Have you found yourself in a financial jam where you’re struggling to repay your personal loan in Singapore? The question on your mind is simple yet significant: can you eliminate your loan? Here’s the good news: you’ve hit the jackpot. In this piece, we’re going to unveil a comprehensive roadmap on how to waive off personal loans in Singapore.

What is a Loan Waive-Off?

A loan waive-off is a legal arrangement that can liberate a borrower from the responsibility of repaying a loan. To make this happen, you and your lender need to hammer out an agreement that factors in your financial situation and the original loan agreement.

Depending on your specific circumstances and your lender’s disposition, they may consent to forgive a portion of the debt or adjust the interest rate to make it more manageable for you to pay off. Do keep in mind, however, that the final outcome of these negotiations is subject to several variables, including your financial standing and your creditor’s willingness to collaborate.

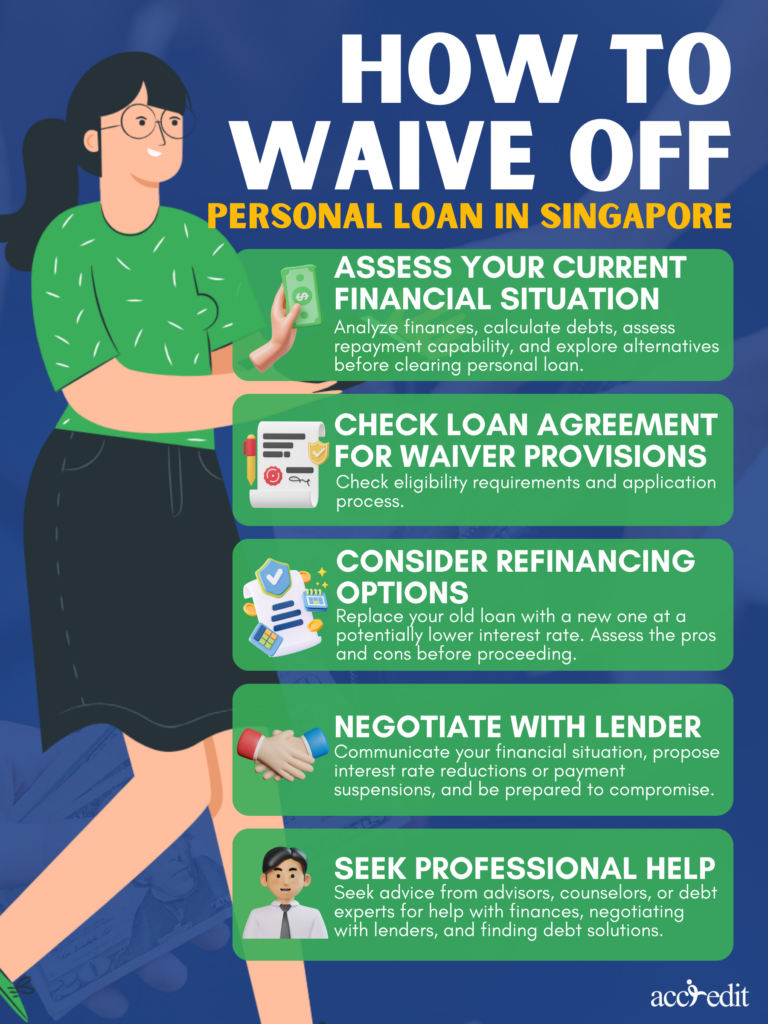

Assess Your Current Financial Situation

First things first, before you can erase your Singaporean personal loan, you must analyze your current financial state. Begin by grasping your monthly revenue and costs, calculating the sum of your outstanding debt, and evaluating whether you can repay the loan. Once you have a clear picture of your finances, you can determine if you have sufficient resources to repay the loan or if you need to seek out alternative solutions.

Check Your Loan Agreement for Waiver Provisions

The next step in your quest to waive off personal loans in Singapore is to closely examine your loan agreement for any waiver provisions. Plenty of loan agreements contain clauses that permit loan waiver under specific situations, like severe illness or unemployment. If your loan agreement has this kind of provision, it’s crucial to comprehend the eligibility requirements for the waiver and the proper application process.

Consider Refinancing Options

If you don’t qualify for a loan waiver, what’s the next step? Refinancing could be your savior. The concept is simple: get a new loan to pay off the old one, ideally at a lower interest rate. With any luck, you may even stumble upon a lender who offers more favorable conditions than your current one. But before you make a move, it’s essential to weigh the advantages and disadvantages of refinancing thoroughly.

Negotiate with Your Lender

When refinancing or waiving your loan isn’t viable, negotiation becomes your next best weapon. Start by reaching out to your lender and laying out your financial circumstances. As the conversation progresses, you can suggest measures such as interest rate cuts, temporary payment suspensions, or other forms of aid. Remember, your negotiating skills will be under the microscope, so prepare a solid strategy and be open to compromise.

Seek Professional Help

In case you’ve hit a wall trying to waive off the loan or strike a deal with your lender, it may be time to turn to the pros. Seek out the wisdom of financial advisors, credit counselors, or debt management companies. These seasoned experts can offer invaluable advice on handling your finances, bargaining with your lender, and considering alternate paths to resolving your debt.

Thoughts

If you’re contemplating joining the loan waiver movement, it’s vital to grasp the potential impact on your credit rating. Going down this road may leave you exposed when it comes to obtaining future loans. To avoid unforeseen financial turbulence, it’s prudent to seek guidance from a financial authority before making any moves. This will enable you to make an informed decision that puts you on a trajectory toward durable financial security.

Accredit Moneylender: The Stress-Free Solution for Your Loan

Repaying a loan can be stressful, but at Accredit Moneylender, we get it. That’s why we’ve designed our repayment plans to be as flexible as possible, so you can focus on paying off your loan without fretting over finances. We’ll collaborate with you to find the perfect option to suit your individual financial situation, making the process easy and worry-free.