Ahh, the holidays in Singapore. A time when the Lion City truly roars with festive cheer, glittering lights, and, if to be honest, a tinge of consumerism. Although it’s a season of joy, gifts, and empty wallets, you need licensed moneylenders on holidays.

It’s the most common scenario many people encounter during the financial holiday frenzy. Thus, it’s imperative to yearn for a solution as desperately as Kevin in “Home Alone” longed for his family.

Then behold, your financial Santa Claus has come to town – Singapore’s moneylenders open on holidays.

Yes, you’ve heard it right. Yet, what makes these festive financiers unique?

And why must you be more exhilarated about them than a plateful of festive cookies? Unwrap this gift.

Licensed Moneylenders on Holidays

Like Kevin McCallister was left behind in the busy holiday chaos, have you ever felt left high and dry by the conventional financial institutions during these festive times? Yet behold, the licensed moneylenders on holidays will rescue you, granting you personal loans and more. They’re like the secret Santas in the finance world.

Their doors remain open even when the rest of the world is busy unwrapping presents. These licensed moneylenders comply with the Moneylenders Act and every provision applicable to all lending transactions with a borrower.

But what is it that truly separates these lenders from traditional banks? Imagine walking into a jubilant wonderland, where the loan approvals are as swift as Santa’s sleigh, and the interest rates are as soft as fresh snowfall.

They thrive on understanding the financial crunch during holidays and tailor their offerings to suit your monetary requirements. Does it sound too good to be true?

It’s comparable to Kevin setting out traps for Harry and Marv; it’s time for you to get into the further details of these licensed moneylenders on holidays.

Dashing Through the Snow or Stumbling Over Interest? Understanding Holiday Loan Rates

Singapore’s lending industry has interest rates that can be like Kevin scampering through icy sidewalks in Home Alone 2 – slippery and tricky.

Traditional banks might have you believe that borrowing during the holiday season is a financial misstep waiting to snowball into an avalanche of debt. So, you may presume you don’t have a chance to resolve your holiday cash fever. But what if you’ll find out that there’s a jollier alternative?

Licensed moneylenders on holidays are the season offer competitive interest rates of 1% to a maximum of 4% per month. It means you won’t have to spend your holidays worried about the Grinch of towering interests stealing your Christmas cheer.

Instead, you’ll be dashing through your joyous shopping, assured that your repayment terms won’t land you in financial frostbite.

On Donner, On Blitzen, On Fast and Flexible Terms: The Perks of Holiday Money Lending

Did you know that licensed moneylenders deliver a certain thrill they aim to provide?

Unlike traditional banks that move as slowly as a drowsy Rudolph, these lenders dash through the loan approval process like a team of eager reindeer. Whether flexible repayment terms or fast loan approvals on the same day, they can pull out all the stops to make your holiday borrowing as smooth as a sleigh ride on Christmas Eve.

Licensed moneylenders on holidays understand that the season is about celebration and joy, and these lenders ensure that the holiday cash flow problems won’t dim your festivities’ twinkle.

Santa’s Workshop or a Trap? Identifying Legitimate Holiday Money Lenders

So how do you ensure you’re walking into Santa’s Workshop and not a trap set by the Wet Bandits of finance?

The key is to do research. The Ministry of Law provides an accessible list of licensed money lenders, which serves as your guiding North Star in a snow-covered financial scenery. It’s crucial to compare holiday money lenders in Singapore; remember to ensure they’re on the Registry of Moneylenders’ list.

They may be unlicensed lenders or loan sharks if they’re not on the licensed moneylender list or directory.

Thus, use your diligence to pick the right lender. Because in the end, the right licensed moneylenders on holidays can light your holiday like the stunning lights on Orchard Road.

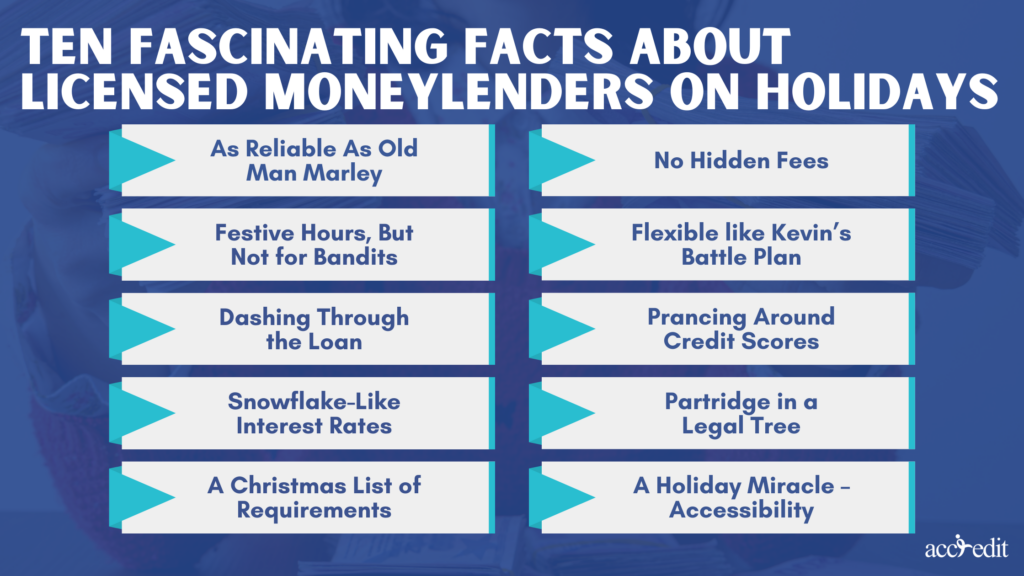

Ten Fascinating Facts About Licensed Moneylenders on Holidays

Would you like to dive into holiday-filled money lending?

It’s time to unwrap the enigma that is the licensed moneylenders on holidays. These ten facts are your trusty BB gun, protecting you from the misconception of burglars or unlicensed moneylenders that often sneak around in this industry.

So, get ready to say. “Keep the change!” to any doubts about holiday money lending.

As Reliable As Old Man Marley

Licensed moneylenders on holidays are as reliable as Old Man Marley, the misunderstood Home Alone hero. They are registered under MinLaw’s Registry of Moneylenders, ensuring every operation is as transparent as a holiday window display.

Festive Hours, But Not for Bandits

Licensed moneylenders keep their doors open even during the festive seasons. They’re always there, ensuring your financial needs don’t have to wait until the carol singing ends.

Dashing Through the Loan

With their fast loan approval process, whether business loans, payday loans, foreigner loans, debt consolidation and personal loans, you can feel confident that they’ll address your financial requirements fast.

Snowflake-Like Interest Rates

No two snowflakes are the same. It’s similar to the interest rates that licensed moneylenders set. Don’t fret because they’ll set competitive rates within the Act’s regulations. So, your repayment terms won’t be chilly as a holiday night.

A Christmas List of Requirements

To apply for a loan, you only need your identification card, passport, proof of residency, proof of income, proof of employment, and the spirit of trust.

No Hidden Fees

These lenders maintain transparency throughout the process. So you don’t have to worry about hidden fees creeping up on you.

Flexible like Kevin’s Battle Plan

The loan terms from these licensed lenders are just as flexible. So you can manage repayments without any holiday stress.

Prancing Around Credit Scores

While banks may prance around your credit score like a skittish reindeer, holiday money lenders take a more comprehensive view of your financial situation. They’ll consider all factors and may still approve your loan.

Partridge in a Legal Tree

The operations of these money lenders are wholly legal and abide by the Singaporean Laws. Thus, borrowers like yourself are well protected against unfair lending methods.

A Holiday Miracle – Accessibility

Accessibility is their middle name. With accessible online applications, getting a loan from licensed moneylenders on holidays is like ordering a cheese pizza – easy, quick, and satisfying.

Licensed holiday money lenders are indeed the gift you need, like Accredit.

Accredit: A Paragon of Holiday Lending

It’s the friendly face in the crowd of holiday money lenders is Accredit. They’re your perfect partner in steering the holiday financial scenery.

Accredit is reliable, operating transparently, with a speedy loan process and approval. They’ll help you shine bright all holiday and be holly, jolly, and stress-free!

You can confidently claim that your holiday season with Accredit doesn’t have to be fraught with financial worries.

Be Merrt and Money-Wise with Licensed Moneylenders on Holidays

Remember, the holidays are about being merry and bright. Licensed moneylenders on holidays, especially the reliable elves at Accredit, are there to guarantee monetary concerns don’t steal your yuletide cheer. With their flexible terms, fast approvals, and holiday-friendly operations, they are the gift that keeps giving.

So, the next time you feel alone and need a quick cash solution during the Singaporean holidays, keep calm. Remember, the Santa of financial aid is never far away from you.

With licensed moneylenders on holidays awaiting you, you’ll never be alone in dealing with unexpected expenses. Thus, here’s to a holiday season with love, laughter, and financial stability. Merry Borrowing!