Singapore’s housing market is infamous for its sky-high prices, making it tough for countless folks and families to attain their dream abodes. Nonetheless, there exists a practical remedy in the form of a home loan, which opens doors to homeownership even wider. In this article, we will explore five compelling benefits of taking a home loan in Singapore and delve into how it positively impacts individuals and families.

Understanding Home Loans in Singapore

When it comes to purchasing a property, home loans emerge as the go-to solution. These secured loans operate on a simple principle: the property itself serves as collateral. Should the borrower falter, the lender possesses the ability to sell the property and recover the outstanding balance.

In Singapore, home loans commonly feature fluctuating interest rates that align with either the Singapore Interbank Offered Rate (SIBOR) or Swap Offer Rate (SOR). Additionally, the repayment duration can span either 30 or 35 years, contingent on the loan amount and the lender’s terms.

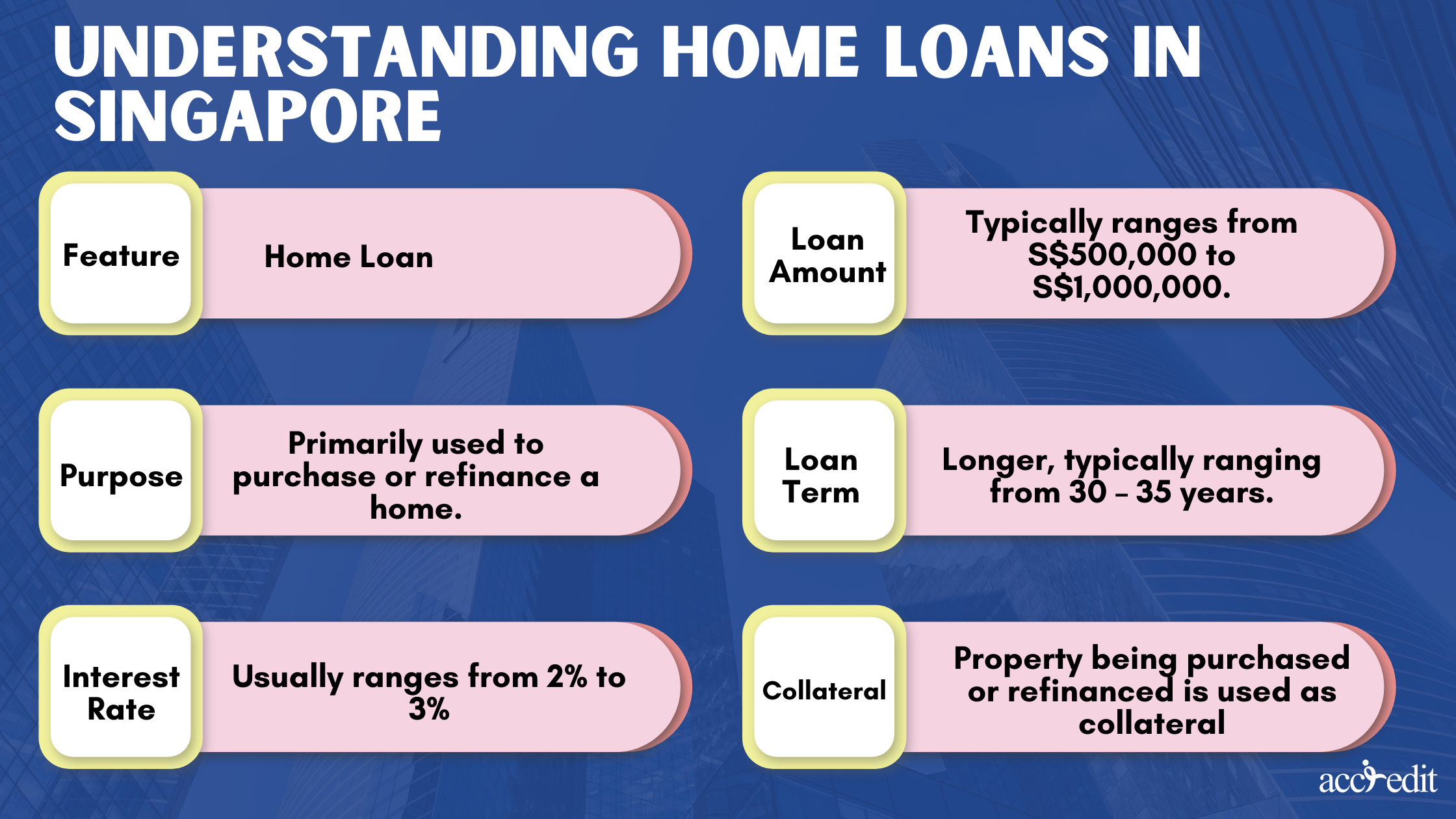

| Feature | Home Loan |

| Purpose | Primarily used to purchase or refinance a home. |

| Interest Rate | Usually ranges from 2% to 3% |

| Loan Amount | Typically ranges from S$500,000 to S$1,000,000. |

| Loan Term | Longer, typically ranging from 30 – 35 years. |

| Collateral | Property being purchased or refinanced is used as collateral |

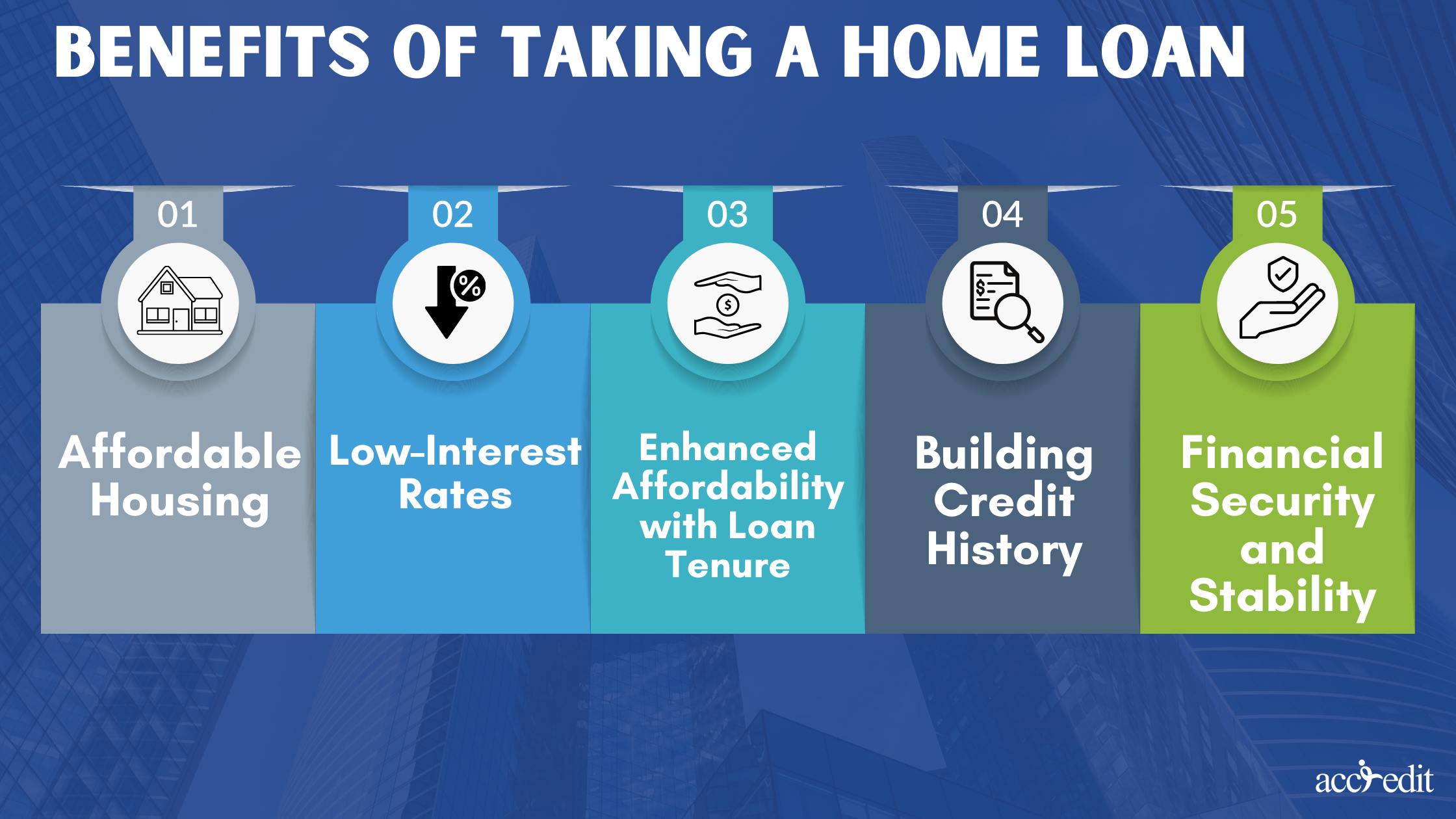

Benefits of Taking a Home Loan

Having grasped the concept of a home loan, it’s time to delve into the perks it brings to the table. Here’s a rundown of the benefits you can reap:

1. Affordable Housing

When it comes to Singapore’s housing market, soaring prices are a well-known hurdle. However, the introduction of home loans has played a pivotal role in transforming affordable housing into a tangible possibility for many. Rising property costs have made it difficult for individuals to gather the necessary funds for an outright home purchase. Thankfully, home loans step in as the solution, providing vital financial assistance.

Typically ranging from S$500,000 to S$1,000,000, home loans allow individuals to spread the burden of homeownership across a manageable repayment period. This enables them to afford homes that would have otherwise been beyond their financial grasp.

Moreover, Singapore offers diverse loan options, including Housing Development Board (HDB) loans and bank loans, tailored to accommodate varying income levels and housing preferences. These alternatives ensure that borrowers can discover a loan that aligns with their financial capabilities and grants them the opportunity to secure an affordable home.

2. Low-Interest Rates

When it comes to home loans in Singapore, one major perk lies in the prevailing low-interest rates. The interest rates on these loans typically range from 2% to 3%. Even a slight variation in rates can accumulate into significant long-term savings.

The reason behind these favorable rates is the classification of home loans as “secured” loans, where your house is at risk if you default. This classification enables lenders to offer attractive interest rates.

The impact of low-interest rates translates directly into improved affordability for home loans. With reduced monthly mortgage payments, homeowners can save substantial amounts over the loan term. This not only eases the financial burden but also enhances the overall affordability of homeownership, making it an enticing choice for potential buyers.

3. Enhanced Affordability with Loan Tenure

In Singapore’s home loan market, borrowers gain a valuable advantage with extended loan durations. As per the Monetary Authority of Singapore (MAS), the permitted tenure for HDB flats can stretch up to 30 years, while private properties allow for up to 35 years.

By extending the loan tenure, affordability receives a significant boost as monthly repayments decrease. This proves especially advantageous for young families and first-time homebuyers facing initial financial constraints.

It’s important to bear in mind that longer loan tenures result in higher overall interest payments compared to shorter ones. However, with prudent financial planning and disciplined repayment, borrowers can effectively manage this aspect and still reap the benefits of enhanced affordability.

4. Building Credit History

In Singapore, cultivating a robust credit history is essential for unlocking a range of financial possibilities. Home loans serve as a valuable tool for constructing and enhancing an individual’s creditworthiness.

By diligently meeting the repayment deadlines for home loan installments, one showcases their financial responsibility and dependability, leading to a positive impact on their credit score. This, in turn, boosts the chances of securing favorable terms for upcoming loans, be it for a car or a business venture.

Furthermore, a solid credit history opens doors to more competitive interest rates, effectively reducing borrowing costs and presenting borrowers with superior loan alternatives down the road.

5. Financial Security and Stability

In Singapore, opting for a home loan ensures lasting financial security and stability for individuals and families. Unlike renting, owning a home enables the accumulation of equity and possession of a valuable asset. With each repayment, borrowers gradually enhance their ownership stake in the property.

This ownership brings about stability, granting homeowners autonomy over their living arrangements while shielding them from sudden rental hikes or the threat of eviction. Moreover, homeowners enjoy the freedom to customize their properties to suit their preferences and make desired modifications.

The Bottom Line

When it comes to acquiring a home loan in Singapore, the advantages are plentiful, making the dream of owning a home more within reach and financially advantageous. From accessing affordable housing to enjoying flexible repayment choices, low-interest rates, improved affordability with extended loan tenure, establishing a credit history, and achieving financial security and stability.

For potential homebuyers, it’s vital to meticulously assess their financial situation, explore the array of loan options, and carefully consider the specific benefits that align with their goals and preferences. By harnessing the power of home loans, individuals can embark on a journey toward homeownership, relishing stability, security, and financial prosperity along the way.

Accredit Moneylender: Unlock Your Financial Flexibility with Personal Loans

Now that you’ve got the lowdown on the perks of opting for a home loan in Singapore, have you ever considered the power of a personal loan?

Listen up: with a personal loan, you have the freedom to spend the money however you please. Want that sleek new Samsung phone? Treat yourself. Craving an unforgettable trip to Korea? Go ahead and make it happen. Maybe even that stunning engagement ring you’ve had your eye on? It’s yours for the taking. And guess what? Accredit Moneylender is right here to provide you with the trusted support you need for your personal loan journey.

At Accredit Moneylender, we’ve got your back with personal loans at seriously competitive interest rates. Not only that, but we’ll also work closely with you to create a repayment plan tailored to your needs, ensuring a stress-free and hassle-free process.

So, why wait any longer? Take that crucial first step and reach out to us today! Let’s unlock your financial freedom together.