Do you find yourself in a cash bind and need quick moolah to cover your expenses? Perhaps you’re considering a personal loan to get you through. But hang on just a moment; if your gross income sits at a measly $20,000, will banks in Singapore grant you the loan? This article will determine what you need to do to qualify for a personal loan in Singapore.

Personal Loans in Singapore: What You Need to Know

If you’re looking to fund a personal expense, a personal loan may seem like an attractive option. Need a wedding ring for that special someone? Want to take a luxurious vacation? Or perhaps a small vehicle is on your wishlist? A personal loan can help make these dreams a reality.

But beware of the potential for interest rates and charges to pile up quickly, leaving you buried in debt. To avoid that from happening, one must continue with caution should one slip into a financial trap. It is essential to look for personal loans that provide favorable rates and terms, such as low-interest rates, extended payback durations, and no processing costs.

Key Takeaways

- Personal loans are popular and versatile in Singapore

- Rates range from 3-10% and tenures from 1-5 years

- Banks and moneylenders offer personal loans

- Late repayments can incur extra charges and harm credit scores

Bank Requirements for Personal Loans

When obtaining personal loans in Singapore, the majority of individuals turn to banks as their go-to source. Nevertheless, fulfilling specific eligibility requirements is necessary to secure a personal loan from a bank. Foremost among these prerequisites is the income factor.

For Singaporeans and PRs, banks in Singapore commonly demand a minimum yearly income of $30,000 for personal loan eligibility. Foreigners, on the other hand, typically require a yearly salary of S$40,000 to S$60,000. It’s worth noting, however, that various banks might impose distinct income requirements, depending on the type of loan you seek and your creditworthiness.

Can You Get a Personal Loan from a Bank in Singapore with a Gross Income of $20,000?

Obtaining a personal loan from a bank in Singapore with a yearly salary of $20,000 may appear daunting. Although, don’t lose hope as it’s not entirely impossible.

Personal loans for those in a lower income band may be difficult to come by, but certain institutions may be ready to do so if the borrower meets certain requirements. A good credit score and a manageable debt-to-income ratio are two examples.

Do your homework and evaluate different loan offers from different institutions to increase your approval chances. The time spent doing so might pay you in the long run if you find more accommodating qualifying requirements or significantly cheaper interest rates.

Factors Considered for Personal Loans

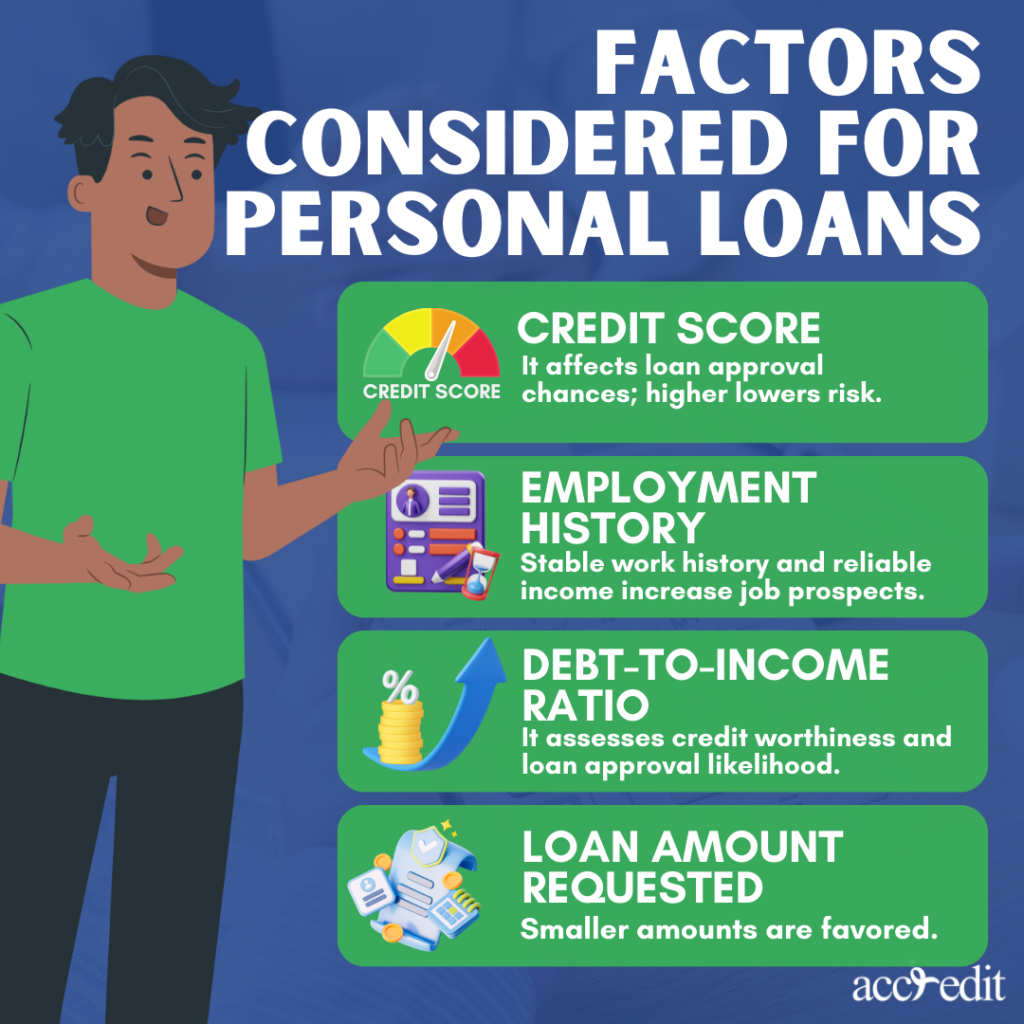

Let’s take a look at some factors that banks consider when reviewing loan applications:

- Credit score: When you apply for a loan, lenders scrutinize your credit score to assess your financial credibility. A higher credit score not only reduces the risk of defaulting on payments but also enhances your chances of securing loan approval.

- Employment history: Financial institutions favor candidates with a consistent work record and a reliable revenue stream. Prospective employees who can demonstrate a history of steady employment are perceived as more dependable and trustworthy and are more likely to be viewed as viable candidates for the role.

- Debt-to-income ratio: The debt-to-income ratio serves as a crucial factor for lenders to evaluate your creditworthiness. By examining this metric, lenders can determine whether you’re capable of repaying your debts without any hassle. A lower ratio signifies a lower chance of default, which increases the likelihood of loan approval.

- Loan amount requested: Your eligibility for a loan can be impacted by the amount of money you wish to borrow. Banks tend to be more inclined towards approving smaller loan amounts as compared to larger ones.

The Best Personal Loan Options for S$20,000 Earners in Singapore

For Singaporeans and PRs earning S$20,000 or below, financing options are still within reach. You can rely on the likes of Standard Chartered CashOne, OCBC Personal Loan, and DBS/POSB Personal Loan to provide you with personal loans. These financial institutions cater to those earning S$20,000 or more per year. However, if your income is below the benchmark, fret not!

You can avail yourself of licensed moneylenders such as Accredit, who offer an alternative means of acquiring personal loans. Such lenders present an excellent option for those who might not meet the eligibility requirements of conventional banks.

| Personal Loan Provider | Interest Rate | Minimum Income | Loan Amount | Processing Fee |

| Accredit Personal Loan | Up to 4% per month | Less than S$20,000 | $3,000; 6x monthly income if earn more than S$20,000 | 10% of the Principal Amount |

| DBS/POSB Personal Loan | 3.88%. (EIR 7.9% p.a.) | S$20,000 | S$500 – 4x monthly salary | 1% processing fee |

| OCBC Personal Loan | 5.43% (EIR 11.47% p.a.) | S$20,000 | S$1,000 – 4x monthly salary | S$100 |

| Standard Chartered CashOne | 3.48% (EIR 7.99% p.a.) | S$20,000 | S$1,000 – 2x monthly salary | S$0 |

Tips for Applying for a Personal Loan in Singapore

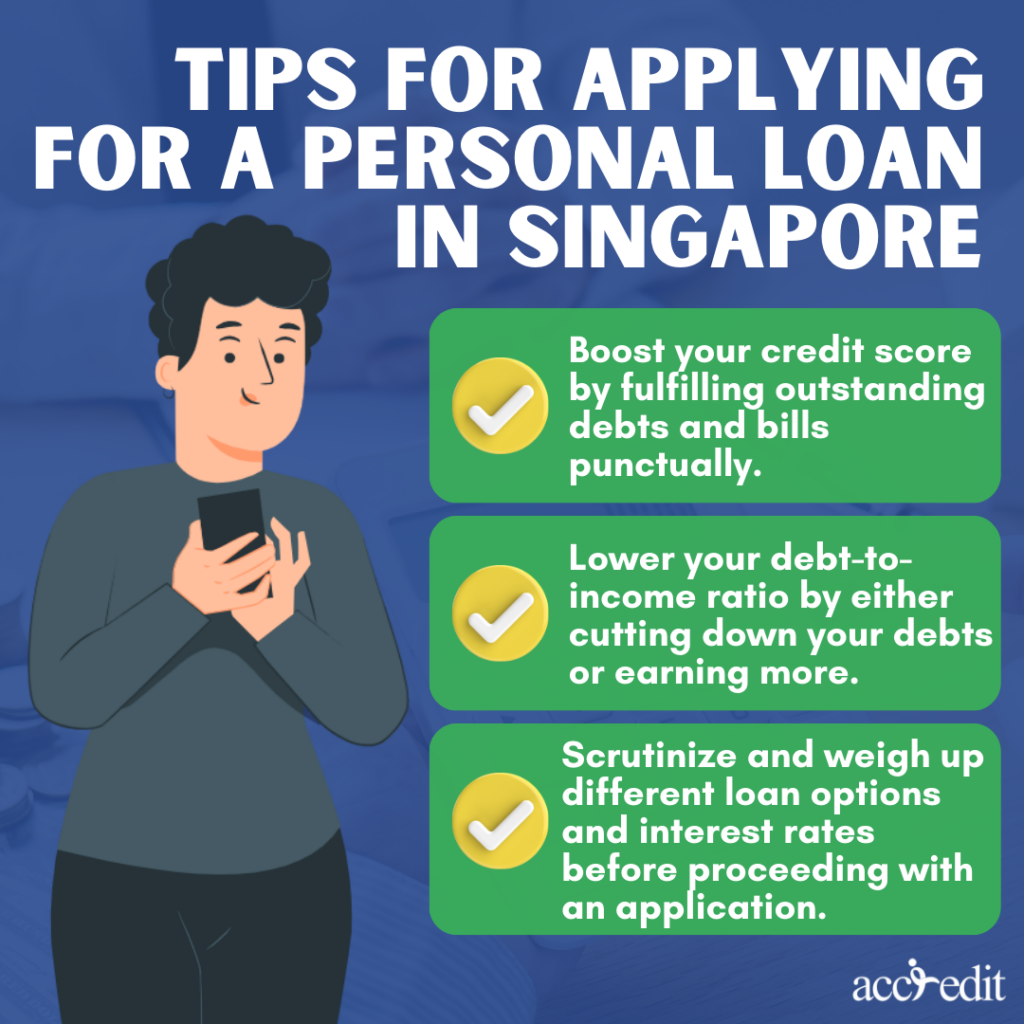

If you’re looking to secure a personal loan in Singapore, it pays to be strategic. Here are some tips that can help:

- Boost your credit score by fulfilling outstanding debts and bills punctually.

- Lower your debt-to-income ratio by either cutting down your debts or earning more.

- Scrutinize and weigh up different loan options and interest rates before proceeding with an application.

Thoughts

For those earning less than S$20,000 annually, acquiring a loan can induce anxiety. But fear not, as the lending landscape is abundant with eager financiers. Your task is to research thoroughly and evaluate every option at your disposal to select the ideal loan that aligns with your unique circumstances and future objectives.

The internet has made it convenient to discover trustworthy lenders, providing access to a wealth of information in contemporary times. Yet, before committing to any loan agreement, a meticulous inspection of the paperwork is imperative.

Looking for Financial Support? Accredit Moneylender Offers Personal Loans for S$20,000 Income Earners

Dreaming of a vacation, home renovation, or unexpected expenses weighing you down? The good news, you don’t need to be a high earner to qualify for a personal loan. Accredit Moneylender offers personal loans to those earning S$20,000 annually or more.

With Accredit, you can borrow up to S$3,000 with an annual income of S$20,000. But if you earn more than that, you can borrow up to six times your monthly income. Imagine the possibilities!

No more putting off your dreams or struggling with financial constraints. Accredit’s personal loans provide the financial assistance you need to turn your aspirations into reality.