have grave health concerns. The costs of medical assistance are indeed expensive. Thus, it is practical to borrow money to ease the financial burden of healthcare costs.

On the other hand, most people are doing their best to make ends meet or to fund their daily necessities until their next pay arrives.

Ultimately, the purposes behind why anyone seeks additional funds differ from person to person. In many cases, even the most prominent companies had to go through numerous loans before breaking even.

Borrowing money is beneficial according to one’s intention and when one fulfils their obligations properly. Thus, seeking licensed moneylenders and selecting the right loan is best.

What are Licensed Moneylenders in Singapore?

Banks and financial businesses offer their services to people requiring immediate cash. However, an alternative among these financial institutions stands out in the country. And these are licensed moneylenders in Singapore.

These individuals have a business that operates to lend money to people willing to pay the designated interest. The number of funds they’re proffering may be smaller than most financial institutions. But, because of the risky classification of their trade, they’re lawfully entitled to impose higher interest rates.

Licensed moneylenders in Singapore can enforce a maximum interest rate charge of 4% per month. It is a cap applicable whether the loan granted is secured, unsecured, and despite the borrower’s income.

If circumstances occur that a borrower misses their repayment schedules, licensed moneylenders can establish 4% for the maximum rate of late interest. The borrower’s monthly repayment status will be upon the agreed schedule.

Per the law, every moneylender in Singapore who has passed all required tests must register their information and business to the Registry of Moneylenders. Also, they are lawfully bound to the Moneylenders Act and Rules.

The Moneylenders Act moreover adds the distinctively diverse specifications of “excluded moneylenders” and “exempt moneylenders.” They are considered registered moneylenders in Singapore

Registry of Moneylenders

The legal entity oversees the registrations and regulations of moneylenders in Singapore. Borrowers keen on gaining further information regarding a licensed moneylender may refer to the Registry of Moneylenders’ complete list. The accessible details are available on the Ministry of Law’s website.

The primary mission and vision of the Registry are to ensure a proficient, professional, and safe moneylending industry in Singapore.

Moneylenders Act and Rules

The Moneylenders Act 2008 is the basis for all regulations revolving around the moneylending industry in Singapore. It comprises the designation and credit bureau control, including collecting, using, and disclosing the borrower’s data and information for associated matters.

Excluded Moneylender

These are any individuals or businesses qualified to lend money per the Moneylenders Act. Companies that belong to this classification are registered credit societies under the Co-operative Societies Act 1979 and licensed pawnbrokers under the Pawnbrokers Act 2015.

Additionally, excluded moneylenders are any person who:

- Loans money to their employees as an employment benefit

- Loans to accredited investors

- Corporations

- Trustee-managers or trustees

- Limited liability partnerships

- Trustees of real estate investments

Exempt Moneylender

These moneylenders in Singapore were granted an exemption from holding a licence under sections 91 or 92.

Licensed Moneylender

Singapore’s licensed moneylenders can provide their loan products to their borrowers. To become licensed lenders, they must first fulfil the requirement imposed by the Ministry of Law. The Registry of Moneylenders will then oversee and regulate the lender applications.

A licensed moneylender in the country can only establish their business by earning their licence first. As a result, every professional intending to become a registered lender should pass the different tests and comply with other necessary steps.

Upon obtaining their licences, they may establish and operate their lending businesses in the country. Moreover, they now have the legal permission and authority to grant diverse loan types to their borrowers.

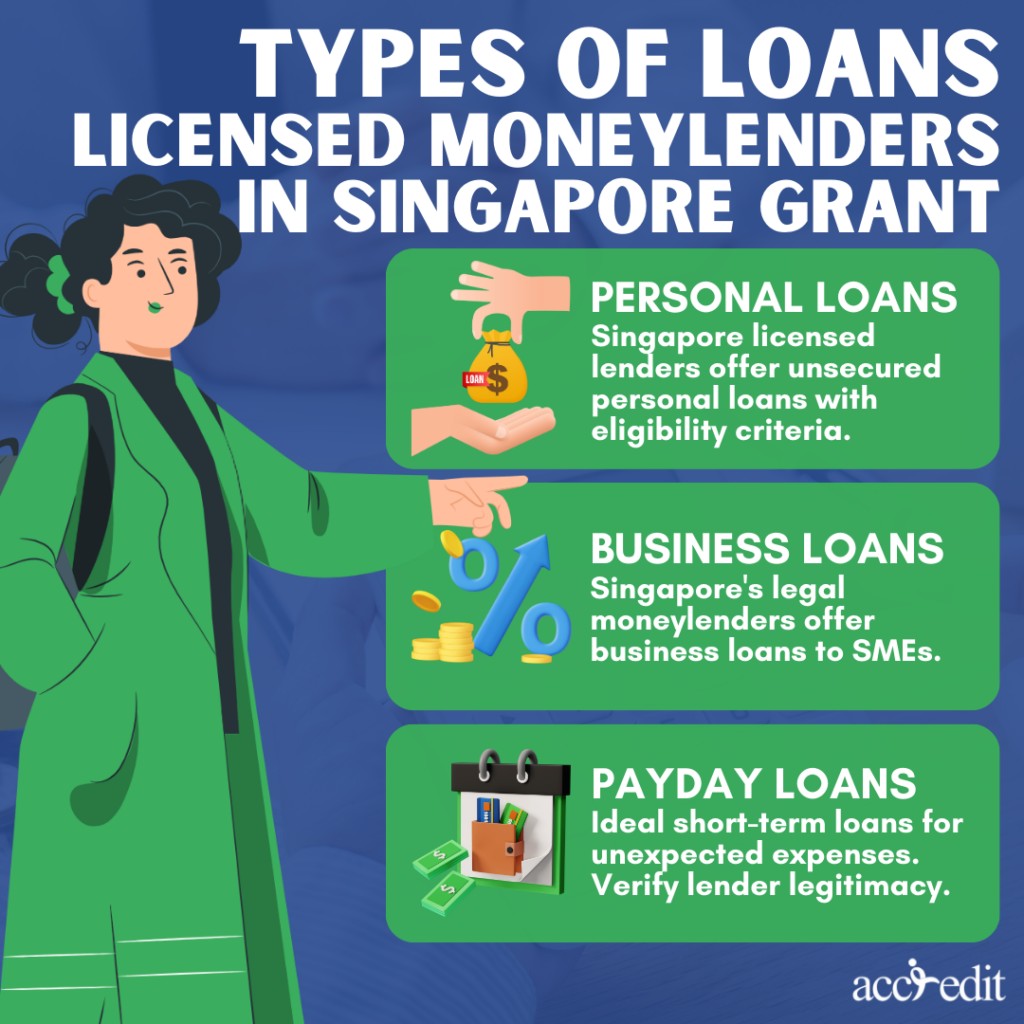

Types of Loans Licensed Moneylenders in Singapore Grant

These days, borrowers do have an advantage when money becomes tight. For one, having access to financial businesses grants diverse scope of monetary assistance. Such is the case for the people living and working in Singapore.

Singapore’s finance industry is famous worldwide for its efficient, reliable guidelines and legislation. Singaporean citizens, permanent residents, and foreigners can rely on the moneylending businesses in the country. But only if the moneylenders are licensed.

These licensed moneylenders have much to offer Singapore’s community, particularly with the types of loans they grant. Here are the loans you may apply for from a licensed moneylender:

Personal Loans

Singapore’s licensed lenders provide unsecured loans. These debts are ideal for individuals who require funding for personal expenses such as vacation, home renovations, car repairs, payment for medical bills, or unexpected expenses.

Personal loan interest rates may range from 1% to 4% monthly, and additional charges may apply for administrative fees and late and early repayment fees.

Eligible applicants for personal loans via a licensed lender include Singapore Citizens, Permanent Residents, and foreigners with valid employment passes and work permits. Borrowers must fulfil minimum income requirements, proof of income, employment, and identity for personal loan application.

Business Loans

Legal moneylenders in Singapore provide business loans to SMEs, which are applicable for expanding businesses, hiring new staff, or buying new equipment.

Interest rates for business loans are similar to personal loans starting from 1% to 4% per month. Borrowers must prepare for additional charges regarding early and late repayments and administrative fees.

Business loans’ eligible applicants are registered businesses in Singapore, with proof of business registration, meeting minimum income requirements, and proof of identity.

Payday Loans

Short-term loans are ideal for covering unanticipated expenses until the next paycheck. The amount accessible is pretty small and should be repaid upon the borrower’s next payday.

The typical interest rates range is 1% to 4% monthly, with extra charges from administrative fees and late and early repayment fees. The repayment period is from fourteen days to a month.

Payday loans eligible applicants are Singapore Citizens, Permanent Residents, and foreigners with valid work permits. The main requirements are meeting the minimum income, proof of employment, and identity.

However, before applying for these particular loans, borrowers should confirm the lending business’s legitimacy. There’s only one way to find out.

How to Confirm Licensed Moneylenders Business Legitimacy?

Singapore aims to protect both its citizens and communities, as well as its economy. The moneylending business is a profitable industry for anyone. But, the threat of unlicensed moneylenders needs a breakthrough, specifically spreading more awareness and encouraging reports from victims and eyewitnesses.

As a result, it is vital to understand and recognise the differences between unlicensed and licensed moneylenders. The points discussed here will focus on the borrowers’ confirmations that they are having a legitimate transaction with a licensed moneylender.

Listed Officially in the Registry of Moneylenders

To ensure the validity of a moneylender, borrowers have to check the official list for the Registry of Moneylenders.

From the Ministry of Law’s website in the list of licensed moneylenders in Singapore page, borrowers are greeted with an important note. The note offers additional awareness of unlicensed moneylenders deceiving their victims. At the lower part of the page, a link directs the borrowers to the official list of LMLs in Singapore.

The information available from the list is the licensed moneylenders:

- Business name

- Business address

- Licence number

- Landline number

- Business URL or website

If a borrower cannot find the moneylenders they have contacted before on the list, they need to view it further below. It’s because any moneylenders in Singapore whose licence was suspended shall be set out in a detailed separate list.

Ethical Practices of Licensed Moneylenders in Singapore

Licensed moneylenders have to abide by the Moneylenders Act, or they can be sanctioned when a borrower files a complaint for their lack of professionalism or untoward behaviour.

Thus, licensed moneylenders practise their legal responsibilities to the borrowers in many forms, such as;

- Having to elaborate terms that the borrowers find confusing or need help understanding. They are lawfully obligated to explain all the necessary words in the loan contract. What’s in the loan contract? It incorporates the repayment timetable, interest rate fees, and charges.

- Secured loans with licensed moneylenders enable them to lodge a caveat on a real estate property’s sale proceeds upon loan repayment default. They are authorised to appoint the terms. Thus, borrowers must ask for information for clarification before signing the contract.

- Licensed moneylenders may only allow a maximum loan total amount of $3,000 to Singapore citizens, permanent residents, and foreigners residing in Singapore when they earn an annual income from $10,000 to less than $20,000.

Individuals under $10,000 annually may be granted $3,000 for Singapore citizens and permanent residents.

However, foreigners are allowed only a $500 loan. But, when the borrower has at least a $20,000 annual income, Singapore citizens, permanent residents, and foreigners can loan up to six times their monthly payments.

- Abiding the fees chargeable to borrowers of not exceeding $60 per month for late repayments, loan principal should not exceed 10% once it’s granted, or the court-ordered legal costs for a successful claim by the moneylender for their loan recovery.

- Giving the borrowers the Note of contract for the loan.

- Meeting the borrower in their office, having a person-to-person consultation about the loan, etc.

If a lender acts unethically, borrowers must file a report or complaint to the authorities.

Seek Relevant Authorities About Moneylending Concerns

Unfortunately, some moneylenders could cause problems for their clients, especially unlicensed moneylenders in the country.

Calling the Registry at 1800-2255-529 is an essential initial step for such situations. To investigate the situation better, the Registry shall investigate the complaint as thoroughly as possible to ensure that unfair practices are punished according to the law. The relevant authorities will keep the plaintiff’s details private to ensure citizen safety and security.

Loan Transactions are Best with Licensed Moneylenders

Getting a loan from banks and financial institutions in the country is more than possible. But, having a transaction with licensed moneylenders in Singapore has its advantages.

First of all, it is a lot faster. Consider it; banks and other businesses take some time before getting a nod to proceed with the loan. Licensed moneylenders in Singapore can process the assessment up to giving the cash to their borrowers in 45 minutes or less. Of course, the borrowers have to have the proper documents prepared.

Licensed moneylenders concentrate on releasing smaller loans. These smaller loans are ideal for emergency funds, whether for fixing vehicles, rent, or purchasing necessities. Smaller loans are easier to pay off.

Their offices are open even on weekends. So, when the requirement for immediate cash occurs, licensed moneylenders will be there to assist borrowers.

Credit scores and history are crucial information when applying for a loan in Singapore. However, licensed moneylenders in Singapore offer forgiveness of a credit assessment. So long as the borrower proffers proof of decent income, there’s a chance they’ll be approved for a loan.

Do you need to get a loan from a licensed moneylender in Singapore? Click here now to apply!