Investment scams are no joke when it comes to jeopardizing your financial security. In Singapore, these deceptive schemes have caused countless individuals to lose millions of dollars, catching even the savviest of professionals and esteemed members of the financial and legal circles off guard. It’s imperative that we grasp the inner workings of these scams and glean valuable lessons from those who’ve been swindled, all in an effort to fortify ourselves against fraudsters.

This comprehensive guide aims to equip you with practical tips and effective strategies, ensuring that your hard-earned money remains safe and sound from the clutches of investment scams.

Red Flags: Spotting Investment Scams

It’s important to be on the lookout for red flags that signal potential investment scams. By knowing what to watch for, you can better safeguard yourself and lower the chances of falling prey to these fraudulent schemes. Take note of these warning signs:

1. Promises of High Returns at Low or No Risk

Imagine this scenario: you’re taking a leisurely stroll when out of the blue, someone enthusiastically approaches you. They’re bursting with excitement, claiming to have an amazing investment opportunity that guarantees mind-boggling profits with little to no risk. It’s a tempting offer, right? But hold your horses for a moment, because that’s when you need to put on your skeptical hat.

As a smart investor, you understand that every investment involves some level of risk. So when someone dangles the carrot of sky-high returns without any possible downsides, it’s a definite red flag. Scammers often use this strategy to lure unsuspecting folks in. But let’s not forget the age-old wisdom: if something sounds too good to be true, it probably is.

2. Pressure Tactics and Limited-Time Offers

Scammers have this sneaky way of pressuring you into making snap decisions when it comes to investing. They’ll throw in these time-limited offers or create a sense of urgency that tricks you into thinking you have to jump on the opportunity right away. But let me tell you, genuine investments never force you into impulsive choices.

Take your sweet time to really dig into the investment, talk it over with reliable advisors, and make sure it lines up with your financial goals. Just think about those sales pitches like “Hurry, limited time only! Invest now before it’s all gone!” or “Over 5,000 people have already invested – what are you waiting for?” They’re just trying to play you.

3. Offers of Referral Commissions

When it comes to real investment opportunities, they usually don’t rely on offering referral commissions to lure you in. But scammers, oh boy, they adore this trick! They’ll charm existing investors into bringing in their friends and acquaintances by promising them generous referral commissions. Their entire strategy revolves around rapidly expanding their pool of investors.

Now, imagine this: You’re sitting at a hawker center, relishing a plate of your beloved chicken rice. Out of the blue, a stranger comes up to you and says, “Hey, if you bring your friends to try this incredible dish, I’ll give you $10 for each person!” It might sound tempting, right? But hold onto your chopsticks. That’s exactly how scammers operate.

So, if an investment opportunity seems overly focused on enticing you with referral commissions as its main selling point, proceed with caution. Don’t dive in headfirst without doing your homework. Take the time to thoroughly investigate before making any decisions.

4. Fictitious Experience and Track Records

So, here’s the thing, scammers have this sneaky trick up their sleeves. They like to make up fancy stories about their amazing investment experiences and track records, all in an attempt to win your trust. They’ll go on and on about how they’ve been making successful investments for ages, and they might even throw in some glowing testimonials from supposedly satisfied customers.

But hold on a minute! It’s important to approach these claims with a healthy dose of skepticism. Don’t just take their word for it. Take the time to verify the authenticity of their track records. Seek independent validation from reliable sources. Because here’s the reality: those testimonials they’re flaunting could be completely made up.

5. False Claims of Regulation

Okay, so here’s the deal: some investment scams out there will try to trick you by saying they’re all regulated and legit. They’ll throw around fancy words to make you think they’re backed by the authorities. Sneaky, huh? But don’t worry. There’s a way to protect yourself from these smooth talkers.

First things first, always double-check if a company or individual is truly regulated. How? Well, just head on over to the Monetary Authority of Singapore (MAS). They’re the real deal when it comes to financial authority in Singapore. Take a peek at their Financial Institutions Directory and make sure the folks you’re dealing with are listed there.

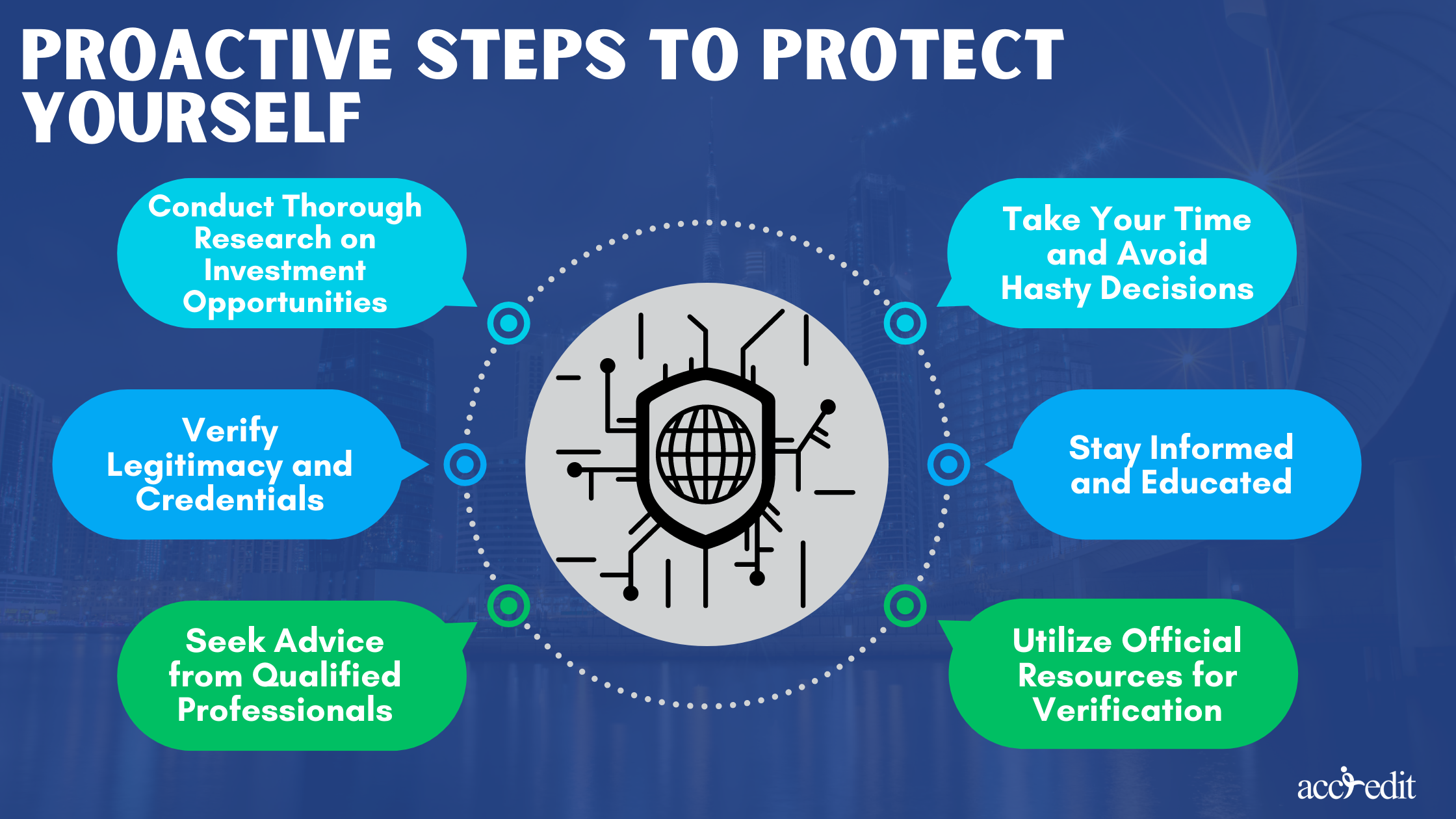

Proactive Steps to Protect Yourself

When it comes to investment scams, being proactive is the key to staying safe. By taking some simple but effective steps, you can greatly minimize the chances of falling prey to fraudulent schemes. Here are some essential measures you should consider to protect yourself against investment scams:

1. Conduct Thorough Research on Investment Opportunities

Before you decide to invest your precious money, it’s important to do some thorough research on the investment opportunity. Take the time to gather information about the company you’re considering, including its past performance and the people behind it.

Keep an eye out for any warning signs or negative feedback you might come across on the internet. To get a good understanding of the investment landscape, check out reliable sources, financial news platforms, and official regulatory websites. This will give you valuable insights that can help you make a smart investment decision.

2. Verify Legitimacy and Credentials

You have to make sure that those business companies and people are who they say they are. Don’t just jump in blindly. Take a minute to verify their legitimacy and credentials. Look out for their business registration number, address, and track record.

And hey, don’t forget to do some snooping around for any complaints or negative comments about them. It’s always a good idea to ask your trusted peeps for recommendations too. Better yet, consider teaming up with registered, qualified advisors who can give you some expert guidance.

3. Seek Advice from Qualified Professionals

When it comes to making investment decisions, it’s always a smart move to reach out to the experts. Qualified professionals like licensed financial advisors, lawyers, or accountants have the know-how to guide you in the right direction.

They can offer valuable insights, help you determine if an opportunity is legit, and assist you in making informed choices that align with your financial goals. So, before you dive into any investment, make sure to tap into the wisdom of these pros. They’ve got your back!

4. Take Your Time and Avoid Hasty Decisions

When it comes to investments, it’s important to give yourself some breathing room. Don’t let anyone rush you into making a hasty decision. Take your sweet time to carefully assess the investment opportunity, get a good grasp of the risks involved, and see if it aligns with your financial goals.

You know, scammers are crafty. They’ll try to pressure you into making snap decisions. But here’s the thing: a legit investment opportunity will still be around even if you take a bit longer to weigh your options.

5. Stay Informed and Educated

It’s important to stay in the know when it comes to investments. You want to be up-to-date on the latest trends, scams, and rules set by the authorities. How can you do that? Well, start by subscribing to reliable financial news sources. They’ll keep you informed about what’s happening in the investment world. It’s also a good idea to follow experts in the field.

They often share valuable insights and tips. And don’t forget about educational seminars or webinars. They’re a great way to expand your knowledge. The more you know, the better you’ll become at spotting potential scams and making smart investment choices.

6. Utilize Official Resources for Verification

When you find yourself in doubt, it’s always wise to turn to official sources for verification. Before you invest your hard-earned money or put your trust in a company or its representatives, take a moment to cross-check their credentials. Thankfully, there are resources available that can help you in this process. Here are a few of them:

- Financial Institutions Directory: This handy list includes all the organizations regulated by the Monetary Authority of Singapore (MAS). It’s a trustworthy reference point to ensure that the company you’re dealing with is genuine and operating within the law.

- Register of Representatives: This comprehensive list comprises individuals engaged in activities regulated by MAS. It’s crucial to confirm that the representatives you’re interacting with are reliable and compliant with legal requirements.

- Investor Alert List: While not an exhaustive compilation, this list serves as a warning for entities that are not regulated by MAS. It’s vital to exercise caution when dealing with such entities, as they may falsely claim to have the necessary licenses or authorization from MAS.

Reporting Investment Scams

If you ever come across a dodgy investment scheme that sets off your internal alarm bells, it’s crucial to take action and report it right away. By doing so, you’re not just protecting yourself but also helping others avoid falling into the clutches of these deceptive scams.

So, what should you do? Well, you can reach out to our trusty Singapore Police Force.

They’re here to assist you! Just pick up your phone and give them a call at 1800-255 0000. If you prefer the convenience of the digital world, head over to their user-friendly website at www.police.gov.sg/iwitness. It’s super easy to submit your valuable information online and help bring those scammers to justice.

The Bottom Line

When it comes to safeguarding yourself against investment scams, you’ve got to be on your toes, be a little skeptical, and take the initiative. Look out for warning signs, dig deep into your research, consult the pros, and stay updated to shield your investments and financial security. Remember, if an investment opportunity seems unbelievably fantastic, chances are it’s too good to be true.

Don’t rush, rely on your gut feelings, and arm yourself with information to make wise choices and steer clear of falling prey to investment scams. Stay alert and equip yourself with the knowledge and resources you need to safely navigate the investment landscape.

Reliable Support for Your Finances – Accredit Moneylender

Are you on the lookout for a reliable way to obtain the financial support you need? Maybe you’re feeling a tad concerned about scams and safeguarding your personal information. Well, fret no more! When it comes to securing funds and ensuring the safety of your data, Accredit Moneylender has got your back.

Accredit Moneylender not only offers top-notch service, but also competitive rates that won’t leave you feeling shortchanged. And hey, they take your security seriously! They’ve got you covered with industry-standard HTTPS (TLS1.2) and rigorous penetration testing to keep your information out of harm’s way. You can rest easy knowing that Accredit Moneylender has your best interests at heart.

So, are you ready to experience dependable financial assistance? Don’t waste another moment—get in touch with Accredit Moneylender today and take that crucial step forward!