Would you say Singapore’s financial sector is a throned and buzzing episode of “Justice in the City,” an engaging legal drama set in Lion City’s heart? With every scene, businesses, individuals, and organisations jostle, negotiate, and make calculated moves, all striving for financial victory. Thus, a borrower like yourself must hear law advice on licensed moneylenders.

Why? Simply because it’s your lawful right as Singapore’s valued community. Furthermore, licensed money lenders are like the drama’s reliable, ever-present lawyers. They are critical in facilitating transactions and bridging the gap between borrowers and ethical creditors.

But where do law firms fit into this intricate plot?

The Legal Script: An Overview of the Law Advice on Licensed Moneylenders in Singapore

Law advice on licensed moneylenders in Singapore regarding lending is like the crisp, carefully penned scripts of a legal drama: precise, demanding, and sometimes intimidating.

For instance, the Moneylenders Act and Rules regulate moneylending activities, providing a specific outline for what lenders can and cannot do. In the glitzy world of financial dramas, these lawful rules are the unsung heroes, the scriptwriters writing intricate stories to keep the economic ecosystem well and balanced.

But what does this mean for you, the potential borrower?

Legal Eagles and Money Lenders: The Vital Role of Law Firms in Advising on Licensed Moneylending

Law firms are the expert directors in this financial series, adept at steering both the lenders and you as a borrower through the legal drama. Like the seasoned actors memorising their lines, law firms familiarise themselves with the loan regulations. As a result, they can advise lenders on compliance and borrowers on loan eligibility, requirements, and even dispute.

Don’t you feel reassured knowing that such skilled and professional directors guide your financial journey according to your need?

But what are these loan opportunities they advise on?

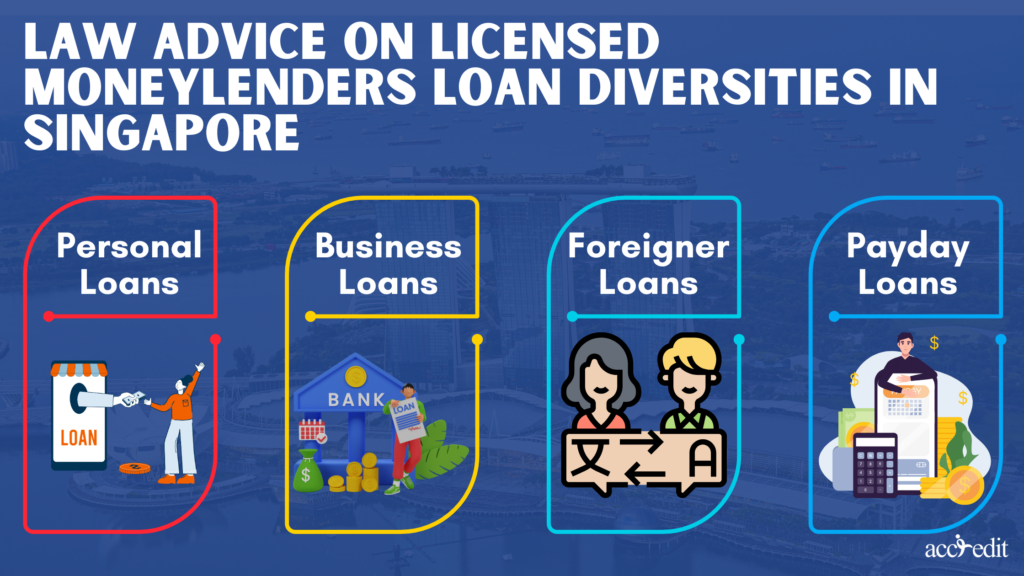

Law Advice on Licensed Moneylenders Loan Diversities in Singapore

In Singapore’s grand theatre of the financial sector, a variation of loan options await you. There’s always a credit line that fits most suitably for every borrower’s needs and preferences.

Personal Loans:

Ladies and gentlemen, here are the best supporting actors of the financial drama – trustworthy, reliable, accessible, and exceptionally crucial. Personal loans provide a suitable sum you can repay within a few months to a few years in fixed monthly instalments.

Business Loans:

Are you currently searching for the best lead actor for your business?

For SMEs, the loan protagonist helps immensely drive Singapore’s economic narrative. Business loans deliver what every company needs, the capital to fund operations, expansion, and growth.

Foreigner Loans:

It’s an exciting cameo in the financial theatre, and these loans cater specifically to the valued non-Singaporean residents in Lion City.

Payday Loans:

These are the quick-fix solution, the thrilling plot twists that help the protagonist when you find yourself in a tight monetary spot. These loans deliver immediate funding to help you survive your busy days until the next paycheck.

So, how do law firms and lawyers assist borrowers when you seek their assistance regarding these loan options?

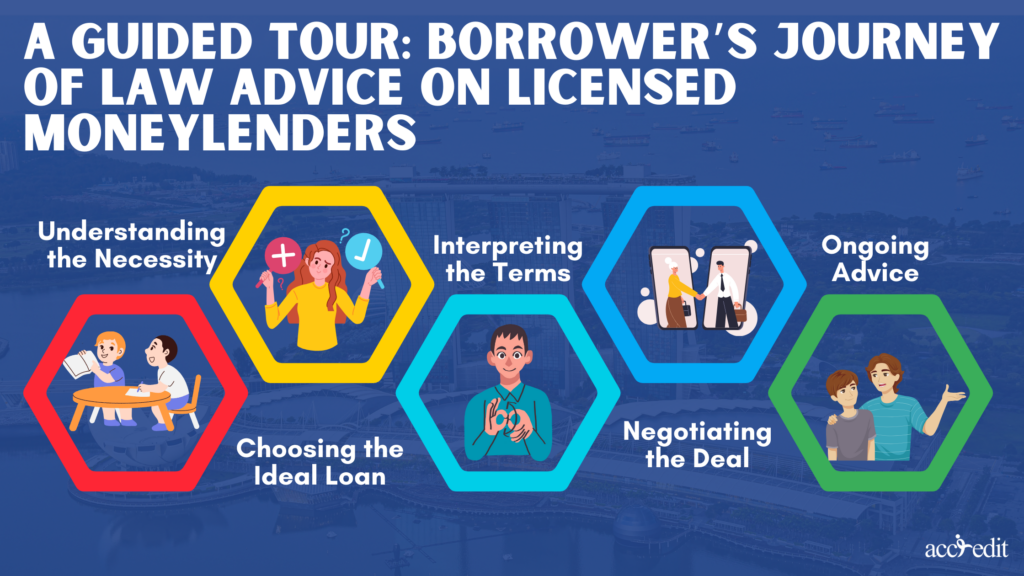

A Guided Tour: Borrower’s Journey of Law Advice on Licensed Moneylenders

Sometimes, a borrower needs an extra helping hand. It’s especially essential when you require more understanding of the play you’re about to watch. Confusing, isn’t it?

A law firm can advise on licensed moneylenders and the lending industry. They’ll be your guide in this specific scenario, leading you through the dramatic complexities of a loan process.

Understanding the Necessity:

Law firms will initially work with you to comprehend your financial situation and loan requirements. You could say they’re helping you understand your particular motivations as a character, laying the groundwork for the subsequent stages.

Choosing the Ideal Loan:

They then help you through the loan variations accessible, assisting you in picking the best option that meets your needs. It’s akin to selecting the most relatable character for a role: every detail matters.

Interpreting the Terms:

Do you need clarification on the legal jargon from the loan terms and conditions?

Don’t worry because a trusted law firm will ensure you understand the loan agreement’s terms and conditions down to the last detail. They will translate every piece of information for you, like in every language – that’s what they do.

Negotiating the Deal:

Like skilled negotiators in a tense courtroom, law firms can help you negotiate the loan terms, ensuring you get the fairest deal.

Ongoing Advice:

Even after you’ve secured your loan, law firms may continue to advise you, especially regarding repayment strategies and any legal changes that could affect your loan terms. They are reliable advisors who will stay by your side throughout the financial series.

Moreover, there are ten specific commandments you must follow. What are these precepts?

The Ten Commandments: Essential Laws Every Singaporean Borrower Must Know

Here are the rules regarding borrowing. These are like the excellent script in every award-winning legal drama series, thus written for a reason.

It’s time to break them down:

Rule One:

According to the Act, licensed money lenders must adhere to the monthly interest rate cap, which is a 4% maximum.

Rule Two:

All legal money lenders must explain the contract terms in the language borrowers like you understand best.

Rule Three:

You’re entitled to a copy of your loan contract.

Rule Four:

Late payment fees have a capping of $60 monthly.

Rule Five:

You may lodge a formal complaint with the Registry of Moneylenders if you believe a lender has acted unethically as per the Act.

Rule Six:

Licensed money lenders must avoid forcing you to sign an incomplete or blank contract. It’s against the law.

Rule Seven:

Legal money lenders should always provide you with a receipt for each repayment you make.

Rule Eight:

Authorised lenders must inform you about any changes to the contract.

Rule Nine:

Lenders cannot keep the borrower’s ID.

Rule Ten:

They cannot disclose your customer information or data without your consent, as it’s against the Personal Data Protection Act.

And most significantly, law firms will always advise you to search for reliable lenders only. Not loan sharks.

Thus, who can guide you to the best in your borrowing venture besides law firms?

The Star of the Show: Licensed Money Lenders

Licensed money lenders are the show’s stars, and with them, you’ll acquire professional financial solutions that the story revolves around. They present loan variations and terms which are more flexible than traditional banks.

Licensed moneylenders like Accredit are trustworthy sidekicks, consistently appearing in multiple episodes of your financial drama. Recognised and recommended by many law firms, Accredit delivers personalised loan services and guarantees detailed advice on loan terms and conditions.

Like award-winning scriptwriters, they perfectly balance compliance with the Moneylenders Act and Rules and customer satisfaction.

The Encore: Your Triumphant Financial Future Starts Now

Like every episode from noteworthy legal drama building towards the next, your monetary trip doesn’t end with one loan. It’s a continuum. A series of financial decisions that shape your future.

You can confidently pursue conscious decisions with the help of law firms and law advice on licensed moneylenders. You now feel secure with the knowledge you have and understand the game rules and use it to your advantage.

Thus. Singapore’s financial stage might appear like a complex drama. Nevertheless, with law firms directing the play and licensed money lenders like Accredit delivering sterling performance, you can be a self-assured actor in this production.

You’re ready for the next episode of your financial series because why not? The show must go on!