As you venture into the world of finance, especially with loans, it is like you’re setting foot in an art gallery. Every gallery has a lot of artistic masterpieces to offer, and the focus on this particular one is the approved money lender in Singapore.

A gallery has an immense collection of paintings, and they’re like Singapore’s money lenders. You’ll be the grand borrower who will purchase the portraits according to your liking.

Today, you will have a fabulous grand tour of Singapore’s finance-art corridors. Are you ready to master the artistry of financial canvas?

Brushing the Basics: Synopsis of an Approved Money Lender in Singapore

What do you like the most about a blank canvas?

It means you can choose to paint your financial goals and future to your preference. And what’s the first layer of paint you’ll use?

It’s to understand the approved money lender in Singapore, especially with the basics. Singapore has an ever-changing and shifting financial scene, but every approved lender is under the Ministry of Law’s Moneylenders Act regulations. With the Act, you can feel confident that they’ll commit to the Act’s laws and statutes.

Here is an approved money lender in Singapore’s key features:

- They’re under the legal regulations from the Ministry of Law in Singapore

- They offer various loan types

- They’ll commit to adhering to the fees and interest rates they may charge

- They’ll follow the just and ethical contract practices set by the Ministry of Law’s Moneylenders Act

Borrowing from an approved lender is similar to working with high-quality paint; it assures a safe, more predictable outcome.

The Primary Colours of Lending in Singapore

What’s the essential groundwork for any masterpiece?

These are mainly the primary colours. When searching for a legitimate loan provider, you must understand the eligibility and loan types of lending in Singapore are fundamental.

An approved money lender in Singapore has particular criteria, including the following:

- Age

- Income

- Citizenship Status

It’s like selecting the best and complemental colour palette; each loan type offers myriad benefits, like red’s vibrancy or blue’s serenity.

Personal Loans:

Personal loans are your most reliable colour palette for quick funds for emergency needs. As it’s an unsecured loan, you don’t have to present any collateral.

Business Loans:

Every SMEs dream is to grow and expand their business. If you’re among Singapore’s most hardworking, innovative and brilliant small and medium enterprises, then it’s the loan you need.

A quick note you must remember is that these may require a solid business plan.

Payday Loans:

Do you prefer taking a quick loan to bridge monetary deficits in between?

Payday loans are short-term loans that’ll help you overcome financial worries until the next paycheck.

Foreigner Loans:

Sometimes living in another country may make you feel alienated. But in Singapore, every non-Singaporean individual receives equal assistance, especially when facing monetary problems.

Singapore’s authorised lenders extend ethical services to foreigners.

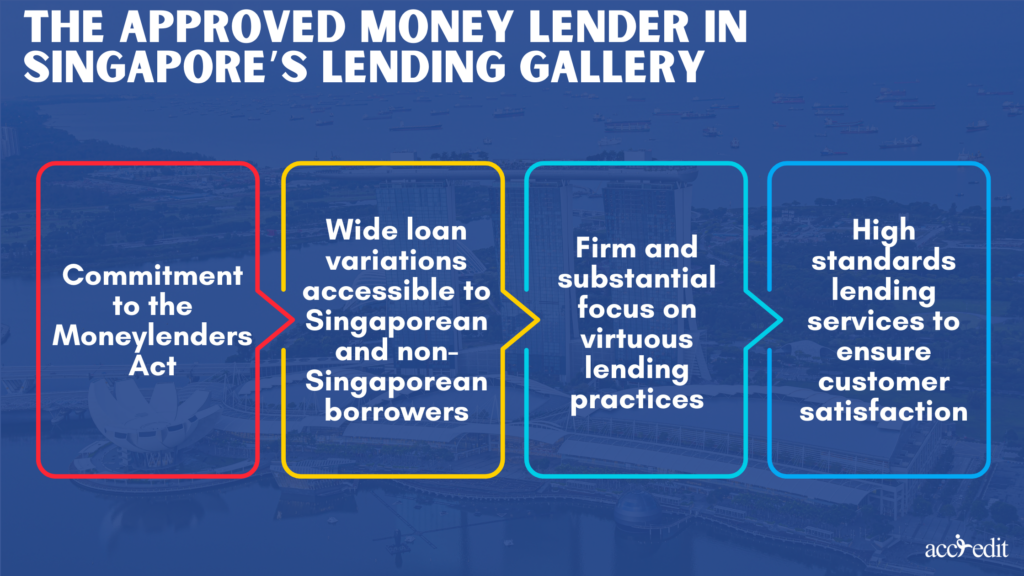

The Approved Money Lender in Singapore’s Lending Gallery

An approved money lender in Singapore is a licensed lender, including Accredit. You can say it’s comparable to a masterpiece hanging in the lender’s gallery. Like Sonny Liew’s multi-award-winning “The Art of Charlie Chan Hock Chye.”, it stands out for its dedication to the Act’s policies, customer assistance, and various loan prospects.

Licensed money lenders like Accredit offer foreigner, business, payday, debt consolidation, and personal loans, giving you a more comprehensive scope of colours to complete your monetary painting.

An approved money lender’s highlights:

- Commitment to the Moneylenders Act

- Wide loan variations accessible to Singaporean and non-Singaporean borrowers

- Firm and substantial focus on virtuous lending practices

- High standards lending services to ensure customer satisfaction

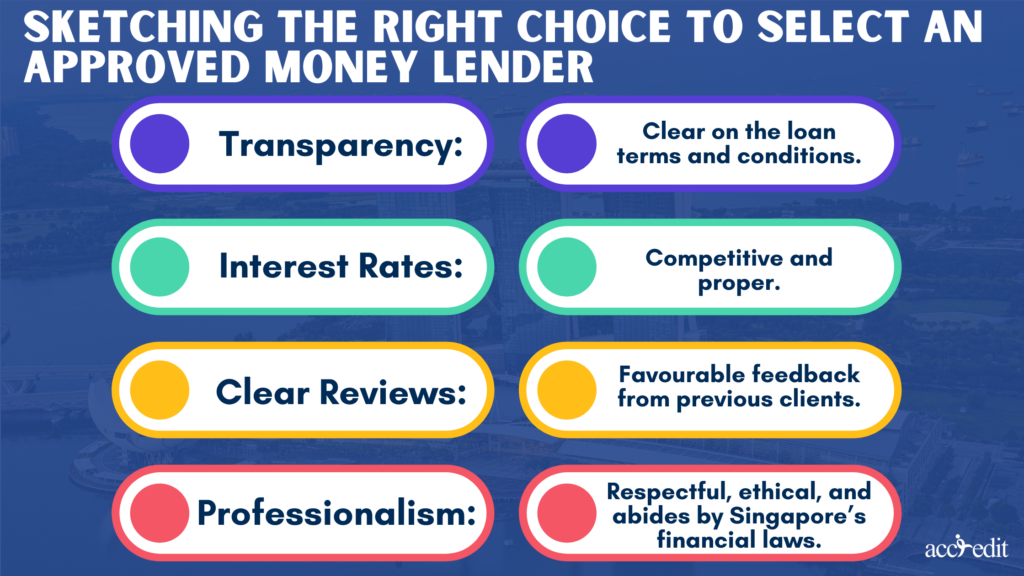

Sketching the Right Choice to Select an Approved Money Lender

You cannot trust anyone when you need a loan, especially if they’re unlicensed lenders or loan sharks. Such entities operate outside the Act and are mainly not listed in the Registry of Moneylenders.

The trick?

Research! Look for transparency concerning the terms and interest rates, and assess their professionalism. Think of it as choosing between a comic strip’s raw authenticity or the multilayered painting’s complexities.

Each lender will have its distinctive and impressive offering. The crucial factors to consider when sketching for the right approved money lender are:

- Transparency: Clear on the loan terms and conditions.

- Interest Rates: Competitive and proper.

- Clear Reviews: Favourable feedback from previous clients.

- Professionalism: Respectful, ethical, and abides by Singapore’s financial laws.

But what are the rules that an approved money lender in Singapore has to follow? When you familiarise yourself with every essential regulation, you can quickly assess if they’re fit for you, which includes:

- Interest Rates Caps: 4% maximum interest rates per month.

- Late Payment Fees: Such fees cannot go beyond $60 monthly.

- Legal Recourse: When a contract dispute arises, you may approach Singapore’s Small Claims Tribunal or Moneylenders Credit Bureau.

Techniques to Triumphantly Clear Your Debt from Approved Money Lender Singapore

Like applying the final touches to your financial artwork, loan repayment fulfils your borrowing voyage. Strategies to manage repayments effectively are exceptionally diverse as Charlie Chan’ Hock Chye’s repertoire of techniques.

Repayment tips to consider:

- You can efficiently set up automated payments to get all the due dates.

- Always communicate with an approved money lender if you anticipate repayment difficulties.

- Do your best to pay more than the designated minimum amount when possible, as it reduces your debt much faster.

Crafting Your Monetary Masterpiece

Financial literacy is a crucial awareness that every person must practice often. But, it’s also a given that not everyone can become a master with the specific practice.

It’s a fact that financial management is an art of its narrative, and it can be the same as making a comic strip. There are specific processes you need to do to fully understand, practice, and attain finesse. With the knowledge regarding the approved money lender in Singapore, like Accredit, you now have a rich palette.

You now have the choice to assemble and complete your financial masterpiece. After all, your monetary trip should reflect you, like the evolving painting styles that reflect Singapore’s dynamic history. Pick up your brush and paint your financial future, one stroke at a time.

Remember, as you continue on your journey to financial stability and security, always focus on making informed choices. Be bold and ask questions; seek assistance whenever you need it.