A person in desperate need will find a solution to all situations. It’s a common scenario for communities worldwide and even Singapore, especially when financial troubles happen. Thus, many consider taking Singapore loans to resolve the money problem fast.

Modern-Day Singapore Life

It has been some time since the country opened its windows and doors to create a more substantial and sturdier economy. As everyone in Singapore understands well enough, an ingrained economy equates to a sustainable and high-quality standard of living.

Yet, the communities realise paying specific prices regarding high-quality standard lifestyles. With anticipation, the price tags are often too costly for comfort.

As a result, people living and working in Singapore always consider the possibility of bringing in a loan. Loans are the typical choice when personal finances can no longer support one’s financial needs.

Loans are not new in the industry of finance. It’s an essential piece of the puzzle which could jumpstart someone’s career or business. The purpose of having loans differs for all people.

Find out here the critical details on loans and how it works. Discover the different types of loans accessible in the country and which lenders would be the best providers for you.

Dive into the world of Singapore loans and how it works below.

What is a Loan?

A loan is a kind of credit that involves a specific amount of money intended to be lent to another person or entity. With the loan provided, a repayment exchange would ensue based on the principal amount’s value.

Regarding loans, generally speaking, lenders can add a particular interest rate percentage or other charges to the principal loan. The borrower is responsible for fulfilling their duties and paying the lender the principal balance and fees.

Simply put, it’s borrowing money from a person or a financial company. All loans have designated interest rates, fees, and charges that debtors must pay.

How do Singapore Loans work?

The practice of Singapore loans is as universal as it’s in the finance industry worldwide. However, there’s a specific loan that many Singaporean communities rely on that does not demand collateral to begin with.

It’s the personal loans. It’s deemed an unsecured loan due to the lack of collateral. As a result, many Singaporean Citizens, Permanent Residents, and foreign work pass holders appeal for this particular loan.

These debts work under the stringent regulations of the Monetary Authority of Singapore and the Ministry of Laws Moneylending Act.

All these loans acquired through banks and financial institutions will comply with the MAS Banking Act. Those who’ve obtained their loans via licensed moneylenders are under MinLaw’s Moneylenders Act.

Every loan from these sectors has diverse interest rates, fees, charges, and particular policies. The borrower should entirely understand each to guarantee a smooth business transaction.

When laws are breached, banks, financial institutions, and licensed moneylenders can go to court, file a case, and get back the money owed to them.

Yes, it includes personal loans as well. Even though it’s an unsecured loan, it’s still considered business capital and should be repaid accordingly.

When to Seek Singapore Loans?

Every person working and living in Singapore belongs to different employment industries and salary groups. Singaporean salary rates can start at least $10,000 annually, and others can earn more than a hundred thousand dollars. The median annual salary in Singapore is presumed to be at least more than $45,000.

However, taking out a loan is a prerogative. When do communities seek loans?

Home Purchase

Who doesn’t want to live in their own house? Although having a home could mean more expenses, it also entails the opportunity to acquire a haven away from the noisy and busy world.

These times, the estimated average median housing costs in Singapore for HBD are S$500/sq. foot, condo costs S$1,700/sq.foot overall, and landed homes for S$1,400. HBD flats are estimated at S$500/sq.foot.

Thus, it’s more than acceptable for people to take out a loan to buy their dream home. Banks, financial businesses, and licensed moneylenders can grant loans for this purpose.

Vacations

Inflation rates are rising, and the economy hasn’t recovered much yet. Nevertheless, it doesn’t mean people cannot relax and free themselves from the routine lifestyle.

Vacations are viable reasons to take a loan because there’s nothing more important than ensuring you are healthy physically, emotionally, and psychologically. A personal loan for vacations is accessible from banks, financial institutions, and licensed moneylenders in Singapore.

Emergency Expenses

Another common yet extremely valid purpose for getting a loan is when facing a significant financial crisis. It doesn’t matter who you are or what industry you’re in. When an emergency strikes and there’s not much money in your account, it’s a reasonable time to request a loan.

Although financial companies and banks can provide different debts, the best choice is to seek a licensed moneylender in Singapore during an emergency.

Debt Consolidation

An intelligent way to get a loan is to use it for debt consolidation. Depending on its purpose, it can be a personal or a business loan. With debt consolidation, an individual or company can pay off multiple loans, consolidate them into one loan and acquire a monthly payment schedule for one specific loan.

Monetary businesses and banks will offer debt consolidation loans. Licensed moneylenders may discuss with their borrowers regarding this option. It would be an ideal alternative, especially when borrowers have already maximised their debt capacities.

Types of Singapore Loans

Singapore’s economic strength stays intact despite many issues left and right. Thus, Singapore loan providers in the country, like banks, financial institutions, and licensed moneylenders, are always ready to grant loans to worthy borrowers.

The country has a wide array of loans, such as;

Personal Loans

A personal loan is an unsecured loan. Borrowers may utilise the loan for any purpose, such as paying medical expenses, funding vacations or tips, home renovations, car repairs, or paying education fees and needs.

Education Loans

An education loan is designed to fit the financing needs of students pursuing high education. The coverage of education loans is tuition fees, books, miscellaneous fees, and other related costs.

Home Loans

Home loans are also known as mortgages. These are secured loans specifically outlined for financing the purchase or construction of residential properties in the country.

Car Loans

These are secured loans. The type of Singapore loan fits the needs of individuals requiring additional financing to purchase new and used vehicles.

Business Loans

It’s the type of Singapore loan that caters specifically to businesses. It’s ideal for the monetary needs of startups, entrepreneurs, and established businesses. The coverage of this loan would range from business expansion, equipment purchase, or working capital.

These loans work well per the requirements of the borrower. Moreover, with each loan opportunity, specific qualifications exist to comply with, screen, and ultimately be granted the loan.

Singapore Loans Eligible Applicants

As of today, Singapore’s population has reached more than 5.4 million. These numbers are not solely Singaporean Citizens. From the recently acquired demographics for Singapore, 4 million are considered Singaporean Citizens and Permanent Residents.

The remaining 1.45 million are primarily immigrants or foreign nationals studying or working legally in the country.

The country promotes a harmonious environment for all communities in Singapore. Thus, everyone is allowed to get Singapore loans when they have to.

Yet there are caps imposed on loans. It’s the Singapore government’s effort to keep a balanced financing industry. Furthermore, it will limit the over-borrowing practices of the communities and interest rates and fees manipulation by banks, financial institutions, and moneylenders.

Among the country’s most notable loan caps is from the moneylending industry. The Ministry of Law’s Moneylenders Act has stipulated that a borrower may only obtain a maximum amount of funds based on their annual income.

These usually fall for unsecured loans that are popular with the communities in the country. The current computations are;

Less than $10,000 annual income

All Singaporean Citizens and Permanent Residents who acquire less than $10,000 annual income may borrow a maximum of $3,000. Foreigners living and working in the country may borrow $500.

At least $10,000 and less than $20,000 annual income

Each Singaporean citizen, Permanent resident, and foreigner in the country with an annual income ranging from $10,000 to $20,000 can take out a maximum of $3,000 loan.

At least $20,000 annual income

Every Singaporean citizen, Permanent resident, and foreigner residing in Singapore with an annual income reaching at least $20,000 is allowed six times their monthly income to borrow.

The Moneylenders Act further enhances its advocacy to protect all parties in the moneylending business through additional loan caps and fixed fees or charges. Licensed moneylenders are only allowed to;

- The interest rate for the loan is fixed at 4% a month.

- Charge 10% for the one-time administrative fee of the loan principal.

- 4% monthly charges for the current average for late interest rates

- $60 a month is set for late fees

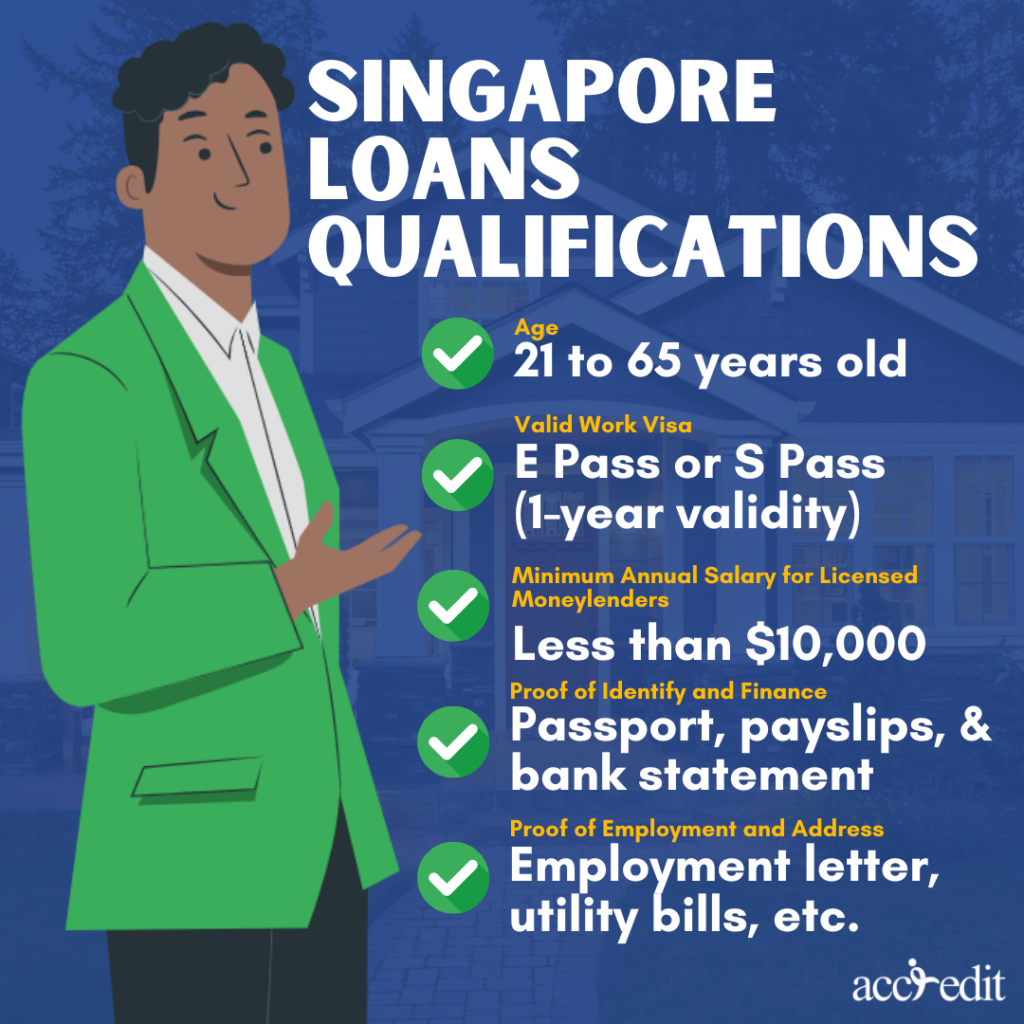

Singapore Loans Qualifications

Singapore is definitive when it comes to its laws and regulations. It’s mirrored, too, through the qualifications for Singapore loans.

Individuals who wish to get a loan from a bank, financial institution, and licensed moneylenders have to be;

- Of legal age at 21 years old and above

- Proof of income

- Details on their address and contact numbers

For foreigners Additionally, requirements are needed, such as;

- Work pass

- 1-year validity of one’s proof of employment or employment pass

- Income proof for the last three recent months

Best Option to Get Singapore Loans

For those wondering, where would be the best option to acquire the loans from? The answer is licensed moneylenders.

Why licensed moneylenders?

Licensed moneylenders in Singapore are reliable and trustworthy options for obtaining a loan. But it rises above the other financial institutions because of the advantages it provides its borrowers.

Taking out a loan from a licensed moneylender in Singapore is fast. Borrowers won’t even have to wait a day to have their loan approved. With all the necessary documents prepared, the loan process may take less than an hour. It’s that fast and efficient.

Licensed moneylenders grant smaller loan amounts. The procedure to supply the demand to their borrowers is easier to fulfil.

The licensed moneylenders in Singapore are available on weekdays. Yet they are also offering their services on weekends. Licensed moneylenders can make it happen as they need immediate emergency funds on the weekend.

Credit assessment is nerve-wracking for all borrowers. Banks and financial institutions are strict with credit evaluation. Anyone who cannot meet the standard credit score level declines the loan.

But, licensed moneylenders in Singapore forgive credit assessment. Under specific conditions like the borrower has to have proof of decent income or could have collateral.

It’s imperative to comprehend that taking out a loan is a severe financing business. It isn’t a transaction that should be taken lightly since one’s reputation, personal finances, and credit score could be affected.

Final Thoughts

Consider taking out Singapore loans when you find yourself in difficult financial situations. Contact the lender you want to work with and comply with the eligibility criteria and requirements.

Remember only to borrow what you can afford to pay. It’s to ensure that your loan experience is excellent and hassle-free.