Slogging through personal loan payments? There’s a smart solution: refinancing. Picture getting a sweet deal with lower interest rates and easy-to-manage repayment terms. Curious about how it works? We’ve got you covered. In this piece, we’ll crack open the secrets of personal loan refinancing and offer insights to help you decide if it’s right for you.

What is Refinancing a Personal Loan?

Looking to give your personal loan a makeover? Enter refinancing. This savvy financial maneuver means swapping out your old loan for a new one. It’s a chance to snag lower interest rates, longer repayment schedules, or a new loan structure that fits your needs. But hold on; there’s a catch. Refinancing is like hitting reset on your loan, so you need to weigh the pros and cons before taking the plunge.

Pros and Cons of Refinancing Your Personal Loan In Singapore

Refinancing is the ticket to reducing interest costs and easing monthly payments. It’s a smart move that can keep you afloat financially without upending your life. Even better, paying off your debts can elevate your credit score and open doors to more funding down the road.

But don’t forget, prepayment penalties may lurk in your loan agreement. To avoid surprises, consult your lender. And be aware that refinancing could temporarily affect your credit score. It’s a balancing act worth considering.

| Pros | Cons |

| ✔️ Get a lower interest rate ✔️ Cut down on your regular payments ✔️ Improved overall debt management | ❌Early repayment fines ❌You’ll need to reapply for a loan ❌You risk lowering your credit score |

How Does Refinancing a Personal Loan Work?

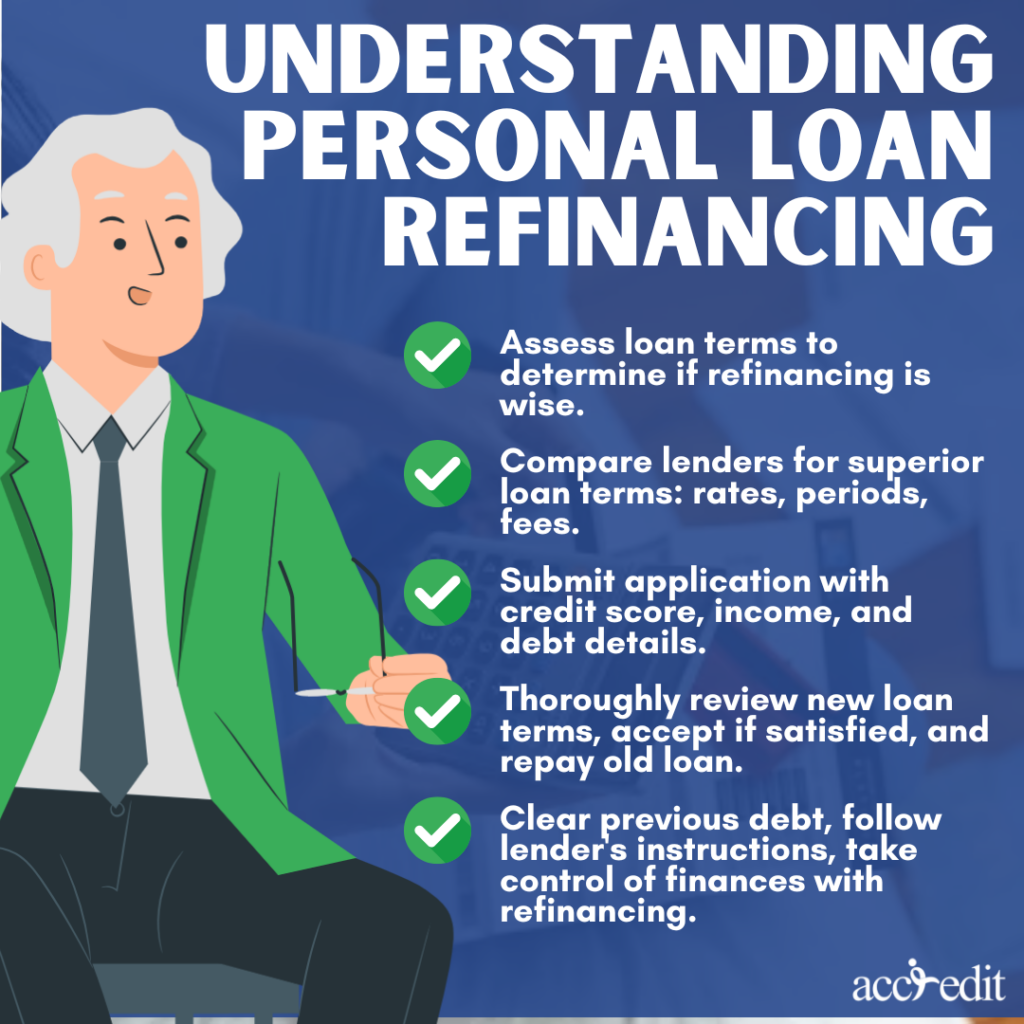

Refinancing a personal loan might seem daunting, but it’s simpler than you think. Here’s what you need to know:

Step 1: Evaluate your current loan by analyzing its interest rates, monthly payments, and fees. This will help you decide if refinancing is a smart move.

Step 2: Research lenders that offer better terms than your current loan. Look at interest rates, repayment periods, and fees to identify the most advantageous option.

Step 3: Apply to your chosen lender and provide your credit score, income, and debt-to-income ratio information.

Step 4: Review the terms and conditions of the new loan carefully, and accept the offer if you’re satisfied. Then, pay off your old loan.

Step 5: Repay your new loan as instructed by the lender after clearing your previous debt. That’s all there is to it! Take control of your financial future by refinancing your personal loan today.

Factors to Consider When Refinancing a Personal Loan

When it comes to refinancing a personal loan, prudent research is a must. To guarantee a wise move, take note of these pivotal considerations before diving in:

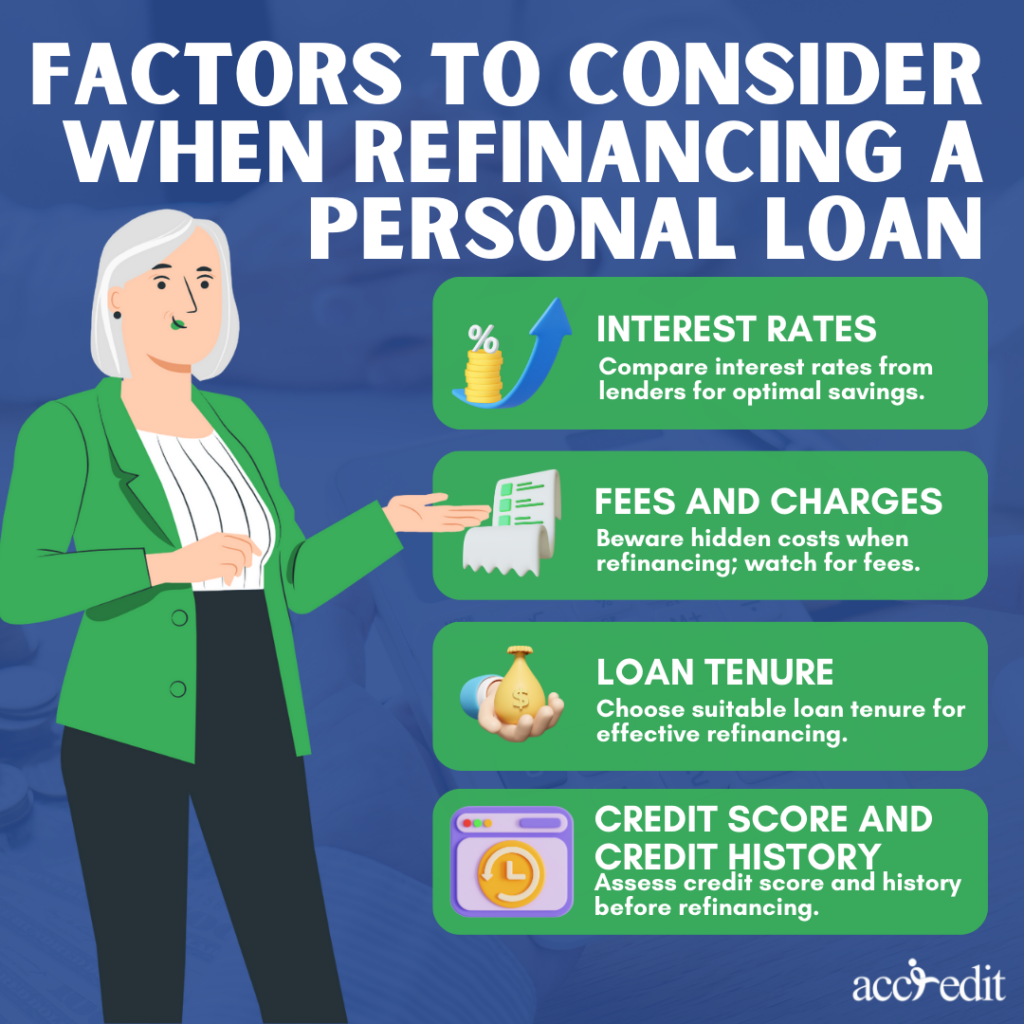

Interest Rates

Interest Rates. One critical factor to keep in mind when refinancing your personal loan is the interest rate. The lower the interest rate, the more significant your potential savings over the loan’s lifespan. Therefore, it’s essential to shop around and compare interest rates from various lenders to find the best deal.

Fees and Charges

When considering refinancing, it’s crucial to keep your eyes peeled for the fine print. Don’t get blindsided by the sneaky fees and charges that could chip away at your savings. Of course, you’re already aware of the interest rates and processing fees, but did you know that prepayment penalties and late payment fees could also come into play? It pays to be vigilant when it comes to the hidden costs of refinancing.

Loan Tenure

Loan tenure is the period you commit to repaying your loan, and it plays a critical role in achieving your financial objectives. To refinance your loan effectively, you must understand the importance of selecting the right loan tenure. It’s essential to pick a tenure that syncs with your budget and goals, reducing your financial burden and helping you achieve your objectives. With the right loan tenure, refinancing can be a powerful tool in managing your debt and finances.

Credit Score and Credit History

In the realm of refinancing, credit score and credit history are no mere bystanders. They wield immense power, determining your eligibility and interest rates. So, before you consider refinancing your personal loan, it’s imperative to conduct a comprehensive self-analysis of your credit score and credit history.

Thoughts

The benefits of personal loan refinancing are clear: greater debt control, cost savings, and credit score enhancement. But before making a move, take time to assess the implications. Conduct a thorough review of interest rates, fees, loan terms, and credit background. Also, partner with a trustworthy lender for optimal results. Armed with these insights, you’ll be better positioned to make a sound decision that aligns with your financial objectives.

Repay Your Loan with Ease with Accredit Moneylender

Loan repayment can be nerve-wracking, but at Accredit Moneylender, we understand the anxiety it can cause. That’s why we’ve created flexible repayment plans that allow you to concentrate on settling your loan without worrying about your finances. We work together with you to determine the most suitable option for your unique financial circumstance, making the entire process a breeze, with no stress. For a trouble-free personal loan journey in Singapore, Accredit Moneylender is the trusted solution.