Do you need clarification about credit scores in Singapore? No worries, you’re not alone. In this article, we’ll dive into the specifics and functions of credit scores and how they’ll impact your loan transactions in the future.

What are Credit Scores?

A credit score is also known as a credit rating. An individual’s credit rating is among the most critical aspects of managing one’s finances. It’s because its numerical value directly exemplifies your creditworthiness, mainly based on your credit history.

Credit ratings didn’t exist in the country until the Credit Bureau of Singapore created and maintained the system. CBS is the current and primary repository of all credit information in the country.

Banks, credit card companies, financial institutions, and licensed moneylenders rely highly on CBS to obtain factual and detailed credit data information on potential borrowers. These are mostly an individual’s or business’s credit rating and reports.

The score ranges from one to two thousand (1 to 2000), and those with high scores indicate better credit history with the lowest chances of default. The reports comprise the borrower’s credit accounts, payment history, bankruptcies, outstanding balances, and other accessible records.

CBS can legally provide credit reports to financial businesses and consumers. All information in the credit report reflecting your credit rating affects your opportunity to obtain better interest rates and loan terms.

Why is Your Credit Rating Important?

Have you ever asked yourself – “why is my credit rating important?” then you’ve probably encountered some issues. A person’s credit rating is vital, especially when planning to take a loan from different financial businesses in Singapore.

Borrowing Funds

It has a massive effect on your ability to borrow funds, like applying for a personal loan. Moneylenders in Singapore will use your credit rating to assess whether they’ll approve your loan application. When you have a higher credit score, it increases the possibility of getting your loan approved.

Credit Line

Application for credit cards or credit lines heavily relies on one’s credit rating due to the issuer’s evaluation. When you have a higher credit rating, then it automatically increases your chances for the credit card’s approval. On the other hand, if it’s lower, you could get rejected.

Interest Rates

In other instances, a credit score can be a significant advantage or disadvantage regarding the chargeable interest rates. For example, the loan you requested was approved, and the financial institutions will decide whether to impose a higher or lower interest rate based on your credit rating.

Banks and other financial businesses may proceed with this practice. Can you use your credit rating to have a lower interest rate from a legal moneylender? No, it isn’t possible, as licensed moneylenders in Singapore abide by the Moneylender’s Act of imposing the 4% per month capping.

Employment and Residential Renting

In addition, your credit score may also have an impact on securing employment and the ability to rent.

Some employers in the country are specifically cautious about individuals applying for their companies. These employers mostly conduct credit checks as a viable part of their hiring procedure.

It’s a common practice, especially in industries associated with financial responsibility or handling confidential and sensitive information. They’ll profile your capacity to handle financial commitments and other obligations.

Nonetheless, not all employers do this kind of credit checking, which varies mainly on the job’s nature.

The rates for purchasing and owning real estate property in Singapore are expensive. Thus, residential renting has become a viable choice for most communities in the country. Some property managers and landlords conduct credit checks to assess and affirm the renter’s creditworthiness.

They see it as a means to evaluate if the renter has a high risk of default, which may lead to defaulting rental payments. As a result, property managers and landlords may choose renters higher than those with lower credit ratings.

A credit rating may be an additional aspect of employment and residential renting, but it’s not the primary focus of employers and landlords.

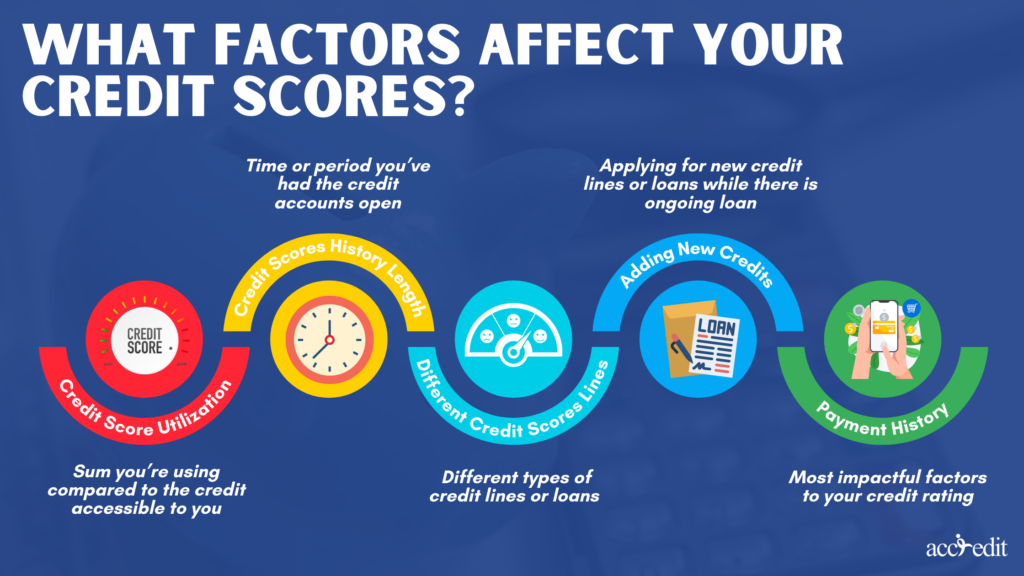

What Factors Affect Your Credit Scores?

As your credit rating plays a massive role, particularly your creditworthiness, it’s logical to understand the factors that may affect it ultimately. This way, you may prepare and fix your credit rating. It’s a helpful strategy you could do before applying for a loan, new employment, or credit line.

So, what are the factors that could affect your credit rating?

Credit Scores Utilisation

Credit utilisation refers to the sum you’re using compared to the credit accessible to you. A “high credit utilisation” means you may have overextended your credit limit. Through this information, a lender could assess you as someone who may encounter difficulties repaying your debts.

Credit Scores History Length

It represents the time or period you’ve had the credit accounts open. This type of information can have an impact on your credit rating. Most especially when you already have a more extended credit history, which emphasises to lenders that you have a more substantial and stable financial situation.

The Mixture of Different Credit Scores Lines

Do you have different types of credit lines or loans? If you do, then it belongs to the credit mix category.

Did you know having a diverse credit mix could positively affect your credit rating?

Yes, it does. Not everyone can handle different types of credit all at once. When you have this on your credit history, it means you’re responsible for credit management. Moreover, you don’t rely solely on one credit alone, thus exemplifying your capabilities to manage debts without a problem simultaneously.

Your chances of getting a higher credit rating or loan approvals are high. Lenders assess you as an individual with low-risk default and financial stability.

Adding New Credits

Financial troubles do come at the most unexpected moments. Thus, applying for new credit lines or loans can be tempting. However, proof of successfully managing simultaneous credits won’t appeal to lenders.

They may see you as a borrower who quickly opens new loans and credit from banks, financial institutions, or licensed moneylenders. The action could imply you’re taking on more debt than you can handle.

It could lead to an undesirable credit rating. As a result, you need to be responsible with the loans or credit you’re taking and make sure you’re paying back accordingly.

Payment History

Nothing signifies an excellent borrower than seeing a credit score with an ideally perfect payment history. Some people may not see it, but your payment history is among the most impactful factors to your credit rating.

Paying your bills on time, repaying according to schedule and never defaulting on any loans immediately boosts your credit rating. Lenders instantly consider you for faster loan approval because of your payment history.

How to Enhance Your Credit Scores?

Have you recently checked your credit score? Personally assessing and reviewing your credit score enhances your chances of getting a loan. It’s because you have the understanding to gauge whether you’ll be approved for a personal loan.

It saves you the effort if your credit scores are not too satisfying, as you’ll need more time to enhance your credit score.

Upon reviewing your credit score, notice a risk grade and risk percentage. These additional factors lenders look out for to determine whether they may approve your loan.

Here’s an illustration of Singapore’s credit rating system created by the Credit Bureau Singapore:

| Credit Score | Risk Grade | Credit Health | Interpretation |

| 1911 to 2000 | “AA” | Excellent | Individuals with this particular credit score range represent their excellent credit history and are at low risk of defaulting on any credit product. |

| 1844 to 1910 | “BB” | Very Good | Borrowers with this credit score have an excellent credit history. They are also considered low-risk loan defaulters. |

| 1825 to 1843 | “CC” | Good | People with a good credit history suggest they’re low to moderate-risk loan defaulters. |

| 1813 to 1824 | “DD” | Fair | Individuals with this credit score range have a relatively fair credit history. They are assessed as moderate-risk loans or credit defaulters. |

As you quickly checked your credit rating and risk grade, you realised it wasn’t as impressive as it seemed. Not to worry because there are methods you can do to enhance your credit scores.

Always Pay Your Bills on Time

It’s undeniable that late payments seriously damage your credit score. Paying attention to the repayment schedules and consistently delivering the bills on time is vital. It’s possible to pay minimum repayment, which is much better than not paying the lender.

Moreover, those unpaid bills shouldn’t pile up on your record. It’s because those late payments stay within your credit report for as long as seven years! As a result, the late payments’ negative impact isn’t a short-term matter.

What can you do to alleviate the problem? Contact the creditors or lenders immediately if you have issues paying on time. In this manner, you may discuss together creating a payment plan that would fit you better.

Sometimes, a person’s too busy with other responsibilities and forgets their other obligations. It’s normal, but commitment is needed when you repay loans or credit. You can quickly pay your bills at a specific time via reminders and automatic payments.

It’s possible to ask for these from banks or financial institutions. You may also inquire with your trusted licensed moneylender regarding such an option.

Credit Utilisation Should Always Be “Low”

Keeping your credit utilisation at the lowest possible usage is highly encouraged. Thus, you must maintain it below 30% to ensure it’s within the limit of a healthy credit rating.

For instance, you currently have a credit limitation of $10,000. You need to make sure to keep your balance below $3,000.

What if you’re having challenges keeping the credit utilisation low? No worries; there are ways to remedy the issue successfully.

First, pursue an increase to your credit limit. As you increase the amount accessible for the credit, you lower the credit utilisation.

If it’s not possible, you could pay down the balances. You can focus on paying off the highest interest-rate debts first and move forward to the other loans or credits. It’s a long process but also a tested and proven tactic.

Refrain from Applying for More Credits at Once

As you apply for new credit, it affects your credit score and lowers it temporarily. It isn’t an advisable approach, thus, should be avoided at all costs.

If you need a new credit line or apply for a loan, make sure you’ll space out the applications. Moreover, always only use or request credit when you genuinely need it.

In addition, whenever you do apply for credit, lenders will pull out your credit report. It’s their process of executing “hard inquiry”. When it’s repeated so many times, it’ll lower your credit score further.

Understanding Credit Scores Leads to Financing Benefits

In a country where credit scores play a significant role in determining a person’s financial health and eligibility, this is becoming an important reason to understand the matter better.

When you have a good credit rating, it becomes an effective means to lower the interest rates from banks and financial institutions. You also get to enjoy higher credit limits. Gaining better and more favourable terms for credit products or loans is possible.

As a result, you have to concentrate on maintaining your good credit score. Paying bills on time already significantly impacts your record, and so do the other methods you can do. When you’re fully aware of these factors and continually monitor your credit score, controlling your overall financial well-being and goals is more accessible.

Remember that having a great credit score isn’t primarily about numbers. It’s mainly a representation of your management skills and financial responsibility. So, keep those credit scores in check and maintain beneficial financial health.

Let’s discuss your credit scores and help you apply for your loan today! Please click here!