Having a place to call your own is among the best things you can give yourself and your family. It provides you and the people you love a safe sanctuary, and getting the best renovation loan in Singapore to enhance the whole space isn’t a bad idea.

Many people say that it will be a rather expensive affair. Imagine you would upgrade the living space, add new features, or remodel the kitchen or bathroom. It does seem costly, but it can boost the real estate’s worthwhile experience and the full impact of your investment.

A renovation loan can easily proffer the funds needed for these upgrades. In this article, you’ll learn the critical factors of this type of loan, how it works, which lenders to send an application form and ultimately, choose the best renovation loan in Singapore.

What is a Renovation Loan?

It’s the type of loan specifically designed for home remodelling or renovations. It can be used for either minor repairs to massive renovations. As a result, homeowners seek it to initiate the project or boost their funds for renovating their homes without taking a big chunk away from their savings or emergency funds.

A renovation loan also functions like a personal loan. Borrowers can borrow and repay an outstanding cash amount over a fixed period. But compared to personal loans, they can have a lower interest rate and longer repayment terms.

Determine the Amount Needed for the Home Renovation Loan

Before applying for this particular loan, a borrower has to determine the total amount they’ll have to request. The best approach to obtain the total amount is by calculating how much the renovation project would cost them. For instance, borrowers have to consider the costs of:

Scope of work:

It’s the overall scope of the work needed for the renovation and accumulates the possible expenses. This includes the size area that must be renovated, materials, and level of complexity.

Labour:

As it’s a significantly crucial aspect when it comes to home remodelling. The everyday expenses acquired through labour are when hiring professionals like architects, contractors, interior designers, project managers, engineers, electricians and plumbers.

Although some remodelling plans do not necessarily require most of these professionals, most skilled individuals and their fees can be covered with the renovation loan.

Materials:

These are required for remodelling activities, which highly vary depending on the renovation borrowers prefer for their spaces.

For instance, you plan to replace the old flooring with better and newer tiles. Thus, you have to purchase cement, tiles, and grout. It’s the same when planning to repaint ceilings and walls, which requires materials like brushes, paint, rollers, and other painting supplies.

The total expenses for this will heavily depend on the brand, quality, desired aesthetics, and quantity of materials.

Permit fees:

These are substantial factors when doing home renovations. However, it isn’t a requirement upon having minor remodelling. But, if the project is rather massive, it’s critical to comply with the regulations and building codes to guarantee the safety of the occupants and workers.

These permits are crucial requirements, mainly if the renovation involves:

- Adding or removing walls, altering space layout, or changing the building’s support structures must apply for the Building and Construction Authority (BCA) permit and pay the fees.

- Changing the existing electrical or plumbing systems or installing a new system requires a permit from the Public Utilities Board (PUB) and the Energy Market Authority (EMA).

- Installing air-conditioning units for the home thus necessitates a permit from the National Environment Agency (NEA) to ensure all teams are installed per the environmental regulations.

To acquire the permits, homeowners must submit applications for the specific permits to relevant authorities. These should be accompanied by supporting documents of photocopy of passport or NRIC, floor plan, structural plans and calculations, contractor’s details, the proposed timeline of renovation work, proof of ownership or tenancy and other needed documents.

Once the application is approved, pay the required permit fees before the renovation can commence. Also, during and after the work, authorities may conduct inspections to guarantee the work is carried out by the regulations and building codes. A certificate of completion is obtainable as well.

Design fees:

If you plan to enhance the home’s interior, you will work with either an architect or interior designer. These highly-skilled professionals proffer their design services for a substantial fee. Remember that the fees they’ll impose will depend upon the project’s scope, design complexity, experience and expertise in the field.

Other inclusions in the fees are linked to creating the design plans and blueprints. In addition, they also require payments for revisions and consultations. On average, the fees range from 5% to 15% of the overall project expense. For instance, if the intended plan expense is SGD 50,000, the design fee could be between SGD 2,500 to SGD 7,500.

Designers and architects may charge for their service either an hourly rate or a flat fee. Matters like these must be discussed and agreed upon before the project initiates.

Contingency funds:

Another vital aspect that borrowers must consider is the contingency funds, which are crucial to buffer and cover unexpected expenses that could arise during the renovation process. The primary purpose of these funds is to mitigate the possible financial impact of the uncalculated costs.

Commonly, contingency funds become helpful when structural issues are uncovered only during renovation. Other times require extra materials and supplies, or changing the design and project scope would require contingency cash to fund the alterations. Delays in the construction timeline necessitate extra money to fund the rest of the project until its completion.

How much do you have to set aside? That vastly depends on the renovation project’s total scope. Nevertheless, homeowners must be wise and set aside at least 10% up to 20% of the overall budget accessible via renovation loan Singapore as the contingency funds.

Ensure that the funds are separated explicitly from the budget to avoid mixing them and being used unintentionally.

Accessible Renovation Loan Amount

Anyone who owns a property or home in Singapore often wants to remodel or renovate their spaces. It’s because, upon the renovation, the property’s overall value also rises. Thus, before you take out the best renovation, consider the possible amount accessible you may use for the project.

Banks offering renovation loans may grant up to SGD 30,000 with a 3,88% to 4.88% per annum interest rate. The tenure can last up to five years.

On the other hand, licensed moneylenders offer SGD 5,000 to SGD 30,000. The interest rates from licensed moneylenders could range from 1% to a maximum of 4% per month, with a loan tenure lasting up to twelve months.

Get the Best Renovation Loan by Noting the Financing Expenses

Since you plan to take out a renovation loan in Singapore to fund the home renovation project, it’s wise to consider the essential factors within the financing expenses. These would mainly include:

Renovation Loan Interest Rates:

Renovation loans in Singapore incurred interest rates that could be variable or fixed. The country’s local banks and licensed moneylenders offer fixed and variable interest rates.

The main difference is that fixed interest rates are usually higher yet provide an easy-to-follow and stable repayment schedule. On the other hand, variable interest rates could fluctuate, mainly linked to the market’s current condition.

Local and famous banks in Singapore can offer interest rates of an estimated 3.88% up to 4.88% per annum. Licensed moneylenders in Singapore charge a notably higher interest rate per annum. These lending businesses impose a 4% maximum monthly interest rate by the Moneylenders Act.

Processing Fees:

These fees are mostly charged once throughout the renovation loan process and are levied by lenders to cover the cost of processing the loan application. It’s the percentage of the loan amount or the fixed amount. Processing Fees:

The processing fee will be deducted from the loan amount. So, you will acquire the funds without it. Lenders charge it to pay for the expenses linked to the loan application, such as paperwork, credit cheques, and other administrative tasks.

Banks in Singapore charge a minimum of 1% to 3% of the loan amount. On the other hand, licensed moneylenders in the country mostly charge a processing fee from 1% up to 10%. Remembering that the Ministry of Law regulates licensed moneylenders in Singapore is worth remembering. Thus, they can only charge a maximum 10% processing fee and must never exceed it.

Late Payment Fees:

Sometimes, borrowers are expected to forget their repayment schedules and miss a payment. Thus, authorised lenders in Singapore demand late payment fees from their borrowers.

The primary goal of these late payment fees is to encourage borrowers to repay their loans on time and to avoid the accumulation of overdue payments. It also compensates the lenders for the added administrative expenses and opportunity costs due to not having funds accessible to lend to other borrowers.

Local banks charge 1.5% to 3% per annum above the prevailing interest rate. The licensed moneylenders often charge a late payment interest of 4% for each missed monthly repayment or $60 monthly.

Early Repayment Fees:

Accredited lenders in Singapore charge early repayment fees when borrowers repay the loan before the term’s supposed to end or the agreed-upon repayment schedule.

The purpose of the early repayment fee is to compensate lenders for losing interest income they would’ve earned during the original repayment schedule. They’d mostly offset the costs they incur when loans are repaid earlier.

Banks impose a 1.5% up to 3% early repayment fee of the outstanding loan amount. Licensed moneylenders in the country may accept early repayment without fees.

Legal Fees:

Lenders charge these fees for legal documentation related to the renovation loan. The typical range of legal fees is $150 to $500. Legal moneylenders usually don’t charge legal fees.

Insurance Premiums:

Borrowers may need to pay for insurance premiums if their chosen lender, such as a bank, charges it concerning the renovation loan. In Singapore, the standard range of insurance premiums may start at 0.5% up to 1% of the loan’s amount.

It’s imperative to know that not all banks impose the insurance premium as a mandatory addition to the renovation loan. Some provide it as an optional choice. Legal moneylenders usually don’t offer these types of insurance for renovation loans.

Compare the Best Renovation Loan Providers in Singapore

Everyone wants the best. Everyone deserves the best.

But, to get the best renovation loan provider in the country, you first need to compare and filter which is the best in the field.

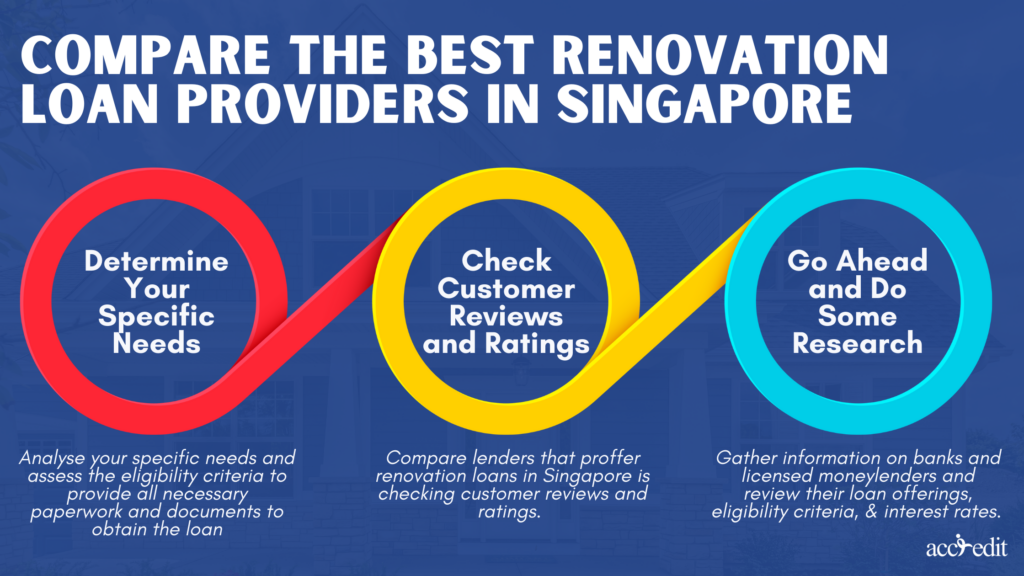

It can indeed be an overwhelming task. Nonetheless, your objective of obtaining only the best loan services and amount for your home renovation project is the top priority. So, to effectively compare and find out which are the best renovation loan provider in the country, you need to go through these steps:

Determine Your Specific Needs

Asking yourself the right questions will lead you to the correct answers. First, you have to analyse and determine what your specific needs are. How much do you have to borrow for the remodelling or renovation plans?

Additionally, ask yourself what kind of repayment terms or schedule you feel most comfortable with, and you can quickly repay. Assess the eligibility criteria to provide all necessary paperwork and documents to obtain the loan.

Check Customer Reviews and Ratings

Another practical approach to compare lenders that proffer renovation loans in Singapore is checking customer reviews and ratings.

Reading these ratings and reviews gives you a glimpse of what you can expect with the lender’s overall customer service, credibility, and reliability.

Take in the positive reviews and still consider the negative thoughts. In this manner, you can gauge the capacities of the lenders to proffer financial assistance to their borrowers better.

Go Ahead and Do Some Research

Banks and licensed moneylenders in Singapore are the notable loan providers borrowers can count on. Researching their financial services regarding home renovation loans will ease the borrower’s worries and even attain additional relevant information.

You may research online and gather information on various banks and licensed moneylenders in the country. Review their loan offerings, eligibility criteria, and interest rates.

At times, a personal touch is what a person needs. Asking friends, colleagues, and family members who may have taken out a renovation loan from these lenders may offer better and more meaningful insight.

Visit the banks and legal moneylenders personally. There’s no better way than speaking with the loan officers and licensed lender about the crucial questions you must ask. Also, make a point to get information about the loan terms and conditions that’ll assist you in making the final decision.

Creditworthiness Will Get You the Best Renovation Loan Offers

In a country that highly relies on the credit system for financing transactions, you must always consider your creditworthiness.

CBS imposed the credit score and risk grade system to assist financing businesses in profiling their borrowers.

Most commonly, they would choose a borrower with a credit score 2000 or grade AA. Individuals with these scores and grades are noted as low-risk borrowers with excellent credit histories. They don’t commit late or missed payments and are well-responsible for managing different loans at once.

On the other hand, individuals who have a 1000 credit score or HH risk grade are profiled as high-risk borrowers. They may also have an unfavourable credit history, which affects their score immensely.

Thus, before you apply for a loan, reassess and reevaluate your creditworthiness first. With a definitive credit score and background, you’ll acquire the best renovation loan offers and agreements and obtain a lower interest rate.

Apply and Get Your Home Renovated the Way You Wanted

You must go through a lengthy yet quick process when applying for a renovation loan. Before filling out the application form, assess your eligibility for the loan.

First of all, you need to be at least twenty-one years old. You have to be either a Singapore Citizen or Permanent Resident. It’s essential to meet the lender’s minimum monthly or annual income requirement and present your good credit score.

Other documents you may have to prepare are your identification documents or passport or NRIC, renovation contract, proof of property ownership, and bank statements.

When all documents are passed with the application form filled out, it’s time to wait for approval. The time you need to wait for the bank’s approval may take days to weeks. Licensed moneylenders could proffer the funds you require on the same day if it’s a relatively small loan.

Once the loan amount is disbursed to your bank account, you may renovate your home how you want.

Use the Renovation Loan Prudently

Remodelling or renovating a specific area in your home or the entire house requires a lot of money. Considering all the necessary permits, materials, expenses, and professional fees you have to pay, it isn’t wise to let the cash drip away from your grasp.

The primary purpose of taking out the renovation loan is to ensure you and your family have a better and more comfortable space. Furthermore, a well-maintained and updated home acquires a higher real estate value.

So, renovating your home isn’t a bad idea but an excellent investment move for you. Use the funds you have as prudent as possible. You might get extra from the contingency funds when the project’s complete and use it to add decorations or furniture to enhance the aesthetic details of your humble abode.

Are you excited about starting your home renovation projects but need more extra funds? Please click here now to apply for a loan today!