For a person who’s particularly cautious about personal finances, getting a loan is already beyond your safe space. It includes the many factors attached to the loan, especially when considering the moneylending interest rate.

Nonetheless, changing times require changing perspectives and strategies. Many people share the same mindset of steering clear from financing activities. But getting a loan isn’t a wrong move in specific circumstances.

Modern Moneylending in Singapore

Singapore’s moneylending has provided monetary assistance to needy individuals since the 1800s. However, in these earlier times, lending businesses were mainly involved in excessively high-interest rates and unrelenting fees. There were instances that moneylenders in the past imposed up to 20% or more interest rates and fees per month!

As a result, the Ministry of Law intervened in the matter. Thus, establishing the Moneylenders Act and Rules became a prominent guideline for moneylending in Singapore. The Registry of Moneylenders regulates and grants licenses to moneylenders.

Singapore’s community can rely on the Moneylenders Act and the Ministry of Law’s legal intentions. These entities ensure fair and balanced loan transactions between licensed lenders and borrowers. It’ll include the capping on the moneylending interest rate and fees.

Moneylending in Singapore

Singapore’s colossal financial market has taken the world. The country is the leading example and represents Asia’s financial centre.

In Singapore, banking, financial institutions, and financing businesses are the three main financing markets that most communities rely on. However, moneylending in Singapore has primary lenders providing its services to individuals in need of financial assistance are licensed moneylenders.

The practice of moneylending is simple. Registered moneylenders in Singapore assess eligibility, requirements, loan application and approval, and disburses cash to their borrowers.

The types of loan moneylending in Singapore providers are various. These are business loans, payday loans, bridging loans, education loans, debt consolidation loans, and renovation loans. However, personal loans are the most popular and sought-after financial products in Singapore’s moneylending.

What are Personal Loans?

A personal loan is a type of loan which proffers smaller amounts of funds accessible to the borrowers. It is also the kind of loan that is easier to apply for in Singapore.

Personal loans in Singapore prefer it amongst other loan products. It’s because it’s convenient to get and utilise cash for personal expenses, medical bills, travel funds, or car and home repairs. In the moneylending industry, it’s referred to as an unsecured loan.

It’s an unsecured loan because borrowers may seek and be permitted to borrow cash without using valuable possessions. For instance, you don’t have to surrender your real estate, vehicles, or assets as debt security or guarantee.

Many people presume that the amount obtainable from a personal loan needs to be more significant. It’s with the consideration of the moneylending interest rate that borrowers have to repay. Yet there’s a crucial reason behind the process and why its interest rate is higher than some loans.

Moneylending Interest Rate

Lending money in Singapore continues to help with the country’s economic stability. Even when some people see borrowing money as a bad personal financing practice, others can benefit well from taking a loan. The matter that bothers me most is the interest rate of moneylending in Singapore.

To clarify, loaning in the country is legal. It is under the Ministry of Law. The Registry of Moneylenders oversees, regulates, and protects the country’s borrowers and licensed moneylenders.

All licensed moneylenders enlisted in the Registry of Moneylenders must be committed and comply with the Moneylenders Act and Rules. Any person or group who breaches the laws and regulations from the Act and Rules are subject to punishment enforced by the Ministry of Law.

Among the crucial provisions of the Moneylenders Act is the moneylending interest rate.

The moneylending interest rate for a personal loan granted by a licensed moneylender in Singapore is from 1% up to 4% monthly.

Is the Moneylending Interest Rate High?

The Ministry of Law and the Monetary Authority of Singapore comprehend the riskiness of the moneylending industry. Even when it is managed by the authorities and with clear ordinances, rules help control issues of overborrowing and default, which are common incidents with small loans.

Furthermore, the monthly interest rate of 4% can offer the licensed moneylender a bit of leverage to acquire their return on investment faster, which they will use to supplement new unsecured loan applications in their businesses.

Always search for a licensed moneylender in Singapore to ensure you will only obtain a 4% interest rate for an unsecured and personal loan.

Types of Moneylenders in Singapore

Lately, there has been news regarding unlicensed moneylenders aggressively harassing their victims whom they’ve scammed and caused trouble. These unlicensed moneylenders are known as loansharks, or ah longs, as Malaysians and Singaporeans call them.

Due to their rowdy activities, the Ministry of Law – Registry of Moneylenders and Singapore Police Force implores people in Singapore to only borrow money from authorised and licensed moneylenders in Singapore.

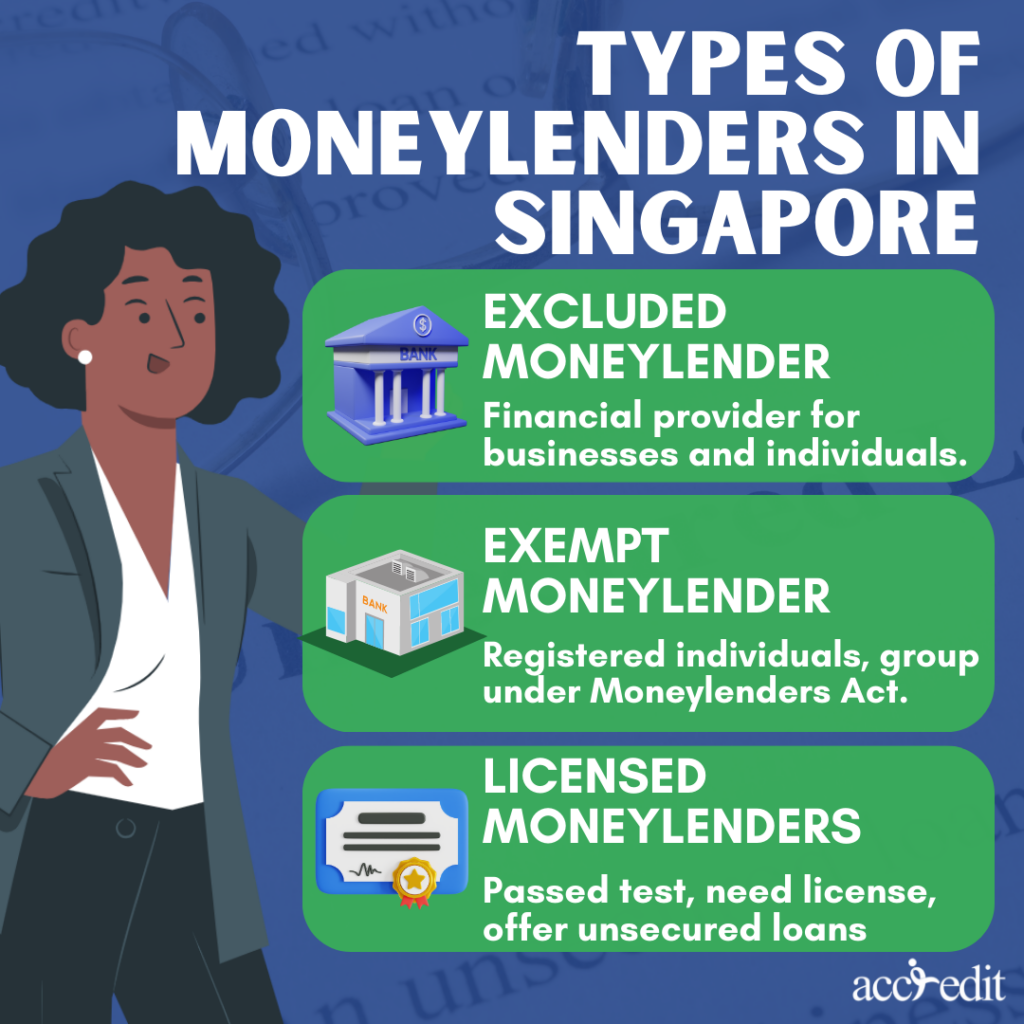

The authorised moneylenders in Singapore fall into three specific categories: an excluded moneylender, an exempt moneylender, and a licensed moneylender.

These groups have acquired their certifications and licences from the Registry of Moneylenders. Aside from their classifications, these moneylenders in Singapore are under diverse legal acts and proffer their financial services to particular systems and borrowers.

Excluded Moneylender

A person or a body that concentrates on providing financial assistance to corporations, business trustee-managers, real estate trustees, accredited investors, limited liability partnerships, or can be an individual who grants their employee loans as an employee benefit.

Exempt Moneylender

An individual or group who consciously applied to the Registry of Moneylenders to have their businesses become exempt moneylenders. It is essential that their companies fall under the clauses of the Moneylenders Act, sections 35 and 36, to be awarded the exemption.

Licensed Moneylenders

A person or group who applied for the Moneylender’s test and passed it. Aside from passing the test, these licensed moneylenders must obtain business licences, or they will not be allowed to operate within the moneylending industry in Singapore.

The licensing process for a moneylender is an essential step for the business to grow and operate its full loaning potential to borrowers.

These moneylenders in Singapore are easily seen or accessible to borrowers. Not because they solicit their loans to borrowers but because they are included in the official list of the Registry of Moneylenders.

The Registry specially ordains Moneylending in Singapore, and all licensed moneylenders must provide financial assistance by the Moneylenders Act.

Licensed moneylenders in Singapore usually grant unsecured loans to their borrowers. But, they can cater secured loans if their borrowers pursue it.

Average Moneylending Interest Rate

In this case, the 4% interest rate of moneylending is fixed whether the loan request is secured or unsecured. It is stipulated in the Moneylenders Act and has been an active regulation since 1 October 2015.

Additionally, the 4% interest rate of moneylending is pertinent to the max amount loanable by borrowers.

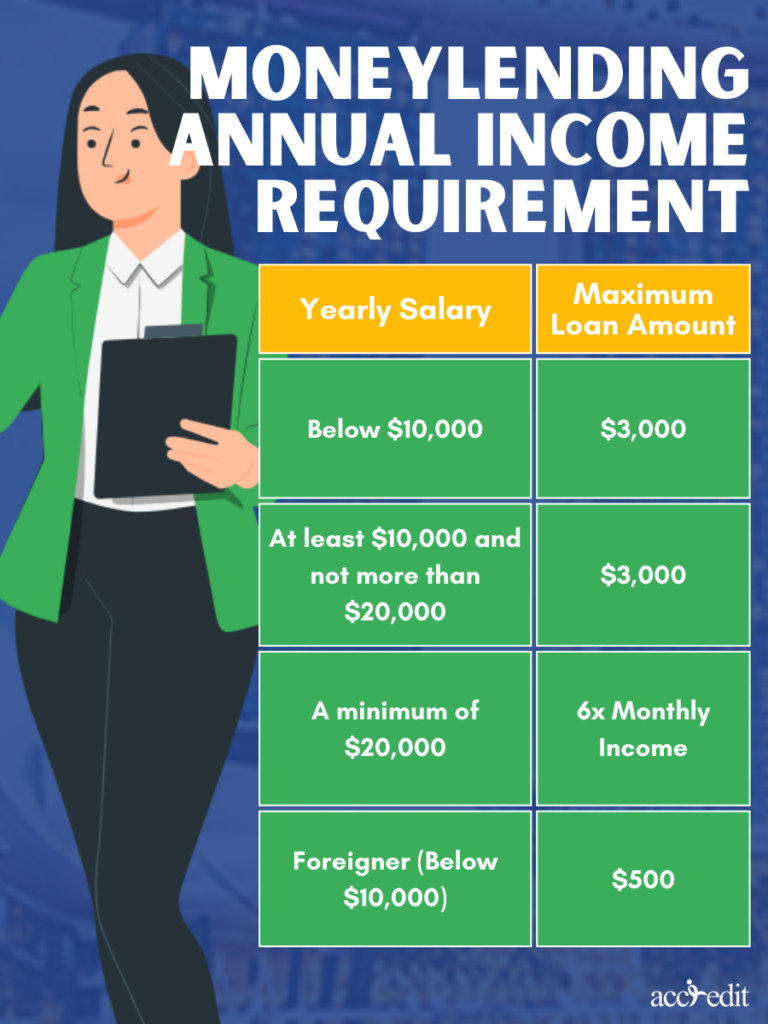

Moneylending Annual Income Requirement

The qualifications for the maximum sum loanable from a licensed moneylender in Singapore would depend on the borrower’s citizenship and annual income as follows;

Below $10,000 Total Yearly Salary:

For a Singapore Citizen or Permanent Resident obtaining a yearly salary of below $10,000, you are allowed to take a maximum sum of $3,000.

If you are a foreigner living and working in the country with the same acquired yearly overall salary, you get $500.

At Least $10,000 and a Minimum of $20,000 Total Annual Salary:

For a Singapore Citizen, Permanent Resident, or foreign work pass holder with at least $10,000 or a minimum of $20,000 annual salary, you may take a maximum loanable amount of $3,000.

Minimum of $20,000 Total Yearly Salary:

A borrower who’s a Singapore Citizen, Permanent Resident, or foreigner residing in the country earning an annual income minimum of $20,000 can have access to a maximum loanable sum of up to six times your monthly salary.3

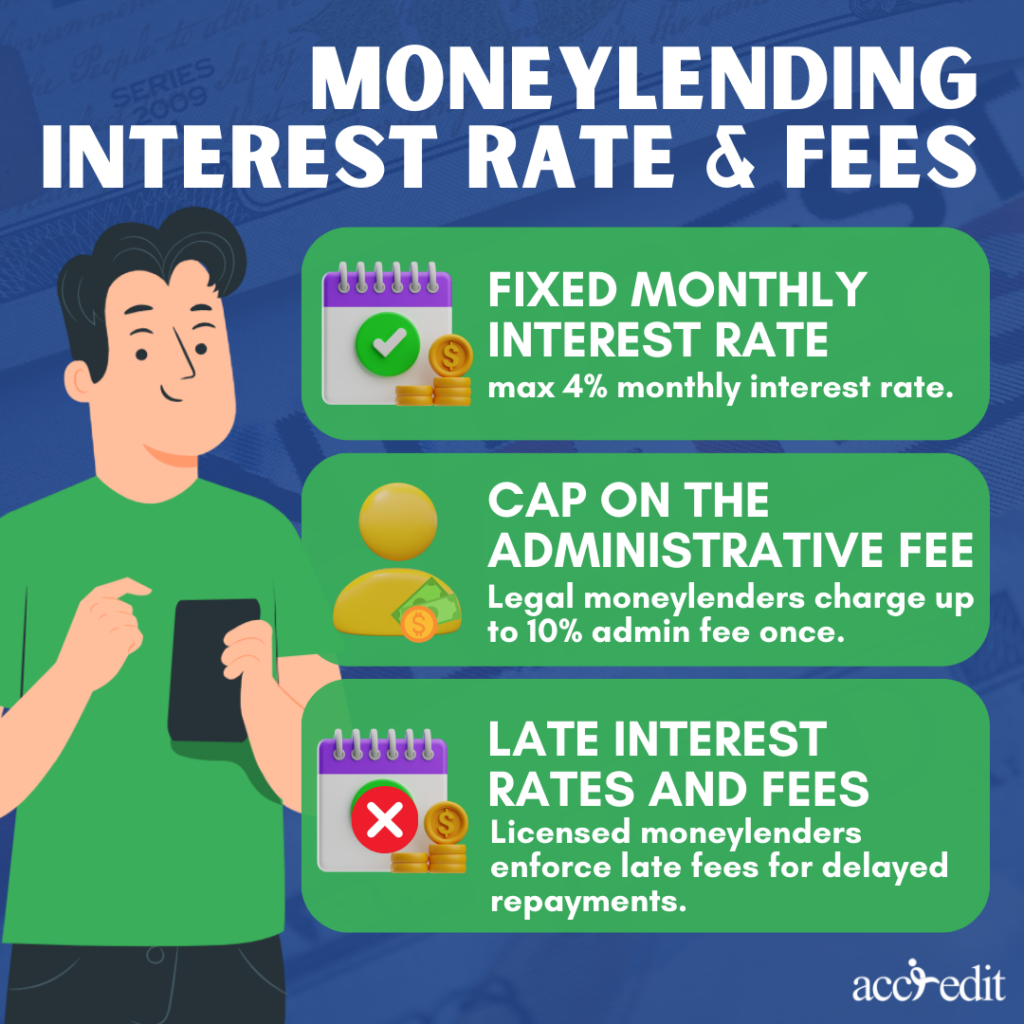

Moneylending Interest Rate and Fees

The 4% interest rate of moneylending applies to all these and is fixed according to the Moneylenders Act. Besides the 4% interest rate of moneylending in Singapore, are there more loan caps that you should be aware of? There are, and these are the administrative fee, late interest rates and fees.

- The administrative fee is 10% and is from the loan principal. A licensed moneylender will charge this only once. And the rate is fixed and mustn’t be altered in any manner or amount.

- You must fulfil the designated late interest rate and fee once you miss your repayment schedule. The interest rate for delayed payment is 4% for each month you overlooked and $60 for the fee.

The average is the late 4% interest rate of moneylending and fee. If a moneylender attempts to add more, it has to be reported. Complainants can contact the Registry at 1800-2255-529 or through the website at services. law.gove.sg/enquiry/.

Use Moneylending Interest Rate to Your Loan Advantage

Handling any monetary issue can be a big concern to a person, especially if you have yet to venture into the moneylending industry. The threats of unlicensed moneylending intentionally pushing the interest rate higher gives the moneylending industry a bad reputation. The news often causes stress to borrowers and the community.

However, gaining awareness about the industry does help with avoiding illegal moneylenders. Knowing which types of moneylenders are in Singapore gives you an advantage because all transactions are legal and legit. The details give you better chances of managing your finances by using the average moneylending interest rate.

Upon uncovering the average moneylending interest rate, you can quickly gauge the total loan amount you must repay. It’ll grant you time to prepare and adjust your finances according to your current situation.