The business industry can be fickle, especially if the market is too competitive. Many companies have experienced highs and lows these past years. But, moneylenders loan in Singapore continues to go against the geopolitical and economic odds.

In truth, many people seek financial assistance to relieve the stress accessible from high taxes and inflation rates. Are you among these people? If you are, you want to pursue a more financially stable present and future.

Do you desire to get a loan? Then we’ve got you covered!

If you are here to learn the facts on moneylender loans in Singapore, sit back and take notes. As this guide will assist you in understanding the lawful ties of moneylending in Singapore, loans to obtain and specifics, whether you’re an eligible client or not and more!

Moneylenders loan in Singapore Legally

Singapore has a strong economy due to its financing industry. Thus, it can’t be helped to get caught up with the current need to loan money from financing institutions.

Because of such particular needs, the country’s finance and moneylending industry consistently follows challenging and high-standard operations. It’s to ensure that the government maintains its best banking and lending practices that are famous worldwide.

For a borrower like you, it can be an overwhelming situation, especially not knowing the specifics of the lending industry. The news of illegal moneylenders is rampant, which causes you to worry more about such transactions.

But the fact is moneylenders loans in Singapore legally. The moneylending industry is under the jurisdiction of the Ministry of Law, and the Registry of Moneylenders regulates the licenced lenders in the country.

The following fact you must learn is where to borrow money from in Singapore legally.

Legally Borrowing Moneylenders Loan

For a borrower like you, you must be extra careful with your loan transactions. You have to select which financing or lending industry fits your needs more. The top lenders in the country are banks, financial institutions, and moneylenders.

Singapore’s traditional banks have more stringent eligibility and requirement screening. Specifically, you must present a suitable to excellent credit score from 1800 to 2000, a minimum annual income of S$20,000 or more, and stable employment or source of income.

Moneylenders loan in Singapore also filters their borrowers via creditworthiness, annual income, whether they’re self-employed or have steady jobs. But, legal moneylenders are more forgiving, particularly regarding credit scores.

To legally borrow from a moneylender’s loan in Singapore, you must first fulfil the eligibility criteria and requirements. You must be sure you’re dealing with a licensed moneylender, like Accredit Money Lender, so all transactions are under the Ministry of Law’s Moneylenders Act.

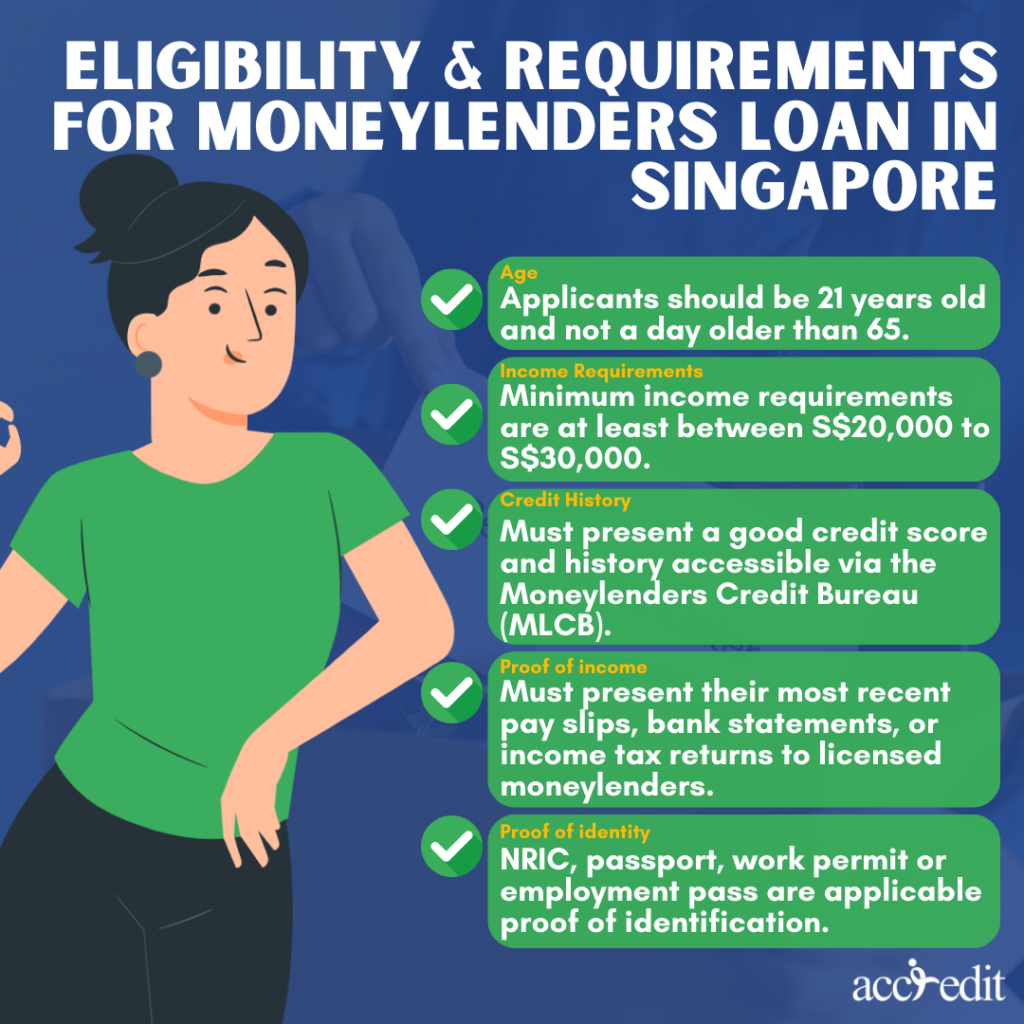

Eligibility and Requirements for Moneylenders Loan in Singapore

Moneylenders loans in Singapore have various eligibility criteria and requirements. It varies on the moneylender’s policies and other factors. However, you can prepare for a loan transaction from a licensed moneylender by knowing and setting the criteria and requirements first.

Here are the standard criteria and requirements for moneylenders loan in Singapore:

- Age: Applicants should be 21 years old and not a day older than 65.

- Income Requirements: The range of minimum income requirements are at least between S$20,000 to S$30,000.

- Credit History: Applicants must present a good credit score and history accessible via the Moneylenders Credit Bureau (MLCB).

- Proof of income: Applicants must present their most recent pay slips, bank statements, or income tax returns to licensed moneylenders.

- Proof of identity: NRIC, passport, work permit or employment pass are applicable proof of identification.

Moneylenders Loan Transaction Facts

Singapore’s moneylenders are responsible for lending assistance to bona fide Singaporean Citizens, Permanent Residents, and foreign work pass holders.

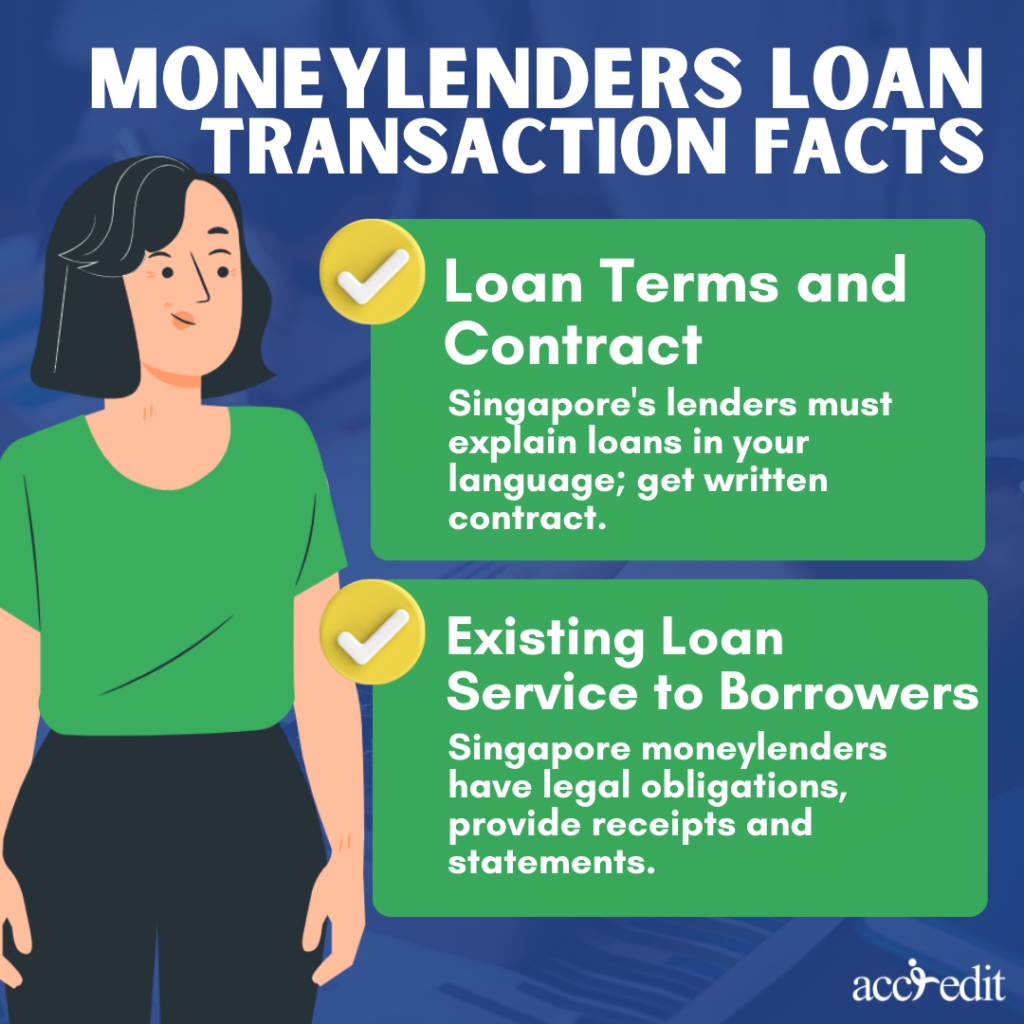

Here are additional facts you must discover before taking out a loan from a licensed moneylender:

- Loan Terms and Contract

Legitimate moneylenders in Singapore must explain the loan terms and contracts to their borrowers like you. It has to be in the language that you feel most comfortable with.

Also, you have the legal right to acquire a signed copy of their loan contract, including terms and separate cautionary statements, all in writing.

- Existing Loan Service to Borrowers

Moneylenders loan in Singapore have legal obligations that entail proper practices and services, particularly to you and if you have existing loans.

The Moneylenders Act requires all licensed moneylenders to issue receipts to all repayments borrowers provided towards the existing loan. In addition, licensed moneylenders in Singapore must grant you their statement of accounts once within half the year, specifically during January or July.

These responsibilities lie heavily to anyone who wants to lend money to someone legally. Nonetheless, the primary responsibility of a licensed moneylender is to earn the licence to operate the moneylending company in Singapore.

Types of Moneylenders Loan in Singapore Options

All borrowers like you have diverse financial needs. Licensed moneylenders in Singapore grant different loan types that’ll suit your requirements. These are the several moneylenders’ loan Singapore types you may choose from:

Business Loans

Start-up business owners and SMEs in Singapore may seek a business loan in Singapore. The loan type can offer financial coverage to expand company operations, manage cash flow, or purchase equipment or machinery.

Debt Consolidation Loans

The moneylenders’ loan Singapore option can assist you in consolidating various debts into one payment. It’ll help you immensely simplify your finances and decrease total interest payments.

Payday Loans

An ideal loan choice if you find your budget in trouble a long way before your next salary. It’s a short-term loan that can cover urgent expenses. You must repay the payday loan 14 days to a month in a lump sum on your next payday.

Personal Loans

A personal loan is a popular unsecured loan in Singapore. It’s why many borrowers prefer seeking a licensed moneylender for loan assistance. Primarily because personal loans are flexible to use, whether for financial emergencies, additional funds for special events or occasions, home or car repairs, or to consolidate debts.

Moneylenders in Singapore Laws and Regulations

The Moneylenders Act is the primary law and regulations they must abide by as licensed moneylenders in Singapore.

The legislation intends to curtail illegal moneylending activities, specifically done by Ah Longs or loan sharks. It was first enacted in 1936 and continues its amendments to meet the modern demands of the communities living in Singapore.

The Act specifies the diverse types of moneylenders authorised by the law, such as extended, exempt, and licensed moneylenders.

All registered lenders can legally lend money to someone with due diligence to comply with the stipulated loan caps on interest rates, fees, and charges under the Act, such as;

- Interest Rates

Licensed moneylenders in Singapore do not have the privilege to impose interest rates according to their wishes. The Moneylenders Act limits the maximum interest rate changes to 4% per month.

No matter the borrower’s annual income or whether they’re requesting a secured or unsecured loan, the interest rate remains at 1% to a maximum of 4% monthly.

- Loan Principal

All licensed moneylenders may impose a one-time administrative fee that will never exceed 10% of the loan’s principal.

- Late Interest Rates and Fees

Late payments are natural occurrences in the finance industry. Because of its prevalence, the Moneylenders Act improved its approach to late interest rates and fees.

Late interest rates shall be 4% monthly, with the late fees at $60 monthly. Any changes done by a licensed moneylender are legally viewed as blatant efforts to disobey the Moneylenders Act.

As a legal borrower, you can file complaints to the Ministry of Law and the Singapore Police Force.

Moneylenders Must Follow the Law

Of course, to legally lend money in the country, all licensed moneylenders must comply with the Act with uncompromising commitment.

As with every legislation with strict regulations, those proven guilty of such acts breaching the Moneylenders Act are penalised according to the law. Otherwise, it’s inevitable to get labelled as an unlicensed moneylender.

First-time Offenders:

People discovered guilty of carrying on or assisting in unlicensed moneylending activities may be jailed for up to four years, will pay a fine between $30,000 and $300,000, and be caned up to six strokes.

Moneylending in Singapore is recognised for its influence on the community and the country’s economy. But, it is a risky business because most of the loans provided are unsecured. With these loans, moneylenders in Singapore don’t demand the borrower to give any collateral.

It is crucial that regardless of the riskiness of the business, moneylenders should never harass borrowers. All a licensed moneylender can do is politely send notifications and reminders.

What happens when a moneylender sends rude, abusive text messages or calls to the borrower or vandalises properties, pestering the community associated with the borrower? The borrower can file a complaint or harassment case.

Harassment Cases:

Individuals found condemnable based on irrefutable evidence filed by the borrower is subject to paying a fine not less than $5,000 and not exceeding $50,000 with mandatory imprisonment of up to five years and mandatory caning of up to six strokes.

However, if the borrower doesn’t comply with their obligations, a licensed moneylender may go to court and seek legal assistance to get the funds they loaned.

You must contact the Registry at 1800-2255-529. Also, you may acquire assistance from Singapore’s Police Force by calling their hotline at 1800-255-0000.

Moneylenders in Singapore Licensing

Interested moneylenders must apply to the Registry of Moneylenders for the legal right to lend money to someone.

People interested in building a business in moneylending in Singapore have to register with the Moneylender’s Test Booking System and then get a test slot, and pay a non-refundable fee of S$130. The fee is inclusive of GST.

However, the Ministry of Law has since halted all licensing processes for individuals desiring to become licensed moneylenders. It’s only temporary for now.

Moneylenders Operations and Transparency in Singapore

Passing the Moneylender’s Test doesn’t automatically mean licensed moneylenders can then process to loan money to their borrowers. Yes and no.

Although the licensed moneylenders now have licenses to operate in the lending industry, they must fulfil all licencing processes for their companies.

Licensed moneylenders should apply for licensing for businesses, business locations, staff, etc. They must also present their licence for borrowers to see via their office certifications or official websites.

These acts are notable for the transparency licensed moneylenders must present to borrowers like you. It’s to earn your trust and ensure you are safe and protected from illegal moneylending activities.

Choose Moneylenders Loan Singapore for Financial Needs

Moneylenders loan in Singapore isn’t complicated to understand. You only have to know and learn about the specific law and regulations before you apply for a loan from them. Evaluate your eligibility and prepare the requirements at all times.

Select the loan type that fits your needs at the moment. Remember the loan cap interest rates and charges to guarantee you won’t have to deal with hidden charges.

Be sure to assess the loan agreement to guarantee loan transaction transparency constantly. Don’t hesitate to practice your legal rights as a borrower by filing a report or complaint against illegal moneylending activities.

Licensed moneylenders in Singapore aim to offer you the monetary assistance you deserve. And knowing and understanding these facts on moneylenders in Singapore gives you better chances of ensuring the transaction is legit and free from illegal activities.

If you’re looking for a fast, customer-focused, and accessible loan in Singapore, you only have to turn to Accredit Money Lender. It’s the licensed moneylender you can trust. Apply now to obtain exceptional loan service and experience!