Many people live their lives differently and prefer to do things their way. However, people seek lending money in Singapore options for the money crisis. It’s an entirely natural approach and has been happening in the country for a long time.

Recently, the country has experienced massive healthcare and economic occurrence. It led people to sit out in one corner as lives were halted, and finances were almost non-existent.

Such events prompted many individuals to consider borrowing money from financial institutions, including moneylending in Singapore. The industry is relevant in the finance world and has become a reliable source of immediate funds for emergencies since then and now.

However, news comes up on legalities involving lending money in the country. In this article, uncover the truth on moneylending, its legitimacy, which is permitted and not permitted to lend you money, types of loans and more below! It’s time to discover more about the legality of the moneylending industry in Singapore.

Is Lending Money in Singapore Legal?

Lending money in Singapore is legal. It is duly stated by the Ministry of Law, which oversees and regulates the massive financial industry.

To ensure the legitimacy and laws of lending money in Singapore are honoured, all moneylenders in Singapore must follow the Moneylenders Act and Rules.

The Ministry of Law provides every Singaporean citizen, Permanent Resident, and foreigner residing in the country with the relevant laws and directives linked with the legislation for moneylending.

As it is legal to lend money in Singapore, the Ministry of Law proffers the Moneylenders Act and Rules, which comprises particular mandates that revolve around appropriate concerns;

- Operations of moneylending in Singapore

- Authorised moneylenders in Singapore

- What are the definitive loan caps for a business or individual lending money in Singapore?

- Legalities and regulations on overall moneylending in Singapore

What is Moneylending in Singapore?

The business concept of moneylending in Singapore is simple. In truth, it is straightforward as a practice that provides cash loans to borrowers and may supply services and goods to their clients.

The debts should be repaid on specific dates as it is under financing. Moreover, borrowers must understand that moneylending in Singapore has a high-interest rate.

A particular thing occurs whenever people read or hear about moneylending in Singapore; they feel conscious and awkward. The reason behind such a response is because in the past when someone was a moneylender in Singapore, they were deemed criminals.

However, moneylending in Singapore has evolved rapidly and effectively since its enactment in 1936. Various debates and amendments were made to satisfy the needs of the communities that rely on those offering services of lending money in Singapore.

Through the Ministry of Law and its Moneylenders Act, someone who does lend money in Singapore should have a licence to operate in the industry.

Authorised Lenders Lending Money in Singapore

Moneylenders are the designated individuals or groups who may function or operate as part of the moneylending businesses in Singapore. Moneylenders in Singapore release smaller amounts of loanable receivable for their borrowers than banks and other financial companies.

Moneylending in Singapore is sometimes considered a risky business. It’s mainly linked to unsecured loans like personal loans.

What is an unsecured loan?

An unsecured loan is a debt classification without collateral to disburse the loan amount to the debtor. As there are no collateral or assets involved in the transaction, an authorised lender lending money in Singapore may have relatively higher interest rates to impose.

But it is crucial to note that only some of those who claim to be moneylenders have the legal business rights to lend money in Singapore.

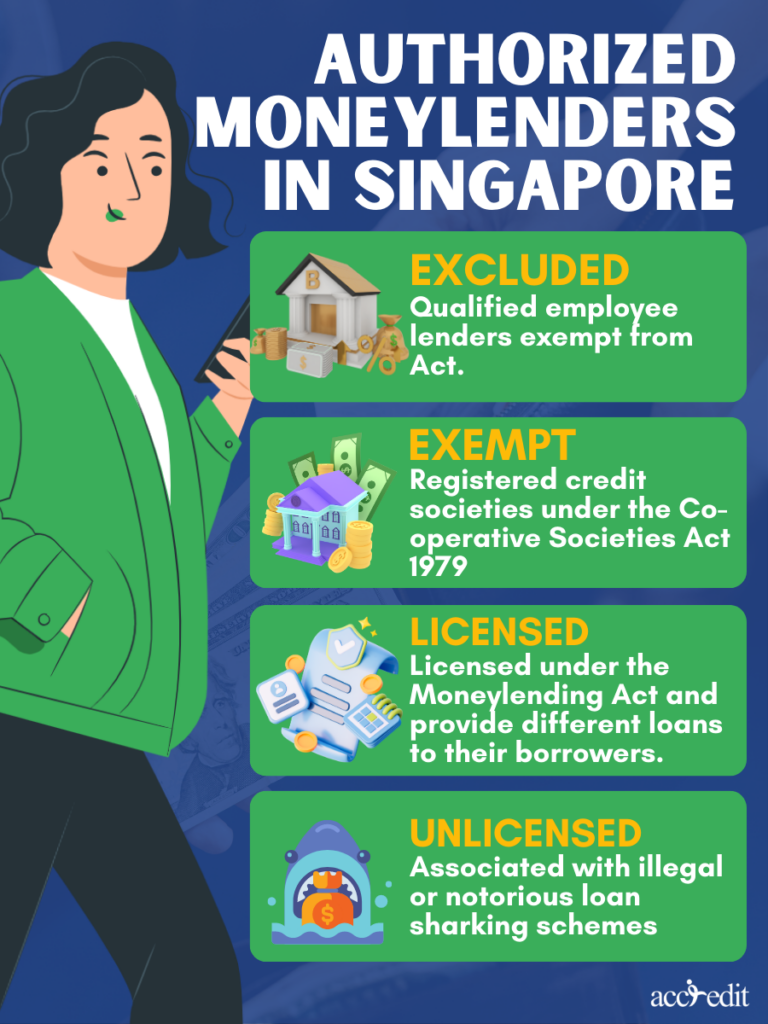

The Moneylenders Act enumerates the person or groups who qualify as moneylenders in Singapore, and they are;

Excluded Moneylenders

Those who fall under the “excluded moneylenders” classification can lend money in Singapore because the Moneylenders Act regulations qualify them.

These excluded moneylenders are mostly groups or people who are pawnbrokers and licensed under the Pawnbrokers Act. Credit societies are considered to exclude moneylenders as well.

Companies that grant loan opportunities to their employees are “excluded moneylenders”. Other lenders, like pawnbrokers, lend money in Singapore but are under different legislation.

Exempt Moneylenders

Another categorisation of who can legally lend money in Singapore is “exempt moneylenders.” These groups of people or entities were exempted from holding a licence.

What was the basis behind the exemption? It is based chiefly upon the government and the subject’s discretion of approval of the application to be classified as an exempt moneylender. All of the proceedings must be per the Singapore Parliament laws.

Licensed Moneylenders

To become a person or group licensed to lend money in Singapore, they must earn it accordingly.

Licensed moneylenders in the country must apply to become legitimate authorised members of the Registry of Moneylenders. The application process includes passing tests, sending requirements such as their essential personal and business details, and registering their businesses to the Registry.

These licensed moneylenders are the original specification of that lending money in Singapore. They grant loans to borrowers who have genuine and urgent financial needs. The loans they proffer can be secured or unsecured, specifically personal loans.

They may exercise authority over their borrowers but are discouraged from harassing the clients. Legal procedures will ensue when licensed moneylenders in Singapore encounter problems with their debtors, mostly when the latter refuses or intentionally does not repay the loans.

Among the three authorised lenders in Singapore, you can rely the most on licensed moneylenders for their financial assistance. What kind of loans may you access from them?

Loan Choices from Lenders Lending Money in Singapore

If you require monetary assistance, you have loan choices from licensed moneylenders lending money in Singapore. These registered lenders guarantee a fair and secure borrowing experience.

Here are the loan choices you may apply for from Singapore’s licensed moneylenders:

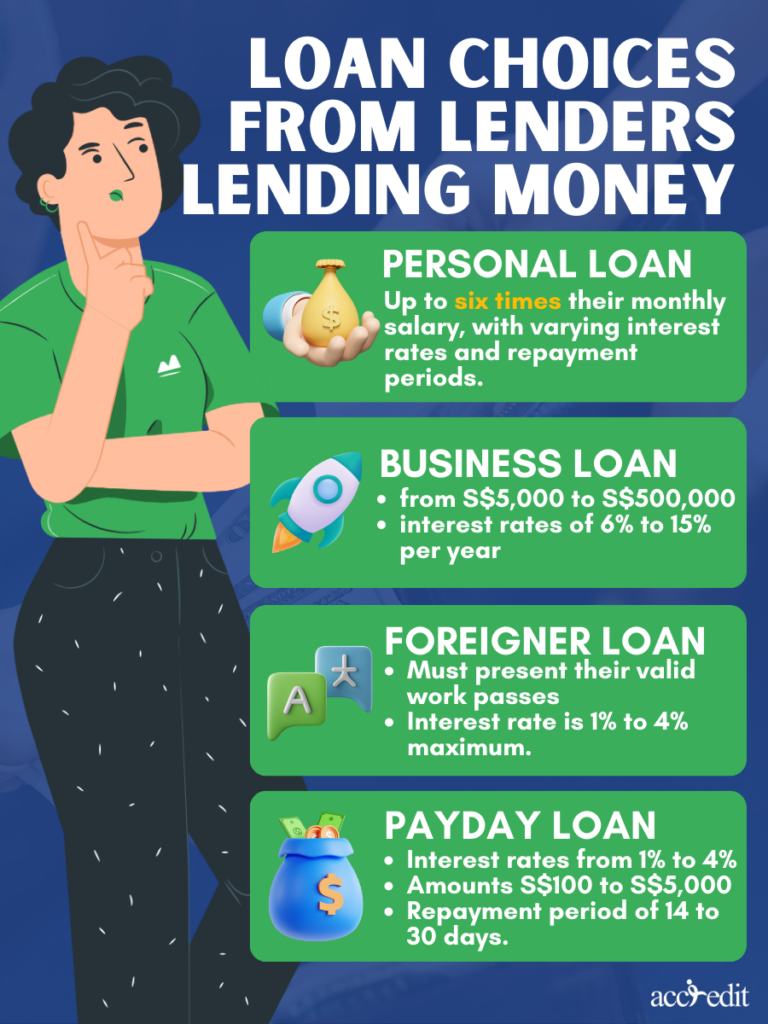

Personal Loans

These unsecured loans don’t require assets or collateral to secure the debt. It’s feasible for different purposes, whether for personal use to cover expenses, home improvements, pay medical bills, or consolidate debts.

Applicants eligible for a personal loan are Singapore Citizens, Permanent Residents, and foreigners with certified and valid work passes. The current interest rate range from 1% to 4% max per month, per the Ministry of Law’s regulations.

The repayment period can last between three months to three years. You may pay for it via fixed monthly instalments or flexible repayment plans.

Payday Loans

Another unsecured yet short-term loans are payday loan. It’s explicitly meant to cover urgent monetary requirements until your upcoming payday.

Singapore citizens, Permanent Residents, and foreigners with valid working permits and passes may apply for a payday loan. The interest rate is capped at 4% monthly by the Ministry of Law’s regulations.

The repayment period is on your next salary day, and the repayment method is a single lump sum.

Business Loans

Lenders are lending money in Singapore and grant business loans to its business owners. The purpose of the loan option is for company expansion or working capital.

Eligible applicants are entrepreneurs with Singapore-based and registered companies with at least 30% of the local shareholding. Business loans’ interest rates are at 1% to 4% max monthly by regulations of the Ministry of Law.

The repayment method is via fixed monthly instalments or flexible repayment plans, with a repayment period from six months to five years.

Foreigner Loans

It’s the type of loan specifically designed for foreigners working in the country.

Applicants must present their valid work passes, such as S Pass, employment pass, or work permit to be eligible. The Ministry of Law says the interest rate is 1% to 4% maximum.

Foreigners may pay for a foreigner loan via flexible repayment plans or fixed monthly instalments between three months to three years.

Licensed moneylenders lending money in Singapore grant these specific loans. You must always opt for these lenders as the Ministry of Law duly regulates them and offer fair and transparent interest rates.

You will also have access to clear loan terms and conditions, as they adhere to a strict code of conduct. As much as possible, do not engage with businesses not legally allowed to lend money in the country.

Illegal Moneylenders Lending Money in Singapore

Illegal moneylenders in Singapore are still present today. Most of these people or groups did not earn their licence for multiple reasons or were stripped of it under lawful grounds.

Malaysians and Singaporeans usually call these unlicensed moneylenders the “Ah Longs” or loan sharks. They have a specific target market to whom they communicate through SMS, messaging apps, and other social media platforms.

Sending a text, MMS, or messages to any community in Singapore to advertise their unlicensed moneylending business and services is already a breach of the Moneylenders Act.

It is because licensed moneylenders may only advertise their businesses through official websites, put up tarpaulins outside their offices, and register in Singapore’s business directories. Furthermore, the Moneylenders Act disallows advertising or reaching out to borrowers to invite them for a loan or grant them the loan even when the latter was not interested in the first place.

Unlicensed Moneylenders’ Alarming Behaviours

As unlicensed moneylenders are not allowed to lend money in Singapore legally, they use different tactics to attract new victims.

And below are the typical warning signs if you are dealing with an unlicensed moneylender in Singapore, such as.

- Pretends to be a licensed moneylender

It is among the most common strategies unlicensed moneylenders in Singapore do to scam new targets. As they cannot lend money in Singapore legally, they’ll pretend to be licensed moneylenders to win the trust of their targets.

Regardless of how smooth and professional these unlicensed moneylenders appear, the most effective way to reveal their identities is by checking their legitimacy through the Registry of Moneylenders.

- Asks for their victims’ details and information

An individual’s data and information is equivalent to their DNA. Personal data are unique and, in many cases, valuable information needed not solely for personal use but for business.

Those who cannot legally lend money in Singapore are desperate to gain their victim’s data. The possession of these critical information offers them leverage to abuse, harass, stalk, and pester victims purposely.

Licensed moneylenders in Singapore do not stoop to this level of privacy breach. It is due to their legal access to the Moneylenders Credit Bureau. The MLCB encompasses the borrower’s repayment, loan records and other vital information.

When a supposed moneylender does not hesitate to ask or fish for personal data information, it is time to let them know they’re accountable and punishable by the Ministry of Law’s Moneylenders Act.

- Abusive in language and behaviour

Unlicensed moneylenders are usually ill-mannered. They demonstrate this behaviour to scare and manipulate their victims. The threats are unending to push a target to suffer from psychological attacks. It attempts to put pressure on victims and give in to their demands.

Penalising Unlicensed Moneylenders

Groups or people not qualified to lend money in Singapore are deemed law offenders, specifically under the Moneylenders Act. They are as they are unlicensed and should not carry on a moneylending business.

The punishment under the Moneylenders Act is as follows;

First-time offenders:

When found guilty of assisting, carrying on, or unlicensed moneylending may be jailed for up to four years with a fine between $30,000 to $300,000 and receive up to six strokes of the cane.

Harassment:

When found guilty of attempting or committing acts of harassment on behalf of an unlicensed moneylender may face up to five years of jail time, fined from $5,000 to $50,000, and may receive three to six strokes of the cane.

Reporting Illegal Lending Money in Singapore Activities

When a person feels they are being stalked and attacked by those who do not have legal rights to lend money in Singapore, a report has to be filed as soon as possible.

The Ministry of Law assures that the Registry of Moneylenders is reachable via 1800-2255-529. All reports filed are undisclosed to protect the privacy and ensure the complainant’s security.

In addition to the Registry, the Singapore Police Force will accommodate reports at ‘999’ or through the X-Ah Long hotline at 1800-924-5664. Foreign Domestic Workers and their employers may contact the hotline as well.

Foreign Domestic Workers, or FDWs, are among the most typical target markets for those not legally allowed to lend money in Singapore. It is because, in many situations, FDWs’ income may be insufficient for their needs or have tight budgets.

Nevertheless, employers should always warn and remind their FDWs to avoid unlicensed moneylenders in Singapore. Or else their work pass will be revoked, and they’ll be deported.

Lending Money in Singapore, it’s Legal, and You Need It.

Borrowing money isn’t taboo. What’s more, It is legal to lend money in Singapore. Lending money in Singapore by licensed moneylenders has been a reliable sector for people who genuinely need funds.

Threats to safety and security rise when someone assists or commits illegal moneylending activities. Ah longs may promise big money with low-interest loans, but the trouble they will bring to someone’s life won’t be worth it.

Singapore has a lot of licensed moneylenders that proffer their services and commit to their responsibilities according to the law. So, when in dire requirements of emergency funds, search for the nearest and most reliable licensed moneylenders in Singapore via the Registry of Moneylenders.