Hey, have a got some great news for you today! Are you interested in obtaining Islamic banking in Singapore services and privileges but are curious about which banks these are and what services they can offer you, whether a personal loan or more? You’re in a comprehensible situation; indeed, you’re not alone.

As you’re one curious cat, that curiosity can be resolved! Because today you’ll be amazed to uncover the truths you must know of where financial services blend seamlessly with religious principles.

Uncover the fascinating history of renowned Islamic Banks in SIngapore, and explore its captivating sector in Singapore’s financial jungle.

What is Islamic Banking?

It was in 1963 when the initiation of modern Islamic Banking came to be. But as time evolves, so do some practices. Among these is the present-day Islamic Banking that debuted in 1975.

OCBC Bank

The Overseas-Chinese Banking Corporation has all the banking services any Singaporean citizen and community can wish for. It includes Islamic banking.

Did you know that OCBC Bank is the powerhouse that launched Al-Amin?

Al-Amin is the Islamic banking subsidiary of OCBC and has the full name OCBC Al-Amin Bank Berhad. It made a distinctive mark because it is a Singapore-based Islamic bank established in the late 2000s.

Come on; it’s possibly the best and most strategic position when it comes to considering Asia’s financial crossroads. Also, OCBC Islamic Banking in Singapore complies with Shariah regarding banking solutions in Asia.

When it comes to its mission, OCOC Bank’s Al-Amin focuses further on diverse banking activities that include:

- Personal Banking

- Advisory

- Capital Markets Services

- Treasury

You can expect that OCBC Al-Amin is committed to adopting and presenting Islamic principles and emphasises profit-sharing and risk-sharing mechanisms. OCBC Al-Amin guarantees ethical and sustainable practices for all its customers through such principles.

Islamic Banking in Singapore with DBS Bank

The Development Bank of Singapore, more commonly known as the DBS Bank, brought its financing force to the country’s banking industry in 1968. Since many people in the region are committed to Islam practices, thus, DBS also ventured to expand its services via Islamic banking in 2004.

Do you think it was DBS Bank’s strategic move? Yes, it is, but it’s also to provide and spread the essence of inclusive financial solutions that must cater to the diverse needs of the Singaporean population.

No one can deny the realities that DBS Bank is among the biggest banks in Southeast Asia. Moreover, the bank already has a solid and concrete financial foundation that has withstood many economic crises since its establishment. As it forayed into Islamic banking, it also allowed the opportunity to Shariah-compliant burgeoning market and services, such as:

- Deposit Accounts

- Fixed Assets Financing

- Working Capital Financing

- Islamic Financial Services

- Loans

- Digital Banking

As a customer eager to obtain Islamic banking in Singapore, you can rely on DBS Bank’s services. You will experience traditional banking expertise with Islamic principles that cater to your diverse financial requirements.

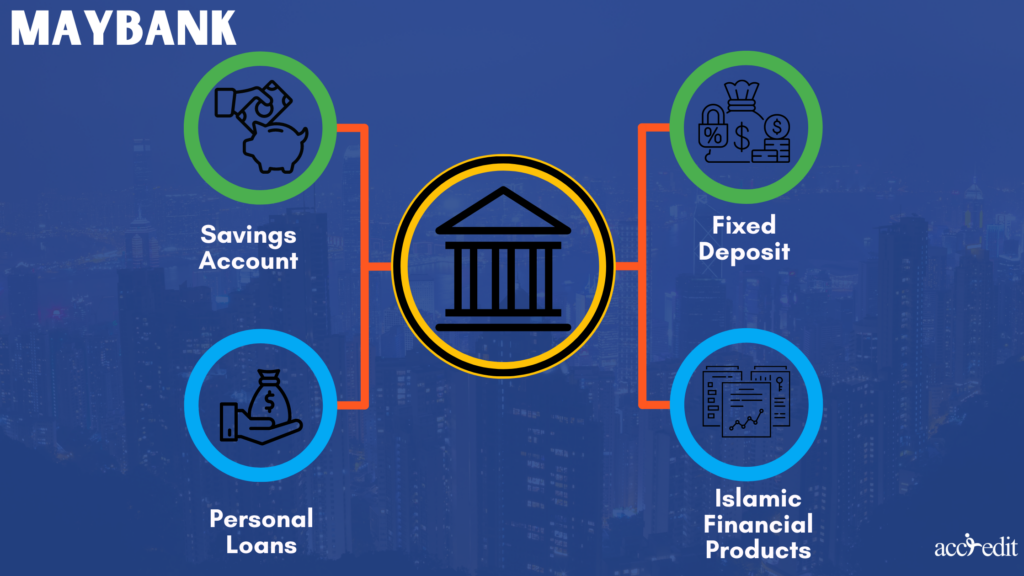

Maybank

The Malayan Banking Berhad, or Maybank, was founded by Tan Sri Khoo Teck Puat. He is a prominent and famous Singaporean business tycoon alongside his partner, Oei Tjong Ie. The Maybank was established in May 1960.

What was the founder’s vision for Maybank? They envisioned the bank to be a massive support to Malaysia’s economic growth, providing wide-ranging financial products and assistance to Singaporeans, individuals and businesses, including:

- Savings Accounts

- Personal Loans

- Fixed Deposits

- Islamic Financial Products

Maybank is among the largest banks in the world in terms of total assets and market capitalisation. It even took an outstanding ranking from the Banker’s 2020 Top 1000 World Banks and ranked 106th. It’s also among Forbes Global 2000 Leading Companies and typing at 349th.

All of this recognition is, without any doubt, astonishing as it is. Thus, it’s also comprehensible that Maybank would venture to a better and more comprehensive banking services inclusivity via Islamic banking.

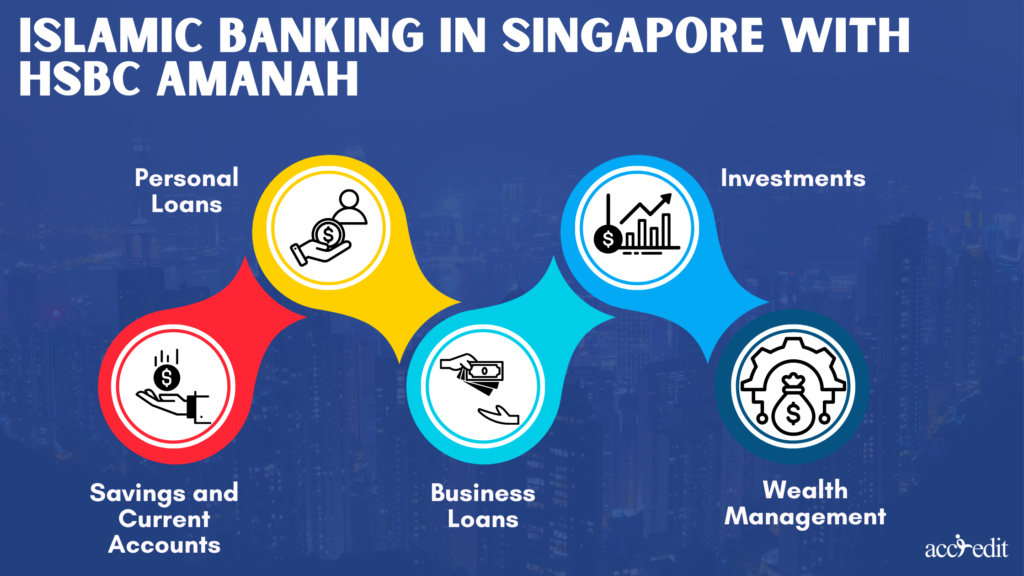

Islamic Banking in Singapore with HSBC Amanah

Who would have thought that a British multinational financial services holding company and the universal bank started relatively small? Indeed, the biggest surprises sometimes come in small packages.

An ideal example would be the Hongkong and Shanghai Bank. Thomas Sutherland, a Scottish banker, founded it on March 3rd 1865. It was a time when the British colony was managing the British Hongkong.

Only after a year it formally became The Hongkong and Shanghai Banking Corporation, which was made possible through the Hong Legislative Council’s Ordinance. In these modern times, HSBC Amanah Malaysia Berhad sprang to life in February 2008.

The bank continued to prosper in the banking industry, as it presented a wide array of banking services:

- Savings and Current Accounts

- Personal Loans

- Business Loans

- Investments

- Wealth Management

Although HSBC continues to reach new heights, it remembered to consider proffering Islamic banking in Singapore. The bank understands that many communities in Singapore are dedicated to their Islam preferences. Thus, the HSBC Amanah came to be.

The HSBC Amana is an esteemed member of the Shariah Committee and has granted Islamic financial services since 1994 in Malaysia and 1998 globally.

CIMB Islamic Banking in Singapore

The CIMB Group Holdings Berhad is among Malaysia’s biggest and most successful banks. Its headquarters is in Kuala Lumpur, founded in January 2006.

Did you know that CIMB is an abbreviation? Yes, it is. The bank’s full name is Commerce International Merchant Bankers.

CIMB has had glorious threads in its history, as it’s a product of historical bank mergers throughout the decades, starting with the following:

- Bian Chiang Bank

- Ban Hin Lee Bank

- Bank Lippo

- Bank Niaga

- Southern Bank Berhad

- Bank Bumiputra Malaysia Berhad

- United Asian Bank Berhad

- Pertanian Baring Sanwa Multinational Berhad

Thus, through such mergers and expansion, CIMB Islamic Banking became among its many banking services along with:

- Home Financing

- Personal Loans

- Savings Accounts

- Shariah-compliant banking solutions

Islamic Banking in Singapore: The Way You Like It

It’s a fact that Islamic Banking in Singapore has flourished throughout the years. It caters to the individual needs of customers and businesses seeking ethical and Shariah-compliant financial services. You have many selections for Islamic banking, all with banking expertise you can genuinely rely on.

And if you also need personal loans, you may explore beyond traditional banks or Islamic banking. Accredit Licensed Moneylender is approved by the Ministry of Law in Singapore and honours the Moneylenders ActIt’s’s the licensed moneylender that offers you viable solutions for personal financing.

The choice is always yours. You can freely embrace the Islamic banking world in Singapore and discover the magnificent harmony of faith and finance. No matter what financial products you seek, whether Islamic banking, personal loans, investments, or assets, such banks can grant your needs. Explore these financial service offerings from esteemed banks and licensed moneylenders and confidently move towards economic well-being with peace of mind.