Have you ever dreamt of a wedding with romantic music, stunning outfits, and a crowd cheering your grand entrance? Of course, you have! But actuality often taps you on the shoulder, reminding you of the costs of such magnificence that licensed moneylender personal loans could assist you.

How Much Does it Cost to Say “I Do” in Singapore?

Did you know a single day of joy and union in Singapore can range between S$30,000 and S$50,000? Thus, getting in touch with a licensed moneylender for personal loans is a thought you must ponder.

Sounds much? Worry not. A personal loan from a licensed moneylender could be the financial ‘knight in shining armor’ you need to turn your wedding fantasy into reality.

So, if you’re ready to leap, you’ll learn how saying “I do” to a personal loan could be your best decision for your wedding.

Discerning Licensed Moneylender Personal Loans in Singapore

When you hear ‘personal loan,’ you instantly think about a fixed sum of money you could borrow for personal use. That is accurate. And once you take the licensed moneylender personal loans, you agree to repay this money, along with interest, over a set period.

Licensed money lenders are undoubtedly the good guys who have ticked all the boxes required by the Ministry of Law’s Moneylenders Act and Registry of Moneylenders Singapore. These legal lenders present personal loans and can be quite a catch in your wedding planning adventure.

Banks can be a little snobbish, requiring you to have a credit score as impressive as a beauty queen’s CV. Not the case with licensed lenders; they focus mainly on your capacity to repay the loan, assembling them into an excellent choice for those with a less-than-ideal credit history.

Moreover, they understand that time is of the essence. Hence, their loan approval procedure is as speedy as a professional baker frosting a cake, usually within a day or two. Yes, your loan can attain approval while you’re still deciding on the font for your wedding invitations!

Funding the Big Day: How a Licensed Moneylender Personal Loans Can Support You

It’s time to discover more facts about how a personal loan can assist in keeping those wedding jitters at bay. You have to face the realities; saying your vows is stressful enough without worrying about how to finance it.

The average cost of a wedding venue and catering in Singapore can easily cross S$15,000. Then take into account the bridal package – the wedding gown, suits, makeup, and all the works – possibly another S$5,000. And do not forget the photographer – because what’s a wedding without memories might set you back another S$3,000 to S$5,000.

It’s where a personal loan steps in like a best man, ready to assist. It could cover such costs upfront, affirming that you don’t compromise on your dream wedding. You can repay the specific amount in monthly installments, spreading the cost over an extended period.

The Monetary Promise: Licensed Moneylender Personal Loans T&C to Regard

Similar to not rushing into a marriage, it’s crucial not to hurry into a loan agreement. The ‘T&Cs’ of your licensed moneylender personal loans are just as vital as the promise you exchange at your wedding.

These T&Cs include:

Loan Tenure: It’s how long you have to reimburse your loan. Most personal loans from licensed legal moneylenders range between one to five years. The longer the tenure, the lower your monthly installments, but remember, you will pay more interest over time.

Interest Rate: The Moneylenders Act in Singapore caps the monthly interest rate at 4%. So, no matter how much you borrow, the maximum interest you pay will not exceed this rate.

Late Payment Fees: These fees kick in if you miss a payment or are late with one. It has a cap of S$60 per missed payment. So, remember these dates, just like you would wedding anniversary.

By understanding these points, you can confirm your monetary future remains as rosy as your wedding day, even after you’ve repaid your loan.

Love, Trust, and Interest Rates: What to Expect

When love blooms, it’s all about trust and expectations. And interestingly enough, it’s the same with personal loans. What can you trust, and what should you expect?

The first thing is the interest rate. Licensed moneylenders in Singapore have their interest rates capped at 4% monthly per the Moneylenders Act. So, there are no sudden spikes that could surprise you. You can trust that your interest won’t exceed the limit, regardless of your borrowed amount and income.

Secondly, keep an eye out for any other fees. These could include administrative charges capped at 10%, late interest capped at 4%, or late payment fees limited to $60. Just as you wouldn’t want any hidden clauses in your marital vows, you wouldn’t like them in your loan agreement either.

Always read cautiously through the agreement and ask questions if anything needs to be clarified. An excellent legal money lender will always be open and transparent about the charges implicated.

Finding the Ideal Match: How To Choose a Licensed Moneylender

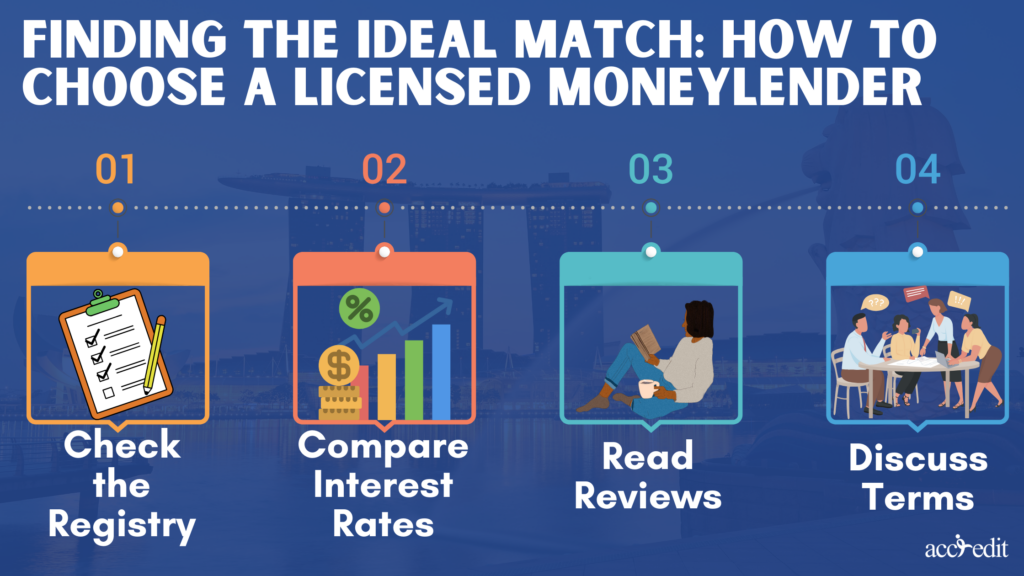

Picking a licensed moneylender is much like choosing a life partner. You would desire someone reliable, trustworthy, and understanding of your needs. But how do you make that choice?

Here are a few tips:

Check the Registry: The Registry of Moneylenders in Singapore preserves an up-to-date list of all licensed moneylenders. Any lender you choose should be on this list.

Compare Interest Rates: Though capped at 4% monthly, diverse moneylenders could deliver different rates. Take some time to shop around and compare.

Read Reviews: Just like you’d ask friends about a potential date, look at reviews and testimonials of the moneylender. How have their past customers felt about their services?

Discuss Terms: It’s vital to comprehend the loan terms. Affirm the moneylender’s obligation as they explain these to you, and you feel comfortable with the terms before proceeding.

The Unwanted Guest: Steering Clear of Loan Sharks

Everyone has their reasons to avoid uninvited guests at their weddings. Regarding financing, loan sharks or unlicensed moneylenders could become a dark cloud on your joyous occasion.

Here are some compelling reasons to steer clear of them:

- Absurdly ridiculous high-interest rates and not following the 4% interest cap.

- Unclear terms that leave room for unexpected costs and manipulations.

- Illegal methods for debt collection cause undue stress and could threaten you and your loved ones.

- The encouragement of bad financial habits from loan sharks leads to debt cycles.

From Licensed Moneylender Personal Loans Application to Wedding Bells

Taking personal loans from a licensed moneylender can be a practical solution to finance your dream wedding. With an understanding of what to anticipate, how to select a licensed moneylender, and the application process, you can make conscious lending conclusions.

Avoid unlicensed moneylenders, as their approach can lead to more harm than good. Consider reputable lenders like Accredit, ensuring a safe, transparent, and accommodating borrowing experience.

While monetary aspects are vital to wedding planning, remember that the day ultimately belongs to you and your partner. Licensed moneylender personal loans should assist you, not overshadow the joy and celebration of your special day. With careful planning and responsible borrowing, you can create unforgettable and cherishable memories without undue monetary strain.

Accredit Licensed Money Lender

Accredit Licensed Money Lender is the shining example of a responsible, trustworthy, and borrower-friendly institution. For your big day, we can offer tailored loan packages, flexible repayment, quick approval, transparency, and excellent customer service.

Regardless of your wedding needs, be it grand reception, intricate decor, or hassle-free approval processes, we’ve got you covered!

If you’re ready to explore a personal loan option for your wedding, apply today, and say ‘I do’ to a stress-free wedding affair.