In Singapore, the prospect of securing a personal loan to fund your home down payment may seem like a convenient solution. Yet, it is important to bear in mind that this route could result in considerable expenses. This piece explores the practicality of relying on personal loans for your home’s down payment, as well as the downsides that accompany this approach.

The Short Answer

The answer is a solid no. You can’t typically use a personal loan for your home down payment. Most lenders won’t permit it. It’s true that personal loans are flexible and can be used for almost anything, but incurring more debt to pay off existing debt may not be the smartest move.

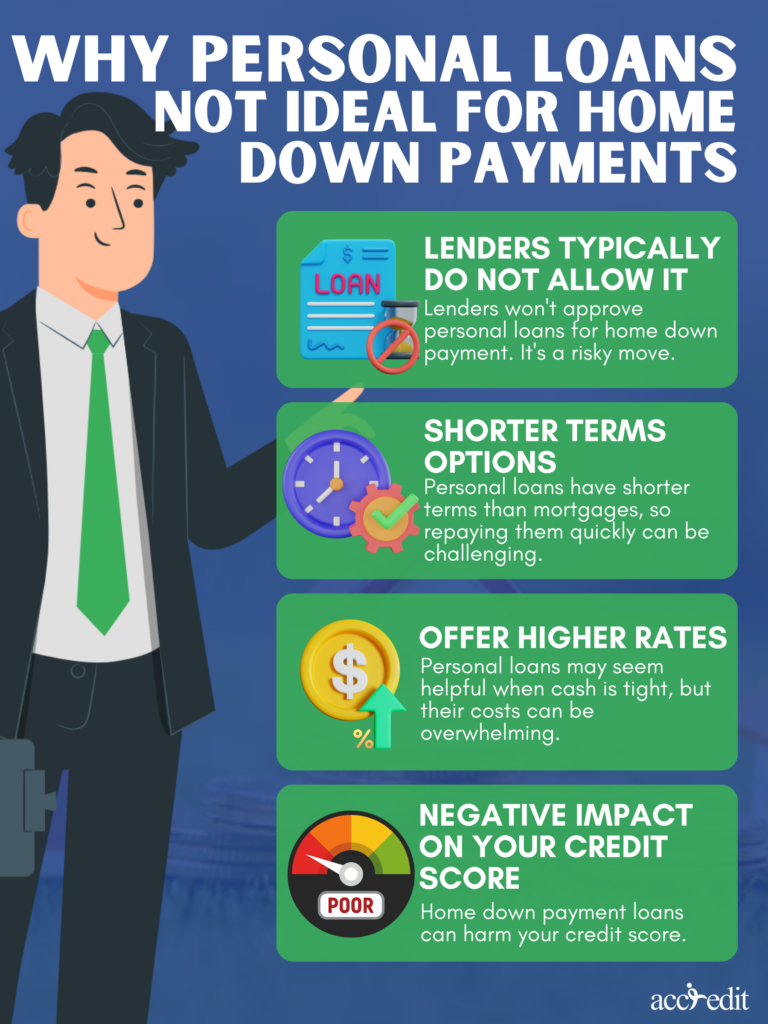

Why Are Personal Loans Not Recommended for Home Down Payments?

When it comes to using a personal loan for your home down payment, there are a few reasons why it’s not the best idea.

Lenders Typically Do Not Allow It

First off, it’s highly unlikely that lenders will approve your request to use a personal loan for your home down payment. Why? They want to ensure that you’re invested in the property you’re purchasing and that you’re putting your own money into the investment. Opting for a personal loan to fund your down payment is a risky move in the eyes of lenders, as you’re essentially taking on debt to buy the home.

Shorter Terms Options

Personal loans are commonly associated with shorter terms compared to mortgage loans. This implies that if you opt for a personal loan for your down payment, you’ll have a limited time to repay it. As a result, your monthly payments may be more expensive, posing a challenge to maintaining your homeownership.

Offer Higher Rates

When cash is scarce, personal loans can seem like a godsend, but the costs can be daunting. Personal loans are infamous for carrying exorbitant interest rates and fees, which can add up rapidly. When it comes to financing a home’s down payment, personal loans are a pricier alternative to mortgage loans due to their inflated interest rates. The result? You’ll likely end up paying a premium in interest over the loan’s lifetime. This could ultimately increase your mortgage payments and jeopardize your financial stability.

Negative Impact on Your Credit Score

Personal loans for a home down payments may have detrimental effects on your credit score. The additional debt may make it more challenging to meet your payments on time, resulting in late or missed payments that could drag down your credit score.

Alternatives to Personal Loans for Home Down Payments

Opting for a personal loan to cover your home down payment is a risky move. Fortunately, there are several innovative ways to finance your down payment without taking on extra debt.

Save Up

Saving up for your down payment is the tried-and-true approach that demonstrates your financial responsibility to lenders. With a solid savings plan in place, you’ll avoid the burden of additional loans and own a stake in the property you’re investing in. Consider automating your savings or finding new ways to trim expenses to build up your down payment fund faster.

Borrow from Family or Friends

When it comes to saving for a down payment, don’t overlook the potential of borrowing from your inner circle. Unlike impersonal loans from financial institutions, borrowing from family or friends can offer more favorable repayment terms. Plus, having the emotional support of loved ones can be a powerful motivator on your journey toward homeownership.

Look for Down Payment Assistance Programs

As a first-time homebuyer, scraping together enough money for a down payment can feel like an insurmountable task. Luckily, down payment assistance programs exist to offer a helping hand. Grants and loans are available to assist with the upfront costs of purchasing your ideal abode.

Consider Checking Housing Schemes And Grants For Homebuyers

In Singapore, the upfront costs of purchasing a home can be daunting. Fortunately, there are various housing schemes and grants available to ease the burden. Families purchasing a resale flat, for example, may qualify for up to $80,000 in CPF Housing Grants.

With this boost, the total housing grants available to eligible first-time families can reach up to $190,000. Don’t let upfront costs hold you back from owning a piece of Singaporean real estate – explore the available housing schemes and grants to unlock the door to homeownership.

Thoughts

Careful consideration is essential when investing in a property. Don’t rush into taking out a personal loan to cover the down payment. Buying a house is a huge financial commitment, so it’s important to give serious thought to all of your possibilities. Think carefully about the ways in which a personal loan might hinder your financial goals and objectives, and assess all of your available choices before making a final decision.

Hassle-Free Personal Loans with Accredit Moneylender

When it comes to urgent financial needs like medical expenses or other bills, look no further than Accredit Moneylender. We offer the lowest interest rates for short-term loans while remaining a reliable and licensed moneylender.

With Accredit Moneylender, you can trust that our loan terms are reasonable and tailored to your needs. Don’t hesitate to contact us today and start your loan application process.

Get the cash you need quickly and easily with Accredit Moneylender today!