For a small business owner in Singapore, it’s perfectly natural to consider taking out a loan to help your company grow. But did you know you must meet every business loan eligibility checklist before applying for one?

If you are new and haven’t tried getting this type of loan, pause for a moment. You must equip yourself with the understanding to qualify for the enterprise loan fully.

What happens when you don’t meet the eligibility requirement accurately? Your loan application might be blocked, delayed, or ultimately rejected. Considering your earnestness in claiming the much-needed financial assistance, it’s genuinely a circumstance you wouldn’t wish to happen.

Today, we’ll present the necessary details to prepare the eligibility requirements. Check out this checklist before setting out and applying for a business loan in Singapore.

Be Aware of Your Credit Score

An individual’s credit score in Singapore can open many opportunities for them. It’s the same case for SMEs in the country.

Credit scores are critical in financing, specifically when lenders evaluate and review a loan application. If you genuinely want to acquire funding for your business, you must be aware of your credit score.

Credit Bureau Singapore (CBS) established and utilised the credit scoring system to assist financial companies in assessing borrowers’ creditworthiness. Borrowers also check and review their credit scores to determine eligibility for specific debt applications like business loans.

Here’s a quick breakdown of Singapore’s credit score system:

AA – 1,900 to 2,000 Points:

AA credit grade with a 1,900 to 2,000 credit score indicates you’re a low-risk borrower regarding defaulting on a loan. Also, it’s the highest possible credit score.

BB – 1,700 to 1,899 Points:

BB credit grade paired with credit scores between 1,700 to 1,899 signifies the borrower may be at moderate risk for default.

CC – 1,500 to 1,699 Points:

Individuals with these credit scores and grades are presumed to be at high risk of default.

DD – 1,499 and below:

Borrowers with a DD credit grade and scores of 1,499 and below may face difficulties getting their loan approved as these numbers indicate an exceptionally high risk of default.

If you’ve never missed bills and payments, you won’t have a problem. Note that every settlement you’ve made in the past, whether debt-related or dues, will reflect on your credit score. It also indicates the level of risk lenders face if or when they will lend you money.

To make sure your credit score is adequate, you must:

Review your credit score and credit report:

You may request a fee for your credit reports from CBS. Once you have it, evaluate for errors or discrepancies that would gravely affect your credit score.

These errors and discrepancies will hurt your score and record. So, when you do find any issues, do not hesitate to contact the Credit Bureau Singapore and have it corrected immediately.

Keep up with your debts and credit card payments:

Late interest fees, charges, and missed payments don’t only tarnish your credit score. These would increase the loan cost and make it hard to repay your responsibilities as soon as possible.

As a result, opt for a non-problematic and viable approach. Make timely payments to keep your credit score and history in tip-top record.

Minimise debt-to-income ratio:

The debt-to-income ratio indicates your existing debt compared to your income. Pay down outstanding debts to help boost your credit score. Always keep the ratio below 2:1.

Use credit smartly:

Multiple loans or using various credit cards at once will eventually impact your credit score negatively. Thus, be strategic in utilising your credit applications.

Also, avoid taking in a new debt unless it’s necessary.

Ensuring your credit score is adequate is the primary step you have to check first from the business loan eligibility checklist. Next to accomplish this is assessing your current financial status.

Assess Financial Situation for your Business Loan Eligibility Checklist

Lenders in Singapore don’t grant loans easily. Even licensed moneylenders known for being lenient have to ensure their borrowers have ample financial means to repay their debts.

Before you seek the loan application, assess whether your financial situation will award you the funds for your business, including:

Deduce your net worth:

How to calculate your net worth? It’s the difference between your total assets and liabilities.

You must list all your assets, such as cash, properties, vehicles, investments, etc. Include your liabilities, like loans, credit card debt, and mortgages.

When you have all the necessary information, you subtract the liabilities from your assets. Then you have your net worth.

Obtaining your net worth would help you assess your business’s financial health.

Create a budget:

Budgeting is an essential factor when aiming to keep your finances well intact. It can be a bit challenging, but it’s doable.

Creating a budget plan for your income and expenses will assist you in identifying which areas to cut back on. It’ll also highlight which are worth spending and which fees SMEs must prioritise.

To start, track both your income and expenses for a few months. Monitor it diligently to get a better idea of your spending habits. Then create a budget that best fits your salary and expenditures.

Also, since you’re an SME, allocate funds for unexpected expenses.

Set your financial goals:

Everyone has specific financial goals. For a small business owner, it’s likely to be related to the growth and expansion of your company.

Since you’ll care for your company and staff, setting your financial goals will do you good. Both short-term and long-term financial goals are crucial factors for your business plans.

It’ll help you stay focused on your economic priorities.

Evaluate your financial statements:

It primarily includes income statements, balance sheets, and cash flow statements. These documents will give you a better preview of your business’s financial situation.

Assess your profitability:

You can acquire your profitability by reviewing your income statement. It’ll grant you a better understanding of your business gainfulness.

In addition, this helps you identify the areas where you can amplify revenue or reduce some expenses.

As you obtain accurate details on your financial status, you need to match them with your business plan.

Study Your Business Plan for Business Loan Eligibility

Your business plan must outline your company’s short-term and long-term goals, strategies, and financial projections. Since you aim to complete the business loan eligibility checklist, set a business plan to convince lenders the company is worth the investment and expansion.

Study and review your existing business plan and verify that it’s:

- Up-to-date and must include current monetary status and projections.

- Outline your business goals and strategies.

- Comprises your understanding regarding the market you’re in, the competitors in the industry, etc.

Compare the Best Lenders for Business Loans

Singapore’s financing industry doesn’t lack choices in terms of lenders and loan types. SMEs may apply for a business loan from traditional banks, credit unions, and licensed moneylenders in Singapore.

But, as there are tons of options, small business owners may feel overwhelmed. Thus, you should research the best lenders and loan types that suit your company. Consider comparing these specific aspects, such as:

- Lowest interest rates and fees

- The most suitable repayment period for your monetary and business status.

- Collateral requirements:

- Real estate properties

- Cars

- Assets

- Eligibility requirements:

- Businesses must be based and registered in Singapore

- Operational histories, such as one to two years of operations or minimum annual revenue estimate

- Good credit score and history for both businesses and their directors or owners

- Collateral for some business loans, such as secured term loans or equipment financing

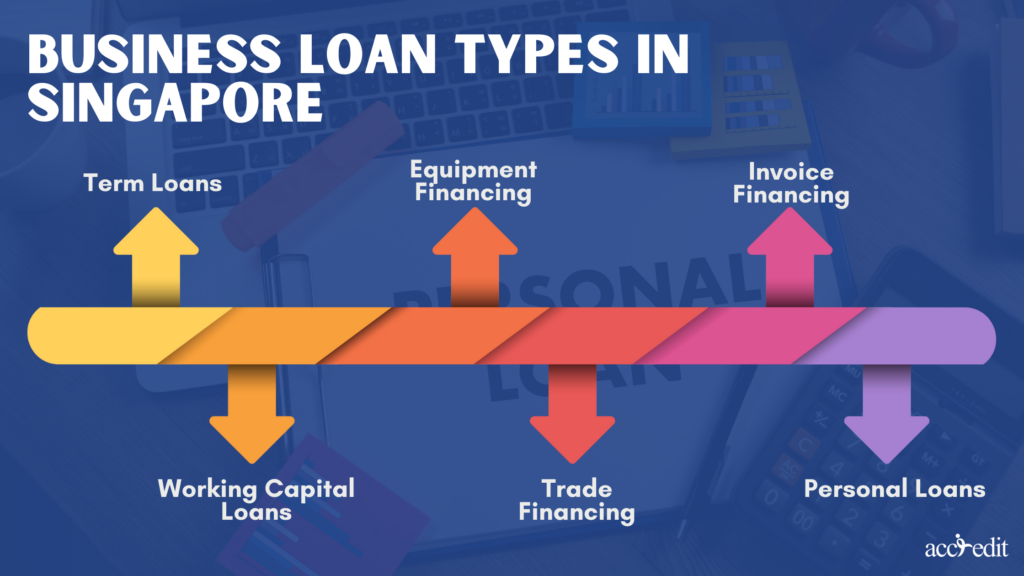

Business Loan Types in Singapore

The business loans you may apply for would be:

Term Loans

These are business loans that deliver fixed-term financing solutions. SMEs will acquire a lump sum to fund their businesses. It has a repayment period and a method of regular instalments over a specific period.

- Loan Amount: Vary on the lender’s assessment and business requirements.

- Interest Rates: Often ranging between 3.5% to 8% per annum for banks, while possible higher rates may apply for licensed moneylenders in Singapore.

- Repayment Period: One to five years

- Charges: Borrowers can expect several charges for processing, legal, late payment, and early repayment fees.

Working Capital Loans

These types of loans offer a short-term financing option to SMEs in Singapore. The coverage would help supply the daily operational expenses, particularly inventory, payroll, and accounts payable.

- Loan Amount: It will vary on the business’s working capital requirements, and the lender’s assessment will vary.

- Interest Rates: Typically ranging from 3.5% to 9% per annum for banks, and higher rates could apply from licensed moneylenders.

- Repayment Period: Up to one year

- Charges: Legal, processing, early repayment and late payment fees

Equipment Financing

The business loan type will suit your business if it requires purchasing new equipment or machines or upgrading existing ones. Or vehicles that are necessary for business operations.

- Loan Amount: Up to 90% of equipment or machine costs.

- Interest Rates: Typically starts from 3.5% to 7% per annum for banks, and possibly higher rates are applicable from licensed moneylenders.

- Repayment Period: One to five years

- Charges: Late payment, early repayment, processing, and legal fees

Trade Financing

The trade financing loan option helps companies bridge financial gaps between the production and sales cycle. It provides the funds essential to continue the importation or exportation activities or local trade transactions.

- Eligible Applicants: Singapore-based and registered businesses engaging in local or international trade

- Loan Amount: The accessible loan amount will vary on the value of the underlying trade transactions

- Interest Rates: It’ll range between 2.5% to 6% per annum for banks, and licensed moneylenders may apply higher rates.

- Repayment Period: 30 to 180 days, which will vary on the trade cycle

- Charges: Legal, processing, late payment, and early repayment fees.

Invoice Financing

It’s the best business loan option for encountering outstanding customer invoices. This loan will provide the funding you need until the subsequent revenue. It also helps with improving cash flow and meeting short-term business obligations.

- Eligible Applicants: Businesses registered in Singapore with a track record of completing transactions and creditworthy clients

- Interest Rates: It’ll range from 0.5% to 3% per month for banks, while it’s 1% to 4% monthly for licensed moneylenders

- Loan Amount: Up to 90% of the invoice’s overall value

- Repayment Period: Upon obtaining the invoice payment by the debtor.

- Charges: Early repayment, late payment, legal, and processing fees

Personal Loans

SMEs in Singapore can utilise personal loans to cater to their businesses’ financial needs. These unsecured loans may assist business operations and aid emergency business needs or growth. Although a personal loan is not specifically designed for business, it is a viable alternative funding source for entrepreneurs requiring quick monetary assistance.

- Eligible Applicants: Singaporean citizens, permanent residents, and foreigners with valid employment passes or work permits

- Interest Rates: Banks impose 3.5% to 10% per annum, while licensed moneylenders charge 1% to 4% monthly. It’ll vary on the lender’s policies, assessments, and the borrower’s credit profile.

- Repayment Period: One to seven years

- Charges: Late payment and early repayment fees, with a one-time processing fee

Gather and Complete Necessary Documentation

For a business owner in Singapore, it’s easy to see the country’s continuously thriving with its financing industry. As the competition in each respective industry becomes fiercer, you need access to more capital and boost your company.

You must gather the essential documentation to support your application to attain this goal. The general requirement paper works include:

- Business and personal tax returns

- Business licences and registrations, such as ACRA business profile

- Business and personal financial statements, such as income statements, balance sheets, cash flow statement

- Business plan, including growth strategies and projections

- Details of liabilities or existing loan, if any

- Bank statements from the past six to twelve months

- Articles of incorporation or organisation

- Relevant documents for specific loan types include equipment quotes and invoice financing.

- Business loan application form

It may take some time before you can complete these documents. Thus, review each paperwork and assess whether it’s up-to-date or missing a specific document before applying for your company’s business loan.

Get Ready and Apply for the Business Loan Now!

Managing a business isn’t a walk in the park. It takes time, effort, planning, dedication, and many trials and errors before you uncover your company’s best strategy and procedure.

During this particular period, many things could happen in between. For instance, the equipment for your business broke down, you require immediate funding for daily operations, or you plan to expand the company altogether. All of these concerns need financing.

To be sure you’re ready to apply for a business loan, be aware of your credit score and keep up with your debts. Minimise debt-to-income ratio and use your credit advantages smartly. Business loans are usually secured, so deduce your net worth, assess profitability, create a budget and set your financial goals.

Pick the best lender with the lowest interest rates, reasonable fees, and repayment period. Ensure your business plan is ready to convince the lender it’s worth the investment. Have your crucial business documents updated, and you’ve completed your business loan eligibility checklist!

Did you check all the listed details? It’s time to prepare and apply for the business loan your company needs! Click here now!