It’s crucial first to get a grip on the rules of the road. Singapore’s moneylending land is governed by the Moneylenders Act and enforced by the Ministry of Law’s Registry of Moneylenders, and the money lenders fast cash within reach.

These fast cash opportunities are speedy, flexible, and far less derailing than traditional bank loans. It’s no wonder many borrowers veer towards this specific alternative when needing instant funds.

Yet, it’s a sector filled with its own unprecedented set of complexity and considerations. But don’t fret! This article will help you conquer the steps for you!

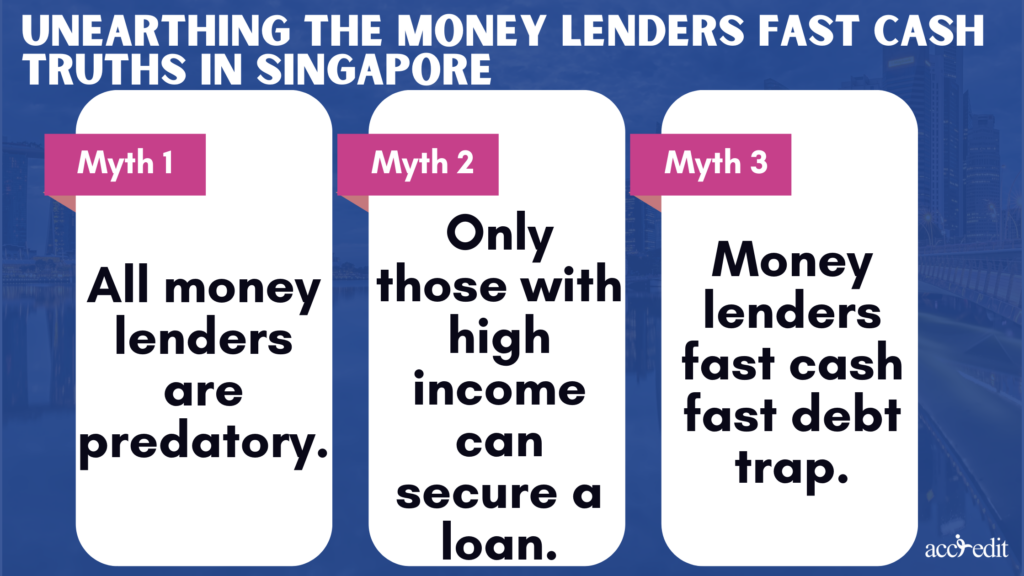

Unearthing the Money Lenders Fast Cash Truths in Singapore

Moving forward to your quest for money lenders fast cash wouldn’t be better if you know the truth. It can happen, especially if you will first unearth the facts regarding the myths and realities. Singapore’s moneylending background is often enveloped in folklore and misconceptions.

It’s time to clear the air.

Myth 1: All money lenders are predatory.

Reality: While there are crooked lenders, many licensed money lenders in Singapore abide by the Ministry of Law’s Moneylenders Act guidelines. They propose legitimate credit options with appropriate interest rates, like personal loans and other financial products.

Myth 2: Only those with high income can secure a loan.

Reality: Many money lenders present loans to individuals with varying income levels from less than $10,000 and up. While it’s a reality that your income may impact the loan amount, it doesn’t disqualify you from getting a loan.

Myth 3: Money lenders fast cash fast debt trap.

Reality: If handled accordingly, a fast cash loan can be a helpful resource during monetary urgencies, not a spiral into an endless debt cycle.

So, what’s up next? Of course, it’s triumphantly getting to the guiding steps to acquire fast cash.

Types of the Money Lenders Fast Cash Loans

Before applying for much-needed assistance from a money lenders fast cash provider, you must choose which loan you should get. Get what you need right to your door, only quicker!

So, what’s on the financial menu in Singapore?

- Payday Loans

- Personal Loans

- Foreigner Loans

- Business Loans

Step-by-Step Guide: How to Obtain Money Lenders Fast Cash Victoriously

Are you ready for the main event? Here’s a step-by-step guide to securing your loan fast.

Research:

- Take your time with the procedure.

- First and foremost, research the licensed money lenders in the Registry of Moneylenders list.

- Include assessing their rates, terms, and conditions.

Eligibility:

Make sure you’re eligible by being between 21 and 65, earning a minimum of S$20,000 p.a and up.

Comparison:

Use the data you got from your research and then compare different lenders to find the one that best fits your needs.

Pursuing Your Application:

Once you have chosen the lender that you prefer best, fill in the application form. You’ll likely need proof of income, employment, and residence.

Documents:

Alongside the application form, you must supply relevant documents, such as NRIC, passport, employment pass, proof of income, employment, and residence proof.

Discussion:

Discuss thoroughly with your lender about your loan terms, including interest rates, repayment schedule, and potential penalties.

Sign the Contract:

Once you agree with the terms, you can sign the loan contract.

Grasping the Process: Illuminating the Paperwork

The paperwork involved in a loan procedure can often need to be clarified. Here’s a simple breakdown of the critical documents you’ll come across:

Application Form:

It’s where you provide basic information, such as name, employment status, contact details, and income level.

Proof of Identification:

A valid passport or NRIC is primarily needed to verify your identity.

Proof of Income:

You might need to provide a utility bill or other authorized parallel with your address to establish your residential status.

Loan Contract:

This document incorporates the terms and conditions of the loan, including the principal amount and administrative fee capped at 10%, interest rate capped at 4%, repayment schedule, and any penalties for late or missed payments.

It’s crucial to read each document carefully and understand all the terms before signing. Feel free to ask the lender if anything needs to be clarified.

The Golden Rules to Getting Money Lenders Fast Cash

Everything has its rules, and the world of a money lender’s fast cash loans is no different. Sticking to these can differentiate between a fruitful experience and a troublesome one. So, take a look at the cardinal do’s and don’ts.

Do’s

Analysis:

Invest time in understanding the differences between lenders, particularly the rates, terms, and conditions, before settling on one.

Budget:

Confirm that you have an undeniably solid repayment plan in place. Loans can assist your financial emergencies, but they’re not free cash.

Read Cautiously:

- Make reading a habit.

- As you read through the contract, comprehend its specifics before you sign it.

- If something seems foggy, feel free to ask.

Don’t’s

Skipping the Fine Print:

Important details often lie in the fine print of your contract. Please pay attention to it.

Borrow Beyond Your Means:

Borrow only as much as you can comfortably repay.

Deal with Unlicensed Lenders:

Stick to licensed lenders as the Moneylenders Act regulates them.

The Legalities of Money Lenders Fast Cash and What the Law Says

Now, it’s time to talk law. Regarding the money lender, fast cash Singapore has a comprehensively stringent legal system to protect borrowers.

Here’s a snapshot:

Interest Rates: As per the Singaporean law’s Moneylenders Act, effective October 2015, the maximum interest rate licensed money lenders can charge is 4% monthly.

Late Payment Fees: If you decline to repay the loan on the scheduled timeframe, the maximum late fee is $60 monthly.

Upfront Administrative Fee: Licensed money lenders can charge an administrative fee upfront. But, this fee should be at most 10% of the principal loan amount.

Total Borrowing Cost: No matter what, the total cost of the borrowing, which includes interest, late interest, upfront fee, and late fee, cannot exceed the principal amount.

What to Expect: Typical Turnaround Time for Loans in Singapore

In the fast-paced world, time is of the essence. When you require fast cash, you genuinely mean swift.

So, how quick is the loan process for the money lenders fast cash in Singapore? Generally, once your application is approved, you can anticipate the funds to be expendable within a day or two. Nevertheless, the exact timeline can vary based on the lender’s procedures and the type of loan you’ve applied for.

Beware the Loan Sharks: Why Unlicensed Lending is a Big No

While it’s tempting to grab the first lifeline thrown your way when you’re in dire straits, it’s crucial to ensure that the hand extended towards you isn’t that of a loan shark. Unlicensed lenders or ‘loan sharks’ function outside the regulations set by the Ministry of Law, delivering attractive quick-cash solutions that often hide predatory interest rates and harsh repayment terms.

Here’s why you should steer clear:

- Absurd Interest Rates (20% and up per week!)

- Harsh Collection Practices (They’ll either harass, abuse, threat and even paint O$P$ on your properties to shame you)

- Lack of Transparency (They won’t grant you a clear understanding of the loan agreement, or sometimes, there are no agreements or contracts, to begin with)

The Final Takeaway

The world of money lenders fast cash in Singapore could initially appear challenging, but armed with the correct details and information, it becomes a better and smoother journey. From unwrapping the myths and realities to knowing the do’s and don’ts, the steps to take, and the legalities to be aware of, you’re now equipped to make conscious conclusions.

Remember, don’t let desperation cloud your judgment when requiring fast cash. Steer clear of the sharks and continue towards a trusted environment like Accredit Licensed Money Lender.

Still, have questions? Ready to take the next step? Reach out to us, and we will help you on your journey toward financial empowerment, a victorious one!