Have you ever wondered about the potential size of a personal loan for someone earning S$120,000 annually in Singapore? The answer is complex and influenced by numerous variables. Your choice of lender, credit history, current financial commitments, and the loan’s repayment period will all play a role.

Lenders in Singapore usually allow personal loans to those earning a yearly income of S$120,000, equivalent to four times their monthly wage. Assuming your credit rating is immaculate, you have no financial obligations, and you fulfill all the requirements, you’re well on your way.

Here’s the math:

| Monthly income: S$120,000 /12 = S$10,000 Loan multiplier (up to four times the monthly income): S$10,000 * 4 = S$40,000 |

Max loan potential: S$40,000, depending on the lender’s policies and your personal money matters.

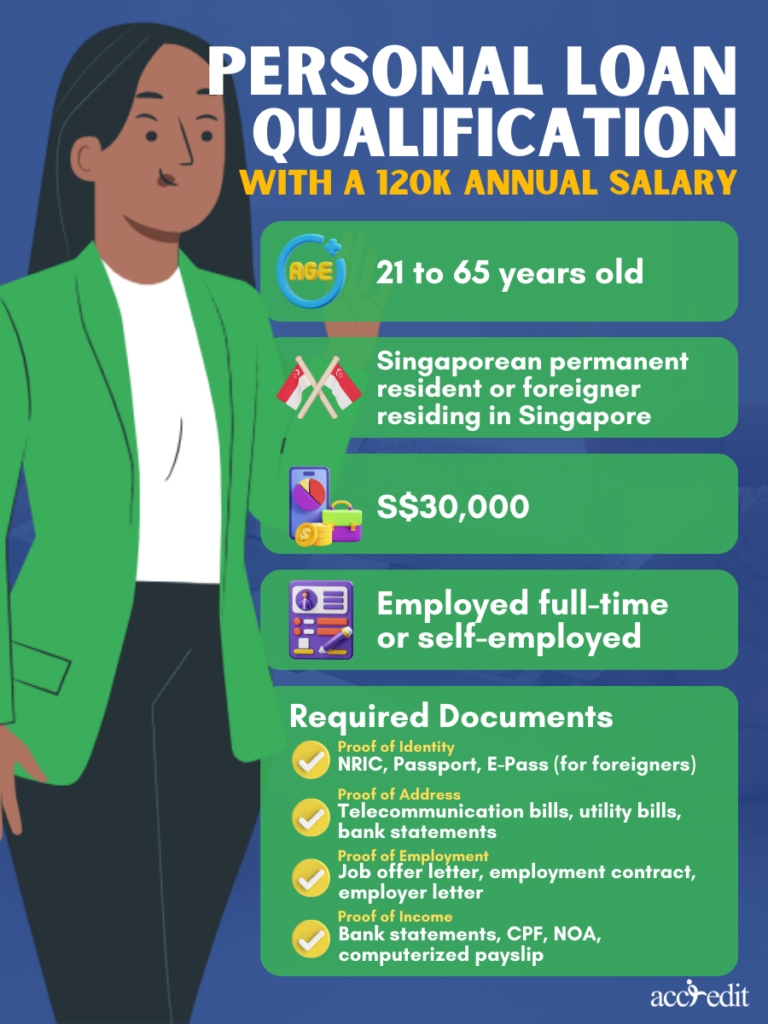

Personal Loan Qualification with a 120k Annual Salary

Acquiring personal loans demands meeting specific criteria. Here’s a speedy rundown of the documents that attest to your eligibility:

| Age | 21 to 65 |

| Citizenship Status | Singaporean, permanent resident, or foreigner residing in Singapore |

| Minimum Income Requirement | S$30,000 |

| Employment Status | Employed full-time or self-employed |

Required Documentation

To expedite your loan application process, it’s vital to have these essential documents on hand. Preparing ahead of time will guarantee speedy approval:

| Proof of Identity | NRIC, Passport, EPass (for foreigners) |

| Proof of Address | Telecommunication bills, Utility bills, Bank statements |

| Proof of Employment | Job offer letter, Employment contract, Employer letter |

| Proof of Income | Bank statements, CPF, NOA, computerized payslip |

Best Personal Loan for 120000 Salary in Singapore

Earning S$120,000 annually in Singapore unlocks a world of banking possibilities, as most banks have a minimum annual salary requirement of S$30,000. However, if your credit score is less than stellar or you’re dealing with outstanding debts, there’s no reason to fret. Licensed moneylenders, such as Accredit, can still offer the financial support you require.

| Personal Loan Provider | Interest Rate | Minimum Income | Loan Amount | Processing Fee |

| Accredit Personal Loan | Up to 4% per month | S$20,000 | $3,000 – 6x monthly income | 10% of the Principal Amount |

| DBS/POSB Personal Loan | 3.88% (EIR 7.9% p.a.) | S$20,000 | S$500 – 4x monthly salary | 1% processing fee |

| OCBC Personal Loan | 5.43% (EIR 11.47% p.a) | S$20,000 | S$1,000 – 4x monthly salary | S$100 |

| Standard Chartered CashOne | 3.48% (EIR 7.99% p.a.) | S$30,000 | S$1,000 – 4x monthly salary | S$0 |

| Citi Quick Cash Loan | 3.45% (EIR 6.5% p.a.) | S$30,000 | S$1,000 – 4x monthly salary | 0% |

| HSBC Personal Loan | 4% (EIR 7.5% p.a.) | S$30,000 | S$1,000 – 4x monthly salary | S$0 |

| UOB Personal Loan | 3.99% (EIR 7.49% p.a.) | S$30,000 | 95% of your available credit limit | 0% |

Above S$120,000: Personal Loan Options for High-Income Earners

Surpassing the S$120,000 annual earning mark can provide more than just financial security. It could also mean an increase in your borrowing limit, potentially granting you access to personal loans ranging from S$60,000 to S$250,000. It’s worth noting, however, that these figures are simply estimates and may vary depending on the borrower’s circumstances.

| Personal Loan | Annual Income Requirement | Maximum Loan Amount |

| DBS/POSB Personal Loan | Greater than S$120,000 | 10x your monthly salary |

| Standard Chartered CashOne | Greater than S$120,000 | 8x monthly salary (up to S$250,000) |

| HSBC Personal Loan | Greater than S$120,000 | 8x monthly salary (up to S$200,000) |

| OCBC Personal Loan | Greater than S$120,000 | 6x your monthly salary for income greater than S$120,000 |

Final Thoughts

If you’re a resident of Singapore with an annual income of S$120,000 or higher, you could be eligible for a personal loan of up to S$40,000. But don’t stop there. If your monthly earnings continue to rise, your borrowing capacity could increase six or tenfold. Keep in mind, though, that these numbers are just estimates and can fluctuate based on a variety of factors that are unique to your situation. So do your due diligence and research carefully before making any financial decisions.

Get Up to 6x Your Monthly Income in Personal Loans with Accredit Moneylender

When it comes to fast cash for emergencies, you won’t find a better solution than Accredit Moneylender. Our streamlined personal loan application process ensures you get funded without delay. And if you earn S$20,000 or more, you’ll be eligible for loans up to six times your monthly income. No more stress or anxiety about unexpected expenses.