Securing a personal loan in Singapore can be challenging, especially when lenders assess your creditworthiness. Your credit score plays a crucial role in determining whether your loan application gets the green light. But what credit score is necessary for loan approval? Fortunately, we’ve got you covered. In this article, we’ll explore the minimum and maximum credit scores required for personal loan approval in Singapore.

The Meaning of a Credit Score

When it comes to taking out a loan, your credit score is a critical factor that lenders consider. This score, which ranges from 1,000 to 2,000 in Singapore, serves as an indicator of your ability to repay a loan. It reflects your reliability and risk grade, making it a crucial part of the loan approval process. Banks, in particular, favor those with high credit scores, as it signals a lower risk of default.

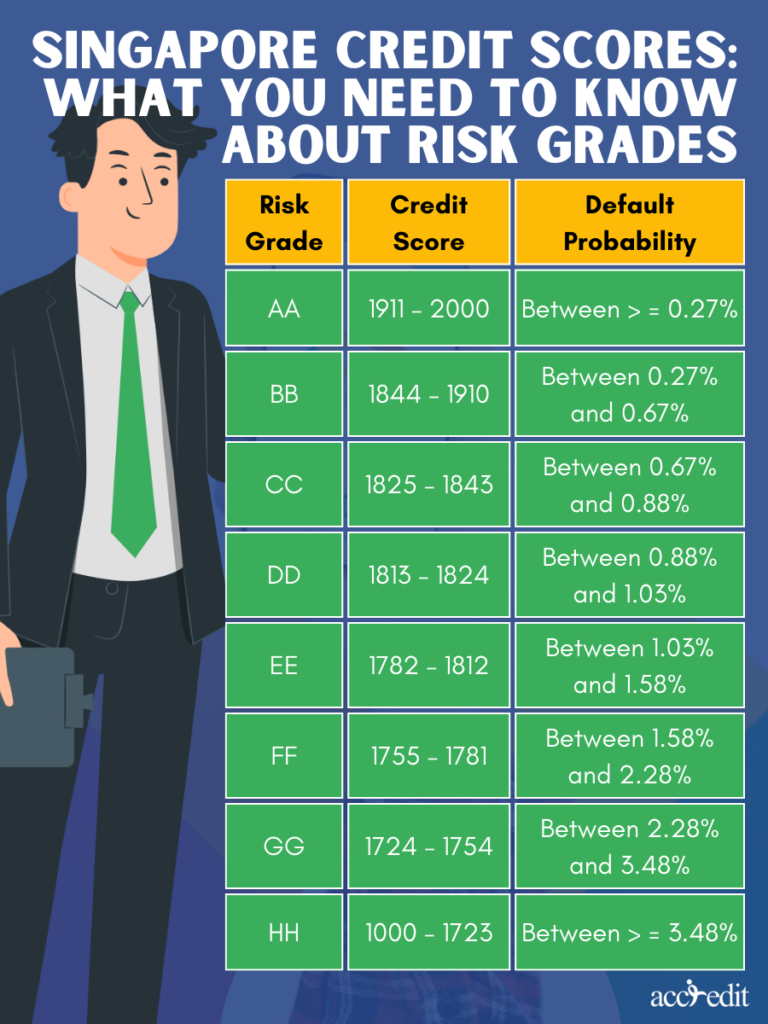

Singapore Credit Scores: What You Need to Know About Risk Grades

Lenders don’t just look at your income and expenses when deciding whether to grant you credit. They also take into account your risk rating, determined by your credit score. In Singapore, the risk rating scale ranges from AA, the safest, to DD and below, which indicates that you’re a high-risk borrower.

While a rating of BB or CC might suggest you’re not the most reliable borrower, it’s still possible to secure credit with some effort. However, a rating of DD or below is a red flag, as it implies you’ve defaulted on loans in the past. Knowing where you stand on the risk scale can help you make informed decisions and take steps to boost your credit score.

| Risk Grade | Credit Score | Default Probability |

| AA | 1911 – 2000 | Between > = 0.27% |

| BB | 1844 – 1910 | Between 0.27% and 0.67% |

| CC | 1825 – 1843 | Between 0.67% and 0.88% |

| DD | 1813 – 1824 | Between 0.88% and 1.03% |

| EE | 1782 – 1812 | Between 1.03% and 1.58% |

| FF | 1755 – 1781 | Between 1.58% and 2.28% |

| GG | 1724 – 1754 | Between 2.28% and 3.48% |

| HH | 1000 – 1723 | Between > = 3.48% |

What is the Maximum Credit Score to Get a Personal Loan in Singapore?

A score between 1911 to 2000 is considered excellent and shows lenders that you’re a reliable borrower. It increases the likelihood of loan approval and can lead to more favorable loan terms, including lower interest rates and higher loan amounts. In other words, a high credit score can help you save money and access the funds you need to achieve your financial goals.

What is the Minimum Credit Score to Get a Personal Loan in Singapore?

There is no minimum credit score required to get a loan; lenders do consider your score when deciding whether to approve your application. Typically, borrowers with credit scores between 1825 to 1910 or Grade CC to Grade BB are more likely to be approved for a loan. However, those with scores lower than Grade DD and below may be viewed as risky borrowers and may have their loan applications rejected.

Top Financial Institutions for Personal Loans in Singapore: High and Low Credit Scores

Singapore’s personal loan market is saturated with various financial institutions. However, for those seeking the best options, the top players in the industry are worth considering. These leading financial players cater to both high and low credit scores, providing you with suitable personal loan packages.

| Personal Loan | Interest Rate | Loan Amount | Processing Fee |

| Accredit Personal Loan | Up to 4% per month | S$3,000 – 6x monthly income | 10% of the Principal Amount |

| HSBC Personal Loan | 4% (EIR 7.5% p.a.) | S$1,000 – 8x monthly salary | S$0 |

| SCB CashOne Personal Loan | 3.48% (EIR 7.99% p.a.) | S$1,000 – 8x monthly salary | S$0 |

| DBS/POSB Personal Loan | 3.88% (EIR 7.9% p.a.) | S$500 – 10x your monthly salary | 1% processing fee |

| Citi Quick Cash Loan | 4.55% (EIR 8.5% p.a.) | S$1,000 – 4x your monthly salary | S$0 |

Accredit Personal Loan

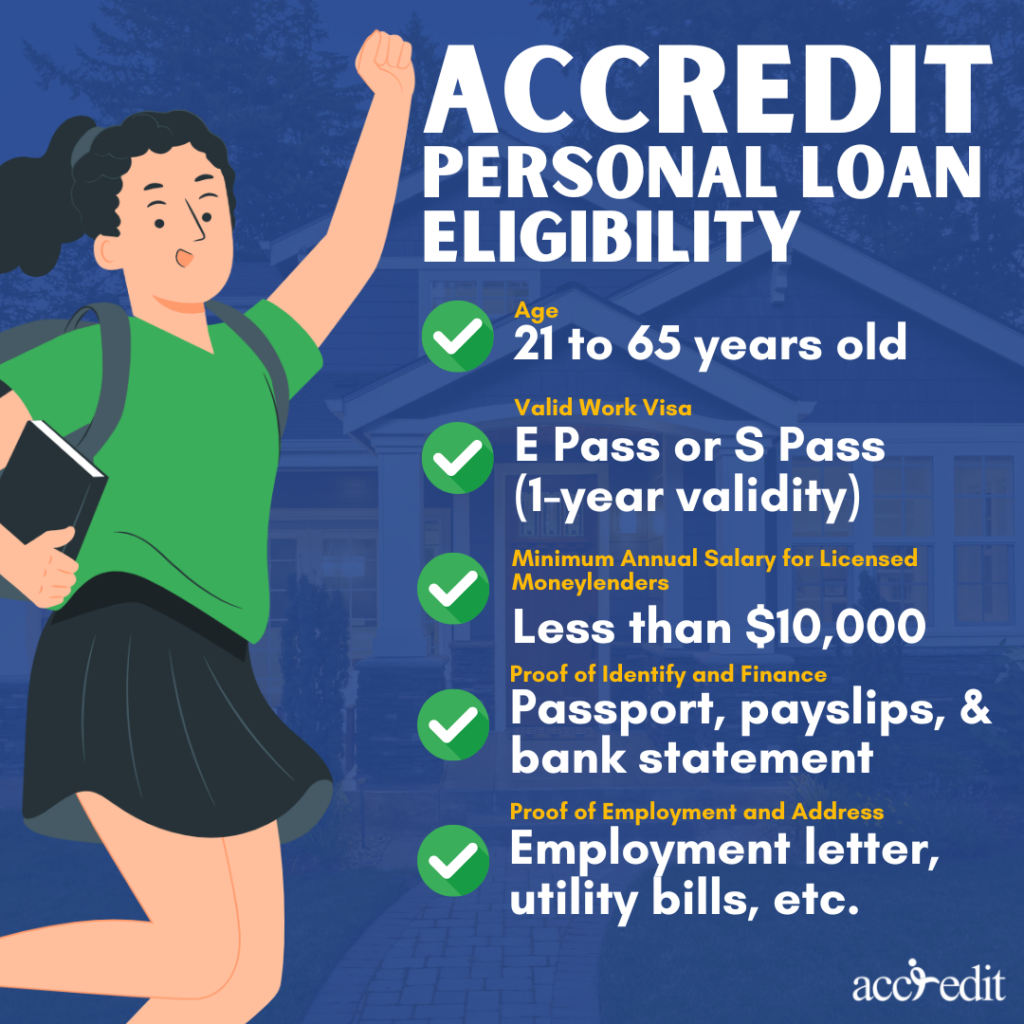

Finding yourself rejected by traditional banks due to your income or credit score can be discouraging, but Accredit, a licensed moneylender, offers a solution. Regardless of your financial standing, Accredit evaluates your ability to repay the loan, providing more options for obtaining a personal loan. With Accredit’s approach, even low-income earners and those with less-than-perfect credit can secure the funding they need.

Eligibility:

- Age: 21 to 65 years old

- Annual Income: S$10,000 or less

- Citizenship: Singaporean, Permanent Residents, and Foreigners

- Pass Type: E-Pass (foreigners)

HSBC Personal Loan

Looking for a top-notch personal loan that offers competitive rates and a longer repayment period? Look no further than the HSBC Personal Loan. With a low-interest rate starting at 4% (EIR 7.5% p.a.) and a repayment tenure that can stretch up to seven years, this loan is a wise option for individuals with low-income or poor credit scores who are in need of a larger loan.

Eligibility:

- Age: 21 to 65 years old

- Annual Income: S$30,000 (Singaporean & PRs), S$40,000 (foreigners)

- Citizenship: Singaporean, Permanent Residents, and Foreigners

- Pass Type: E-Pass (for foreigners)

Standard Chartered CashOne Personal Loan

Standard Chartered CashOne Personal Loan is an ideal choice for Singaporeans and PRs with low income. With a competitive interest rate of 3.48% (EIR 7.99% p.a.), this loan offers quick approval and cash disbursement, perfect for those who need cash on the go. Whether it’s for a major expense or to fund a project, the CashOne Personal Loan caters to borrowers who need a significant amount of money at a low-interest rate.

Eligibility:

- Age: 21 to 65 years old

- Annual Income: S$20,000 (Singaporean & PRs), S$60,000 (foreigners)

- Citizenship: Singaporean, Permanent Residents, and Foreigners

- Pass Type: E-Pass (for foreigners)

DBS/POSB Personal Loan

DBS/POSB’s Personal Loan may be an excellent choice for Singaporeans / PRs who are on a low income. This option boasts a competitively low interest rate of 3.88% (EIR 7.9% p.a.) and provides an immediate loan approval process, along with fast cash disbursement for existing customers. Additionally, DBS/POSB’s personal loan offers the freedom to borrow smaller loan amounts, with the minimum starting sum set as low as S$500.

Eligibility:

- Age: 21 to 65 years old

- Annual Income: S$20,000 (Singaporeans & PRs), S$45,000 (foreigners)

- Citizenship: Singaporean, Permanent Residents, and Foreigners with Cashline or Credit Card Accounts

Citi Quick Cash Loan

Citibank has a solution for foreigners who have low incomes and are in need of a personal loan that is tailored to their unique needs. Although the interest rate is slightly higher than other loan options, it is still competitive at 4.55% (8.5% EIR p.a.) for existing customers. Meanwhile, new customers can enjoy an even lower rate of 3.45% (6.5% EIR p.a.). This loan is ideal for those who only need a small loan amount for a short-term repayment period.

Eligibility:

- Age: 21 to 65 years

- Annual Income: S$30,000 (Singaporeans & PRs), S$42,000 (foreigners)

- Citizenship: Singaporean, Permanent Residents, and Foreigners

- Pass Type: E-Pass (foreigners)

The Bottom Line

When it comes to securing a personal loan in Singapore, your credit score holds immense importance. Financial institutions delve deep into your credit history to assess your creditworthiness and level of risk, and this evaluation will determine whether or not you get approved for the loan.

To increase your chances of approval, it’s advisable to have a credit score that falls between 1825 and 1910. But to achieve the best terms, lower interest rates, and maximum flexibility, it’s crucial to shop around and compare the offerings of different banks. Therefore, conducting thorough research is essential to finding the best possible deal that meets your financial objectives.

Accredit Moneylender: The Money Solution for Those with Poor Credit Scores

Legal moneylenders in Singapore are required to comply with the regulations set by the Money Authority of Singapore (MAS). However, if you have a poor credit score, worry not, as Accredit Moneylender can still offer you a personal loan. All you need to do is maintain a positive payment history and demonstrate low default risk. By doing so, you may even qualify for a lower monthly interest rate.