Moneylending in Singapore has continued to provide financial products to its community since the 1800s. Many changes occurred over time, and here are five things you must know before borrowing from legal moneylenders in Singapore. The specifications and lender functions became divergent, including legal moneylenders.

The businesses concentrate on moneylending grants extensive monetary assistance to many individuals. The intentions to borrow money from these companies vary, like emergencies, medical bills, paying rent, purchasing essentials, and even starting a business. In truth, borrowing money is no longer frowned upon but is considered an essential part of people’s lives.

Singapore’s Financing and Moneylending Industry

Singapore, Asia’s current and top financial hub, is unstoppable in the financing and moneylending industry. The Ministry of Law and Monetary Authority of Singapore duly regulates and imposes rules on all lenders in the country.

Thus, the existence of different types of moneylenders in the country can hinder borrowers from finding and choosing the best option.

If you plan to borrow money from a moneylender, first read through this article. Here, you’ll learn the comprehensive distinctions between Singapore’s different types of moneylenders.

In addition, determine the five you must know before borrowing from a legal moneylender: regulations, interest rates and repayment terms, loan specifics, risks and benefits. Discover why they’re the best option among the diverse types of moneylenders in the country.

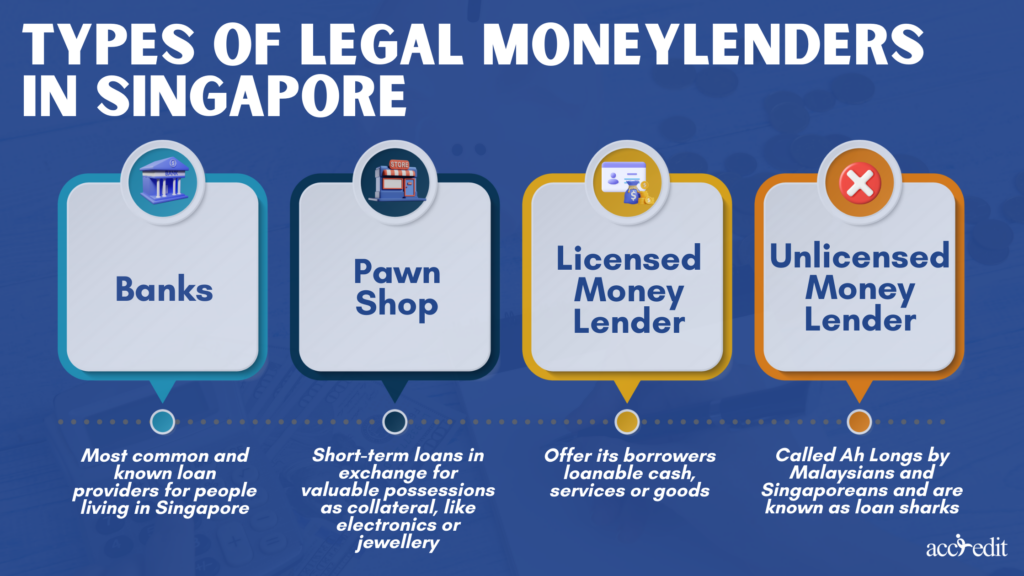

Types of Legal Moneylenders in SG

As a borrower, you have the legal rights to learn about Singapore’s different types of moneylenders. It’s essential to grasp these entities or individuals’ diversities, as not all lenders are equal.

Thus, it’s crucial to know precisely their distinctions to make an informed decision about which monetary business is worth trusting with your financial requirements.

Banks

Without a doubt, banks are among the most common and known loan providers for people living in Singapore. These businesses are under the strict regulations imposed by the Monetary Authority of Singapore (MAS). Aside from personal loans, banks also provide several products, such as credit cards, savings accounts, insurance products, and loan products.

Borrowers who acquire loans from banks have several repayment terms and methods to choose from, such as;

- Monthly instalments

- Partial prepayment

- Early repayment

- Lump sum payment

These monetary businesses have a lower interest rate than other moneylenders in the country. The estimated interest rates for mortgages and car loans may range from 1.5% to 2.5% per annum. Business and personal loans’ estimated interest rates may start from 3.5% to 8.5% per annum.

But the most significant factor for a borrower to become eligible to borrow money from a bank is presenting a stable income with additional documents and a good to excellent credit score.

Individuals with a stable job yet an unimpressive credit score or background could get rejected for the loan application. The higher the credit risk, the more cautious the banks are.

Risks that align with taking a loan from a bank are stringent eligibility requirements, collateral, and credit score impact. The benefits of acquiring from having a transaction with banks are lower interest rates, flexible repayment terms, and credible and trusted institutions.

Pawnshops

Another financial institution that lends money to its borrowers is pawnshops. These businesses are under the regulations of the Ministry of Law with the Registry of Pawnbrokers. Pawn Shops must adhere to the Pawnbrokers Act, which aims to protect consumers and guarantee a well-organised industry.

Pawnshops grant short-term loans in exchange for valuable possessions as collateral, like electronics or jewellery. The loan will be based on the item’s value which the borrower has to repay in a specific time, along with the interest rate. If the borrower cannot commit to the payment agreement, pawn shops may hold the pawned items for at least six months before it’s sold in auctions.

Interest rates from pawnshops are capped at 1.5% per month. Additional charges may apply for storage, appraisal, and insurance fees.

The risks of borrowing from a pawnshop are higher interest rates, limited loan amounts, and potential collateral loss. The benefits accessible from pawnshops are quick access to cash, no need for income verification, and no risks to credit score assessment.

Licensed Moneylenders

Licensed or legal moneylenders are under the regulations and laws of the Ministry of Law (MinLaw) and offer its borrowers loanable cash, services or goods. The types of loans a legal lender in Singapore are secured and unsecured, such as business loans, payday loans, bridging loans, and personal loans.

All licensed moneylenders in the country must abide diligently by the strict laws stipulated by the Ministry of Law. Or else the Ministry of Law may file a case against their legal faults.

These moneylenders are particularly popular in Singapore because although they’re under the Ministry of Law’s Moneylenders Act, they’re much more flexible than other financial businesses. For instance, a borrower ultimately declines the loan request or process if their credit score isn’t as exemplary.

Licensed moneylenders forgive the credit score and records. But a borrower needs to present proof of decent income and stable employment for the loan process to proceed to disbursement. It’s a small yet incredibly massive factor that borrowers consider whenever seeking financial assistance from a company.

Repayment terms and methods for loan transactions with licensed moneylenders are monthly instalments, lump sum payments, and automatic deductions. The interest rates are from 1% to 4%, with additional charges of up to 10% for administrative fees, 4% late payment interest, and early repayment fees.

Risks tied to licensed moneylenders are possible higher interest rates, loan repayment risks, and predatory lending practices. The benefits to experience from these legal moneylenders are quick access to funds, easy eligibility, and customisable repayment plans.

Unlicensed Moneylenders

These moneylenders are called Ah Longs by Malaysians and Singaporeans and are known as loan sharks. An illegal moneylender is not regulated by any government agency and primarily operates illegally.

Unlicensed moneylenders break every law in the Moneylenders Act. In particular, they are soliciting a loan from people who aren’t even considering borrowing money.

They promote misinformation via texts or calls regarding lower interest rates and recklessly advertise their illegal lending activities on social media or messaging apps.

Their usual targets are individuals in the country who need funds and are primarily habitual gamblers, foreign workers, and others. Unlicensed moneylenders will charge high-interest rates extensively while threatening and manipulating their victims when collecting debts.

These are the current and known types of moneylenders in Singapore. Some are considered illegal and should be reported to the authorities. At the same time, others are certified by government agencies and proffer their financial services to the people in Singapore.

But among these moneylenders, one stands out, and it’s the legal moneylender in Singapore.

Before borrowing from a legal lender in the country, there are specific things you have to know. These five things are essential for borrowers to know and understand. It’ll provide better visualisations and realistic expectations when loaning money from a legitimate lender.

Legal Moneylenders in SG Loan Approval

The loan approval process from legal moneylenders in Singapore is an aspect a borrower must consider before taking out a loan. It’s because, via understanding the procedure, a borrower can prepare themselves and increase their chances of approval.

The loan application process mostly requires the submission of necessary documents to the licensed moneylenders, such as;

- Passport, NRIC or government-issued identification

- Proof of residence or address via utility bills or tenancy agreement

- Proof of income, such as employment letter or latest payslip

- Bank statements to verify your income and expenses cycle

- Credit Score and history report

- Business registration documents and financial statements for business loans or mortgages

These are typically the general paperwork a certified lender asks for. Nevertheless, double-check and ask them for the complete list of essential documents.

Passing all the prerequisite documents speeds up the loan process. Thus, when you genuinely need the extra funds from a small loan, ensure you have every paperwork.

Legal Moneylenders in SG Borrowing Limitations

The Ministry of Law regulates all certified lenders in the country and strictly permits the lending of specific amounts. It’ll depend specifically on matching the borrower’s income. It’s a logically safe approach to ensuring borrowers won’t be overly burdened with debts and prevents predatory lending methods.

For instance, a borrower earning below $10,000 yearly can access $3,000 if or you’re a Singaporean Citizen or Permanent Resident. A foreigner working in the country with the same annual rate gets $500 for their max loanable amount.

Singapore Citizens, Permanent Residents, and foreigners in the country gaining a $10,000 minimum or not exceeding $20,000 per annum may take a $3,000 max loanable sum.

Singaporeans, Permanent Residents, and foreigners with legitimate tenancy obtaining at least $20,000 per year can take as much as six times their monthly income for the max loan amount.

Here’s a table to illustrate the specific borrowing limits and different salary levels:

| Borrower’s Overall Yearly Salary | Maximum Loan Amount |

| Below $10,000 | $500 for Foreigners and $3,000 for Singaporean public and Permanent Residents |

| $10,000 minimum and not exceeding $20,000 | $3,000 for Singaporean Citizens, Permanent Residents, and foreigners with work passes |

| $20,000 minimum | As much as six times the monthly salary |

Moreover, it’s worth noting that the indicated maximum loanable sum is mostly not 100% guaranteed. It’s because legal moneylenders in Singapore consider additional factors in the equation. These factors are your employment status and credit history.

It’s your responsibility to assess your current financial situation before taking out a loan. It’s the best practice to ensure you won’t overborrow and commit to the indicated repayment amount, interest rates, and schedules.

Legal Moneylenders in SG Rates and Fees

Certified lenders in the country are accessible for loan requests but impose high-interest rates and fees. The motion concentrates on the risky background involved with money lending. In particular, as most loans granted are unsecured credit, thus authorised lenders require to gain profits with their business.

4% Maximum Monthly Interest Rate

The Ministry of Law (MinLaw) stipulates that a legal money lender in Singapore may only charge a 4% maximum interest rate per month. For example, for every $100 loaned, the maximum interest rate chargeable is $4 monthly.

Yet, licensed moneylenders can levy additional fees like administration, late payment, and early repayment fees. These factors may surge the loan’s total cost.

For instance, a borrower gets a $10,000 loan with a 12-month tenure. If the lender demands 4% monthly interest, the overall interest charge will be $4,800 because $400/month x 12 months.

Also, the lenders can charge 10% administrative fees, which is $1,000. The total loan cost is $15,800 from the $10,000 loan + $4,800 interest charge + $1,000 administrative fee.

Loan Terms and Conditions

Borrowers must be aware of and understand the details of the loan terms and conditions. It’s essential to carefully review each provision before signing any contracts.

A legal moneylender in Singapore will assist you each step of the way to fully comprehend the information within the terms and conditions. If you have questions needing clarification, address them without hesitation. The certified moneylender should help you understand the contract’s terms and conditions.

Repayment Failure Leads to Additional Fees

All borrowers must know that failure to repay loans within the agreed contract will result in late payment fees. Thus, it’s wise to cautiously consider the repayment schedule and make sure you’ll pay the loan on time.

Assess Legal Moneylenders in SG’s Credibility

The Singaporean government often reminds its community to be on full alert and cautious when transacting with lenders in the country. It isn’t to target moneylending but to enhance the awareness of searching and applying for a loan only to legitimate and certified licensed financing businesses.

Making an informed decision is one of the best methods a borrower can use to uncover the lender’s reputation and credibility. There are steps to accomplish it by:

- Checking if the moneylender is duly licensed by the Ministry of Law. To ensure they’re credible in moneylending, borrowers may visit the Ministry of Law’s website. Applicants can search for the Registry of Moneylenders’ comprehensive list of legal moneylenders.

- Online reviews are essential tools you may check for, especially from previous customers, to see their first-hand experience with specific lenders. Search for independent websites for more legit and authentic feedback.

- Explore if they’re duly accredited by the Credit Association of Singapore (CAS) or the Moneylender’s Association of Singapore (MALS) usually indicates the lender’s authentic and reputable financial services.

- Asking for recommendations for friends or family members as their first-hand experiences help choose a reliable and credible lender.

- Visiting the legal moneylender’s office proves their establishment in the industry and legitimacy. Moreover, providing borrowers with the opportunity to ask questions and evaluate the level of professionalism and customer service of the lender.

Make Conscious Choices Borrowing from a Legal Moneylender

Borrowing any amount of cash from a moneylender is a significant obligation. For one, you must understand all the conditions and terms of the loan, as it’s a legally binding document.

You also become aware of the possible consequences if you fail to comply with the contract. Borrowers will face additional fees, undesirable credit score effects, and legal action.

Knowing these five things before borrowing from a lender benefits you. You’re now well-informed on the process, interest rates, fees, charges, and methods of searching for a credible lender. With this information, you can make a more practical, responsible, and conscious choice.