Are you pondering the idea of securing a personal loan in Singapore? One of the crucial components of your loan decision-making process should be determining the loan’s repayment term.

How long will you be obligated to pay back the borrowed amount, plus interest? This article will delve into the loan tenure of personal loans in Singapore and equip you with the information necessary to make a knowledgeable choice.

The Basics of Personal Loans in Singapore

The arena of personal loans in Singapore offers a diverse range of options for individuals seeking financial assistance. These options encompass unsecured loans, secured loans, and payday loans.

Personal loan applicants in Singapore must be either citizens or permanent residents, and they must also meet the lender’s income requirements and credit score standards.

From a few hundred to several thousand dollars, loan amounts are quite flexible, and interest rates are based on a mix of lender policies and the applicant’s creditworthiness.

What is Loan Tenure?

The loan tenure in the context of personal loans refers to the duration over which the loan must be repaid, encompassing both the principal amount and the associated interest. The selected repayment period will have a direct impact on the monthly payment amount; therefore, it is imperative to thoroughly evaluate one’s financial situation prior to making a decision.

How Long Are Personal Loans in Singapore?

The loan landscape in Singapore is characterized by a wide range of personal loan options, with repayment terms that usually extend from one to five years. The precise term of the loan may fluctuate, dependent upon the loan amount and the lending institution. If you’re seeking a longer repayment window, some lenders do offer terms that go up to seven years.

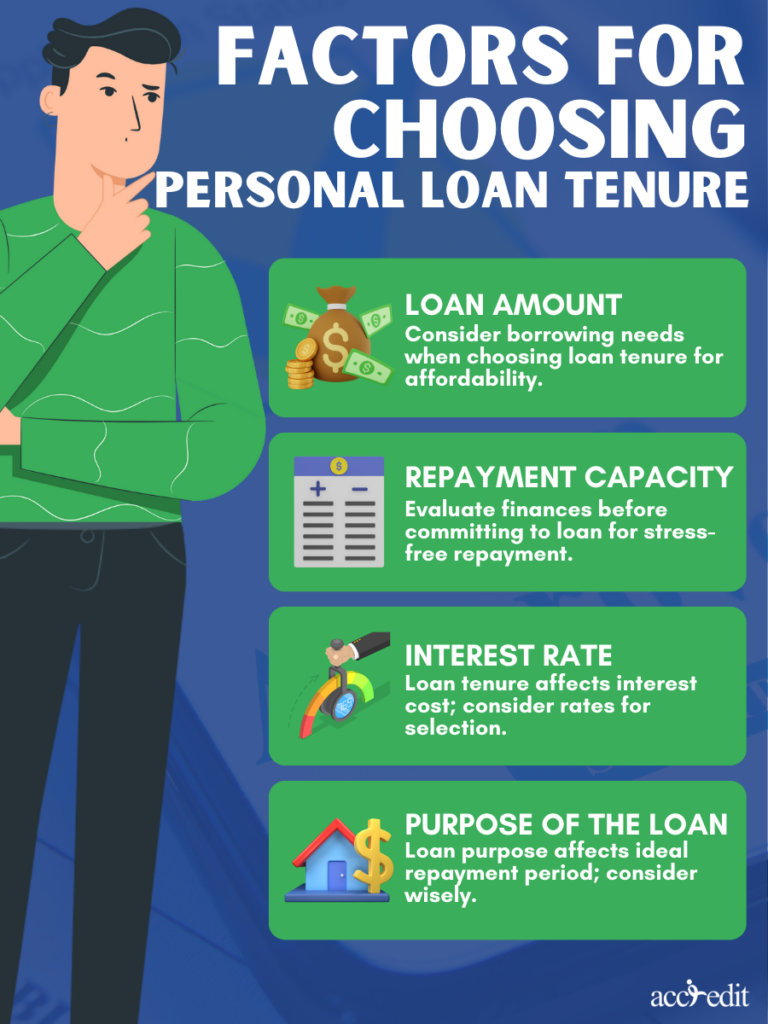

What factors should be considered when choosing a personal loan tenure?

The duration of your personal loan is an essential element that can greatly influence your financial equilibrium in the future. Thus, it’s crucial to consider several pivotal factors before determining the ideal tenure that suits your financial needs.

Loan amount

Your borrowing needs will play a role in determining the loan tenure. If you’re borrowing a considerable sum, it may be wise to opt for a longer repayment tenure to ensure that you’re able to meet the affordable monthly payments. On the other hand, if your borrowing needs are relatively modest, a shorter repayment period may be the way to go.

Repayment capacity

To ensure a smooth and stress-free repayment journey, it’s crucial to assess your current financial standing and income before committing to any loan agreement. Take a moment to gauge your comfort level with the proposed repayment terms, and consider whether your monthly income can accommodate the added debt.

Interest rate

The length of your loan tenure can also significantly impact your interest cost, which makes it vital to consider the interest rate when selecting your preferred duration. It’s essential to note that longer loan tenures come with increased interest costs, while shorter tenures result in lower overall interest payments.

Purpose of the Loan

Lastly, the intended usage of the loan can significantly impact the optimal repayment period. For instance, if you require funds for a brief and urgent expense such as a medical emergency, then opting for a shorter tenure may be prudent. Conversely, if you are borrowing to make a long-term investment in your business, a longer repayment period may be appropriate to ensure manageable cash flow.

Compare personal loan repayment rates in Singapore

With so many lending options available in Singapore; it can be a challenge to determine which personal loan provider offers the best repayment terms. Some providers, like Accredit, offer a short loan tenure lasting just one year.

In many traditional banks like Standard Chartered and UOB, to international powerhouses like Citibank, most lenders cap their loan tenure at 5 years. However, there are a few select providers, like HSBC and Bank of China, that extend the repayment period to a full 7 years.

| Personal Loan | Minimum Loan Tenure | Maximum Loan Tenure |

| Accredit Personal Loan | 1 year | 1 year |

| Standard Chartered CashOne Personal Loan | 1 year | 5 years |

| UOB Personal Loan | 1 year | 5 years |

| DBS Personal Loan | 1 year | 5 years |

| POSB Personal Loan | 1 year | 5 years |

| OCBC ExtraCash Loan | 1 year | 5 years |

| Citibank Quick Cash | 1 year | 5 years |

| CIMB CashLite Personal Instalment Loan | 1 year | 5 years |

| Maybank CreditAble Term Loan | 1 year | 5 years |

| HSBC Personal Loan | 1 year | 7 years |

| BOC $martLoan | 1 year | 7 years |

Choosing the Right Personal Loan for You

When it comes to choosing a personal loan, simply focusing on the loan tenure won’t cut it. It’s imperative to weigh in on the interest rate, loan amount, and processing fees to make an informed decision. To help simplify your decision-making process, here is a table of recommended personal loans in Singapore.

| Personal Loan | Interest Rate | Loan Amount | Processing Fee |

| Accredit Personal Loan | Up to 4% monthly | S$1,000 – 6x monthly income | 10% of the principal amount |

| HSBC Personal Loan | 4% (EIR 7.5% p.a.) | S$1,000 – 8x monthly salary | S$0 |

| SCB CashOne Personal Loan | 3.48% (EIR 7.99% p.a.) | S$1,000 – 8x monthly salary | S$0 |

| CIMB CashLite Personal Loan | 3.38% (EIR 6.38% p.a.) | Up to 90% of your credit card limit | S$0 |

| UOB Personal Loan | 3.99% (EIR 7.49% p.a.) | S$1,000 to 95% of your available credit limit | S$0 |

| DBS/POSB Personal Loan | 3.88% (EIR 7.9% p.a.) | S$500 – 10x your monthly salary | 1% processing fee |

| Citi Quick Cash Loan | 4.55% p.a. (EIR 8.5% p.a.) | S$1,000 – 4x your monthly salary | S$0 |

| OCBC Personal Loan | 5.43% (EIR 11.47% p.a) | S$1,000 – 6x your monthly salary | S$100 |

Thoughts

When searching for the ideal personal loan in Singapore, it’s essential to delve beyond the surface-level loan amount. To make a choice that aligns with your financial circumstances, you need to examine the interest rate, loan terms, and processing fees.

In Singapore, loan tenure options range from a compact 1 year to a generous 7 years. If you take your time to think things through, you may choose a personal loan that will get you closer to achieving your goals.

Longer Term Personal Loan – Accredit Moneylender

Accredit Moneylender offers unmatched personal financing alternatives in Singapore, featuring extended tenures that enable efficient management of repayment schedules. Our philosophy is grounded on the belief that personal loans and financing solutions should ease the challenges that borrowers face, rather than add to their financial burdens. Longer tenures allow borrowers to alleviate their monthly debt obligations and achieve greater peace of mind.