Personal finances demand a great deal of discipline. True enough, people with immense will and determination can attain financial security faster than most. People who know how to budget then take a loan, consider the maximum interest rate and convert it to profit.

For anyone searching for additional funds for various reasons, that’s not a problem. It doesn’t necessarily mean your finances cannot be in a better position in the future. When you genuinely require it, getting a loan broadens your comprehension of individual finances and relevant monetary-related information.

Since you’ve been planning to take out a personal loan but are unsure of the fees or charges, it’s easy to understand your hesitation. Remember that all problems have solutions; you only need to pick the right one.

So, here’s what you need to know about personal loans, banks and moneylenders, fees, charges, loan caps and the highest interest rate in Singapore.

Personal Loans in Singapore

Singapore’s banking and financing industry proffer different types of loans to its general public. It guarantees that every financial need within the community may attain according to assistance.

The particular utilisation of loans in Singapore is to add funds to business or personal projects, purchase assets, make new investments, for medical reasons, for education or studying purposes, etc.

Thus, many people prefer to out personal loans in Singapore that are accessible via banks and licensed moneylenders. It’s the easiest to acquire immediate funds from lenders in the country. However, due to its accessibility, it’s also a high-risk loan as it falls under the unsecured credit category.

Unsecured credit is risky due to its lack of collateral. Secured credits are opposite in nature and categorisation, as they require collateral from borrowers like vehicles, real estate properties, investments, assets, etc.

You can apply for a personal loan from banks and licensed moneylenders in Singapore with a smaller allowable amount and reasonable interest rates, fees, and charges.

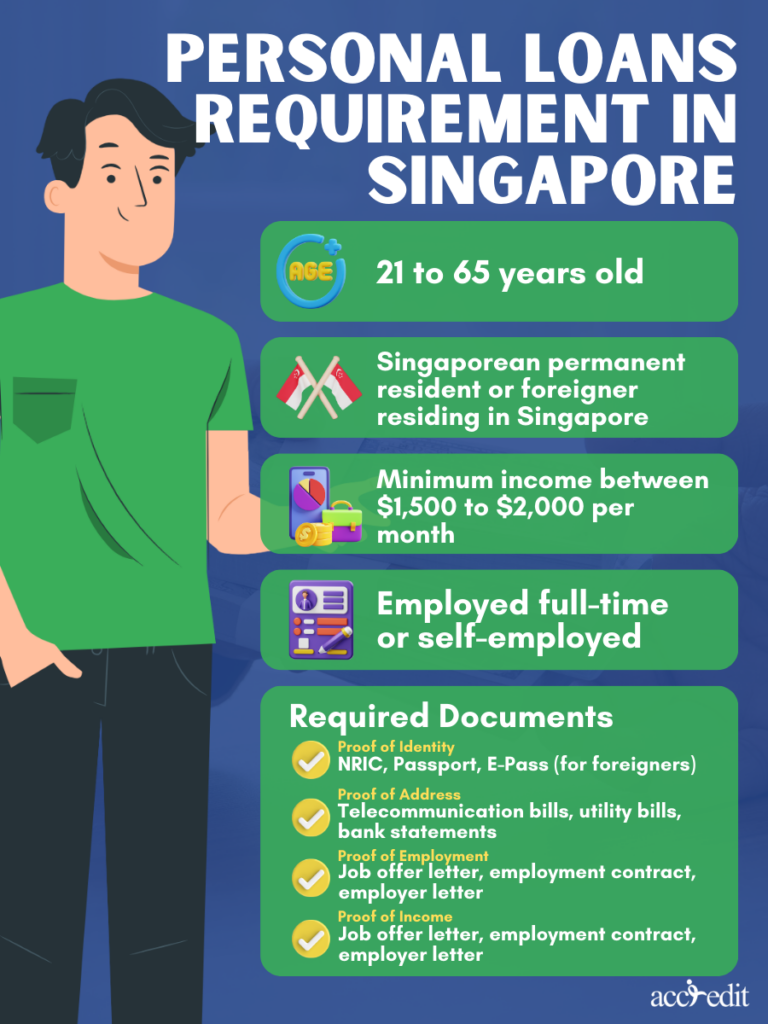

Personal Loans Requirement in Singapore

When seeking loan approval, the borrower must fulfil the documentation and information required by banks and moneylenders in Singapore. Moreover, an individual must meet the specific criteria and requirements to become an eligible borrower.

These criteria and requirements may vary on the lender’s policies. But here are the standard requirements for personal loans in Singapore:

- Age requirement: Borrowers should be twenty-one to request a personal loan from a licensed moneylender in Singapore.

- Income provision: Individuals must provide proof of earning a minimum income ranging between $1,500 to $2,000 per month.

- Employment proof: Licensed moneylenders in Singapore must ensure borrowers can repay their loans. Thus, a steady source of income from one’s employment proof is critical, notably employment certification, employment pass, or work pass.

People currently self-employed may provide other proofs, such as income tax statements or bank statements to prove income.

- Credit history: Licensed moneylenders in the country will check and assess a borrower’s credit history. It’s to determine their creditworthiness.

Individuals with poor credit scores and histories may need help to get loan approval or acquire higher interest rates.

- Verification of identity: Valid photo identification documents, such as Singapore IC or passports, are essential to prove identities.

- Address verification: Borrowers must provide proof of address, such as a tenancy agreement or utility bill, which efficiently verifies residential addresses.

These are the standard requirements lenders initially prioritise assessing. Be sure to take note and discuss it further with your chosen licensed moneylender to guarantee you’re loan eligibility and hassle-free application.

What is an Interest Rate?

Achieving a loan grant with an interest rate associated with the debt is possible. The interest rate is the amount a lender uses to impose charges on the borrower. It is mainly taken away from the principal loan’s specific percentage.

It is the money that the borrower has to repay during the loan period. The interest rate is the compensation for the lender or where they will acquire their investment return to lend the money to the borrower.

Interest Rate Calculation

The basis for an interest rate is from the computation of the remaining principal loan amount after deductions.

Singapore’s Maximum Interest Rate

Knowing the highest interest rate is crucial for someone new to borrowing money from banks or moneylenders in Singapore before requesting a loan.

Bank’s Maximum Interest Rate

Banks are under the regulations of the Banking Act of the Monetary Authority of Singapore. These monetary businesses have various interest rates depending on the bank you will apply for a personal loan.

The maximum interest rate in Singapore from banks could range from 3.2% to fixed interest rates above 8%. The tenure can range from 3 to 60 months, ultimately affecting the interest rate banks demand.

An impactful downside when choosing a bank for a personal loan is its stringent policies and qualifications for its borrowers. Banks are strict about assessing and evaluating a borrower’s credit score.

A borrower with a credit score of AA or 2000 points is considered a low-risk debtor. Yet those with a HH credit score of 1000 points are high-risk debtors who’ll most likely opt to default on their loans.

Furthermore, banks mainly only prioritise allowing their clients to get a personal loans from them. These clients are especially Singapore Citizens and Permanent Residents.

What about foreigners who want to get a loan in Singapore? Foreign work pass holders may need more credit background to qualify for the personal loan. Nevertheless, there’s a possibility of being approved for the request if they can get a guarantor to assist and take legal responsibility regarding the loan.

Licensed Moneylenders’ Maximum Interest Rate in Singapore

Moneylenders in Singapore are another prime choice as a loan provider. These moneylenders have to be duly licensed under the Registry of Moneylenders and should comply with the Moneylenders Act and Rules.

A licensed moneylender in Singapore provides little cash loanable to its borrowers with a feasibly high-interest rate. As moneylenders in Singapore are the go-to financial service provider for the general public, business is riskier; thus, a high-interest rate is appropriate.

Since October 1st, 2015, the Moneylenders Act has regulated the maximum interest rate a moneylender may charge its borrower, from 1% to 4% per month.

Fixed Maximum Interest Rate

Yes, it is. The cap is administered and implemented despite the borrower’s monthly or annual income. Or whether they have taken out a secured or unsecured credit request.

Maximum Interest Rate for Late or Missed Payments

Situations like these happen a lot. So, the Ministry of Law Moneylenders Act has provided an additional provision for just compensation to the moneylender in Singapore. It stipulates that for every missed repayment schedule, a borrower has to pay the maximum late interest rate of 4% for each month they’ve missed.

Late fees also apply and should be within the fixed rate of $60 monthly. A borrower should report a moneylender instigating raising the interest rate for any reason to the Registry for investigation. If the moneylender in Singapore is guilty, they will be penalised according to the Moneylenders Act.

Maximum Administrative Fee in Singapore

The Moneylenders Act specifically emphasised a cap that licensed moneylenders may charge their borrowers, including the one-time administrative fee.

All licensed moneylenders in Singapore can only impose a 10% admin fee for the loan a borrower requests for. If a moneylender pushes for a higher admin fee, the borrower must report the incident to the Registry or the Singapore Police Force.

Maximum Total Loan Amount

Moneylenders in Singapore have to conform to the Ministry of Laws Moneylenders Act to guarantee the continuous operation of their businesses. Thus, the country’s licensed moneylenders recognise and apply the maximum allowable loan amount to all of their borrowers.

The criteria for the maximum loan amount moneylenders in Singapore may release their borrowers depending on the latter’s yearly income. Below are the legally acknowledged loan caps or the maximum total loan amount in Singapore.

- Yearly income not reaching $10,000

Singapore Citizens and Permanent Residents who earn a yearly income not reaching $10,000 are allowed a maximum loan of $3,000. Foreign work pass holders may take home a maximum of $500.

- Yearly income reaching $10,000 but not more than $20,000

Singapore Citizens, Permanent Residents, and foreigners living and working in the country with at least $10,000 and at most $20,000 yearly can simultaneously get $3,000.

- At least $20,000 yearly income

The citizens in Singapore, Permanent Residents, and foreigners residing in the country earning at least $20,000 yearly income can take out loans up to six times their monthly salary.

File Report for Loan and Maximum Interest Rate Concerns

Borrowers in Singapore still go through troubles connected with interest rates and the overall loan process and experience. The Ministry of Law, the Ministry of Manpower, and the Singapore Police Force continue to motivate the general public’s participation in addressing loan dilemmas.

Ah Longs, loan sharks, or unlicensed moneylenders in Singapore are the common culprit for such events. Correspondingly, eyewitnesses, especially victims, must file and send reports regarding particular loans, interest rates, and moneylending concerns.

Ah Longs or Unlicensed Moneylenders in Singapore

Unlicensed moneylenders are locally known as Ah Longs by Malaysians and Singaporeans. The moneylenders in Singapore’s undesirable backgrounds because of their ruthless schemes and malicious intent. Their strategy is primarily to scam vulnerable overworked individuals who earn exceedingly low wages, habitual gamblers, or anyone who cannot pass the qualifications imposed by financial businesses in the country.

It’s critical to pinpoint the warning signs and report any unlicensed moneylending activities to avoid being punished by the law. The typical warning signs of an Ah Long targeting its victims is through;

- Role-playing as a licensed moneylender and even providing fake websites and business information

- Soliciting loans to their targets even when the latter is not interested

- Asking for ID usernames and passwords

- Requesting to acquire details for NRIC and other personal identification documents, whether it be a passport, driver’s license, work or employment pass

- They promise to grant loans with much lower interest rates but change the agreed fees midway through the loan contract.

- Restricting the borrower from any access to the loan contract

- Limiting the information on loan terms and conditions

- Asking for upfront fees for the loan process and activation

- Deflecting personal appearance for loan process or grant and preferring only online transactions or agreements

- Using abusive language to demand and scare their targets

- Threatening and harassing their victims, whether online, through calls, or physically

The behaviours of unlicensed moneylenders in Singapore are specific. They intend to make an impactful presence to put fear and manipulate their victims.

Contact Relevant Authorities

Thus, the moment you notice the slightest unhinged manners from someone claiming to be a licensed moneylender, reach the Registry at 1800-2255-529, Singapore Police Force’s 1800-255-000, ‘999’, X-Ah Long hotline at 1800-924-5664. For the anti-scam helpline, complainants may call them at 1800-722-6688.

If the lines are unattainable, victims and eyewitnesses may file and send their reports at www.police.gov.sg/iwitness and www.scamalert.sg.

You have now gained all the essential information on the imposed regulations and the maximum interest rate in Singapore. Feel free to assess your credit score, evaluate your annual income, prepare all necessary documents and compute the maximum interest rate to save yourself the trouble.

You’re ready to contact a licensed moneylender for your personal loan. Click here to obtain the best interest rate and financial services today!