Embarking on a new chapter of your life in a foreign land as an expat is like diving headfirst into a thrilling roller coaster ride. It’s a mix of exciting opportunities and daunting challenges, and one aspect that demands your careful attention is managing your finances. Singapore, with its buzzing economy and multicultural vibe, presents a unique experience for expats like yourself.

To help you smoothly navigate the financial landscape and make the most of your time in this vibrant city-state, we’ve put together a handy guide packed with valuable tips and insights. Whether you’re a seasoned expat who has mastered the ropes or a newbie just beginning your journey, these tips will empower you to take charge of your financial well-being. So let’s dive right in!

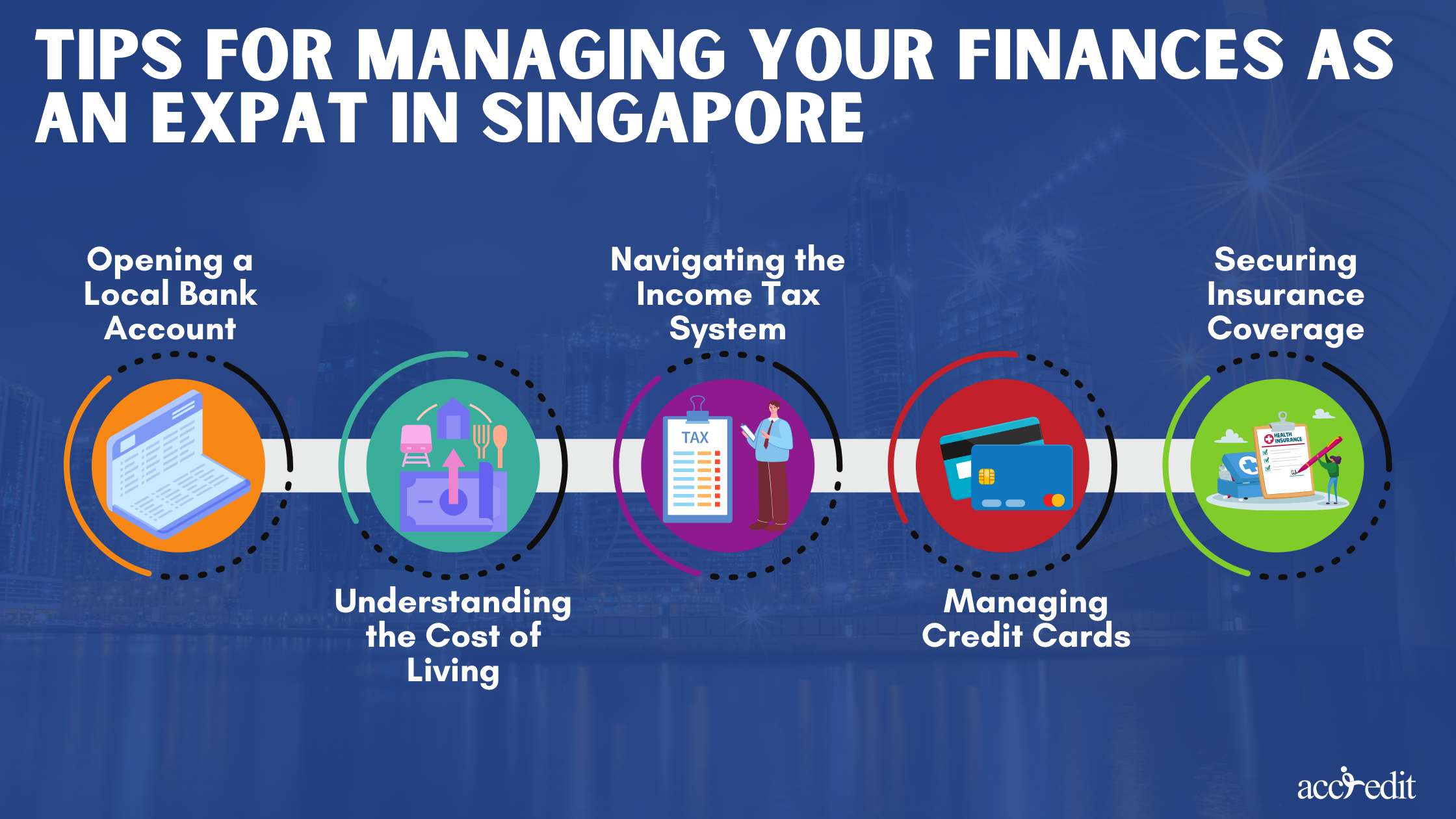

1. Opening a Local Bank Account

When you’re living in Singapore as an expat, one of the first things you should do to handle your finances is open a local bank account. Yes, it might be tempting to stick with your original bank account from your home country but, going local can actually save you some bucks.

By having a bank account with a local bank like DBS, OCBC, or UOB, you get to enjoy better rates and lower transaction fees. That means more money in your pocket in the long run. And hey, here’s another perk: you’ll have the convenience of accessing local currency whenever you need it, without all the hassle of wiring funds internationally and dealing with those pesky currency conversion fees.

2. Understanding the Cost of Living

If you’re an expat, it’s important to wrap your head around the cost of living in Singapore. This little island nation offers a high standard of living and all sorts of convenient amenities, but it’s crucial to manage your money smartly, so you don’t end up drowning in financial worries.

To really understand how much it costs to live here, tap into the wealth of online resources like expat blogs, forums, and Facebook groups. Connect with the local community and pick their brains about what it’s like to live the life you’re aiming for. While everyone’s financial situation is different, gathering information and making rough estimates of your potential expenses will help you come up with a sensible budget.

3. Navigating the Income Tax System

When it comes to income taxes in Singapore, expats need to have a good grasp of the system. The tax structure in this country is well-defined, and it’s crucial for you to familiarize yourself with the rules so that you can meet your tax obligations without any hiccups.

Now, in Singapore, the income tax filing season kicks off at the end of the first quarter, typically running from 1 March to 18 April.

Most people choose the hassle-free option of filing their taxes electronically through the IRAS website. But hey, if you’re old school and prefer paper filing, make sure to get your completed tax form over to the IRAS headquarters by 15 April. Keep in mind that the tax assessment is based on the income you earned in the previous year.

4. Managing Credit Cards

Credit cards have the power to be your financial saviors, but only if you handle them wisely. On the flip side, they can turn into real troublemakers if you’re not careful. Now, as someone living in Singapore, it’s crucial for you to keep a watchful eye on how you use your credit cards and develop smart spending habits. It’s all about being mindful of the choices you make when it comes to your finances.

Now, let’s delve into a simple yet effective strategy: creating a monthly budget dedicated solely to your credit card expenses. When you meticulously keep track of each purchase, you gain a crystal-clear understanding of where your hard-earned cash is flowing. Oh, and here’s a nifty trick: strive to pay off your entire credit card balance every month, if you can manage it. By doing so, you’ll successfully evade those pesky interest charges that cunningly accumulate over time.

5. Securing Insurance Coverage

Living in a foreign country like Singapore brings its own set of unique risks and uncertainties. We all want to protect ourselves and our loved ones from any financial setbacks that may arise unexpectedly. That’s where insurance comes in, serving as our safety net for a secure financial future.

Let’s dive into term life insurance, a type of coverage that provides affordable protection and pays out a predetermined sum upon your passing. Many people utilize term life insurance as part of their estate planning strategy, and the best part is, it’s suitable for everyone, regardless of income or net worth. By having term life insurance in place, you can have peace of mind, knowing that your family will be financially supported.

But hold on, there’s more! It’s important not to overlook other insurance options, such as health insurance. Ensuring coverage for medical expenses is crucial in safeguarding yourself against unexpected healthcare costs. Take the time to assess your specific needs and seek guidance from insurance professionals who can assist you in finding the most suitable policies for your situation.

Additional Tips for Financial Success

Alright, we’ve got the basics covered for becoming a financial superstar in Singapore. Now, let’s dive into some extra tidbits of wisdom that can take your money game to new heights:

- Save for those rainy days: Life has a knack for surprising us, doesn’t it? That’s why it’s crucial to tuck away some cash in a separate savings account. You never know when unexpected expenses or financial hurdles will come knocking, so having a safety net is key.

- Make your money work for you: If you find yourself with a bit of extra dough after taking care of your emergency fund, consider putting it to good use. We’re talking about savvy investments here, like stocks, bonds, real estate, or mutual funds. Let your money do the heavy lifting and grow over time.

- Embrace automation as your savings buddy: We’re all crazy busy these days, am I right? That’s where automation steps in to save the day. Many banks offer handy tools that can automate your savings game. Set it up so a chunk of your salary goes straight into a savings or investment account without you lifting a finger.

- Stay in the know and keep learning: Money matters can be a tad tricky, but you don’t have to navigate the financial jungle alone. Stay up to date with the latest news, trends, and investment strategies that matter to folks in Singapore. Attend seminars, webinars, or workshops organized by trustworthy financial institutions. Stay sharp and in the loop.

The Bottom Line

When you’re living the expat life in Singapore, handling your money matters is absolutely crucial. It’s all about being proactive and taking charge. Start by getting yourself a local bank account and getting the lowdown on the cost of living. Tackle any debts you might have hanging over your head, figure out how to navigate the income tax system, and make sure you’ve got insurance coverage in place.

And hey, here’s a bonus tip: there are some extra tricks you can employ to set yourself up for financial success. By doing all this, you’ll be building a solid foundation for your financial well-being. So go on, seize control of your expat finances, and watch yourself thrive in Singapore!

Embark on a Journey into the World of Foreigner Loans with Accredit Moneylender

Do you find yourself facing financial challenges while living and working in Singapore as a foreigner? If you’re in need of assistance, look no further than Accredit Moneylender. They are seasoned experts in the realm of finance, specifically catering to individuals like you who could benefit from a little extra support.

Accredit Moneylender holds a prominent position in Singapore’s moneylending industry, prioritizing transparency above all else. Say goodbye to hidden fees and unwelcome surprises. But that’s not all—prepare to be amazed by their lightning-fast approvals, which effortlessly transform the loan process into a stroll in the park.

Ready to ease your financial burdens and seize control of your situation? Reach out to Accredit Moneylender today and unlock a world of possibilities.