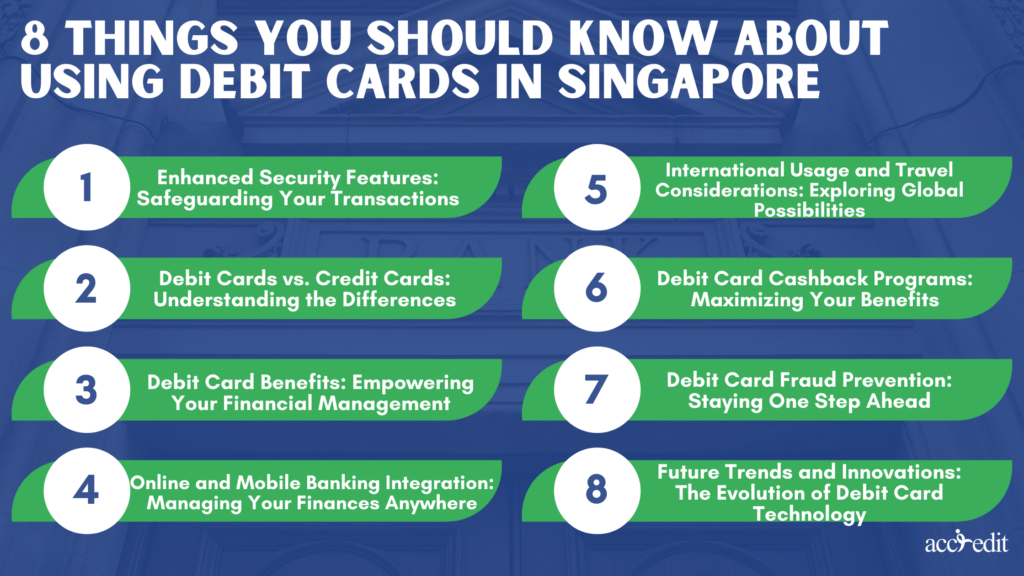

Amidst the cashless revolution, debit cards have emerged as indispensable allies in handling our financial matters. With their convenience and security, debit cards have revolutionized the way we make payments and access our funds. In Singapore, a financial hotspot brimming with sophistication, unraveling the intricacies of debit card usage holds the key to a treasure trove of advantages and possibilities. In this article, we will explore eight things you should know about using debit cards in Singapore.

1. Enhanced Security Features: Safeguarding Your Transactions

When it comes to debit cards in Singapore, cutting-edge security measures have been implemented to safeguard your transactions. These encompass PIN authentication, EMV chips, and the convenience of contactless payments. By utilizing a Personal Identification Number (PIN), only authorized individuals can validate transactions, amplifying the level of security.

Encrypted EMV chips introduce formidable technology that thwarts fraudulent attempts at card replication. And with the ease of contactless payments, a mere tap of your card on the payment terminal ensures swift and secure transactions, minimizing the perils of card skimming or physical theft.

2. Debit Cards vs. Credit Cards: Understanding the Differences

While debit cards and credit cards may appear similar, there are fundamental differences between the two. In Singapore, debit cards serve as a direct link to your bank account, enabling you to access available funds for your expenditures.

Conversely, credit cards grant you a credit line, permitting you to borrow money from the issuing institution. Unlike credit cards, the utilization of a debit card has no bearing on your credit score, as you’re essentially spending your own funds. This key distinction can influence your financial decisions and budgeting strategies.

3. Debit Card Benefits: Empowering Your Financial Management

In the realm of financial management, utilizing a debit card in Singapore brings forth a host of benefits that can revolutionize your approach. Primarily, it empowers you with enhanced control over your budget, as it restricts spending to the funds available in your account. By doing so, it safeguards against the perils of debt accumulation and excessive expenditures.

Moreover, debit cards grant effortless access to your funds, enabling convenient cash withdrawals from ATMs. They also facilitate seamless online and in-store payments, eliminating the need for cumbersome cash-carrying. With their adaptability and ease of use, debit cards emerge as an indispensable ally for your day-to-day financial transactions.

4. Online and Mobile Banking Integration: Managing Your Finances Anywhere

In Singapore, debit cards effortlessly blend with online and mobile banking systems, granting you full dominion over your financial matters. These platforms equip you with the ability to keep tabs on your account balances, monitor expenses, and establish spending boundaries.

Furthermore, online and mobile banking facilitates seamless fund transfers, bill payments, and even remote check deposits. The integration of debit cards with digital banking services offers unparalleled convenience and transparency, allowing you to manage your finances anytime, anywhere.

5. International Usage and Travel Considerations: Exploring Global Possibilities

When traveling abroad, using a debit card in Singapore comes with its own considerations. Before embarking on your journey, it’s important to be aware of foreign transaction fees imposed by your bank. Moreover, keep in mind that currency conversion rates can impact the overall expenditure of your transactions.

It is advisable to notify your bank of your travel plans to prevent your card from being blocked due to suspicious activity. By conducting thorough research into ATM availability and associated charges at your destination, you can strategically strategize your cash withdrawals.

6. Debit Card Cashback Programs: Maximizing Your Benefits

When it comes to debit cards in Singapore, a world of cashback programs awaits, ready to elevate your financial journey. Take the OCBC FRANK Debit Card, for instance, granting you a 1% cashback on fast food, select online fashion, convenience stores, and ride-hailing expenditures. Additionally, the UOB Debit Card offers a generous 3% cashback on Shopee Singapore.

By utilizing your debit card for transactions, these cashback programs allow you to reclaim a portion of your spending, ensuring tangible savings on your everyday outlays. Don’t forget to delve into your bank’s reward and cashback offerings to unleash the full potential of your debit card’s benefits.

7. Debit Card Fraud Prevention: Staying One Step Ahead

When it comes to safeguarding yourself against debit card fraud in Singapore, being proactive is key. Stay one step ahead by regularly examining your bank statements and transaction history to swiftly detect any unauthorized charges. Exercise caution when divulging your card information online, limiting it to secure websites exclusively.

Prioritize legitimacy and tamper-free conditions when conducting transactions at ATMs or point-of-sale terminals. If you suspect any fraudulent activity, waste no time reporting it to your bank and the appropriate authorities. By maintaining constant vigilance and implementing preventive measures, you can effectively minimize the risk of becoming a victim of debit card fraud.

8. Future Trends and Innovations: The Evolution of Debit Card Technology

In the ever-evolving realm of technology, debit cards are not left behind. Singapore witnesses a fascinating transformation in payment methods driven by future trends and innovations. The rise of contactless payments, enabling swift transactions with a mere tap of a card or mobile device, has captivated users with its unmatched convenience.

Seamlessly integrating your debit card into a digital wallet on your smartphone takes the ease of payments to new heights. Furthermore, the integration of biometric authentication, employing fingerprints or facial recognition, fortifies the security of debit card transactions. Keep an eye on these emerging trends as they revolutionize the way we use debit cards in the future.

Thoughts

When it comes to using a debit card in Singapore, prepare to be pleasantly surprised by the multitude of advantages and remarkable features it brings. With top-notch security measures and seamless integration into online and mobile banking systems, debit cards provide a convenient and secure way to handle your finances. By delving into Singapore’s exclusive perks and enticing cashback programs, you can fully capitalize on the benefits of your debit card.

It’s crucial to be mindful of international usage considerations and adopt effective fraud prevention strategies to ensure a worry-free experience. Finally, staying updated on future trends and innovations ensures that you are well-equipped to embrace the evolving world of debit card technology. Embrace the power of debit cards in Singapore and unlock a world of endless financial possibilities.

Discover Financial Solutions Beyond Debit Cards with Accredit Moneylender

Sure, debit cards are super handy for everyday transactions like groceries, shopping, and bills. But have you ever wondered if you could use your debit card for bigger expenses like home renovations or even a dream wedding? Well, here’s the deal: since your debit card is linked to your savings account, it might not be the smartest move to drain your savings completely for those hefty costs.

But fret not! When unexpected financial challenges come knocking, Accredit Moneylender is ready to come to your rescue. Our team of experienced staff is fully dedicated to providing the essential financial assistance you need. With our highly sought-after personal loans, you can access the funds you require for a variety of purposes.

Don’t miss out on the possibilities—get in touch with us today and let us help you navigate those unexpected expenses with ease.